Steps to Verify Employment for Student Loan Forgiveness

Understanding Student Loan Forgiveness Employment Verification

What is Student Loan Forgiveness?

Student loan forgiveness is a financial relief program that cancels a portion or all of a borrower’s student loan debt under specific conditions. Programs like the Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness are designed to incentivize careers in public service, education, and other fields by providing debt relief after a set period of qualifying payments.

Employment verification is a crucial aspect of most student loan forgiveness programs. It ensures that borrowers meet the necessary criteria for eligibility, particularly in programs tied to specific job roles or sectors.

Why Employment Verification is Essential

Programs like PSLF or Teacher Loan Forgiveness require borrowers to work in qualified professions, such as:

- Government jobs

- Nonprofit organizations

- Education or healthcare sectors

Employment verification confirms:

- The borrower’s job aligns with the program’s eligibility criteria.

- The borrower has consistently worked in a qualifying role during the required timeframe.

- Employers meet the program’s standards, such as nonprofit status under Section 501(c)(3).

Without proper verification, applicants risk losing their eligibility or delaying the loan forgiveness process.

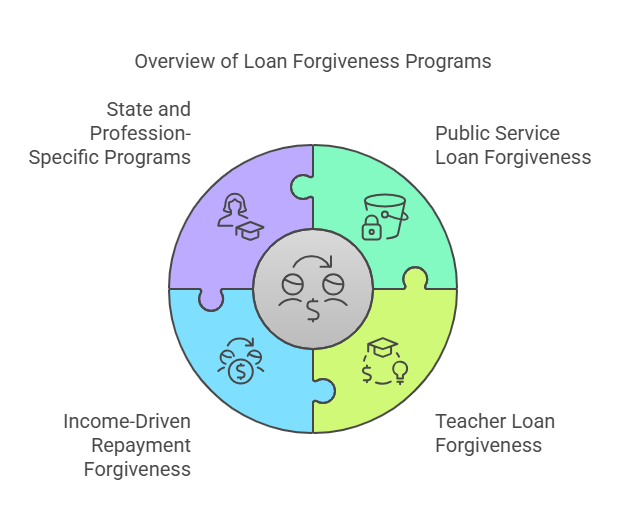

Types of Student Loan Forgiveness Programs Requiring Employment Verification

1. Public Service Loan Forgiveness (PSLF)

PSLF is one of the most prominent forgiveness programs, designed for individuals working in public service or nonprofit roles. Key requirements include:

- 120 qualifying monthly payments.

- Full-time employment with a qualifying employer.

- Submission of an Employment Certification Form (ECF) annually or when changing employers.

2. Teacher Loan Forgiveness

Available for educators who work full-time in low-income schools for at least five consecutive years. Employment verification ensures that:

- The school is eligible based on federal guidelines.

- The borrower meets full-time teaching requirements.

3. Income-Driven Repayment (IDR) Forgiveness

IDR plans offer forgiveness after 20–25 years of qualifying payments. While these plans don’t strictly require specific job roles, borrowers must verify income and family size annually to ensure they remain eligible for reduced payment terms.

4. State and Profession-Specific Forgiveness Programs

Programs like NURSE Corps Loan Repayment or John R. Justice Program for attorneys often require detailed employment verification.

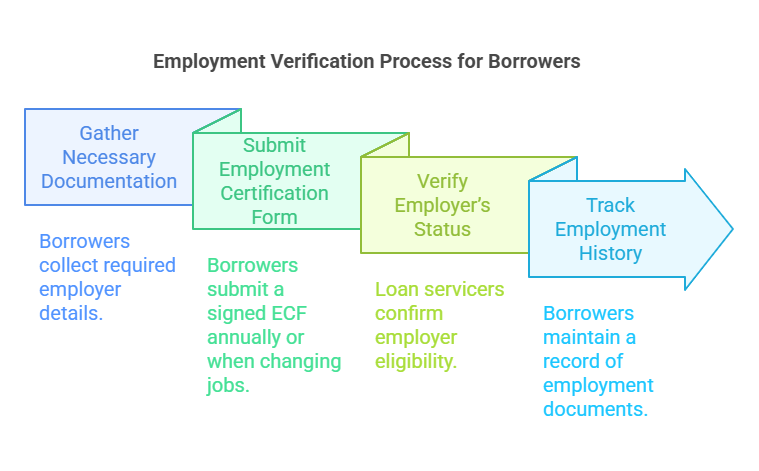

How Employment Verification Works

The process of employment verification involves multiple steps, and accuracy is critical. Here’s a breakdown:

- Gather Necessary Documentation

Borrowers must provide the following:- Employer’s name, address, and contact information.

- Employment start date and, if applicable, end date.

- Employer Identification Number (EIN).

- Submit an Employment Certification Form (ECF)

- For PSLF, borrowers are required to submit an ECF annually or when switching jobs.

- The form must be signed by both the borrower and their employer to confirm eligibility.

- Verify Employer’s Status

Loan servicers cross-check employer details to confirm eligibility under the forgiveness program’s guidelines. - Track Employment History

- Borrowers should maintain a record of their employment history, including pay stubs, W-2 forms, and signed contracts.

Benefits and Challenges of Employment Verification for Loan Forgiveness

| Benefits | Challenges |

|---|---|

| Ensures program eligibility | Delays in processing forms |

| Helps track progress toward forgiveness | Employer non-cooperation |

| Provides transparency and accountability | Errors in documentation or submission |

Who Benefits from Employment Verification?

For Borrowers

- Employment verification ensures they are on track for loan forgiveness and provides peace of mind about their eligibility.

For Employers

- Verifying employee details reinforces their commitment to supporting staff in financial stability and professional growth.

For Loan Servicers

- Verification prevents fraudulent claims and ensures compliance with program rules.

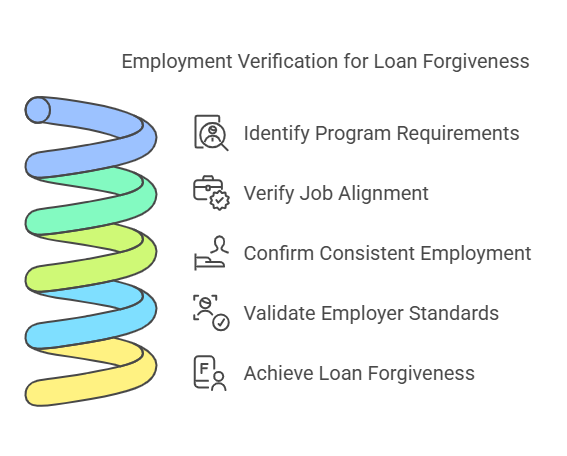

The Step-by-Step Process of Employment Verification for Student Loan Forgiveness

Step 1: Understand the Requirements of Your Forgiveness Program

Each student loan forgiveness program has unique rules regarding employment eligibility and verification. Carefully review the program details to ensure you understand the requirements.

- Public Service Loan Forgiveness (PSLF):

Requires borrowers to work full-time for a government or nonprofit organization. Annual submission of an Employment Certification Form (ECF) is required. - Teacher Loan Forgiveness:

Applies to full-time educators who work for five consecutive years in a qualifying low-income school or educational service agency. Verification includes proof of teaching status and school eligibility. - Profession-Specific Forgiveness Programs:

Programs like the NURSE Corps Loan Repayment Program or the John R. Justice Program often require detailed records of employment and certifications.

Understanding your program ensures you gather the correct documentation and avoid delays.

Step 2: Gather the Necessary Employment Documentation

Proper documentation is the foundation of successful employment verification. Ensure you collect the following items:

- Employment Certification Form (ECF):

This is a standardized form used in most forgiveness programs. For PSLF, it must be completed and signed by both the borrower and employer. - Employer Identification Number (EIN):

Found on your W-2 forms, the EIN identifies your employer and confirms their eligibility under the program’s requirements. - Pay Stubs and Tax Forms:

Recent pay stubs and W-2s provide additional proof of your employment status and income consistency. - Employment Contracts or Offer Letters:

Signed contracts help confirm your job title, start date, and employment terms. - Job Description or Duties Statement:

A detailed description of your role ensures it aligns with the program’s criteria, especially for teaching or healthcare-related programs.

Step 3: Complete and Submit the Employment Certification Form (ECF)

The ECF is a critical document that officially certifies your employment for loan forgiveness. Here’s how to complete it accurately:

- Section 1: Borrower Information

Provide your name, Social Security number, and contact details. Ensure accuracy to avoid delays. - Section 2: Employer Information

Input your employer’s name, EIN, address, and your employment dates. - Section 3: Employer Certification

This section must be completed and signed by an authorized representative of your employer, typically someone in the HR or payroll department. - Submit the Form

- For PSLF, send the ECF to the Federal Student Aid office or your designated loan servicer.

- Keep a copy for your records.

Step 4: Monitor Your Submission and Follow Up

Once submitted, loan servicers may take weeks to process your ECF. Be proactive by:

- Confirming Receipt: Check with your loan servicer to ensure your form was received.

- Tracking Progress: Log in to your loan servicer’s portal to monitor updates on your submission.

- Addressing Rejections Promptly: If your form is rejected, correct any errors and resubmit as soon as possible.

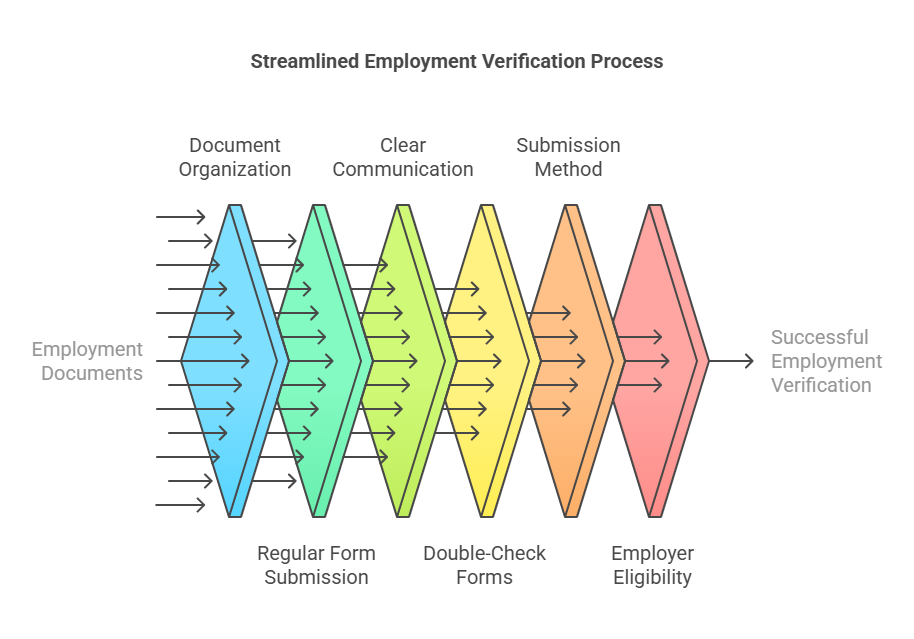

Comprehensive Best Practices for Employment Verification

- Organize Your Documentation

- Create a digital folder for all employment-related documents, including pay stubs, contracts, W-2s, and ECFs.

- Regularly update this folder to reflect any changes in your employment.

- Submit Forms Regularly

- For PSLF, submit your ECF annually or whenever you switch employers. Regular submissions help track your progress and ensure records are up to date.

- Communicate Clearly with Employers

- Provide clear instructions to your HR or payroll department on how to complete the employer certification section of the ECF.

- Follow up with them to ensure timely completion and submission.

- Double-Check All Forms Before Submission

- Ensure every section of the ECF is filled out correctly, with no typos or missing information.

- Verify employer details, such as EIN and contact information, for accuracy.

- Use Certified Mail or Online Submissions

- If mailing your forms, use certified mail to track delivery.

- Many loan servicers offer online submission options, which are faster and more secure.

- Understand Your Employer’s Eligibility

- Verify that your employer qualifies under your forgiveness program’s guidelines. For PSLF, this includes government entities or 501(c)(3) nonprofit organizations.

- Keep Copies of All Submissions

- Always retain copies of submitted forms, proof of delivery, and any correspondence with your loan servicer.

- Seek Professional Assistance

- If you encounter challenges with verification, consider working with a service like Exact Background Checks, which specializes in verifying employment for loan forgiveness programs.

Common Challenges and How to Overcome Them

- Unresponsive Employers

- Problem: Employers may delay completing the ECF or be unaware of the process.

- Solution: Provide clear instructions, set deadlines, and escalate requests to higher-level contacts if necessary.

- Errors in Forms

- Problem: Typos, incorrect dates, or missing details can lead to rejections.

- Solution: Review forms carefully before submission and address errors immediately if your form is returned.

- Employer Status Changes

- Problem: Employers may lose their nonprofit or qualifying status during your employment period.

- Solution: Document previous qualifying employment and consult your loan servicer for guidance.

- Lost Submissions

- Problem: Loan servicers may lose track of mailed forms.

- Solution: Use certified mail or online submission, and always keep copies of your forms.

Role of Exact Background Checks in Employment Verification

Exact Background Checks can simplify the employment verification process for borrowers and employers by:

- Confirming employer eligibility under loan forgiveness programs.

- Verifying employment details accurately and efficiently.

- Providing detailed reports that comply with program requirements.

Final Tips for Success

- Stay proactive: Regularly check the status of your loan forgiveness application and address issues promptly.

- Stay informed: Keep up to date with changes in loan forgiveness program guidelines.

- Stay organized: Maintain detailed records to ensure a smooth verification process.

With the right approach and attention to detail, employment verification can be a seamless step on your path to student loan forgiveness.

Legal Considerations for Employment Verification and Student Loan Forgiveness

Navigating the legal aspects of employment verification is crucial to ensure compliance with federal guidelines and program-specific requirements.

1. Adherence to Federal Program Rules

Each forgiveness program operates under specific federal laws, such as the College Cost Reduction and Access Act, which governs PSLF. Borrowers and employers must adhere to these rules, which include:

- Employment at a qualifying organization.

- Submission of accurate and truthful information.

- Meeting full-time employment definitions, which are typically at least 30 hours per week.

2. Misrepresentation or Fraud

Providing false information on Employment Certification Forms (ECFs) or other documentation can lead to severe consequences, including:

- Denial of forgiveness benefits.

- Legal penalties, including fines or imprisonment, for knowingly providing false information.

Borrowers should ensure all documentation is accurate and obtained through legitimate channels.

3. State Regulations and Employer Obligations

While most forgiveness programs are federally managed, some aspects may intersect with state-specific labor laws. Employers may have obligations to provide verification within certain timeframes under local employment regulations.

4. Privacy Considerations

Employers and borrowers should protect sensitive information, such as Social Security numbers and tax details, during the verification process.

- Use secure submission methods like encrypted online portals or certified mail.

- Retain records securely for future reference.

Potential Risks and How to Mitigate Them

- High Rejection Rates

- Risk: Incorrect or incomplete employment verification forms are common reasons for application denials.

- Solution: Double-check all forms, maintain open communication with your employer, and follow up with your loan servicer regularly.

- Employer Status Changes

- Risk: Employers losing their nonprofit or qualifying status can disqualify borrowers.

- Solution: Regularly verify employer eligibility and submit forms annually to document your progress.

- Missed Deadlines

- Risk: Delays in submitting verification forms can affect forgiveness timelines.

- Solution: Set reminders for submission deadlines and track the processing of your forms.

- Program Changes

- Risk: Policy changes, such as adjustments to eligibility criteria, can impact forgiveness opportunities.

- Solution: Stay informed about updates through official sources like StudentAid.gov.

Frequently Asked Questions (FAQs)

What is an Employment Certification Form (ECF)?

The ECF is a document used to verify employment for loan forgiveness programs like PSLF. It confirms your employer’s eligibility and your job details. You must submit this form annually or whenever you change employers.

Can part-time employees qualify for student loan forgiveness?

Yes, but part-time employees must combine hours across multiple qualifying employers to meet the minimum 30-hour weekly requirement for programs like PSLF.

What happens if my employer no longer qualifies for forgiveness programs?

If your employer loses its qualifying status, your previous employment will still count toward forgiveness. However, you’ll need to switch to a qualifying employer to continue accruing credit.

How long does employment verification take?

Processing times vary by loan servicer but typically take several weeks. Proactively submitting accurate forms and following up can reduce delays.

What if my employer refuses to complete the ECF?

In cases where employers are unresponsive or unwilling:

- Provide them with clear instructions and deadlines.

- Seek help from a higher-level contact, such as an HR director.

- If unresolved, consult your loan servicer for alternative solutions.

What is an Employment Certification Form (ECF)?

The ECF is a document used to verify employment for loan forgiveness programs like PSLF. It confirms your employer’s eligibility and your job details. You must submit this form annually or whenever you change employers.

Can part-time employees qualify for student loan forgiveness?

Yes, but part-time employees must combine hours across multiple qualifying employers to meet the minimum 30-hour weekly requirement for programs like PSLF.

What happens if my employer no longer qualifies for forgiveness programs?

If your employer loses its qualifying status, your previous employment will still count toward forgiveness. However, you’ll need to switch to a qualifying employer to continue accruing credit.

How long does employment verification take?

Processing times vary by loan servicer but typically take several weeks. Proactively submitting accurate forms and following up can reduce delays.

What if my employer refuses to complete the ECF?

In cases where employers are unresponsive or unwilling:

- Provide them with clear instructions and deadlines.

- Seek help from a higher-level contact, such as an HR director.

- If unresolved, consult your loan servicer for alternative solutions.

Conclusion

Employment verification is a critical step in achieving student loan forgiveness. It requires meticulous attention to detail, proactive communication with employers, and strict adherence to program guidelines. By staying organized, understanding legal considerations, and leveraging resources like Exact Background Checks, borrowers can streamline the process and avoid common pitfalls.

Key Takeaways:

- Always review the specific requirements of your forgiveness program and gather documentation accordingly.

- Submit employment verification forms annually or after employment changes to maintain up-to-date records.

- Protect your personal information by using secure submission methods.

- Leverage professional services like Exact Background Checks to ensure the accuracy and efficiency of your verification process.

Responsible and informed borrowing practices can pave the way to successful loan forgiveness, helping borrowers achieve financial freedom while fulfilling the program’s employment criteria.