Personal Loan Options Without Employment Verification

Understanding Personal Loans Without Employment Verification

In today’s evolving economic landscape, many people earn income in ways that don’t involve traditional employment. Freelancers, gig workers, independent contractors, and even some retirees often lack standard proof of employment, such as pay stubs or a W-2 form. This non-traditional financial profile can make it difficult to access conventional loans from banks or credit unions, which typically require employment verification to assess repayment ability.

Enter personal loans without employment verification—a financial solution designed to provide access to credit for those who don’t fit the mold of a traditional borrower. These loans cater to people who need funding but have irregular income, work on a freelance basis, or rely on alternative income sources. While they offer critical financial flexibility, they also come with risks and requirements that borrowers must fully understand before proceeding.

This section will explore what personal loans without employment verification are, why they exist, the types of loans available, who can benefit from them, and the potential benefits and drawbacks of this financing option.

What Are Personal Loans Without Employment Verification?

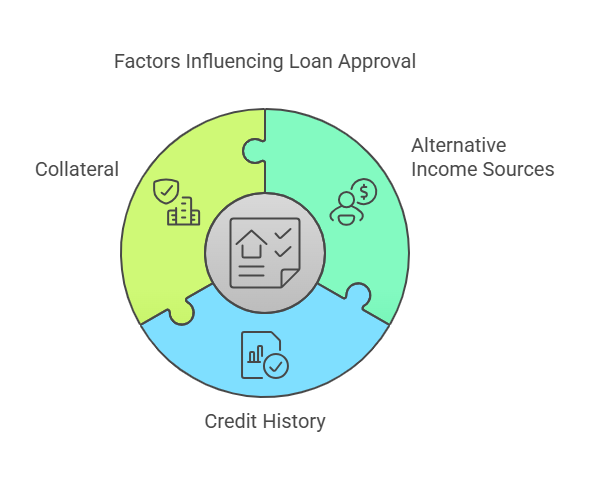

Personal loans without employment verification are exactly as they sound: loans that don’t require borrowers to provide proof of traditional employment to qualify. Instead of focusing on a steady paycheck, lenders assess applicants based on other factors, such as:

- Alternative income sources: This could include income from investments, rental properties, freelance work, or government benefits.

- Credit history: A strong credit score may outweigh the absence of employment verification.

- Collateral: For secured loans, lenders may accept assets such as a car, house, or savings account as security.

These loans are typically unsecured, meaning they don’t require collateral, but secured options are also available. The primary appeal lies in their accessibility, especially for individuals who might struggle to meet traditional lending criteria.

Types of Personal Loans Without Employment Verification

There are several types of personal loans that don’t require proof of employment. Each type has unique features, eligibility criteria, and use cases:

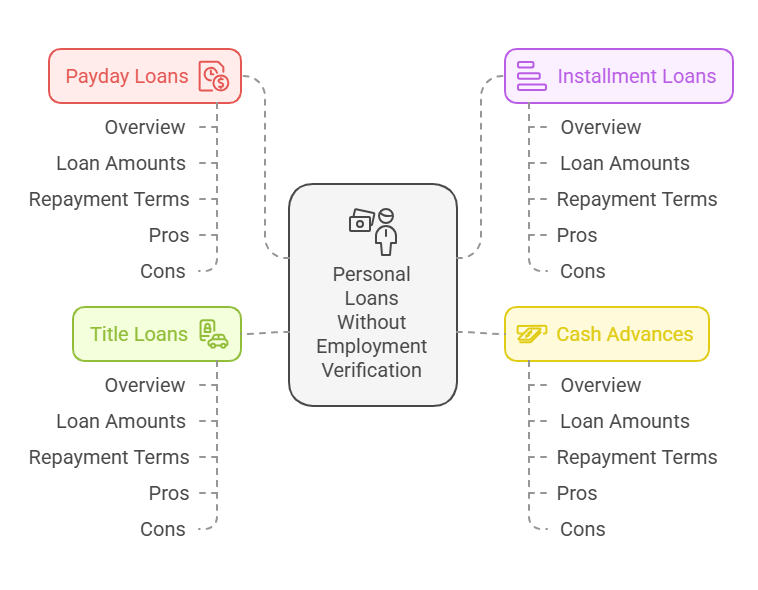

- Payday Loans

- Overview: Payday loans are short-term loans intended to cover immediate expenses until the borrower’s next payday.

- Loan Amounts: Typically small, ranging from $100 to $1,500.

- Repayment Terms: Due within two weeks or by the borrower’s next paycheck.

- Pros: Quick approval and funding, minimal documentation.

- Cons: Extremely high interest rates and fees, risk of a debt cycle.

- Installment Loans

- Overview: Installment loans allow borrowers to repay the loan in fixed monthly payments over a predetermined period.

- Loan Amounts: Can range from $500 to $50,000, depending on the lender.

- Repayment Terms: Typically six months to several years.

- Pros: Predictable payments, suitable for larger expenses.

- Cons: Higher interest rates for borrowers with poor credit or no employment verification.

- Cash Advances

- Overview: Cash advances are short-term loans borrowed against a credit card or through online lenders.

- Loan Amounts: Usually up to a percentage of the credit card’s limit.

- Repayment Terms: Flexible but subject to high interest rates.

- Pros: Immediate access to cash, no need for traditional employment verification.

- Cons: High fees and interest rates, risk of increasing credit card debt.

- Title Loans

- Overview: Secured loans that use the borrower’s vehicle title as collateral.

- Loan Amounts: Based on the value of the vehicle.

- Repayment Terms: Often 30 days or more, with options for renewal.

- Pros: Easier to qualify for, even with bad credit.

- Cons: Risk of losing the vehicle if repayments are not made.

Who Might Need These Loans?

The demand for personal loans without employment verification stems from the diverse financial needs of modern borrowers. Common scenarios include:

- Freelancers and Gig Workers: People in these roles often have variable income, making it difficult to provide consistent pay stubs.

- Self-Employed Individuals: Business owners and entrepreneurs may not have traditional proof of employment but still need financing for personal or business-related expenses.

- Unemployed or Between Jobs: During periods of unemployment, individuals may require short-term financial assistance to cover essential bills or emergencies.

- Retirees: Retirees living on pensions, Social Security, or investment income may not meet standard employment criteria but still have the ability to repay loans.

- Seasonal Workers: Workers with income fluctuations tied to specific seasons may struggle to qualify for traditional loans.

Typical Requirements for Personal Loans Without Employment Verification

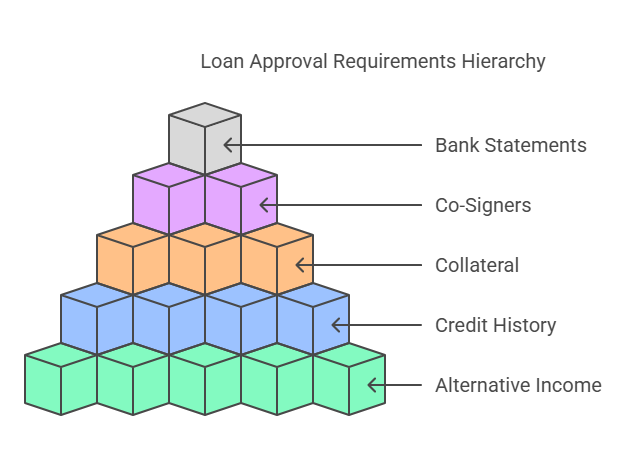

While employment verification may not be required, lenders still assess the borrower’s financial stability and ability to repay the loan. Here are some common requirements:

- Proof of Alternative Income:

Lenders may ask for documentation showing income from:- Freelance or contract work

- Rental properties

- Investment dividends

- Government benefits, such as Social Security or disability payments

- Credit History and Score:

A strong credit score demonstrates financial responsibility and increases approval chances. Borrowers with poor credit may still qualify but might face higher interest rates. - Collateral (for Secured Loans):

Secured loans may require assets such as a vehicle, home, or savings account to back the loan. This reduces the lender’s risk but increases the borrower’s exposure if payments aren’t made. - Co-Signers:

A creditworthy co-signer can improve approval odds by guaranteeing the loan repayment if the borrower defaults. - Bank Statements:

Many lenders request recent bank statements to verify income deposits and assess financial habits.

Pros and Cons of Personal Loans Without Employment Verification

| Feature | Advantages | Disadvantages |

|---|---|---|

| No Traditional Employment Proof | Accessible to non-traditional workers, freelancers, and self-employed individuals. | Often comes with higher interest rates and shorter repayment terms. |

| Quick Approval Process | Minimal documentation required, leading to faster approval and funding. | Some lenders may exploit borrowers with hidden fees and unfavorable terms. |

| Flexible Eligibility Criteria | Includes alternative income sources and collateral options for eligibility. | Risk of losing collateral in case of secured loans. |

| Variety of Loan Types | Options available for short-term and long-term needs. | Predatory lenders may target vulnerable borrowers, requiring careful research before applying. |

How Personal Loans Without Employment Verification Work

The process typically begins with an online application, where borrowers submit details about their financial situation and upload required documents. Many lenders offer pre-approval within hours and disburse funds as soon as the next business day. While convenient, borrowers must thoroughly evaluate loan terms to avoid falling into a cycle of debt due to high interest rates or hidden fees.

Personal loans without employment verification provide a vital financial bridge for those in non-traditional work arrangements or facing temporary financial challenges. However, they require careful planning, research, and responsible borrowing to ensure they meet the borrower’s needs without creating undue financial strain.

How to Apply and Prepare for Personal Loans Without Employment Verification

Applying for a personal loan without employment verification can be a straightforward process, but it requires careful preparation and understanding of the steps involved. This section provides a detailed guide to help you navigate the application process, avoid common pitfalls, and improve your chances of approval.

Step-by-Step Guide to Applying for Personal Loans Without Employment Verification

- Assess Your Financial Situation

Before applying, evaluate your current financial standing, including:- Monthly Income: Identify all sources of income, such as freelance work, rental income, government benefits, or investment dividends.

- Expenses: Calculate your regular expenses, including rent, utilities, groceries, and debts, to determine your repayment capacity.

- Credit Score: Check your credit score and credit report. A higher score improves your chances of securing favorable loan terms.

By understanding your financial situation, you can avoid over-borrowing and choose a loan amount that aligns with your ability to repay.

- Research and Compare Lenders

Not all lenders offering personal loans without employment verification are the same. Research is critical to find a reputable lender that suits your needs. Consider the following factors:- Interest Rates: Compare rates from multiple lenders to secure the most competitive terms.

- Loan Amounts and Terms: Look for a lender that offers the loan size and repayment period you need.

- Fees and Charges: Check for origination fees, late payment penalties, or prepayment charges.

- Customer Reviews: Read reviews and testimonials to ensure the lender has a solid reputation.

Tip: Focus on lenders who specialize in alternative income verification, as they are more likely to accommodate your financial profile.

- Prepare Your Documentation

While employment verification isn’t required, lenders still need proof of financial stability. Commonly requested documents include:- Proof of Alternative Income: Submit bank statements, tax returns, or proof of government benefits.

- Identification: Provide a government-issued photo ID, such as a driver’s license or passport.

- Credit History: Some lenders may request access to your credit report.

- Collateral Documents (if applicable): For secured loans, prepare documents proving ownership of the asset being used as collateral.

- Complete the Application Process

Most applications can be completed online or in person, depending on the lender. During the application process:- Provide accurate personal and financial information.

- Upload the necessary documents.

- Wait for the lender’s approval. Pre-approval is often provided within hours, while final approval and funding can take 1–3 business days.

- Review Loan Terms Carefully

Once approved, the lender will provide a loan agreement outlining the terms and conditions. Pay close attention to:- Interest Rate (APR): Understand the total cost of borrowing.

- Repayment Schedule: Note due dates and monthly payment amounts.

- Fees: Look for hidden fees or charges.

- Penalties: Be aware of consequences for late payments or early repayment.

Only sign the agreement if you fully understand and accept the terms.

- Receive Funds and Use Responsibly

After signing, funds are typically disbursed via direct deposit into your bank account. Use the loan for its intended purpose, whether it’s covering emergency expenses, consolidating debt, or managing cash flow.

Tips to Increase Your Chances of Approval

Securing a personal loan without employment verification can be challenging, but following these strategies can improve your odds:

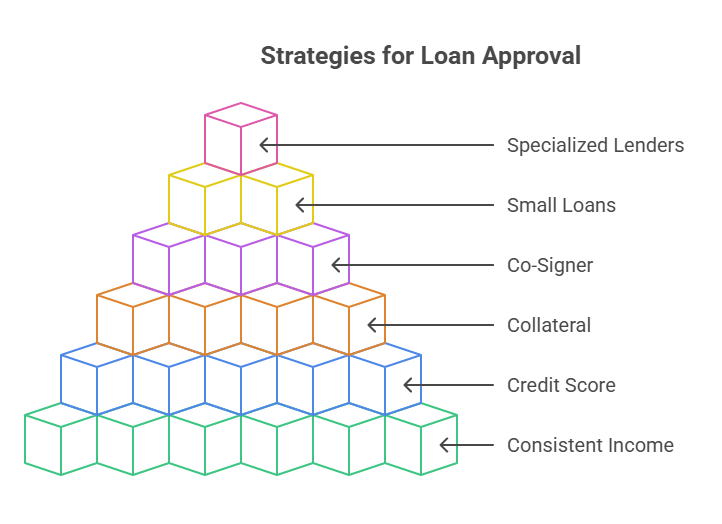

- Show Consistent Income

Demonstrate regular deposits from freelance clients, rental properties, or government benefits. Lenders value consistent cash flow, even if it’s not from traditional employment. - Build Your Credit Score

A strong credit score signals reliability and reduces perceived risk for lenders. Improve your credit score by:- Paying bills on time.

- Reducing credit card balances.

- Disputing errors on your credit report.

- Offer Collateral

Secured loans are easier to obtain because the lender has an asset to recover in case of default. Consider using a vehicle, savings account, or other valuable asset as collateral. - Use a Co-Signer

A creditworthy co-signer with stable income can strengthen your application and lead to better loan terms. However, ensure the co-signer fully understands their financial responsibility. - Start with a Small Loan

Borrowing a smaller amount increases approval chances and minimizes the lender’s risk. Repaying small loans on time also builds trust for future borrowing. - Work with Specialized Lenders

Look for lenders experienced in working with self-employed or gig workers. They are more likely to understand your financial situation and offer flexible solutions.

Best Practices to Avoid Scams or Predatory Lenders

The demand for personal loans without employment verification has unfortunately attracted unscrupulous lenders. Protect yourself by following these best practices:

- Verify Lender Credentials

- Check if the lender is licensed in your state.

- Look for accreditation from organizations like the Better Business Bureau (BBB).

- Research online reviews and complaints.

- Be Wary of Upfront Fees

Legitimate lenders don’t ask for payment before loan approval. Avoid lenders who demand application fees, processing fees, or other charges upfront. - Scrutinize Loan Terms

Predatory lenders often hide exorbitant interest rates or fees in the fine print. Review all terms thoroughly and ask questions if something isn’t clear. - Avoid Guaranteed Approval Offers

No lender can guarantee approval without reviewing your financial situation. Be cautious of such claims, as they often signal a scam. - Trust Your Instincts

If a lender’s offer seems too good to be true, it probably is. Walk away from any deal that feels suspicious or high-pressure.

The Role of Exact Background Checks in Responsible Lending

At Exact Background Checks, we specialize in providing reliable financial screening services to help lenders make informed decisions. Our expertise ensures that lenders can:

- Verify alternative income sources accurately.

- Assess applicants’ creditworthiness without relying solely on employment verification.

- Comply with lending regulations and avoid legal complications.

For borrowers, working with lenders who use our services means a fairer and more transparent loan approval process.

Dos and Don’ts for Borrowers

To navigate the loan application process successfully, follow these essential guidelines:

Do:

- Compare multiple lenders to find the best terms.

- Provide complete and accurate information on your application.

- Use the loan for its intended purpose and create a repayment plan.

- Keep all loan-related documents for future reference.

Don’t:

- Borrow more than you can afford to repay.

- Ignore the fine print in loan agreements.

- Miss payments, as this can harm your credit score and result in additional fees.

- Fall for high-pressure tactics from lenders.