How to Secure a Loan Without Employment Verification

Understanding Loans Without Employment Verification

What Are Loans Without Employment Verification?

Loans without employment verification are specialized financial products designed to assist individuals who lack traditional employment or cannot provide standard proof of income. Unlike conventional loans that rely heavily on pay stubs or employer verification, these loans consider alternative criteria to determine a borrower’s ability to repay. This flexibility makes them particularly appealing to those with non-traditional income sources, irregular employment, or unique financial situations.

Why Do Loans Without Employment Verification Exist?

The rise of the gig economy, freelance work, and entrepreneurial ventures has created a diverse workforce with varying income structures. Traditional lending models often fail to cater to this demographic, leaving a gap in the market. Loans without employment verification bridge this gap, offering financial solutions to:

- Freelancers and gig workers with fluctuating income.

- Self-employed individuals who may not have formal payroll records.

- Retirees or those relying on alternative income sources, such as investments or pensions.

- Individuals transitioning between jobs or experiencing temporary unemployment.

By accommodating these groups, lenders can expand their customer base while meeting the evolving needs of today’s workforce.

Types of Loans Without Employment Verification

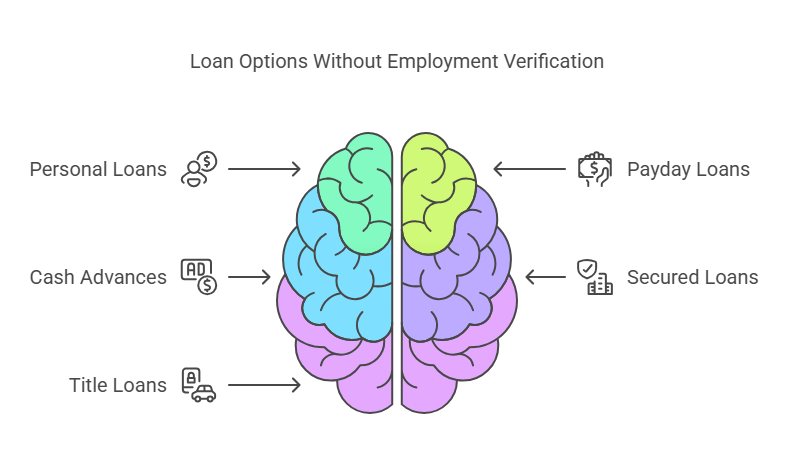

Several loan types cater to individuals who cannot provide standard employment documentation. Below are the most common options:

- Personal Loans

- Overview: Unsecured loans provided by banks, credit unions, or online lenders.

- Key Features: May require proof of alternative income, such as rental earnings or bank statements.

- Best For: Borrowers with decent credit scores but unconventional income streams.

- Payday Loans

- Overview: Short-term, high-interest loans designed to cover immediate financial needs until the next payday.

- Key Features: Approval often depends on bank account activity rather than income verification.

- Best For: Individuals needing small amounts of cash quickly.

- Cash Advances

- Overview: Loans typically linked to credit cards or merchant accounts.

- Key Features: Funds are drawn against a borrower’s credit line or expected revenue.

- Best For: Credit card holders with urgent cash requirements.

- Secured Loans

- Overview: Loans backed by collateral, such as vehicles, property, or other assets.

- Key Features: Lower interest rates due to reduced risk for lenders.

- Best For: Borrowers with valuable assets but inconsistent income.

- Title Loans

- Overview: Loans secured by the borrower’s vehicle title.

- Key Features: Quick approval process but high risk of losing the asset if repayment terms are not met.

- Best For: Borrowers needing immediate funds who own a vehicle outright.

Circumstances Where These Loans Might Be Needed

Loans without employment verification are most often sought in the following scenarios:

- Freelancers and Self-Employed Individuals: Many freelancers lack regular pay stubs but can demonstrate income through invoices, contracts, or bank deposits.

- Seasonal or Part-Time Workers: Jobs in industries like agriculture or retail often result in irregular earnings.

- Those Between Jobs: A short-term loan can help cover expenses during transitions.

- Retirees: Fixed income from pensions, Social Security, or investments can serve as proof of repayment ability.

Typical Requirements for Loans Without Employment Verification

Although these loans waive traditional income verification, lenders still require some assurance of financial stability. Common criteria include:

- Proof of Alternative Income: Documents such as bank statements, tax returns, or income from investments.

- Credit History: A strong credit score can offset the lack of employment documentation.

- Collateral: Assets like vehicles, property, or savings can be used to secure the loan.

- Bank Account Statements: Evidence of consistent deposits or financial activity.

Pros and Cons of Loans Without Employment Verification

Understanding the benefits and drawbacks of these loans can help borrowers make informed decisions. Below is a summarized comparison:

| Pros | Cons |

|---|---|

| Accessibility for non-traditional workers | Higher interest rates |

| Flexible qualification criteria | Short repayment terms |

| Quick application process | Risk of predatory lending practices |

| No traditional income proof required | May require collateral |

Examples of Borrowers Who Benefit

- A freelance graphic designer with fluctuating monthly income applies for a personal loan using tax returns and bank statements as proof of financial stability.

- A self-employed ride-share driver uses their vehicle as collateral for a title loan to cover unexpected medical expenses.

- A retiree relies on investment income and Social Security to qualify for a secured loan for home repairs.

Applying for a Loan Without Employment Verification and Best Practices

How to Apply for a Loan Without Employment Verification

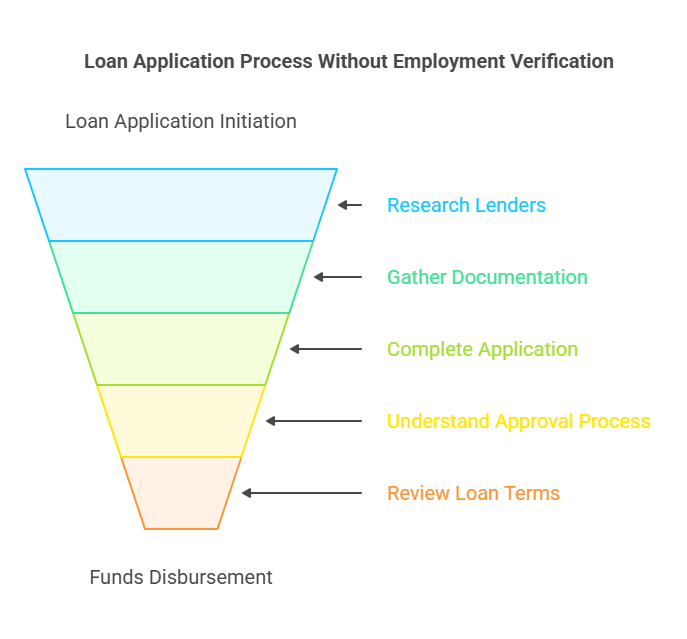

While applying for a loan without employment verification may seem intimidating, the process is manageable if approached methodically. Here is a step-by-step guide to ensure a smooth application experience:

Step 1: Research Lenders

Finding the right lender is crucial, as not all lenders cater to individuals without standard employment documentation. Here\u2019s how to identify a suitable lender:

- Explore Online Lenders: Many online platforms specialize in offering flexible loan options to those with unconventional income streams. These lenders often have quicker approval processes and fewer bureaucratic hurdles.

- Compare Traditional and Non-Traditional Lenders: Credit unions and smaller banks may also have tailored products for borrowers in unique financial circumstances.

- Check Terms and Reviews: Compare interest rates, fees, repayment schedules, and customer feedback. Look for lenders with transparent policies and positive reviews from borrowers in similar situations.

Step 2: Gather Documentation

Although employment verification isn\u2019t required, you\u2019ll still need to prove your ability to repay the loan. Prepare the following:

- Bank Statements: Provide records from the past 3\u20136 months showing consistent deposits, whether from freelance work, rental income, or other sources.

- Proof of Alternative Income: Examples include tax returns, invoices, client contracts, or pension statements.

- Credit Report: A solid credit history can increase your chances of approval, even without employment verification. Obtain a copy of your credit report and address any discrepancies before applying.

- Collateral Documentation (if applicable): If applying for a secured loan, ensure you have the necessary documents for the asset you\u2019re offering, such as a vehicle title or property deed.

Step 3: Complete the Application

Once you\u2019ve chosen a lender, fill out their application form carefully. Include accurate details about your financial situation, ensuring all information matches your submitted documentation. Inaccurate or incomplete applications can lead to delays or rejection.

Step 4: Understand the Approval Process

The approval timeline varies by lender. Many online platforms offer pre-approval within minutes, providing an estimate of loan terms without a hard credit check. Full approval and fund disbursement may take 1\u20132 business days for most lenders. Be prepared for additional inquiries about your income or financial stability during this period.

Step 5: Review the Loan Terms

Before accepting a loan, review the agreement in detail. Key elements to pay attention to include:

- Interest Rates: Ensure the rate is competitive and within your budget.

- Repayment Schedule: Check whether the repayment terms align with your financial circumstances, including the frequency and amount of payments.

- Fees and Penalties: Look for hidden charges, such as origination fees, late payment penalties, or prepayment penalties.

Step 6: Receive Funds

Once approved, funds are typically transferred directly to your bank account. Depending on the lender, this can happen within a few hours or up to a few days.

Best Practices to Avoid Scams and Predatory Lenders

Loans without employment verification often attract predatory practices, given the higher risk for lenders. Protect yourself by following these best practices:

- Verify the Lender\u2019s Legitimacy:

- Confirm that the lender is licensed to operate in your state.

- Check for accreditation from organizations like the Better Business Bureau (BBB).

- Read customer reviews and testimonials to identify red flags.

- Beware of Upfront Fees:

- Legitimate lenders do not ask for fees before loan approval. Scammers often use upfront payment requests as a tactic to defraud borrowers.

- Avoid Unrealistic Promises:

- Be cautious of lenders who guarantee approval without reviewing your financial information. Legitimate lenders assess your ability to repay, even without employment verification.

- Understand the Fine Print:

- Ensure you fully comprehend the loan\u2019s terms and conditions, including fees, interest rates, and penalties. Seek legal or financial advice if necessary.

- Stick to Reputable Platforms:

- Use well-known lending platforms or financial institutions with a track record of reliability and transparency.

Alternative Options for Borrowers Who Don\u2019t Qualify

If you are unable to secure a loan without employment verification, consider these alternatives:

- Borrowing from Friends or Family:

- This informal option can be cost-effective and flexible. However, it\u2019s essential to agree on clear repayment terms to avoid straining relationships.

- Community and Non-Profit Assistance:

- Many local organizations and charities provide financial aid for emergencies. Look into community grants or low-interest loans for eligible individuals.

- Secured Loans:

- If you have valuable assets, such as a vehicle, property, or savings account, consider a secured loan. Collateral reduces the lender\u2019s risk and can improve your chances of approval.

- Side Gigs or Freelance Work:

- Generating additional income through short-term gigs or freelance projects can strengthen your financial profile and improve your eligibility for future loans.

Exact Background Checks: Helping Lenders Ensure Reliable Borrowing

For lenders, assessing the financial stability of borrowers without employment verification can be challenging. This is where Exact Background Checks comes in. Our company specializes in verifying alternative income sources, such as freelance earnings, rental income, or pension payments. By leveraging our expertise, lenders can confidently extend loans to a broader customer base while minimizing risks.

Tips to Improve Loan Approval Chances

- Strengthen Your Credit Profile:

- Pay off outstanding debts and maintain a low credit utilization ratio. A strong credit score can compensate for the lack of employment verification.

- Present Comprehensive Documentation:

- Provide thorough evidence of income sources, including contracts, invoices, or bank deposits. The more detailed your documentation, the stronger your application.

- Consider a Co-Signer:

- A co-signer with a stable income or strong credit history can improve your chances of approval and secure better loan terms.

- Start with Small Loan Amounts:

- Requesting a smaller loan initially can demonstrate your ability to repay, building trust with the lender for future borrowing.

- Negotiate with Lenders:

- Don\u2019t hesitate to discuss your unique financial situation with lenders. Many are willing to work with borrowers who present a clear repayment plan.