Understanding Employment and Salary Verification Letters

Introduction to Employment and Salary Verification Letters

In today’s interconnected world, employment and income verification has become a crucial part of both professional and financial transactions. Whether you’re applying for a loan, securing a new rental property, or undergoing an employment background check, one essential document that may be required is an employment and salary verification letter.

These letters confirm an individual’s employment status, job title, and income, which can be pivotal in a variety of circumstances. Whether you’re an employee needing to verify your income or an employer tasked with writing these letters, understanding their purpose and importance can help streamline the process. In this section, we’ll explore what employment and salary verification letters are, why they are necessary, and the key components they should include.

What Is an Employment and Salary Verification Letter?

An employment and salary verification letter is a formal document written by an employer or human resources (HR) department to confirm an employee’s employment status and income. It outlines essential details such as the employee’s job title, length of employment, salary, and other relevant information.

The main purpose of the letter is to provide third parties, such as lenders, landlords, or other employers, with official proof of an individual’s job and income. This documentation is often requested during loan applications, rental applications, visa applications, or background checks, among other situations.

For example, if an individual is applying for a mortgage loan, the lender will need to verify that the applicant is employed and earning a consistent income. The same principle applies when applying for an apartment lease, where landlords want to ensure tenants can afford the rent. Similarly, employers may request verification of past employment during hiring or background check processes to confirm the truthfulness of a candidate’s resume or work experience.

An employment and salary verification letter serves as an official record that confirms the income level, employment status, and work history of the individual, making it a crucial document for a range of financial and legal processes.

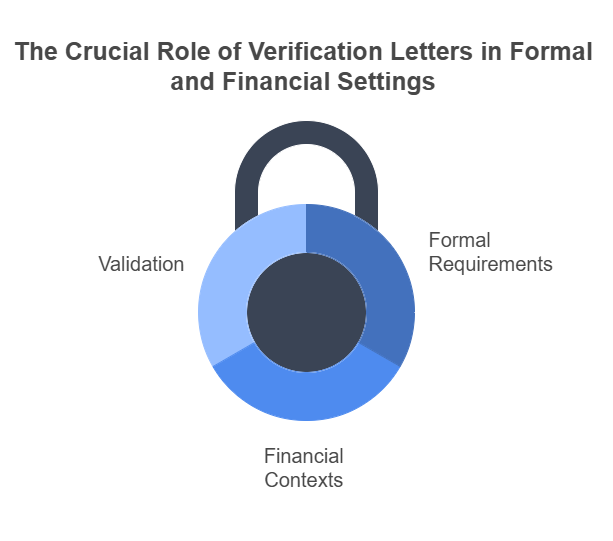

Why Are Employment and Salary Verification Letters Important?

There are several key reasons why these letters are so important, especially in formal and financial contexts. Below are some of the main reasons why they are often required:

1. Loan Applications

When applying for a personal loan, mortgage, or car loan, lenders need to ensure that the applicant has the means to repay the loan. Banks, credit unions, and other lending institutions often request a verification letter as part of the application process. This letter confirms the borrower’s income level and employment status, ensuring they are financially capable of managing monthly repayments.

2. Background Checks

Employers conduct background checks to ensure that candidates are truthful about their past work experience and qualifications. By requesting an employment and salary verification letter, potential employers can confirm the applicant’s previous job titles, employment dates, and salary information. This verification process helps ensure that the candidate is the right fit for the position and has the necessary experience.

3. Rental Applications

Landlords and property management companies frequently request employment verification letters when reviewing rental applications. The primary reason for this request is to confirm that the potential tenant has a steady income and will be able to pay the rent on time. A valid employment verification letter offers assurance to the landlord that the tenant is financially responsible and capable of fulfilling their rental obligations.

4. Immigration and Visa Applications

Certain visa applications require proof of employment or income. For individuals applying for work visas, immigration authorities may request an employment verification letter to confirm that the applicant has the financial means to support themselves during their time abroad. Similarly, student visa or family-based immigration applications may also require this document as proof of employment and financial stability.

5. Legal and Financial Situations

Employment verification letters are often used in child support cases, divorce settlements, or other legal proceedings where the individual’s income needs to be proven. In these cases, the letter helps verify the individual’s financial capabilities and ensures that legal or financial decisions are based on accurate information.

Overall, the importance of an employment and salary verification letter lies in its ability to provide a trustworthy and verifiable record of an individual’s employment history and income level. Whether for securing a loan, renting a home, or applying for a job, this letter plays a critical role in confirming that the information provided by the individual is accurate and verifiable.

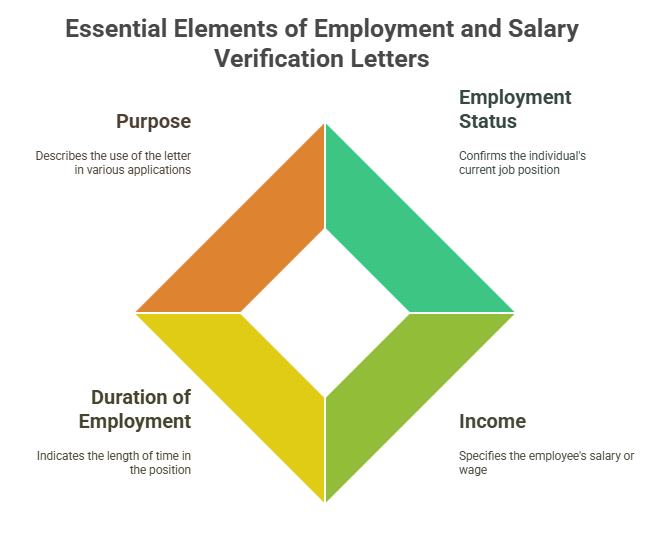

Key Components of an Employment and Salary Verification Letter

For an employment and salary verification letter to be effective and meet its intended purpose, it must include several key components. Each of these sections plays an important role in ensuring that the letter is both comprehensive and verifiable. Below are the primary components that should be included:

1. Employee’s Name

The letter must include the full name of the individual whose employment and salary are being verified. This is crucial for ensuring that there is no ambiguity about which employee is being referenced in the letter. The name should match the individual’s official records for accuracy.

2. Job Title

The letter should clearly state the employee’s job title or position within the company. This provides the recipient with a clear understanding of the employee’s role, responsibilities, and level of employment within the organization. Job titles help verify the employee’s experience and qualification level, which may be necessary for specific applications (e.g., visa applications or employment background checks).

3. Employment Dates

The letter should include the employee’s employment start date and, if applicable, the end date if they are no longer employed. If the individual is currently employed, it should be clearly stated that their employment is ongoing. This helps confirm the duration of the employee’s tenure with the company, which is often a critical piece of information for loan applications, background checks, or rental agreements.

4. Salary Information

The salary section of the letter is arguably the most important. It should include specific information about the employee’s compensation:

- Annual salary (for salaried employees)

- Hourly rate (for hourly employees)

- Bonuses, commissions, or other incentives (if applicable)

- Other benefits, such as health insurance, pension plans, and other fringe benefits that are part of the total compensation package.

Including this level of detail ensures that the recipient of the letter has a comprehensive understanding of the employee’s financial standing, which is especially important when verifying income for loan or rental applications.

5. Employer’s Contact Information

The letter must also provide the employer’s contact information, including the company’s name, address, phone number, and email. This is necessary in case the recipient of the letter needs to verify the details with the employer or HR department. Providing this contact information adds credibility and legitimacy to the letter, and allows the recipient to confirm the validity of the contents if necessary.

Each of these components plays an important role in ensuring that the employment and salary verification letter serves its intended purpose. By including these details, the letter helps confirm both the employment history and financial stability of the individual.

Common Uses of Employment and Salary Verification Letters

| Purpose | When It’s Requested | Why It’s Needed |

|---|---|---|

| Mortgage Application | When applying for a home loan | To confirm income and employment status before approving a loan |

| Background Checks | During the hiring process | To verify that an applicant’s employment history is accurate |

| Rental Applications | When applying to rent a property | To ensure the applicant has stable income for rent payments |

| Loan Applications | When applying for personal or auto loans | To verify that the applicant has the means to repay the loan |

| Visa Applications | For international travel/immigration | To prove employment status for visa or work permit purposes |

| Child Support Cases | In legal proceedings | To determine income for calculating child support obligations |

This table summarizes some of the common situations where an employment and salary verification letter is requested, highlighting the diverse ways in which these letters are utilized.

How to Request an Employment and Salary Verification Letter

For employees needing an employment and salary verification letter, the first step is to request it from their employer or HR department. While many employers routinely provide this service, it’s important to understand the proper way to make the request and the typical process involved. Here’s a comprehensive guide to requesting this important document:

1. Contacting the HR Department or Employer

The HR department or the employee’s direct supervisor is typically the first point of contact when requesting an employment and salary verification letter. If your company has an HR department, they will most likely handle these requests, as they maintain official employee records.

When making the request, it’s important to be clear and professional in your communication. You may choose to make your request via email, phone, or in-person (depending on company procedures). Here’s a brief breakdown of how you should approach the request:

- Email: If you’re emailing the HR department, ensure that your email is polite and to the point. Provide relevant details like your full name, position, and the purpose of the request.

- Phone Call: If calling, be ready to provide information about why you need the letter and ensure you clarify any details about the format, such as whether the letter needs to be notarized or include specific information (e.g., bonuses, benefits).

- In-Person Request: When making the request in person, be polite and professional, providing a clear explanation for why you need the letter.

2. Providing Necessary Details

When requesting the letter, ensure that you provide your employer or HR representative with all necessary information. Common details they will need from you include:

- Your Full Name: To ensure the correct individual is referenced in the letter.

- Job Title: Ensure your current job title is accurate, especially if you have had recent promotions.

- Dates of Employment: Provide the start date of your employment, and if applicable, the end date if you are no longer with the company.

- Salary Information: Let your employer know if you need your salary to be included in the letter. If you earn commissions, bonuses, or other incentives, provide these details as well.

- Purpose: Indicate the reason for the verification request, such as applying for a loan, renting an apartment, or other situations requiring proof of income and employment.

By providing this information, you help the HR department draft a more accurate and relevant verification letter. The clearer and more detailed your request, the quicker the process will go.

3. Timeframe for Request

Depending on your employer’s processes, the timeframe for receiving the verification letter may vary. Generally, employers need a few business days to process and generate the letter. It’s always best to request the letter well in advance, especially if the letter is needed for an important deadline (e.g., a loan approval or rental application).

If you are on a tight schedule, kindly express your urgency when making the request. However, understand that the process may take time, and it’s a good idea to follow up with HR if the letter isn’t received within the expected timeframe.

How to Write an Employment and Salary Verification Letter

While many employees request an employment and salary verification letter from their employer or HR department, some employers may need guidance on how to write one themselves. Whether you are an HR professional or a supervisor responsible for drafting the letter, following a clear and professional structure is key. Below is a step-by-step guide to writing an employment and salary verification letter.

1. Format the Letter Properly

Start with a formal business letter format. The letter should be printed on company letterhead if possible, as this adds legitimacy. At the top of the letter, include the following details:

- Company Name and Address

- Date of Writing

- Recipient’s Name and Address (if known)

A formal tone is essential when writing this letter. Use professional language and ensure all spelling and grammatical errors are corrected before submitting.

2. Introduction and Purpose

Begin the letter by introducing yourself (the employer or HR representative) and the purpose of the letter. Make it clear why the letter is being written, for example:

“This letter is to verify the employment of [Employee’s Name], who has been employed with [Company Name] from [Start Date] to [Current Date or End Date]. This letter serves to confirm the details of their employment and income as requested.”

It’s important to keep the introduction concise while providing the necessary context.

3. Employee’s Information

Provide the employee’s details, including:

- Full Name: The employee’s full name as listed in company records.

- Job Title: Clearly state the employee’s job title or position within the company.

- Dates of Employment: Indicate the employee’s start date and end date (if applicable). If the employee is still employed, be sure to include “currently employed.”

Example: “[Employee’s Name] holds the position of [Job Title] and has been employed with [Company Name] since [Start Date]. As of [Date], they are still actively employed.”

4. Salary Information

The salary information section is critical, as it validates the employee’s income level. Include the following:

- Salary Amount: State whether the employee is salaried or hourly. For salaried employees, list the annual salary; for hourly employees, indicate the hourly wage and any standard working hours.

- Bonuses or Commissions: If applicable, mention any bonuses, commissions, or additional compensation the employee receives.

- Additional Benefits: You can also include information about employee benefits such as health insurance, retirement plans, or other perks, if relevant to the verification request.

Example: “[Employee’s Name] earns a salary of [Salary Amount] annually. They are eligible for annual bonuses, which are based on performance and company profits. In addition, they receive standard company benefits, including health insurance and a 401(k) retirement plan.”

5. Offer to Provide Additional Information

Conclude the letter by offering further assistance if necessary. This shows that you are open to communication and willing to help the recipient verify the employee’s details. Example:

“If you require any additional information or clarification regarding [Employee’s Name]’s employment, please do not hesitate to contact me at [Contact Information].”

Sample Employment and Salary Verification Letter

Here’s a simple sample template for an employment and salary verification letter:

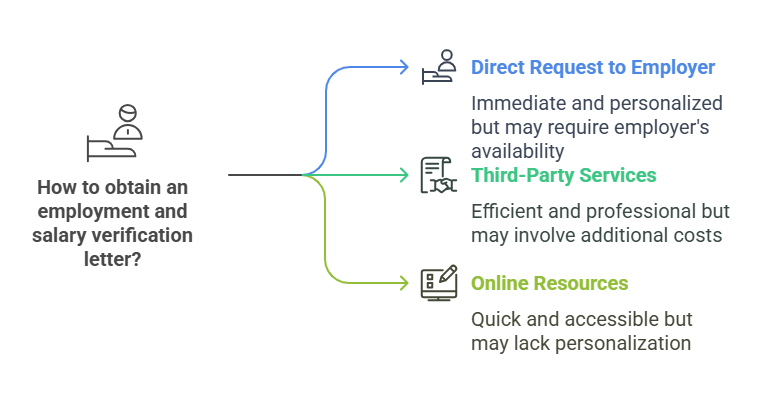

Methods of Obtaining Employment and Salary Verification

There are a few ways to obtain an employment and salary verification letter, depending on the need and urgency. Below are some methods, including the pros and cons of each:

1. Direct Request to Employer

- Pros: Direct, typically reliable, and free.

- Cons: May take time depending on your employer’s schedule and internal processes.

2. Using Third-Party Verification Services

- Pros: Fast, professional, and eliminates the need to rely on internal HR processes.

- Cons: May involve fees for the service.

One such service is Exact Background Checks, which offers quick and accurate employment verification services for both employers and employees. Third-party services may be especially useful in cases where employees need verification letters for multiple purposes or have limited access to their company’s HR department.

3. Online Resources and Databases

- Pros: Convenient and automated.

- Cons: Limited to data that is available through online systems and may not include all relevant salary details.

Legal Aspects of Employment and Salary Verification Letters

While employment and salary verification letters are essential for confirming an individual’s employment and income status, they are also subject to various legal requirements. It’s crucial to be aware of the legal framework around these letters to avoid potential issues such as privacy violations or errors in documentation. Below, we outline key legal aspects related to employment and salary verification.

1. Privacy and Confidentiality Concerns

One of the most important legal considerations in issuing or receiving an employment and salary verification letter is the issue of privacy. Employers must ensure that they are not disclosing information beyond what is necessary for the request.

In many cases, an employer cannot share an employee’s salary information, job performance, or other sensitive details without the employee’s consent. This is especially relevant when the request is made by external entities such as lenders or rental agencies. Before issuing such a letter, the employee may need to sign a release form allowing the employer to share certain details.

Employers are also bound by various privacy laws to ensure that they do not violate the confidentiality of their employees. This can include restrictions on sharing salary history or other personal details, particularly in regions where salary history bans have been enacted. For example, California, New York City, and several other areas have laws preventing employers from asking job candidates about their salary history.

2. Consent Requirements

In general, employers are required to obtain the employee’s consent before issuing an employment and salary verification letter. Some employers may have a standard release form for employees to sign that grants permission for the HR department to share employment details.

If the employee is requesting the verification letter for personal reasons (such as applying for a mortgage or car loan), written consent is often necessary to comply with privacy laws. However, in certain cases where the verification request is for legal purposes, such as a child support enforcement request, the need for consent may be waived.

3. Salary History Bans and Limitations

Several states and localities have implemented salary history bans to combat gender pay inequality. In these areas, employers cannot ask candidates about their previous salaries, and they are often restricted from disclosing salary history in employment verification letters. Instead, they are only permitted to provide details about current employment and current compensation.

In these cases, employers must ensure that the verification letter only includes information that is permissible under state and local law. This means that salary details may need to be omitted or limited to certain types of compensation (e.g., base salary, bonuses).

4. Accuracy and Liability

Providing accurate information is critical in employment and salary verification. Employers can face legal consequences if they provide incorrect details about an employee’s employment status or income. If an employer provides false or misleading information, they could potentially be held liable for damages, especially if the information was used for financial decisions, such as loan applications.

For example, if an employer incorrectly states that an employee earned a higher salary than they actually did, and this causes harm (e.g., a lender approves a loan based on inaccurate income data), the employer could face legal action.

Employers should also ensure that the information they provide is based on official company records to avoid any discrepancies. As a best practice, HR departments should maintain up-to-date records of employees’ positions, salaries, and employment dates.

Frequently Asked Questions (FAQs)

Let’s now look at some of the most frequently asked questions about employment and salary verification letters. These common queries help clarify common concerns about the process.

What is an employment and salary verification letter?

It's a formal document from an employer confirming an employee's job title, employment dates, and income, used as official proof for third parties like lenders or landlords.

Why are employment and salary verification letters important?

They are important for loan applications, background checks, rental applications, immigration and visa applications, and legal/financial situations, providing trustworthy proof of employment and income.

What key components should be included in an employment and salary verification letter?

Key components include the employee's name, job title, employment dates, salary information (amount, bonuses, benefits), and the employer's contact information.

How do you request an employment and salary verification letter?

Contact the HR department or employer, provide necessary details (full name, job title, employment dates, salary details, purpose), and allow sufficient time for processing.

What are the legal aspects to consider when dealing with employment and salary verification letters?

Employers must consider privacy and confidentiality concerns, obtain employee consent, adhere to salary history bans, and ensure accuracy to avoid liability.

What is an employment and salary verification letter?

It's a formal document from an employer confirming an employee's job title, employment dates, and income, used as official proof for third parties like lenders or landlords.

Why are employment and salary verification letters important?

They are important for loan applications, background checks, rental applications, immigration and visa applications, and legal/financial situations, providing trustworthy proof of employment and income.

What key components should be included in an employment and salary verification letter?

Key components include the employee's name, job title, employment dates, salary information (amount, bonuses, benefits), and the employer's contact information.

How do you request an employment and salary verification letter?

Contact the HR department or employer, provide necessary details (full name, job title, employment dates, salary details, purpose), and allow sufficient time for processing.

What are the legal aspects to consider when dealing with employment and salary verification letters?

Employers must consider privacy and confidentiality concerns, obtain employee consent, adhere to salary history bans, and ensure accuracy to avoid liability.

Conclusion

In this comprehensive article, we’ve explored the importance of employment and salary verification letters, how to request and write them, and the legal aspects that must be considered. These letters serve as vital documents for employees, employers, and various organizations involved in financial transactions, rental agreements, and hiring processes.

Understanding the legal requirements and best practices for writing and requesting these letters can help ensure accuracy and compliance. It is always recommended to seek employee consent and ensure that the information disclosed is accurate to avoid potential legal issues.

If you need an employment verification letter but don’t have the time or resources to obtain it yourself, services like Exact Background Checks can assist in obtaining these letters quickly and accurately.

In summary, employment and salary verification letters play a crucial role in modern employment practices, and understanding their significance and proper use is essential for anyone involved in employment screening, financial transactions, or rental agreements. Whether you are an employee, employer, or other third-party requester, following the correct procedures ensures the integrity of the verification process and avoids unnecessary legal complications.