Best Practices for Tenant Credit and Background Checks

Understanding Tenant Credit and Background Checks

A tenant credit and background check is a screening process used by landlords and property managers to evaluate potential renters before signing a lease agreement. These checks help landlords determine whether an applicant is financially responsible and poses any risks as a tenant.

By reviewing an applicant’s credit history, criminal background, eviction records, and rental history, landlords can make informed leasing decisions that protect their property and ensure a stable rental relationship.

Why Are Tenant Credit and Background Checks Important?

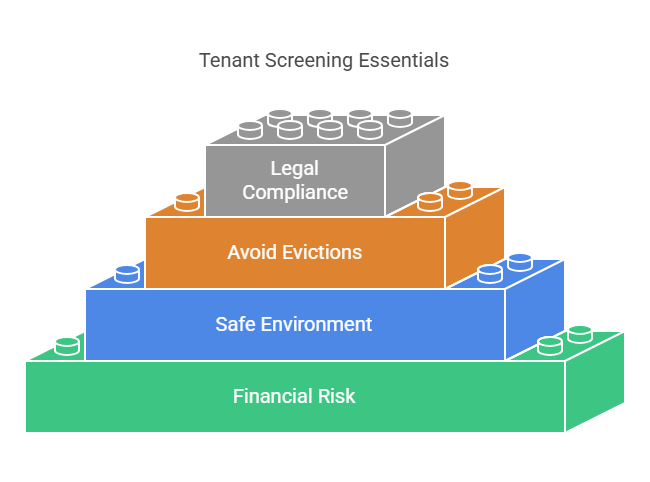

Tenant screening plays a crucial role in the rental process by helping landlords:

✔ Minimize financial risk – A credit check provides insight into a tenant’s ability to pay rent on time.

✔ Ensure a safe rental environment – A background check helps identify any history of violent or fraudulent activities.

✔ Prevent future evictions – Reviewing eviction records can help landlords avoid tenants with a history of lease violations.

✔ Comply with legal requirements – Conducting proper screenings ensures landlords follow fair housing and tenant rights laws.

What Information Is Included in a Tenant Credit Check?

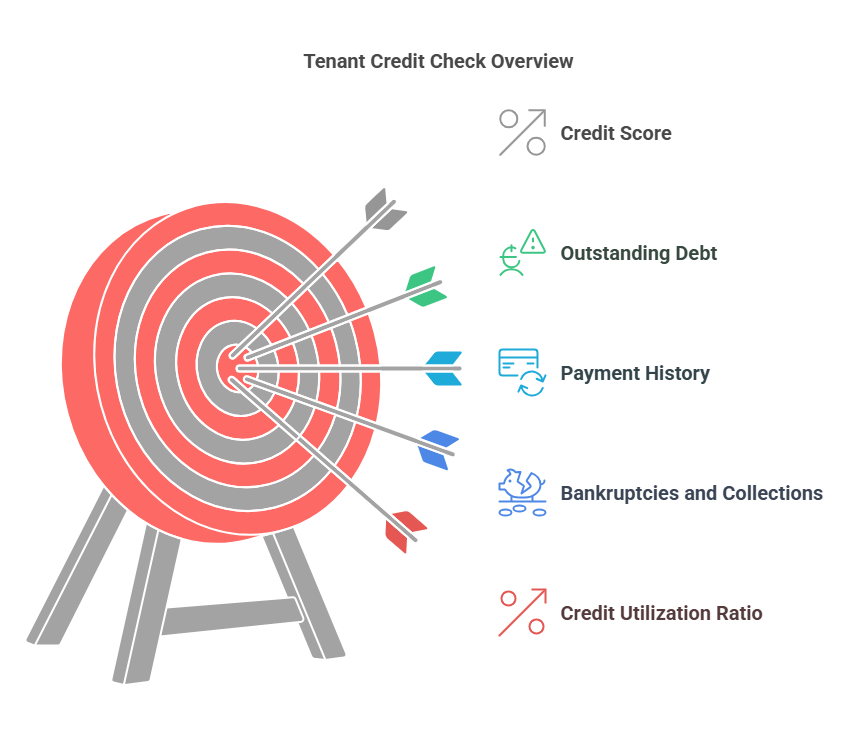

A tenant credit check provides landlords with an applicant’s financial profile, which helps predict whether they will pay rent consistently. The key details in a credit check include:

- Credit Score – A numerical rating (typically 300-850) that represents an applicant’s creditworthiness.

- Outstanding Debt – Any unpaid loans, credit card balances, or financial obligations.

- Payment History – A record of past payments, including late or missed payments.

- Bankruptcies and Collections – Any past bankruptcy filings or accounts sent to collections.

- Credit Utilization Ratio – The percentage of available credit the applicant is currently using.

What Information Is Included in a Tenant Background Check?

A tenant background check helps landlords assess a tenant’s personal and legal history. Common components of a background check include:

- Criminal Record – Any felony or misdemeanor convictions, depending on state laws and screening criteria.

- Eviction History – Past evictions or court judgments related to unpaid rent or lease violations.

- Sex Offender Registry – Whether the applicant appears on a registered sex offender list (varies by state regulations).

- Rental History – Previous landlords, rental addresses, and any past issues with property damage or lease violations.

Who Conducts Tenant Credit and Background Checks?

Tenant screenings are typically conducted by:

🔹 Landlords – Small property owners who manage their own rentals often perform credit and background checks.

🔹 Property Management Companies – Larger rental operations use professional screening services to vet tenants.

🔹 Tenant Screening Services – Third-party agencies like Exact Background Checks provide comprehensive and legally compliant reports.

🔹 Credit Bureaus – Major credit reporting agencies like Equifax, Experian, and TransUnion offer tenant credit checks.

How Tenant Screening Helps Landlords Make Informed Decisions

Tenant screening enables landlords to:

✔ Identify financially responsible renters – A good credit history indicates reliability.

✔ Reduce property damage risks – A clean rental record suggests the tenant will take care of the property.

✔ Prevent lease violations – A tenant’s past behavior can predict their future conduct.

✔ Comply with legal requirements – Following fair screening practices avoids discrimination claims.

A thorough tenant screening process ensures that landlords select reliable, responsible, and qualified tenants for their rental properties.

Step-by-Step Guide to Running a Tenant Credit and Background Check

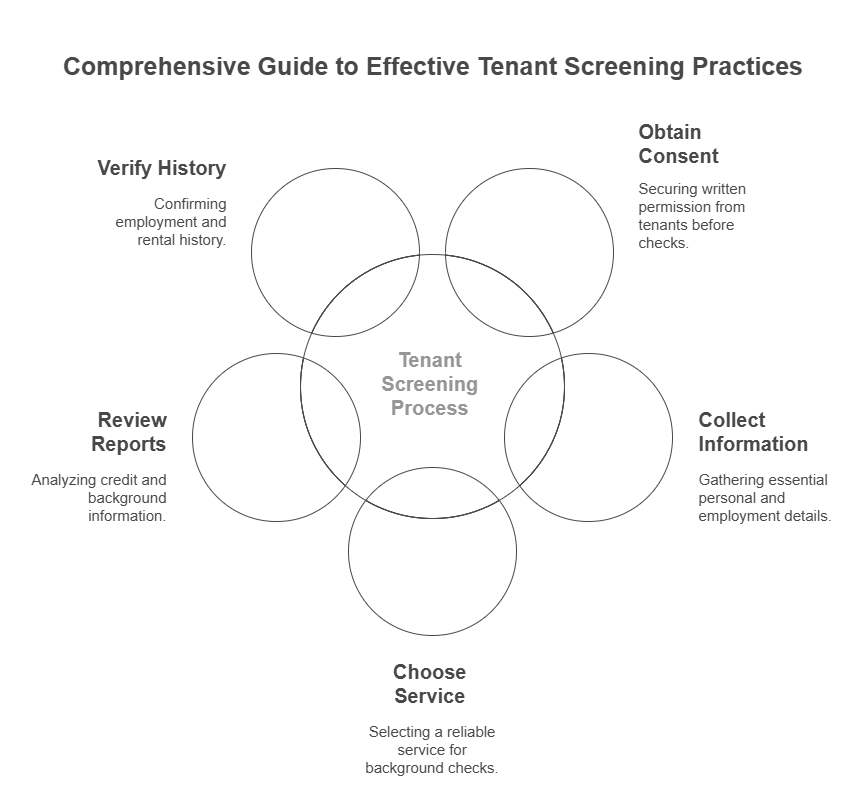

1. Obtain the Tenant’s Consent

Before conducting any background or credit check, landlords must obtain written consent from the applicant. The Fair Credit Reporting Act (FCRA) mandates that landlords get permission before accessing a potential tenant’s credit and personal history.

✔ Provide a rental application that includes a section for tenant consent.

✔ Clearly state that a credit and background check will be conducted.

✔ Ensure compliance with local and federal privacy laws.

2. Collect Necessary Tenant Information

To perform a thorough background check, landlords need to collect the following details:

📌 Full Name (as it appears on legal documents)

📌 Date of Birth

📌 Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

📌 Current and Previous Addresses

📌 Employment Information (Employer name, position, and salary verification)

3. Choose a Reputable Tenant Screening Service

A reliable screening service ensures that landlords receive accurate and legally compliant reports. Landlords can use:

🔹 Credit Bureaus – Agencies like Equifax, Experian, and TransUnion offer tenant credit reports.

🔹 Online Tenant Screening Services – Companies like Exact Background Checks provide comprehensive screening solutions that include credit reports, eviction history, and criminal background checks.

💡 Why Choose Exact Background Checks?

✔ Fast and Reliable Reports – Get screening results quickly to avoid rental delays.

✔ FCRA-Compliant Services – Ensure legal compliance with tenant screening laws.

✔ Customizable Packages – Select specific checks based on your rental requirements.

4. Review the Tenant’s Credit Report

A credit check provides key insights into the applicant’s financial responsibility. Landlords should look for:

✔ Credit Score – A higher score (650+) suggests a tenant is financially stable.

✔ Debt-to-Income Ratio – A lower ratio indicates the tenant can afford rent payments.

✔ Payment History – Frequent late payments may indicate a risk of missed rent.

✔ Bankruptcies or Collections – These may suggest financial instability.

🔹 What Credit Score Is Considered Acceptable?

- Excellent (750+) – Ideal tenant with a strong financial history.

- Good (700-749) – Low risk, likely to pay rent on time.

- Fair (650-699) – Some risk; may require additional screening.

- Poor (Below 650) – Higher risk; landlords may request a co-signer or larger deposit.

5. Conduct a Criminal Background Check

A criminal background check helps landlords identify past legal issues that may affect tenancy.

✅ Check for serious offenses (e.g., violent crimes, property damage, fraud).

✅ Follow state and local laws regarding criminal record use in tenant screening.

✅ Consider rehabilitation and time elapsed since the offense.

🔹 Important Note: Some states and cities have “Ban the Box” laws restricting landlords from considering criminal history in rental decisions.

6. Verify Employment and Rental History

Employment verification ensures the tenant has a stable source of income to pay rent. Landlords should:

✔ Contact the tenant’s employer to confirm job status and salary.

✔ Check pay stubs, W-2s, or tax returns for self-employed tenants.

✔ Verify rental history by speaking with past landlords.

🚨 Warning Signs to Watch For:

❌ Frequent evictions – Indicates past lease violations.

❌ False employment claims – Suggests financial instability.

❌ Multiple late rent payments – Could be a red flag for future payment issues.

7. Make an Informed Rental Decision

After reviewing all credit, background, and rental history reports, landlords can decide whether to approve or decline the application.

🔹 Approved Tenant: Proceed with lease signing and security deposit collection.

🔹 Conditional Approval: Require additional security deposits or a co-signer.

🔹 Denied Applicant: Provide an Adverse Action Notice explaining the decision (as required by FCRA).

Summary: Steps to Conduct a Tenant Screening

| Step | Action |

|---|---|

| 1. Obtain Consent | Get written permission from the tenant. |

| 2. Collect Information | Name, SSN, employment details, etc. |

| 3. Choose a Screening Service | Use a reliable company like Exact Background Checks. |

| 4. Review Credit Report | Check credit score, payment history, debts. |

| 5. Conduct Background Check | Look at criminal history, evictions. |

| 6. Verify Employment & Rental History | Contact employers and previous landlords. |

| 7. Make a Decision | Approve, deny, or request additional requirements. |

💡 Why Use Exact Background Checks for Tenant Screening?

🔹 Quick & Accurate Reports – Avoid long delays in tenant verification.

🔹 FCRA-Compliant – Ensure fair and legal tenant screening.

🔹 Custom Screening Packages – Tailor checks based on rental property needs.

Legal Aspects of Tenant Credit and Background Checks

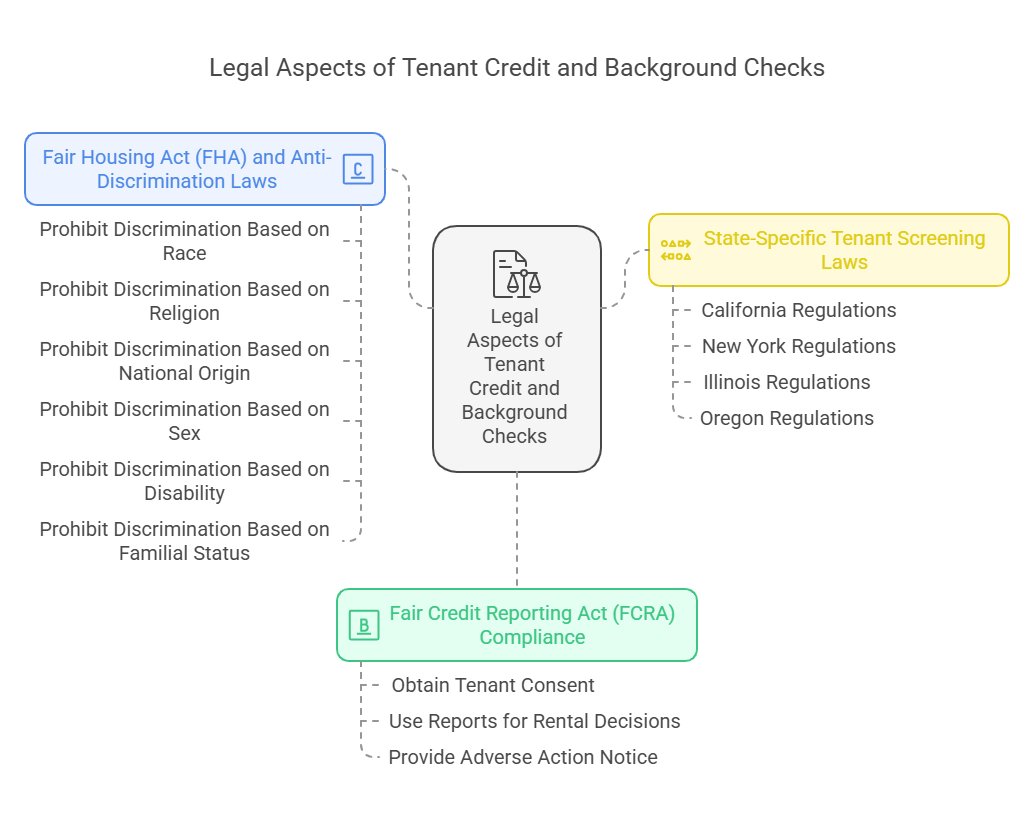

1. Fair Credit Reporting Act (FCRA) Compliance

The FCRA is a federal law that regulates how tenant screening reports can be used. Landlords must:

✔ Obtain tenant consent before conducting a background or credit check.

✔ Use reports only for rental decision-making (not for personal reasons).

✔ Provide an Adverse Action Notice if rejecting a tenant due to their credit or background check.

📌 Failure to comply with FCRA regulations can result in legal consequences, including lawsuits and fines.

2. Fair Housing Act (FHA) and Anti-Discrimination Laws

The Fair Housing Act (FHA) prohibits landlords from discriminating against tenants based on:

🔹 Race or color

🔹 Religion

🔹 National origin

🔹 Sex or gender identity

🔹 Disability

🔹 Familial status (e.g., having children)

❌ Example of Illegal Discrimination: Rejecting a tenant solely due to a criminal record without considering rehabilitation or individual circumstances could violate fair housing laws.

📌 Landlords must apply screening criteria fairly and consistently for all applicants.

3. State-Specific Tenant Screening Laws

Some states impose additional regulations on tenant background checks. For example:

✅ California – Landlords can only charge screening fees up to a legally set limit.

✅ New York – Landlords cannot reject applicants based on past eviction records alone.

✅ Illinois – Certain criminal records cannot be used to deny housing.

✅ Oregon – Has strict rules on considering criminal history in rental decisions.

📌 Always check state laws to ensure compliance when conducting tenant background checks.

Frequently Asked Questions (FAQs)

Can a landlord deny a tenant based on a low credit score?

Yes, but… Landlords must be consistent and fair when using credit scores to evaluate applicants. They cannot discriminate against protected classes (race, gender, etc.).

Best Practice: Some landlords allow tenants with low credit scores if they have a co-signer or higher security deposit.

How far back do background checks go for tenants?

🔹 The timeframe depends on state laws and the type of check:

✔ Credit Reports – Typically 7 years (longer for bankruptcies).

✔ Criminal Records – Some states limit reporting to 7-10 years.

✔ Eviction History – Usually 7 years.

📌 Some states restrict landlords from considering older criminal records.

Can a tenant dispute an incorrect background check?

✅ Yes! If a tenant finds errors in their background or credit check, they can:

✔ Request a copy of the report from the screening agency.

✔ Dispute inaccuracies with the credit bureau or screening provider.

✔ Ask the landlord to review corrected reports.

📌 Under FCRA, tenants have the right to dispute incorrect information.

Can a landlord check a tenant’s rental history?

✅ Yes, landlords can verify rental history by:

✔ Contacting previous landlords.

✔ Checking eviction records.

✔ Reviewing late payment history in credit reports.

📌 Some states limit access to eviction records to prevent discrimination against tenants who faced financial hardships.

What should landlords do if they deny a tenant?

If a landlord denies an applicant based on background or credit check results, they must provide an Adverse Action Notice, which includes:

✔ The reason for denial.

✔ The screening agency used.

✔ The tenant’s right to dispute the report.

📌 This is required under the FCRA to ensure transparency and fairness.

Can a landlord deny a tenant based on a low credit score?

Yes, but… Landlords must be consistent and fair when using credit scores to evaluate applicants. They cannot discriminate against protected classes (race, gender, etc.).

Best Practice: Some landlords allow tenants with low credit scores if they have a co-signer or higher security deposit.

How far back do background checks go for tenants?

🔹 The timeframe depends on state laws and the type of check:

✔ Credit Reports – Typically 7 years (longer for bankruptcies).

✔ Criminal Records – Some states limit reporting to 7-10 years.

✔ Eviction History – Usually 7 years.

📌 Some states restrict landlords from considering older criminal records.

Can a tenant dispute an incorrect background check?

✅ Yes! If a tenant finds errors in their background or credit check, they can:

✔ Request a copy of the report from the screening agency.

✔ Dispute inaccuracies with the credit bureau or screening provider.

✔ Ask the landlord to review corrected reports.

📌 Under FCRA, tenants have the right to dispute incorrect information.

Can a landlord check a tenant’s rental history?

✅ Yes, landlords can verify rental history by:

✔ Contacting previous landlords.

✔ Checking eviction records.

✔ Reviewing late payment history in credit reports.

📌 Some states limit access to eviction records to prevent discrimination against tenants who faced financial hardships.

What should landlords do if they deny a tenant?

If a landlord denies an applicant based on background or credit check results, they must provide an Adverse Action Notice, which includes:

✔ The reason for denial.

✔ The screening agency used.

✔ The tenant’s right to dispute the report.

📌 This is required under the FCRA to ensure transparency and fairness.

Conclusion

A tenant credit and background check is a crucial part of the rental application process. By evaluating credit scores, criminal history, and rental records, landlords can select reliable tenants while ensuring compliance with fair housing laws and FCRA regulations.

Key Takeaways:

✔ Tenant screening protects landlords from financial risks.

✔ Fair Housing and FCRA laws regulate how checks are conducted.

✔ State laws vary, so landlords must stay informed.

✔ Exact Background Checks provides reliable tenant screening services to help landlords make informed rental decisions.

💡 For fast, accurate, and compliant tenant screening, trust Exact Background Checks!

Thorough tenant screening is essential for landlords to minimize risks and ensure a stable rental relationship. Credit and background checks provide valuable insights into an applicant’s financial responsibility and past behavior.