Understanding Employment Verification in Mortgage

Introduction to Verification of Employment for Mortgage

In the mortgage application process, one of the key steps that lenders take to ensure that applicants are financially capable of repaying a loan is Verification of Employment (VOE). VOE plays a crucial role in assessing an applicant’s financial stability, confirming income levels, and ensuring job security. In this article, we will explore the importance of VOE in the mortgage approval process and the various aspects involved in verifying employment status.

What is Verification of Employment (VOE)?

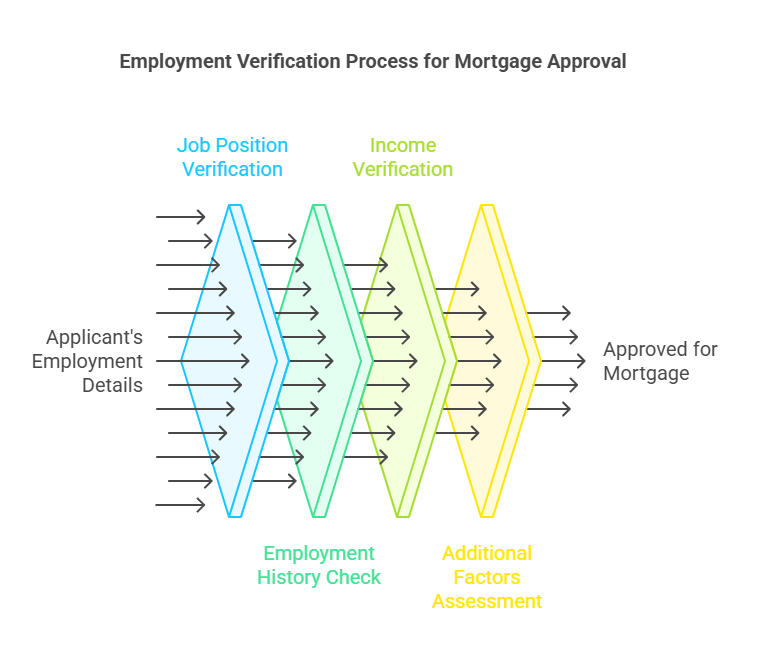

Verification of Employment (VOE) is the process through which mortgage lenders confirm the employment status of an applicant. It involves verifying details such as the applicant’s job position, employment history, income, and other relevant factors that may influence their ability to repay a mortgage loan. Lenders use this process to ensure that applicants meet the necessary financial requirements before granting a loan.

In essence, the VOE process helps lenders determine whether the borrower has a stable and reliable source of income, which is a key factor in their ability to make monthly mortgage payments. This verification process is typically done by contacting the applicant’s employer directly or through third-party verification services.

Importance of Confirming Employment Status, Income, and Job Stability for Mortgage Lenders

For mortgage lenders, confirming employment status, income, and job stability is a vital part of the mortgage approval process. Lenders need to evaluate the borrower’s capacity to repay the loan over time.

- Income Verification: Lenders require verification of income to ensure that the borrower can meet their monthly payments, including principal, interest, taxes, and insurance (PITI).

- Job Stability: A stable employment history reduces the risk for lenders, as it indicates a lower likelihood of financial instability in the future.

- Income Consistency: Lenders also want to ensure that the borrower has a consistent income that meets the debt-to-income (DTI) ratio requirements. If the borrower’s income fluctuates significantly, it may raise concerns about their ability to manage long-term mortgage payments.

By confirming employment and income details, lenders can make more informed decisions regarding mortgage approval, ensuring that the borrower can meet their financial obligations over time.

Why Lenders Require VOE for Mortgage Approval?

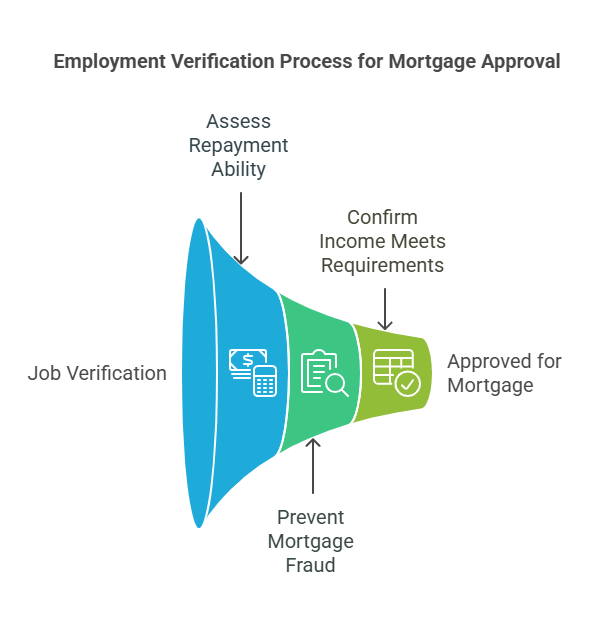

Lenders require Verification of Employment (VOE) for several reasons:

- Assessing Repayment Ability: Lenders use VOE to determine if an applicant can afford monthly mortgage payments. Consistent, reliable income assures the lender that the borrower has the financial capacity to repay the loan.

- Preventing Mortgage Fraud: Employment verification helps prevent mortgage fraud by ensuring that applicants provide accurate information about their employment and income. This protects the lender from potential financial losses.

- Ensuring Income Requirements are Met: Lenders often have specific income thresholds or debt-to-income (DTI) ratio requirements. VOE helps confirm that the applicant’s income meets these thresholds.

What Information is Verified During VOE?

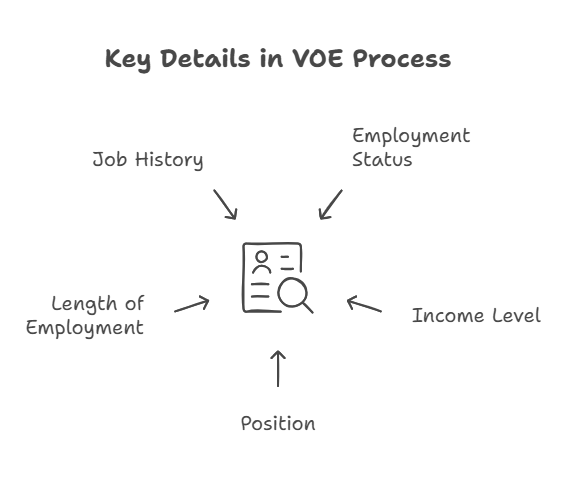

The Verification of Employment (VOE) process typically includes the verification of several key details about the applicant’s employment, such as:

- Employment Status: Whether the applicant is currently employed full-time, part-time, or self-employed.

- Income Level: The applicant’s base salary, hourly wage, or other income sources such as bonuses and commissions.

- Position: The applicant’s job title or position within the company.

- Length of Employment: The duration the applicant has worked at the current employer and whether they have held any previous positions with the company.

- Job History: Lenders often review the applicant’s work history, particularly whether there are any gaps in employment that might suggest instability.

Each of these factors is important for lenders to confirm to ensure the applicant’s financial reliability and job stability.

VOE in the Context of Different Types of Mortgages

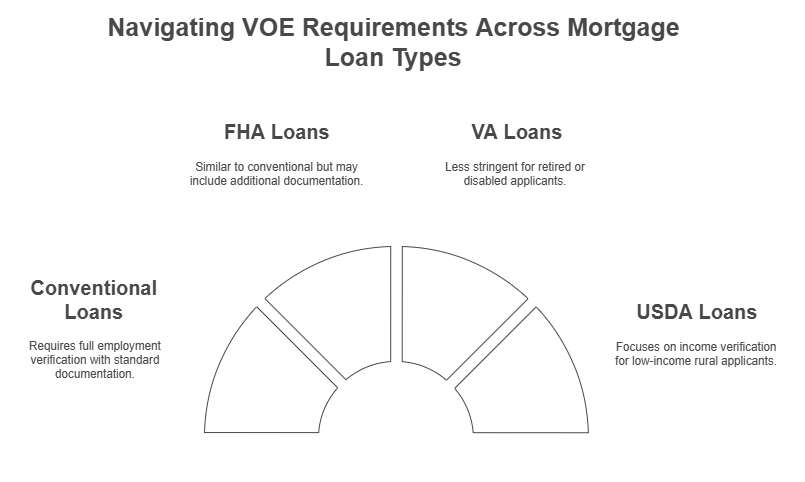

The process of verification can vary depending on the type of mortgage the applicant is applying for. Here’s how VOE applies to different loan types:

- Conventional Loans: Lenders typically require full verification of employment for conventional loans, including documentation such as pay stubs, W-2 forms, and sometimes tax returns.

- FHA Loans: For FHA loans, the employment verification process is similar to conventional loans, but the lender may also consider additional documentation, especially for applicants with less-than-perfect credit or inconsistent employment histories.

- VA Loans: Veterans applying for VA loans must also undergo employment verification. However, the requirements for documentation may be less stringent, especially for applicants who are retired or receiving disability benefits.

- USDA Loans: USDA loans may have slightly different VOE requirements, especially regarding income verification, as they are designed to help low-income applicants in rural areas.

The specific requirements and procedures for VOE may differ by loan type, but the core goal remains the same: to confirm the applicant’s ability to repay the loan.

The Process of Employment Verification for Mortgage and How ExactBackgroundChecks Helps

Now that we’ve discussed the importance of Verification of Employment (VOE), let’s dive into the step-by-step process that lenders follow to verify employment and how services like ExactBackgroundChecks.com can streamline this process.

How Does the VOE Process Work for Mortgages?

The process of employment verification for a mortgage generally follows these steps:

- Application Submission: The borrower submits their mortgage application, which includes personal and financial details, such as employment history and income.

- Employer Contact: The lender, or a third-party service, contacts the borrower’s employer to confirm employment details. This may involve either calling the employer directly, submitting a formal request, or using an online service to obtain the information.

- Document Collection: The borrower may be asked to submit supporting documents, such as pay stubs, W-2 forms, or tax returns, to verify income. In some cases, additional documentation may be requested if the employment history is unclear.

- Verification: The employer provides confirmation of the applicant’s job status, income, and other necessary details. In some cases, third-party verification services are used to expedite the process.

- Approval/Denial: Once the employment and income details are verified, the lender can proceed with the mortgage application review. If everything checks out, the loan is approved; if there are discrepancies or issues, the loan may be denied.

Types of Verification of Employment (VOE) for Mortgages

There are several methods lenders use to verify employment, including:

- Verbal Verification: This is the most common method, where the lender or a third-party service calls the borrower’s employer directly to verify employment status and income details.

- Written Verification: A more formal process where the lender requests a signed letter from the employer confirming the applicant’s employment, job title, and income.

- Automated Verification: Many lenders use third-party verification services to automate the VOE process. These services pull information from employment databases, tax returns, and other resources to confirm employment status and income.

Each method has its own benefits and drawbacks, but most lenders use a combination of these methods to ensure the accuracy of the information provided.

Timeline for Verification

The timeline for Verification of Employment (VOE) can vary depending on several factors:

- Typical Timeline: It usually takes 1-3 business days for verbal or written verification, depending on how quickly the employer responds.

- Automated Verification: If the lender uses an automated verification service, the process can be completed within hours.

- Delays: Delays can occur if the employer is slow to respond or if the borrower has a complicated work history. In these cases, the process can take several days or even weeks.

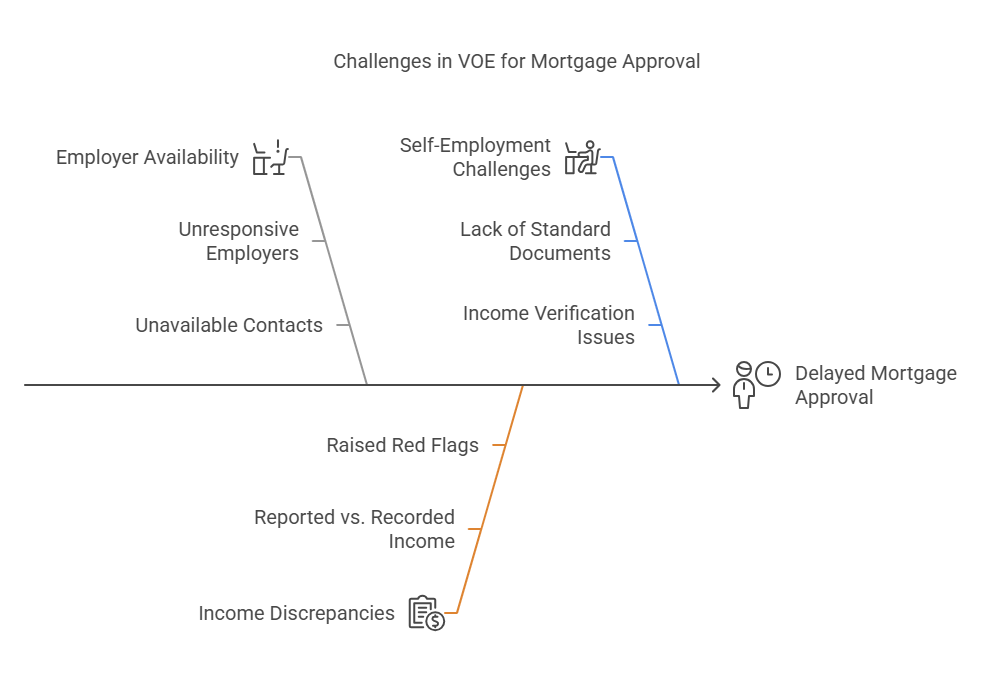

Challenges in VOE for Mortgages

There are several common challenges in the VOE process that can delay the mortgage approval:

- Employer Availability: If the employer is unresponsive or unavailable, it can slow down the verification process.

- Discrepancies in Income: If the applicant’s reported income doesn’t match the employer’s records, it may raise red flags and delay approval.

- Self-Employment: Self-employed applicants often face challenges in verifying income, as they don’t have standard pay stubs or W-2 forms.

How ExactBackgroundChecks Can Help with Employment Verification for Mortgages

ExactBackgroundChecks simplifies the employment verification process for both lenders and applicants. Here’s how:

- Quick and Reliable Verification: ExactBackgroundChecks.com provides fast, reliable verification services that help speed up the mortgage process. The platform ensures that the lender receives accurate employment details quickly.

- Streamlined Process: By using ExactBackgroundChecks.com, lenders can avoid delays in contacting employers directly, as the service uses automated verification systems to expedite the process.

- Compliance: ExactBackgroundChecks.com ensures compliance with industry standards and legal regulations, offering reliable data that meets the needs of mortgage lenders.

- Improved Accuracy: The platform helps reduce human errors and ensures that all employment details are verified correctly.

Legal Aspects of VOE in Mortgage Applications

Verification of Employment (VOE) is a highly regulated process, and several legal considerations must be taken into account to protect both applicants and lenders.

- Privacy Concerns: The Fair Credit Reporting Act (FCRA) governs how employment information can be collected and used, ensuring that applicants’ personal data is handled securely and fairly.

- Consent for Employment Verification: Lenders must obtain the applicant’s consent before verifying their employment. This ensures that the borrower is aware of the verification process and has agreed to share their employment details.

- Fair Lending Laws: VOE helps lenders comply with fair lending laws by providing an objective view of the applicant’s ability to repay the loan without considering discriminatory factors such as race, gender, or religion.

- Discrimination Laws: VOE must be conducted in a non-discriminatory manner, ensuring that all applicants are treated equally, regardless of their protected characteristics.

FAQs about Employment Verification for Mortgages

What is Verification of Employment (VOE) in the mortgage process?

VOE is the process where mortgage lenders confirm an applicant's employment status, income, and job stability to assess their ability to repay a loan.

Why do lenders require VOE for mortgage approval?

Lenders require VOE to assess the applicant's repayment ability, prevent mortgage fraud, and ensure income requirements are met.

What information is typically verified during VOE?

VOE typically verifies employment status, income level, job position, length of employment, and job history.

How does the VOE process work for mortgages?

The process involves application submission, employer contact (verbal, written, or automated), document collection, verification, and then loan approval or denial.

What are the legal aspects to consider regarding VOE in mortgage applications?

Legal aspects include privacy concerns (FCRA), obtaining applicant consent, complying with fair lending laws, and ensuring VOE is conducted in a non-discriminatory manner.

Conclusion

Verification of Employment (VOE) is a critical component of the mortgage approval process. It ensures that applicants are financially capable of repaying the loan and helps lenders assess the risk of lending. Services like ExactBackgroundChecks.com offer streamlined and reliable employment verification, reducing processing times for both lenders and applicants. By understanding the VOE process and utilizing professional services, applicants can improve their chances of securing mortgage approval.