How to Understand the Components of a Background Check

Introduction to Background Checks and Their Purpose

What is a Background Check?

A background check is a comprehensive process used to gather and review an individual’s history to verify the accuracy of the information they have provided, assess their reliability, and ensure they meet the necessary qualifications for a specific role or responsibility. The details collected during a background check vary based on the reason for the check, but typically include personal information, criminal history, employment records, financial status, and sometimes educational or professional credentials.

Background checks are an essential tool for employers, landlords, lenders, and other organizations to reduce risk, enhance security, and verify qualifications. While the specific components of a background check may differ depending on the industry or organization, the general objective is to create a clearer picture of an individual’s history, ensuring they are trustworthy and qualified for the position or responsibility in question.

Employers and organizations often rely on background checks to make well-informed decisions regarding hiring, promotion, renting, security clearances, and other areas that may impact their business or community. By conducting these checks, employers can uncover potential risks and make decisions that safeguard the organization’s interests, assets, and reputation.

Why are Background Checks Commonly Performed?

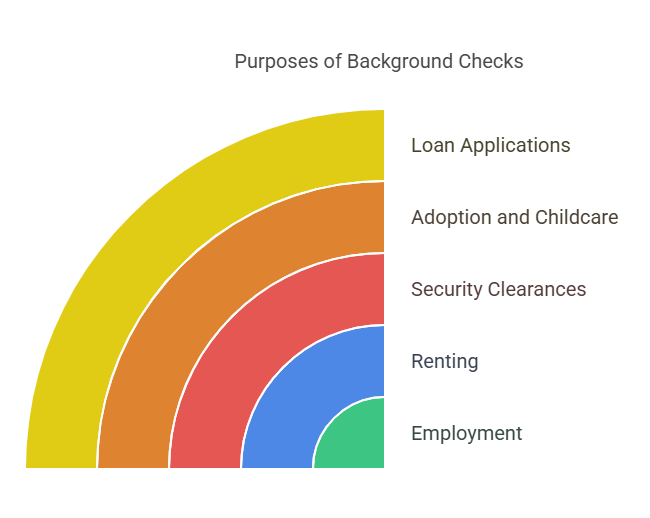

Background checks are performed for several important reasons, each with its own set of benefits and outcomes. The following are some of the most common reasons background checks are conducted:

1. Employment

One of the most common reasons for conducting a background check is in the hiring process. Employers use background checks to verify the information provided by job candidates and ensure that the applicant has the necessary qualifications and integrity to fulfill the job’s requirements. These checks help companies assess an individual’s previous employment history, criminal record, educational credentials, and even financial stability, depending on the position’s requirements.

For example, an employer hiring a financial advisor may conduct an in-depth background check that includes a credit report to assess the candidate’s financial responsibility. Similarly, a healthcare provider might conduct criminal background checks and verify professional licenses to ensure the candidate is not only qualified but also trustworthy and ethical in their field.

Background checks in employment also help minimize risks such as:

- Hiring fraudsters: Some candidates may provide false or exaggerated information to gain employment. A background check ensures that the resume and qualifications are legitimate.

- Workplace safety: Checking criminal history helps ensure that potential hires don’t have a history of violent crimes, which is particularly important in sectors like education, healthcare, and childcare.

- Legal compliance: Certain industries are required by law to perform background checks on their employees, particularly those in healthcare, finance, or positions that involve access to sensitive information or vulnerable populations.

2. Renting

Landlords and property management companies often use background checks when screening potential tenants. This process typically involves checking an applicant’s credit history, criminal record, and rental history to ensure they will be reliable tenants. A background check helps landlords evaluate the financial stability of the tenant, their history of paying rent, and any criminal offenses that may make them an unsuitable tenant.

The components of a rental background check include:

- Credit history: To evaluate the tenant’s ability to pay rent on time and manage debts responsibly. A poor credit score may indicate a history of missed payments or financial instability, which could lead to late rent payments or property damage.

- Criminal history: Landlords check criminal records to ensure that the tenant does not have a history of violent or illegal activities that could pose a risk to other tenants or the property.

- Eviction history: Previous evictions may signal a history of irresponsible behavior or conflicts with landlords, which is something potential landlords want to avoid.

By performing background checks, landlords can reduce the risks of tenant-related issues, such as unpaid rent or property damage, and make more informed decisions when selecting tenants.

3. Security Clearances

Background checks are also essential when applying for roles that require a security clearance, particularly for government jobs or positions where employees handle sensitive or classified information. In these cases, background checks are much more thorough and can involve deep investigations into an individual’s criminal history, financial background, and even personal relationships to assess their loyalty, reliability, and trustworthiness.

Security clearances are often required for positions in national defense, intelligence agencies, law enforcement, or other industries involving access to classified or sensitive data. These extensive checks are designed to evaluate the potential risks associated with allowing an individual access to this kind of information, ensuring that the person can be trusted not to leak or misuse critical data.

Security clearance background checks may include:

- Criminal records: Ensuring that there is no history of illegal activity that could compromise the person’s reliability and trustworthiness.

- Financial history: Investigating financial problems such as large amounts of debt, bankruptcy, or unpaid taxes, as these may indicate vulnerability to bribery or coercion.

- Personal relationships: Examining connections to foreign nationals or individuals with criminal backgrounds, which may raise concerns about potential conflicts of interest or loyalty.

4. Adoption and Childcare

Another common use of background checks is in the field of child protection, particularly in adoption, foster care, and childcare settings. Prospective adoptive parents, foster parents, and daycare providers are often required to undergo thorough background checks to ensure they have a clean criminal record and are suitable for taking care of children. This ensures the safety and well-being of children placed in their care.

Background checks for adoption or childcare typically focus on:

- Criminal history: Screening for any history of child abuse, violent crimes, or other criminal offenses that could make an individual unsuitable for taking care of children.

- Child abuse or neglect records: Checking whether the individual has a history of abuse or neglect of children, which is critical for ensuring the child’s safety.

- References and employment history: Verifying that the individual has experience or positive history working with children and is emotionally and psychologically prepared to care for them.

In these cases, the background check is designed to minimize risks to children and ensure that those entrusted with their care are responsible, reliable, and safe.

5. Loan Applications

When individuals apply for loans, background checks can play a key role in assessing their financial stability and determining their eligibility for a loan. Lenders use credit reports and sometimes other financial documents to evaluate the applicant’s ability to repay the loan. A person with a low credit score, outstanding debts, or a history of bankruptcy may be deemed a higher risk and could face higher interest rates or be denied the loan.

The most common background check component in loan applications is the credit report, which provides an overview of the individual’s creditworthiness. It includes:

- Credit score: A numerical representation of the individual’s creditworthiness based on their history of managing debt.

- Debt-to-income ratio: The ratio of an individual’s debt compared to their income, which helps lenders assess the applicant’s ability to repay the loan.

- Bankruptcy history: If the individual has filed for bankruptcy in the past, it may indicate financial instability or an inability to meet debt obligations.

Lenders use these details to assess risk and determine whether the applicant is likely to repay the loan in full and on time.

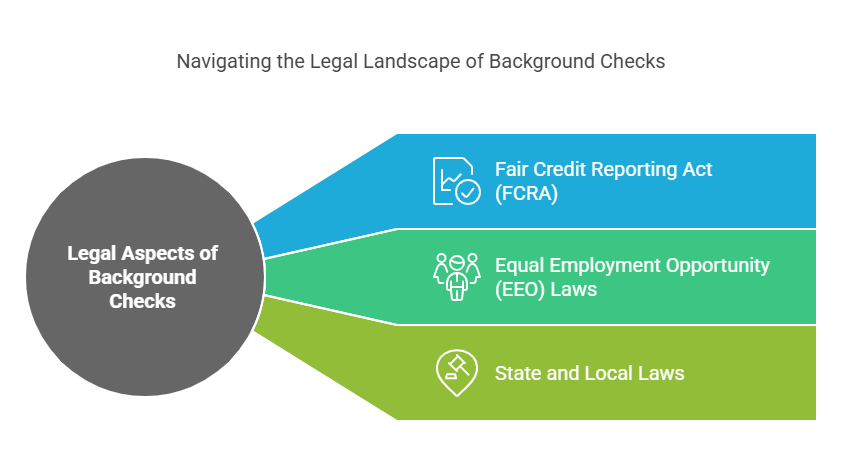

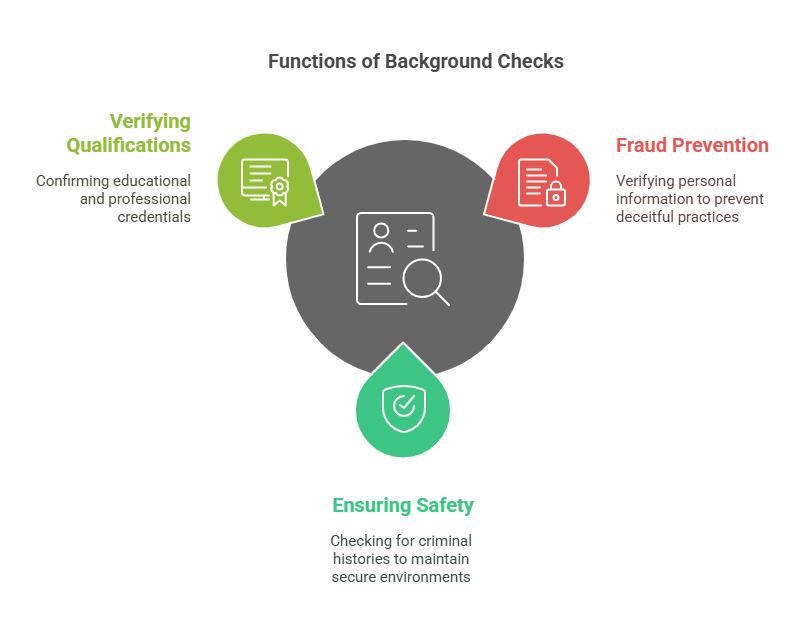

The Role of Background Checks in Preventing Fraud, Ensuring Safety, and Verifying Qualifications

Background checks play a critical role in preventing fraud, ensuring safety, and verifying qualifications across various sectors:

- Fraud Prevention: By verifying the accuracy of personal information, such as education, work history, and criminal records, background checks help prevent individuals from committing fraud by falsifying details on job applications or rental agreements. For instance, some candidates may falsely claim educational qualifications or past job titles, but background checks ensure that this information is verified, reducing the risk of hiring fraudsters.

- Ensuring Safety: Especially in workplaces where safety is paramount, such as hospitals, schools, and childcare centers, background checks ensure that employees or contractors do not have histories of violent crime or unsafe behaviors that could put others at risk. Additionally, conducting thorough checks on prospective tenants or employees helps avoid putting vulnerable populations in unsafe situations.

- Verifying Qualifications: Employers and organizations also use background checks to verify that candidates have the proper qualifications for the position. This may include confirming professional certifications, education degrees, or relevant work experience to ensure the individual is truly qualified for the job.

As the following sections will highlight, the specific components of a background check vary based on the context, but they all serve these important functions.

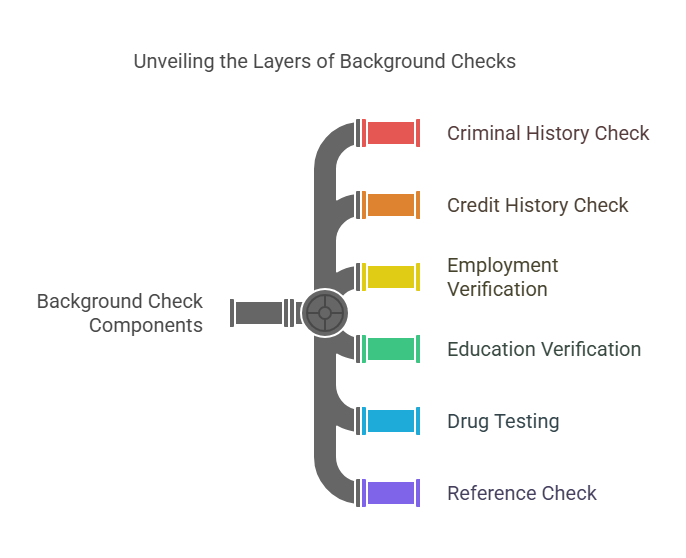

Common Components of a Background Check

We discussed the reasons for conducting background checks and how they help verify qualifications, prevent fraud, and ensure safety. In this section, we will break down the common components involved in a background check. Understanding these elements will give you a clearer view of what organizations look for when performing a background check and how each component plays a crucial role in the overall screening process.

Background checks can vary depending on the nature of the role, industry, and level of responsibility required. However, several core components are consistently included in most background checks, whether for employment, renting, security clearance, or loan applications. Below is a detailed look at each of these components, explaining what they entail and how they contribute to the background check process.

1. Criminal History Check

One of the most significant components of any background check is a criminal history check. This part of the process involves searching local, state, and federal criminal databases to identify any criminal records or convictions associated with an individual. Criminal background checks are essential for identifying candidates or applicants who may have committed crimes that could pose a risk to the organization or its stakeholders.

Types of Criminal Checks:

- Local criminal records: These records contain details of offenses that occurred within the jurisdiction of a particular city, county, or municipality.

- State criminal records: These records are held by state agencies and include criminal convictions that occurred within the state. States typically maintain their own criminal databases.

- Federal criminal records: Federal records cover crimes that fall under federal jurisdiction, such as major drug trafficking, white-collar crimes, and certain types of fraud.

What a Criminal Background Check Reveals:

- Felonies and Misdemeanors: Criminal checks typically reveal whether an individual has been convicted of felonies or misdemeanors, including the nature of the crime, the sentence imposed, and whether the conviction was expunged or sealed.

- Sex Offender Registry: This check searches state and federal databases to see if the individual has been listed on the sex offender registry. It’s particularly crucial for jobs involving minors, such as childcare providers, teachers, or healthcare workers.

- Pending Charges: In some cases, a background check may also uncover whether an individual has pending criminal charges, which can be important for employers or organizations concerned about potential risks.

Why it’s Important: A criminal background check is vital for employers or organizations to ensure workplace safety, protect their reputation, and comply with industry-specific regulations. In many industries, hiring someone with a violent criminal history could pose significant risks to the company, other employees, or customers. In addition, criminal checks help verify the honesty of applicants, especially when their resumes or personal statements indicate past criminal activity.

2. Credit History Check

A credit history check is commonly included in background checks for positions that involve handling money, access to financial records, or sensitive financial data. This check evaluates an individual’s financial history by reviewing their credit report, which includes their borrowing and repayment history, outstanding debts, and credit scores. A credit check can reveal a lot about an individual’s financial responsibility and reliability.

What a Credit Report Includes:

- Credit score: This is a three-digit number that represents an individual’s creditworthiness based on their credit history. The score ranges from 300 to 850, with higher scores indicating better credit risk.

- Credit accounts: A credit report lists all the credit accounts an individual has had, including credit cards, mortgages, and loans. It provides details such as the opening date, credit limit, and current balance.

- Payment history: This section shows whether the individual has made payments on time or missed payments. Late payments or defaults could indicate financial irresponsibility.

- Debt-to-income ratio: This ratio measures the amount of debt an individual carries compared to their income and helps lenders determine their ability to manage additional financial obligations.

- Bankruptcies and judgments: If the individual has filed for bankruptcy or has had a civil judgment against them, this information will be included in the credit report.

Why it’s Important: A credit check helps assess an individual’s financial responsibility. For positions requiring access to sensitive financial data, such as accountants, financial analysts, or those managing company funds, a credit report is crucial for verifying whether the applicant can handle money responsibly. Poor credit history could indicate financial stress, which may increase the likelihood of fraudulent behavior, theft, or other risks.

3. Employment Verification

Employment verification is another critical component of a background check, especially for employers trying to confirm the qualifications and work history of a job applicant. This check ensures that the applicant has held the positions they claim to have and that they have the necessary experience for the role they are applying for.

What Employment Verification Includes:

- Dates of employment: Verification of employment dates ensures that the individual worked during the periods stated on their resume or application.

- Job titles: Employers typically verify the job titles held by the candidate to ensure that the individual’s previous roles align with the position they are applying for.

- Responsibilities and performance: In some cases, the employer may reach out to the previous employer to discuss the candidate’s job responsibilities and performance. This helps confirm that the individual has the right skills and qualifications for the role.

- Reason for leaving: Employers may inquire about why the candidate left their previous job to assess whether they left voluntarily or were terminated.

Why it’s Important: Employment verification helps prevent resume fraud and ensures that the candidate’s qualifications are legitimate. By confirming employment history, employers can gain insights into the candidate’s job performance, reliability, and ability to handle responsibilities. Additionally, it helps determine whether the individual has the necessary experience for the role they’re applying for.

4. Education Verification

Education verification is another key element in background checks, particularly for roles where specific degrees or certifications are required. This check ensures that the individual has completed the education or training they claim to have, such as high school diplomas, college degrees, or professional certifications.

What Education Verification Includes:

- Degree or diploma verification: The background check will verify the degree or diploma the candidate claims to have obtained, including the institution and the graduation date.

- Academic achievements: In some cases, employers may also verify any academic honors or achievements mentioned by the applicant.

- Certification verification: For roles requiring specific certifications or licenses (e.g., a licensed nurse or certified public accountant), the background check ensures that the candidate holds these credentials.

Why it’s Important: Education verification is essential for ensuring that the individual has the necessary academic qualifications for the job. This is particularly important for positions where specialized knowledge is required, such as doctors, lawyers, engineers, or any job where professional licenses or degrees are a prerequisite.

5. Drug Testing

Many employers, particularly in industries such as healthcare, transportation, and manufacturing, include drug testing as part of their background check process. Drug testing helps ensure that the candidate does not use illegal drugs or substances that could impair their ability to perform their job effectively and safely.

What Drug Testing Involves:

- Urine test: The most common method for drug testing, which detects the presence of illegal substances in the individual’s urine.

- Blood test: A blood test may be used to detect drugs that remain in the bloodstream for a shorter period than those in urine.

- Hair follicle test: Hair tests can detect drug use over a longer period (up to 90 days).

- Saliva test: A less invasive and more convenient option for detecting recent drug use.

Why it’s Important: Drug testing is particularly important in industries where safety is a major concern, such as transportation or construction, where impaired judgment could lead to accidents. It also helps employers maintain a drug-free workplace, which can enhance overall productivity, morale, and safety.

6. Reference Check

A reference check is often included in a background check to validate an applicant’s character, work ethic, and abilities. Employers may contact former supervisors, coworkers, or personal references to gather more information about the candidate’s personality, skills, and past work experiences.

What a Reference Check Includes:

- Professional references: Employers typically contact individuals who have worked with the candidate in a professional capacity. They will ask about the candidate’s job performance, reliability, and strengths and weaknesses.

- Personal references: These references are individuals who know the candidate personally, such as friends or mentors. They can provide insights into the applicant’s character and work ethic outside of the professional environment.

Why it’s Important: Reference checks help confirm an applicant’s qualifications and provide insights into how they might perform in the workplace. References can offer a more nuanced understanding of the candidate’s personality, which is crucial for determining whether they will fit within the organizational culture.

7. Social Media and Online Presence Check

In the digital age, employers may also review a candidate’s social media profiles and online presence as part of a background check. This is typically done to gauge the individual’s character, professionalism, and behavior outside of their resume.

What an Online Presence Check Includes:

- Social media profiles: Employers may review platforms such as LinkedIn, Facebook, Twitter, and Instagram to assess how the candidate presents themselves online. They look for signs of professionalism, or alternatively, any red flags, such as inappropriate content or offensive behavior.

- Publicly available information: Employers might also review publicly available blogs, forums, or websites where the candidate has posted personal or professional information.

Why it’s Important: An online presence check can reveal whether a candidate’s actions or behavior on social media align with the values and expectations of the organization. It helps employers assess the candidate’s social responsibility and whether their online behavior could reflect poorly on the company.