Step-by-Step Guide to Uconfirm Verification Process

Introduction and Overview of UConfirm Verification of Employment

UConfirm is a leading employment verification service designed to simplify and streamline the process of verifying an individual’s job history and employment details. By automating employment verification, UConfirm provides a secure, efficient, and accurate solution for employers, employees, and third-party verifiers such as lenders, landlords, and government agencies.

Employment verification is a critical process in various situations, and UConfirm’s specialized platform eliminates the inefficiencies of manual verification methods. This ensures compliance with federal regulations while providing reliable, real-time access to employment data.

Understanding Employment Verification

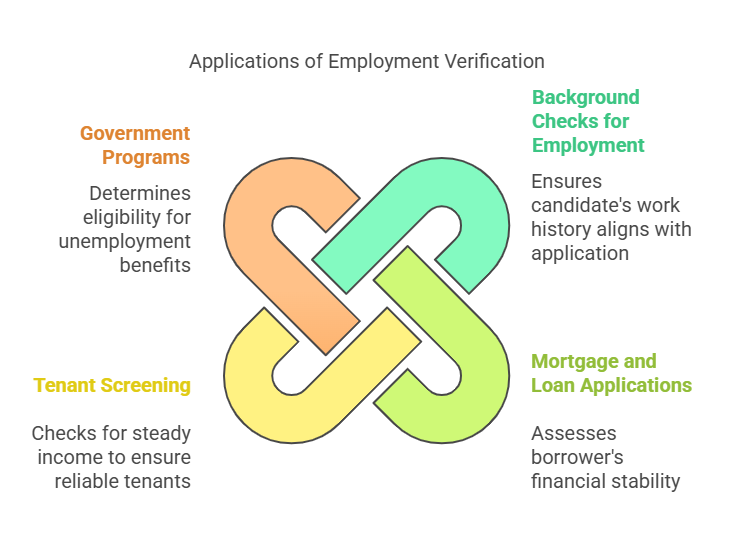

Employment verification involves confirming details about an individual’s job history, including their current or past employers, job title, start and end dates, income, and employment status. This process is crucial in many scenarios, such as:

- Background Checks for Employment: Employers use verification to ensure a candidate’s work history aligns with their résumé and job application.

- Mortgage and Loan Applications: Lenders require employment verification to assess a borrower’s financial stability.

- Tenant Screening: Landlords may check employment history to ensure a potential tenant has a steady income.

- Government Programs: Verification is often required to determine eligibility for unemployment benefits or public assistance programs.

Why Is Employment Verification Important?

The verification of employment (VOE) plays a vital role in safeguarding the interests of all parties involved:

- For Employers: It ensures that job candidates are truthful about their work experience, reducing the risks of fraud or misrepresentation.

- For Lenders and Landlords: It provides a clear picture of an applicant’s financial stability, helping to mitigate risks.

- For Employees: Accurate employment verification simplifies applications for loans, housing, and other benefits.

How UConfirm Transforms the Employment Verification Process

UConfirm leverages technology and partnerships with employers to create a seamless and reliable employment verification system. The service offers several advantages over traditional methods:

- Automated Processes: UConfirm replaces time-consuming, manual verification methods with automated workflows, drastically reducing processing times.

- Accurate and Up-to-Date Information: By connecting directly with employer records, UConfirm ensures the accuracy of employment details.

- Regulatory Compliance: The service is designed to comply with federal laws like the Fair Credit Reporting Act (FCRA) and data privacy regulations.

- Convenience for All Parties: Employees, employers, and verifiers can access information securely and efficiently without unnecessary delays.

Who Uses UConfirm’s Employment Verification Services?

UConfirm serves a wide range of users, including:

- Employers: For verifying the employment history of job applicants and complying with pre-employment screening regulations.

- Lenders: To validate income and employment details during mortgage or loan approval processes.

- Landlords: For assessing the financial stability of potential tenants.

- Employees: To simplify the application process for loans, housing, or benefits by providing verifiable employment records.

- Government Agencies: For eligibility verification in public assistance and other programs.

The Key Features of UConfirm

UConfirm’s employment verification platform offers several key features that set it apart from other methods:

| Feature | Description |

|---|---|

| Automated Data Retrieval | Direct integration with employer systems for fast and reliable data access. |

| Secure Platform | Advanced encryption and data protection measures ensure the security of sensitive information. |

| Real-Time Verification | Provides instant access to employment data without delays. |

| Compliance Assurance | Adheres to legal standards, including FCRA and data privacy regulations. |

| Custom Solutions | Tailored verification services to meet the specific needs of businesses or industries. |

How to Use UConfirm for Employment Verification

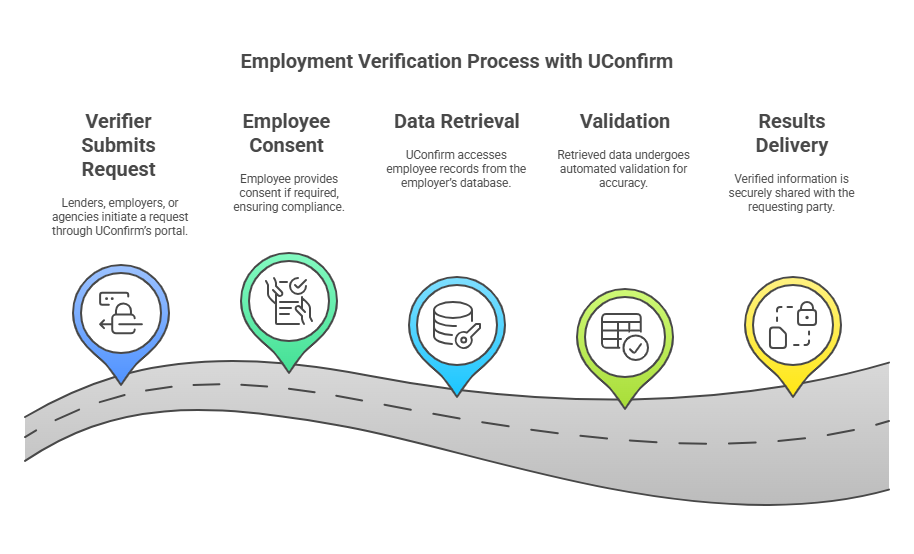

The process of employment verification with UConfirm is straightforward and designed to minimize complexity. Here’s how it works:

- Verifier Submits a Request:

- Lenders, employers, or agencies initiate a request for employment verification through UConfirm’s secure portal.

- The employee provides consent if required, ensuring compliance with federal regulations.

- Data Retrieval:

- UConfirm accesses the employee’s records directly from the employer’s database.

- Information such as employment dates, job title, and salary is retrieved accurately and securely.

- Validation:

- The retrieved data undergoes automated validation to ensure accuracy and completeness.

- Any discrepancies are flagged for resolution.

- Results Delivery:

- Verified employment information is shared securely with the requesting party.

- The process typically takes minutes to hours, depending on the complexity of the request.

Benefits of UConfirm for Employers and Employees

- For Employers:

- Time Savings: Automated processes reduce administrative burdens.

- Reduced Errors: Access to accurate and up-to-date records minimizes discrepancies.

- Compliance: Ensures adherence to FCRA and other relevant regulations.

- For Employees:

- Streamlined Processes: Simplifies applications for loans, mortgages, or benefits.

- Data Accuracy: Ensures that employment records are up-to-date and accurate.

- Privacy Protection: Secure data handling prevents unauthorized access to sensitive information.

Common Use Cases for UConfirm

Employment verification services like UConfirm are essential in several scenarios:

- Job Applications: Employers use UConfirm to verify a candidate’s previous job titles, tenure, and salary.

- Financial Applications: Lenders and banks rely on accurate employment data for loan or mortgage approvals.

- Housing Applications: Landlords request verification to ensure that tenants have the financial stability to meet rental obligations.

- Legal and Government Requirements: Agencies use UConfirm to confirm employment details for public assistance or legal purposes.

Addressing Challenges in Employment Verification

Despite its importance, employment verification can be challenging due to outdated records, incomplete data, or lengthy processing times. UConfirm addresses these challenges through:

- Real-Time Data Access: Ensures that verifiers receive up-to-date information directly from employers.

- Automated Error Detection: Identifies and resolves inconsistencies in records.

- Clear Resolution Protocols: Provides guidelines for employees to dispute incorrect data.

Infographic: How UConfirm Simplifies Employment Verification

Step 1: Request Submission: The verifier initiates a request.

Step 2: Employer Database Access: UConfirm retrieves data directly.

Step 3: Validation: Information is verified for accuracy.

Step 4: Secure Delivery: Results are sent to the verifier.

How UConfirm’s Verification Process Works

UConfirm’s employment verification process is designed to be user-friendly, accurate, and efficient, benefiting employers, employees, and third-party verifiers. Here is a step-by-step explanation of how it works:

Step 1: Request Submission

The process begins when a verifier (e.g., a lender, landlord, or government agency) submits a request to UConfirm for employment verification. This is typically initiated through UConfirm’s secure online portal.

- Who Can Submit Requests?

- Employers verifying a candidate’s employment history.

- Financial institutions confirming a borrower’s income and job details.

- Property owners validating a tenant’s ability to pay rent.

- Government agencies assessing eligibility for benefits or services.

Step 2: Data Retrieval

UConfirm integrates with employer records to access the requested employee information directly. The system is designed to retrieve:

- Employment start and end dates.

- Job title and position.

- Salary details (if consent is provided).

- Employment status (current or previous).

This automation ensures that the data is accurate, up-to-date, and retrieved in real-time.

Step 3: Validation of Data

Once the information is retrieved, UConfirm’s system validates the data to ensure:

- Consistency with employer records.

- Completeness of the requested information.

- Identification of potential errors or discrepancies.

Any identified issues are flagged and resolved before sharing the results with the verifier.

Step 4: Secure Delivery of Results

After validation, the verified employment information is securely delivered to the requesting party. UConfirm uses encryption and strict data security protocols to protect sensitive information. Results are typically provided in minutes, ensuring minimal delays in the verification process.

Key Features of UConfirm’s Verification Process

| Feature | Benefit |

|---|---|

| Automated System | Speeds up the verification process, reducing waiting times. |

| Real-Time Data Access | Ensures accuracy by retrieving current information directly from employer records. |

| Compliance Assurance | Meets federal regulations, including FCRA requirements and data privacy laws. |

| User-Friendly Interface | Simplifies request submission and tracking for verifiers. |

| Error Resolution Protocols | Provides clear steps for addressing discrepancies in employee records. |

Applications of UConfirm’s Employment Verification Services

UConfirm is a versatile tool used in various industries and scenarios. Below are some common applications:

1. For Employers

Employers frequently use UConfirm for pre-employment screening to verify the accuracy of job applicants’ résumés and applications.

- Benefits for Employers:

- Risk Mitigation: Ensures that candidates are honest about their employment history.

- Streamlined Hiring: Accelerates the recruitment process by providing quick verification results.

- Regulatory Compliance: Helps employers meet legal requirements for background checks and employment verification.

2. For Employees

Employees benefit from UConfirm by having a reliable platform to verify their job details when applying for loans, housing, or government programs.

- Common Employee Applications:

- Mortgage or Loan Applications: Verification is often required by financial institutions to validate income and employment status.

- Tenant Screening: Many landlords request employment verification to ensure a steady income.

- Government Benefits: Employees may need to confirm employment details when applying for unemployment benefits or other assistance programs.

3. For Third-Party Verifiers

Lenders, landlords, and agencies use UConfirm to streamline their processes and reduce manual efforts.

- Advantages for Verifiers:

- Efficiency: Automated data retrieval saves time.

- Accuracy: Direct integration with employer systems ensures reliable results.

- Secure Transactions: Encryption and compliance with data protection laws safeguard sensitive information.

Industries That Rely on UConfirm

Some industries benefit significantly from UConfirm’s services due to the importance of accurate employment verification:

| Industry | Application |

|---|---|

| Healthcare | Verifying the employment history of medical professionals for compliance and credentialing. |

| Finance | Confirming job and income details for mortgage, loan, and credit card approvals. |

| Education | Screening educators and staff for qualifications and employment history. |

| Real Estate | Assessing tenant stability through income and employment verification. |

| Government | Validating eligibility for public programs and security clearances. |

Challenges in Employment Verification and UConfirm’s Solutions

- Discrepancies in Records:

- Challenge: Inaccurate or outdated records can cause delays or rejections.

- UConfirm’s Solution: Automated validation flags inconsistencies and ensures resolution.

- Time-Consuming Processes:

- Challenge: Manual methods require significant time and effort.

- UConfirm’s Solution: Automation drastically reduces processing times.

- Data Security Risks:

- Challenge: Employment data contains sensitive information that must be protected.

- UConfirm’s Solution: Advanced encryption and strict compliance with data privacy laws ensure secure transactions.

How UConfirm Compares to Traditional Verification Methods

| Feature | Traditional Methods | UConfirm |

|---|---|---|

| Speed | Often slow, requiring days or weeks. | Automated and completed in minutes. |

| Accuracy | Prone to errors due to manual processes. | Accesses real-time, accurate employer data. |

| Compliance | May lack adherence to regulations. | Fully compliant with FCRA and privacy laws. |

| Convenience | Involves multiple steps and paperwork. | Simple, user-friendly online interface. |

| Scalability | Limited by manual capabilities. | Suitable for high-volume verifications. |

Infographic: UConfirm in Action

- Step 1: Request submitted by verifier.

- Step 2: Employer database accessed.

- Step 3: Data validated for accuracy.

- Step 4: Results securely delivered.

How Exact Background Checks Complements UConfirm

While UConfirm specializes in employment verification, services like Exact Background Checks provide additional value by offering:

- Comprehensive background checks, including criminal history and credit reports.

- Integration with employment verification to provide a holistic view of an individual’s history.

- Tailored solutions for businesses in West Virginia, ensuring local compliance.

Using UConfirm alongside Exact Background Checks allows employers and verifiers to gain a complete understanding of an individual’s profile.

Legal Aspects of UConfirm Verification of Employment

Employment verification processes, including those facilitated by UConfirm, are governed by strict legal and regulatory frameworks to protect individual rights and ensure fair practices. Below, we delve into the key legal considerations that users of UConfirm should be aware of:

1. Compliance with the Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) establishes federal guidelines for the collection, dissemination, and use of consumer information, including employment verification.

- Key Requirements for Employers:

- Obtain written consent from employees or applicants before initiating verification.

- Provide pre-adverse and adverse action notices if information from a verification report is used to make employment decisions.

- Ensure the accuracy and completeness of the data obtained from third-party providers like UConfirm.

- Responsibilities of UConfirm:

- Adhere to FCRA standards for accuracy and privacy.

- Provide mechanisms for individuals to dispute incorrect information.

- Maintain robust data security protocols to protect sensitive employment records.

2. Data Privacy and Protection Laws

UConfirm’s operations are also guided by state and federal data privacy laws that ensure the confidentiality of employee records.

- How UConfirm Safeguards Data:

- Uses advanced encryption for data storage and transmission.

- Limits access to authorized personnel only.

- Regularly audits its systems to identify and mitigate security risks.

- Employer and Verifier Responsibilities:

- Use the data only for legitimate purposes (e.g., hiring decisions, loan approvals).

- Avoid sharing information with unauthorized third parties.

3. Employee and Applicant Rights

Employees and job applicants have specific rights under FCRA and related laws:

- Right to Consent: No employment verification can occur without their explicit, written permission.

- Right to Access Records: Individuals can request a copy of their verification report to review its content.

- Right to Dispute Errors: If inaccuracies are found, individuals have the right to file a dispute with UConfirm to correct the information.

4. Legal Implications of Misuse

Improper use of employment verification information can result in legal penalties, including:

- Fines: Organizations that violate FCRA or privacy laws may face substantial financial penalties.

- Reputational Damage: Misuse of sensitive employee data can harm a company’s reputation.

- Legal Action: Individuals can sue for damages if their rights are violated.

Frequently Asked Questions (FAQs)

What is UConfirm and what problem does it solve?

UConfirm is an automated employment verification service that streamlines the process of verifying job history, solving the inefficiencies of manual verification methods and ensuring accuracy and compliance.

Who uses UConfirm’s employment verification services?

Employers, lenders, landlords, employees, and government agencies use UConfirm to verify employment details for various purposes, including hiring, loan applications, tenant screening, and benefit eligibility.

How does UConfirm’s employment verification process work?

The process involves a verifier submitting a request, UConfirm retrieving data directly from the employer’s database, validating the data for accuracy, and securely delivering the verified information to the requesting party.

What are the key benefits of using UConfirm for employers and employees?

For employers, benefits include time savings, reduced errors, and compliance. For employees, benefits include streamlined processes, data accuracy, and privacy protection.

What legal aspects should users consider when using UConfirm’s services?

Users must comply with the Fair Credit Reporting Act (FCRA), data privacy and protection laws, and ensure they obtain proper consent while respecting employee and applicant rights.

The Benefits of Using UConfirm

| Feature | Benefit |

|---|---|

| Speed and Efficiency | Automated processes deliver results faster than traditional methods. |

| Accuracy | Direct integration with employer records ensures data reliability. |

| Compliance | Adherence to federal and state regulations provides legal protection for all parties. |

| Security | Advanced encryption protects sensitive information from breaches. |

| Transparency | Employees can access and dispute their records, promoting trust and fairness. |

Complementing UConfirm with Exact Background Checks

While UConfirm excels at verifying employment information, it can be used in conjunction with Exact Background Checks to provide a more comprehensive profile of an individual. Exact Background Checks offer:

- Criminal History Reports: Ensuring workplace safety and compliance.

- Education Verification: Validating academic credentials.

- Credit Reports: Assessing financial reliability for sensitive positions.

Using both services together can streamline the hiring process, minimize risks, and ensure compliance with all relevant regulations.

Conclusion: Why UConfirm Is a Game-Changer for Employment Verification

UConfirm has revolutionized the employment verification process by combining automation, accuracy, and compliance into one seamless platform. Its ability to serve employers, employees, and third-party verifiers makes it an invaluable tool for industries ranging from finance to real estate.

The platform’s adherence to legal standards, commitment to data security, and user-friendly features ensure that employment verifications are completed quickly and accurately. When paired with complementary services like Exact Background Checks, UConfirm provides a comprehensive solution for all verification needs.

Call to Action:

Whether you’re an employer looking to streamline your hiring process, an employee applying for a mortgage, or a verifier seeking reliable data, UConfirm offers the tools you need for fast, secure, and compliant employment verification. Don’t leave your verification needs to chance—opt for UConfirm today and experience the difference in efficiency and accuracy!