Key Steps to Prepare for Your Background Check

Introduction and Initial Steps for Preparing for a Background Check

Background checks have become an essential part of many aspects of our lives, from job applications and rental agreements to financial transactions. Whether you’re applying for a job, a loan, or a rental property, it’s likely that a background check will be a part of the process. Understanding what a background check entails and how to properly prepare for it can help ensure a smoother experience and prevent any surprises that could potentially affect your eligibility for the opportunity you’re pursuing.

In this first part, we’ll define what a background check is, explain who conducts them, outline the different types of checks, and list the initial steps you should take to prepare for one.

What is a Background Check and Why is it Important?

A background check is a process used to verify certain aspects of an individual’s personal, professional, and criminal history. It’s a common procedure used by employers, landlords, financial institutions, and other organizations to gather information and assess the suitability of an individual for a particular role, rental agreement, or loan application.

The importance of a background check lies in its ability to ensure that individuals are trustworthy, responsible, and capable of meeting the standards set by the organization or entity conducting the check. For employers, background checks help assess the integrity, reliability, and safety of potential employees. For landlords, background checks ensure that tenants can pay rent on time and respect the property. In financial matters, background checks help evaluate creditworthiness and the risk of lending money.

Who Conducts Background Checks?

Several types of organizations may conduct background checks depending on the context:

- Employers: Background checks are commonly conducted by employers as part of the hiring process. This is especially true for jobs that involve working with vulnerable populations, financial responsibilities, or sensitive data.

- Landlords and Property Managers: For rental applications, background checks help landlords determine if a prospective tenant has a history of paying rent on time and taking care of previous properties.

- Banks and Financial Institutions: When applying for loans or credit, banks and financial institutions may conduct background checks to evaluate your credit history and determine your ability to repay the debt.

- Insurance Companies: Some insurance companies perform background checks to assess risk before issuing a policy.

- Government Agencies: Certain government roles require background checks to ensure the suitability of candidates for sensitive positions involving national security or law enforcement.

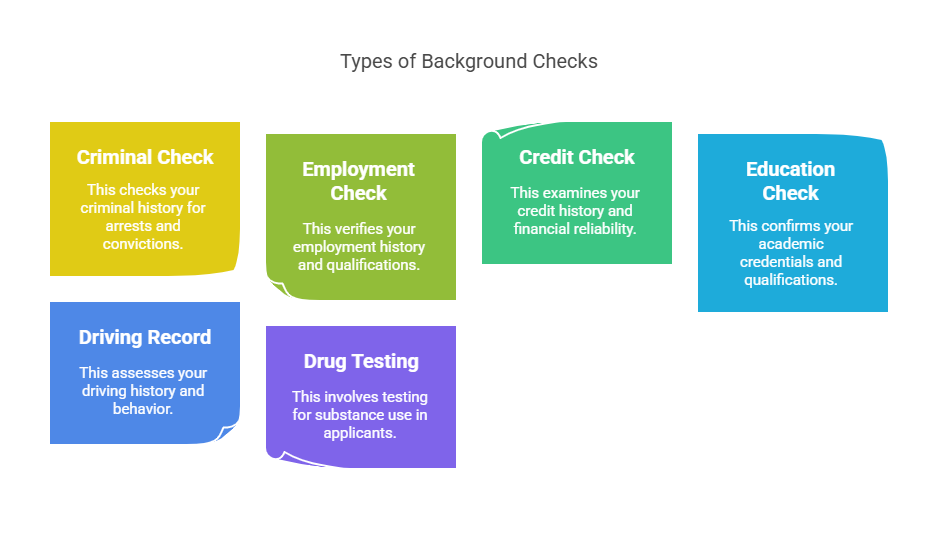

Common Types of Background Checks

There are several types of background checks that may be conducted, each serving a different purpose. Below are the most common types:

- Criminal Background Check: This checks your criminal history for any arrests, charges, or convictions. Employers, landlords, and government agencies often use this to assess safety and trustworthiness.

- Employment Background Check: This verifies your employment history, including job titles, dates of employment, and reasons for leaving previous positions. Employers use this to confirm your work experience and qualifications.

- Credit Background Check: Used primarily by financial institutions, a credit background check looks at your credit history, including your credit score, outstanding debts, and payment history. It’s typically part of the loan or credit card approval process.

- Education Background Check: This verifies your academic credentials, such as degrees or certifications, to ensure that the qualifications listed on your resume are accurate.

- Driving Record Check: For jobs that involve driving, an employer may request your driving record to assess your history of traffic violations, accidents, and overall driving behavior.

- Drug Testing: In some cases, employers require applicants to undergo drug testing as part of the background check process, especially in safety-sensitive roles.

Initial Steps to Take When Preparing for a Background Check

Proper preparation can make the background check process easier and less stressful. Here are the first steps you should take when preparing for a background check:

1. Gather Personal Information

The first step is to ensure that you have all the necessary personal information required for the background check. You may need to provide:

- Full name, date of birth, and social security number.

- Addresses of residence for the past several years.

- Employment history, including dates of employment and job titles.

- Educational history, including schools attended and degrees earned.

- Contact information for references or previous employers.

It’s important to provide accurate and complete information to avoid delays or discrepancies in the background check.

2. Review Your Own Records

Before a background check is conducted, it’s beneficial to review your own records to ensure everything is in order. Here’s how you can do that:

- Check Your Credit Report: You are entitled to a free credit report once per year from each of the three major credit bureaus (Equifax, Experian, and TransUnion). Reviewing your credit report helps you identify any errors or discrepancies, such as accounts that you don’t recognize or late payments that may not be your fault.

- Check Your Criminal Record: You can request a copy of your criminal record through your local police department or through national databases, depending on your country’s laws. If there are any discrepancies, such as outdated or incorrect records, it’s important to address them before they affect your background check.

- Review Employment and Education History: Double-check your resume or job application to ensure that the employment and educational information you’ve provided is accurate. You may want to contact former employers or schools to confirm your records.

3. Request Your Own Background Report

Many services allow you to request your own background check report, which can be helpful in identifying any potential issues ahead of time. This report will show you exactly what an employer or landlord will see when conducting their own background check on you.

Requesting your own background report also allows you to catch any inaccuracies before they become a problem. If you spot any discrepancies or incorrect information, you can take steps to resolve them, saving you time and frustration down the line.

4. Correct Any Errors in Your Records

If you find any errors in your credit report, criminal record, or employment history, it’s crucial to take action immediately. Errors in background check records can cause delays or result in disqualification from a job, loan, or rental agreement.

- For Credit Reports: If you find any errors, you can dispute them directly with the credit bureau. They are required by law to investigate and resolve any disputes within 30 days.

- For Criminal Records: If you notice outdated or inaccurate criminal records, you may need to work with an attorney or the police department to have those errors corrected.

- For Employment or Education Records: Contact your previous employers or educational institutions to confirm the details and request corrections if necessary.

Ensuring the Accuracy of Your Information

One of the most critical steps in preparing for a background check is verifying the accuracy of the information that will be reported. Inaccuracies in your background check can lead to delays, missed opportunities, or even disqualification, so it’s crucial to ensure everything is correct.

Here are key areas to focus on when verifying the accuracy of your background check:

1. Review Your Credit Report

Your credit report is one of the most significant factors in many background checks, especially for jobs involving financial responsibilities or for loans and credit applications. An inaccurate credit report could be a major red flag for employers or lenders, leading to a denied application.

- How to Verify Your Credit Report: You can access your credit report for free once every year from the three major credit bureaus: Equifax, Experian, and TransUnion. Look for discrepancies such as unfamiliar accounts, incorrect balances, or late payments that you believe are inaccurate.

- What to Do if You Find Errors: If you notice any errors in your credit report, you should dispute them with the respective credit bureau. They will investigate the issue, and if it is found to be a mistake, they are required to correct it within 30 days. Make sure you follow up with any necessary documentation or evidence.

2. Check Your Criminal Record

If you’re concerned about what might show up in a criminal background check, it’s essential to review your own criminal record before a background check is performed. Criminal background checks can significantly impact your job prospects, housing opportunities, and more.

- How to Check Your Criminal Record: You can request your criminal history report from the police department, state or local government websites, or third-party services. You’ll need to provide identifying information such as your full name, date of birth, and sometimes fingerprints.

- What to Do if You Find Discrepancies: If you notice that your criminal record contains information that is incorrect, outdated, or belongs to someone else, you must take action. Depending on your jurisdiction, you may need to file a formal correction request or even contact an attorney to help remove incorrect entries.

3. Verify Employment History

Your employment history is one of the first things employers will check to verify your qualifications. If any discrepancies arise between your resume and what’s on record, it could raise red flags during the background check process.

- How to Verify Your Employment History: Review your resume and confirm that the employment dates, job titles, and responsibilities listed are accurate. If you’re unsure of the details, reach out to former employers for confirmation.

- What to Do if You Find Errors: If you identify discrepancies in your employment history, contact the relevant employers to ask for clarification. If necessary, provide supporting documentation such as tax forms, pay stubs, or performance reviews to substantiate your claims.

4. Double-Check Your Education History

Employers often require proof of education for certain roles. Verifying that your academic history is accurate is important to avoid potential complications during the background check.

- How to Verify Your Education: Review your diplomas, transcripts, or certificates to ensure that the details you’ve listed on your resume or job application match what is on file with your educational institution.

- What to Do if You Find Errors: If you find any discrepancies, contact your school or university to get an official verification. If you’ve completed an advanced degree or certification program, ensure that all of the details, such as the graduation date and major, are accurate.

Addressing Discrepancies and Common Reasons for Disqualification

If you find discrepancies in your background check report, it’s important to address them proactively. Background checks can uncover issues that may impact your eligibility for certain jobs or housing opportunities, so understanding common reasons for disqualification can help you better prepare.

Common Reasons for Disqualification During a Background Check

Here are some of the most common issues that may arise during a background check and ways to address them:

- Criminal History: A criminal record can be a major barrier in certain industries, especially for roles that require trust, safety, or handling sensitive information. If you have a criminal record, you should be upfront with potential employers or landlords about your history and explain any circumstances surrounding the offense. In some cases, you may be able to have old convictions expunged or sealed.

- Inaccurate Employment Information: If your employment history is inaccurate or unverifiable, it could raise questions about your honesty or qualifications. Ensure that you can provide accurate references and documentation that verify your employment history. If a previous employer refuses to confirm your details, try to find other ways to substantiate your work history, such as pay stubs or tax records.

- Negative Credit History: For financial positions, loan applications, or rental agreements, a poor credit history may be a red flag. If you have a history of late payments or bankruptcy, it’s important to explain the circumstances. In some cases, creditors may be willing to work with you to resolve outstanding issues or negotiate a payment plan.

- Drug or Alcohol Issues: If your background check involves drug testing, a failed drug test can disqualify you from certain jobs or housing opportunities. If you have a history of substance abuse, it’s important to be transparent and show any efforts you’ve made to address the issue, such as completing a rehabilitation program or remaining sober for an extended period.

How “Exact Background Checks” Can Help

Navigating the background check process can be daunting, especially if you’re worried about potential discrepancies. At Exact Background Checks, we specialize in providing background screening services that are accurate, timely, and in compliance with all relevant legal regulations. Here’s how we can assist you:

- Comprehensive Background Checks: We provide a full range of background screening services, including criminal background checks, credit reports, employment verification, and more. Our services ensure that you’re fully prepared for the background check process.

- Discrepancy Management: If you’ve identified discrepancies or errors in your background report, we can assist you in addressing and correcting them. Our team can guide you through the process of disputing errors and making sure that the final report is accurate.

- Compliance and Legal Guidance: Understanding the legal aspects of background checks is crucial. We help ensure that your background check complies with regulations like the Fair Credit Reporting Act (FCRA) and other relevant laws, protecting your rights during the process.

Steps for Verification, Ensuring Accuracy, and Correcting Discrepancies

Here’s a summary of the steps you should take to verify and ensure the accuracy of your background check:

| Step | Action |

|---|---|

| 1. Review Your Credit Report | Request a free credit report and check for inaccuracies. Dispute any errors with the credit bureaus. |

| 2. Check Your Criminal Record | Request a copy of your criminal record from the relevant authorities and correct any errors. |

| 3. Verify Employment History | Confirm the details with your previous employers and correct any discrepancies. |

| 4. Review Education History | Contact schools to confirm your degrees and certifications. Ensure all details match your records. |

| 5. Address Discrepancies | Take corrective actions if you find errors, and provide supporting documentation when needed. |

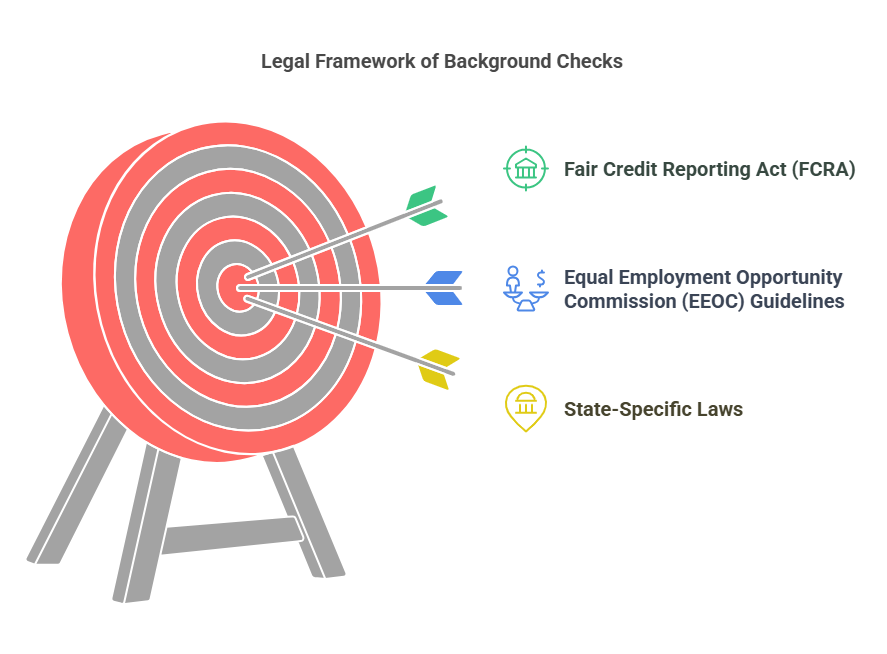

Legal Aspects of Background Checks

When preparing for a background check, it’s crucial to be aware of the legal rights and protections you have under various laws and regulations. Background checks are regulated to ensure that employers, landlords, and other entities use the information responsibly and fairly. Below are some key legal aspects that are important to understand:

1. The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how background checks are conducted and ensures that your rights are protected. The FCRA applies to employers, landlords, and other entities that use background check services, including consumer reporting agencies (CRAs).

Key points of the FCRA include:

- Consent: Employers and other entities must obtain your written consent before conducting a background check.

- Disclosure: If a background check leads to a decision to reject an applicant, the employer must inform the individual and provide a copy of the report.

- Accuracy: Information provided through background checks must be accurate, and any disputes about inaccuracies must be resolved.

- Timing: Employers must provide you with a copy of your background check and give you a chance to dispute inaccuracies before making a final decision.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The Equal Employment Opportunity Commission (EEOC) is another important regulatory body that governs how employers use background checks in hiring decisions. The EEOC’s guidelines ensure that employers do not discriminate based on race, national origin, gender, age, or disability when conducting background checks.

- Non-Discriminatory Use: Employers should not automatically disqualify applicants with criminal records unless it is directly relevant to the job. For example, someone with a minor offense unrelated to the job’s responsibilities should not be automatically rejected.

- Individual Assessment: If an employer uses criminal history to make employment decisions, they are required to consider the nature of the offense, the time elapsed, and its relevance to the job.

3. State-Specific Laws

In addition to federal laws, many states have their own regulations governing background checks. These state laws may impose stricter guidelines or provide additional protections for job seekers.

For example:

- Ban the Box Laws: Some states and cities have enacted “ban the box” laws, which prohibit employers from asking about criminal history on job applications. Employers may only inquire about criminal records later in the hiring process.

- Expungement and Sealing: Some states allow individuals to have certain criminal records expunged or sealed, meaning they will not appear on background checks.

Understanding the legal environment around background checks helps ensure that your rights are protected throughout the process.

Frequently Asked Questions (FAQs) About Background Checks

Below are some common questions individuals often have about background checks, along with detailed answers:

What are the common types of background checks, and why are they important?

- Common types include criminal background checks, employment background checks, credit background checks, education background checks, driving record checks, and drug testing. They are important for ensuring trustworthiness, reliability, and capability in various contexts like employment, rental agreements, and financial transactions.

What initial steps should you take to prepare for a background check?

- Gather personal information (full name, DOB, SSN, addresses, employment/education history), review your own records (credit report, criminal record, employment/education history), request your own background report, and correct any errors in your records.

How can you ensure the accuracy of your information during a background check?

- Review your credit report for discrepancies and dispute errors with credit bureaus. Check your criminal record for inaccuracies and correct them with relevant authorities. Verify your employment and education history with former employers and schools, providing supporting documentation if needed.

What are some common reasons for disqualification during a background check, and how can you address them?

- Common reasons include criminal history, inaccurate employment information, negative credit history, and drug/alcohol issues. Address them by being upfront about your history, providing explanations, correcting inaccuracies, and demonstrating efforts to resolve issues (e.g., expungement, rehabilitation).

What legal aspects govern background checks, and how do they protect you?

- Background checks are governed by the Fair Credit Reporting Act (FCRA), which ensures consent, disclosure, and accuracy; Equal Employment Opportunity Commission (EEOC) guidelines, which prevent discrimination; and state-specific laws, including "ban the box" laws and regulations on expungement and sealing. These protect you from unfair practices and ensure your rights are upheld.

What are the common types of background checks, and why are they important?

- Common types include criminal background checks, employment background checks, credit background checks, education background checks, driving record checks, and drug testing. They are important for ensuring trustworthiness, reliability, and capability in various contexts like employment, rental agreements, and financial transactions.

What initial steps should you take to prepare for a background check?

- Gather personal information (full name, DOB, SSN, addresses, employment/education history), review your own records (credit report, criminal record, employment/education history), request your own background report, and correct any errors in your records.

How can you ensure the accuracy of your information during a background check?

- Review your credit report for discrepancies and dispute errors with credit bureaus. Check your criminal record for inaccuracies and correct them with relevant authorities. Verify your employment and education history with former employers and schools, providing supporting documentation if needed.

What are some common reasons for disqualification during a background check, and how can you address them?

- Common reasons include criminal history, inaccurate employment information, negative credit history, and drug/alcohol issues. Address them by being upfront about your history, providing explanations, correcting inaccuracies, and demonstrating efforts to resolve issues (e.g., expungement, rehabilitation).

What legal aspects govern background checks, and how do they protect you?

- Background checks are governed by the Fair Credit Reporting Act (FCRA), which ensures consent, disclosure, and accuracy; Equal Employment Opportunity Commission (EEOC) guidelines, which prevent discrimination; and state-specific laws, including "ban the box" laws and regulations on expungement and sealing. These protect you from unfair practices and ensure your rights are upheld.

Conclusion

Properly preparing for a background check is essential to ensure a smooth and successful process. By gathering your personal information, reviewing your records for discrepancies, and understanding the legal regulations governing background checks, you can avoid common pitfalls and address potential issues before they arise. Taking the time to review and verify your credit, criminal record, employment, and educational history will help ensure that the information submitted for a background check is accurate and complete.

Moreover, being aware of your rights under the Fair Credit Reporting Act (FCRA) and Equal Employment Opportunity Commission (EEOC) guidelines ensures that you are protected from unfair practices during the background check process. If discrepancies or issues do arise, there are steps you can take to dispute and correct them, and Exact Background Checks is here to help guide you through the process.

By following these steps and being proactive in preparing for a background check, you can set yourself up for success and avoid unnecessary delays or complications.