How to Resolve Colorado Unemployment Identity Issues

Understanding Colorado Unemployment Identity Verification Issues: A Complete Guide

Unemployment insurance (UI) plays a crucial role in supporting workers who lose their jobs through no fault of their own, helping them maintain financial stability as they search for new employment. In Colorado, the unemployment insurance (UI) process is managed by the Colorado Department of Labor and Employment (CDLE), which is responsible for verifying the identity of claimants to ensure the accuracy and integrity of claims. However, many Colorado residents face challenges with unemployment identity verification, which can delay the approval and disbursement of their benefits.

This article aims to provide a comprehensive guide to Colorado unemployment identity verification issues, discussing the role of the verification process, common problems claimants encounter, and ways to resolve these issues. Whether you’re a first-time claimant or have experienced verification problems in the past, understanding these key concepts can help streamline the process and ensure your benefits are processed promptly.

What Is Unemployment Identity Verification?

Unemployment identity verification refers to the process of confirming a claimant’s identity to ensure they are the person who is filing for unemployment benefits. This process is essential for preventing fraudulent claims and ensuring that only eligible individuals receive benefits. For example, if someone attempts to file a claim using another person’s identity, the verification process will help identify that fraud and prevent the false claim from being processed.

In Colorado, the CDLE uses various tools and methods to verify identities, including third-party services like ID.me, which has become a commonly used tool for verifying the identities of claimants during the COVID-19 pandemic and beyond.

Why Is Unemployment Identity Verification Important?

The primary reason for unemployment identity verification is to prevent fraud and ensure that eligible individuals receive the benefits they are entitled to. Without a proper verification process, individuals may exploit the system, claiming benefits under false pretenses. This not only causes financial losses for the state but also deprives those who genuinely need assistance.

Another reason for identity verification is to ensure that claimants are genuine individuals who meet the eligibility criteria set by the CDLE. This includes confirming details like work history, income levels, and personal identification, all of which are required for the approval of unemployment claims.

Common Issues in Colorado Unemployment Identity Verification

Despite the importance of the verification process, many individuals in Colorado face challenges that prevent their unemployment claims from being processed swiftly. Below are some of the most common issues related to unemployment identity verification:

1. Mismatched Personal Information

One of the most common issues claimants face is the mismatch of personal information between the information they submit in their unemployment claims and the records maintained by the CDLE or other third-party verification services like ID.me. For example, small discrepancies such as a misspelled name, incorrect address, or outdated phone number can cause the system to flag the claimant’s identity as potentially incorrect.

2. Issues with ID.me or Other Third-Party Verification Tools

The introduction of third-party verification tools like ID.me has led to increased accuracy in verifying identities but has also introduced new challenges. Some claimants have difficulty uploading the required documentation, such as a government-issued ID or a selfie, or they experience technical issues with the platform. These difficulties can delay the approval process and create frustration for claimants.

3. Problems with Identity Theft

In some cases, individuals may find themselves victims of identity theft, where someone has fraudulently filed for unemployment benefits using their personal information. This can create significant issues for the real claimant, who must go through additional steps to resolve the situation, such as reporting the theft to the authorities and verifying their identity with the CDLE.

4. Errors in Public Records or Government Databases

Occasionally, errors in public records or government databases can prevent identity verification from occurring smoothly. For example, if the CDLE’s system has outdated information on file for a claimant, such as an old address or an outdated name after a legal change (e.g., a name change after marriage), it may cause problems during the verification process.

Common Identity Verification Issues and Their Solutions

Below is a table summarizing common identity verification issues in Colorado’s unemployment claims process and the potential solutions to resolve them:

| Issue | Description | Solution |

|---|---|---|

| Mismatched Personal Information | Personal details, such as name, address, or Social Security number, don’t match the records. | Verify personal information and correct any errors with the CDLE or update your information via your ID.me account. |

| ID.me System Issues | Difficulties with ID.me platform (uploading documents, system errors, or technical problems). | Follow ID.me instructions carefully, ensure a strong internet connection, and contact their support for assistance. |

| Identity Theft or Fraud | Someone uses your identity to file a fraudulent claim. | Report identity theft to the CDLE, file a report with the authorities, and take necessary steps to restore your identity. |

| Outdated Information in Government Databases | Outdated personal records (e.g., name changes, incorrect address) stored in government databases. | Update your personal information with the CDLE and provide the necessary documentation to verify your identity. |

Top Reasons for Unemployment Identity Verification Issues in Colorado and How to Resolve Them

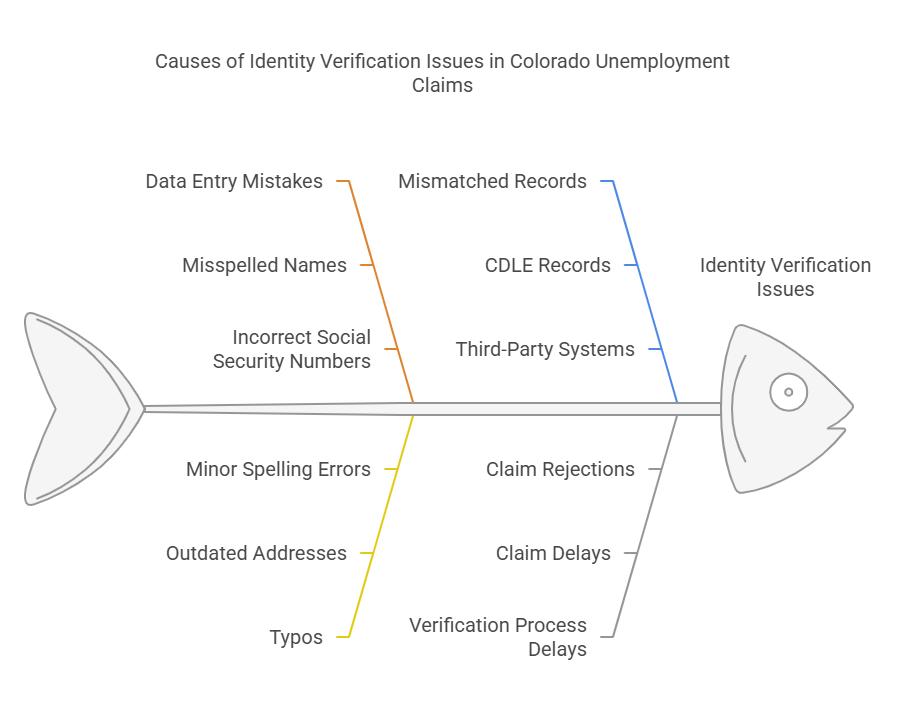

1. Data Entry Mistakes or Typos in the System

One of the most frequent causes of identity verification issues in Colorado unemployment claims is data entry mistakes or typos in the system. Claimants often fill out online forms or submit documents with incorrect information—whether it’s a slight misspelling of their name, an incorrect Social Security number, or an outdated address.

When the information submitted by a claimant doesn’t match the records stored in the Colorado Department of Labor and Employment (CDLE) or third-party verification systems like ID.me, the verification process is flagged for review. This mismatch can lead to the claim being delayed, rejected, or put on hold until the information is corrected.

How to Resolve Data Entry Mistakes or Typos

If you’re facing an identity verification issue due to a data entry mistake, follow these steps:

- Double-check the information you’ve submitted. Compare the details you provided to official documents, such as your Social Security card, ID, or tax return forms.

- Update your personal details with the CDLE. You may need to log into your unemployment account on the CDLE website and correct any discrepancies directly.

- Verify your details with ID.me. If you are using ID.me for identity verification, ensure that the information you’ve uploaded matches your official documents. If there are discrepancies, reach out to ID.me support for further assistance.

By ensuring that all the information provided matches official records, you can quickly resolve most data entry issues.

2. Outdated Information in Government Databases

Another common reason for unemployment identity verification issues is outdated information in government databases. These errors often arise when there has been a name change, address change, or other personal information updates that have not been properly reflected in the CDLE’s database. For example, if you recently married or changed your name but didn’t update your information with the CDLE, your unemployment claim may not match the records on file.

Additionally, changes in your address, email, or phone number that were never communicated to the CDLE may cause the system to flag your account.

How to Resolve Outdated Information in Government Databases

To address outdated information in government databases:

- Contact the CDLE: Notify the CDLE of any recent changes in your personal information. You can do this by calling their customer service or updating your account online.

- Provide documentation: If you’ve recently changed your name (e.g., after marriage or divorce), provide official documentation, such as a marriage certificate or court order, to support the change.

- Check your ID.me account: If you are using a third-party verification service like ID.me, ensure your account details are up-to-date. You may need to upload documents to prove your updated information.

3. Problems with Third-Party Verification Services (ID.me)

In recent years, the Colorado Department of Labor and Employment (CDLE) has partnered with third-party verification services, such as ID.me, to streamline identity verification. However, this has led to some difficulties for claimants who are unfamiliar with the platform or experience technical issues.

Some of the most common issues with ID.me and other third-party verification services include:

- Failure to upload required documents: Claimants may struggle with uploading documents like government-issued IDs or a selfie, which are required to confirm their identity.

- Poor internet connectivity: Slow internet speeds or weak connections can interrupt the document submission process, leading to errors or a failure to verify identity.

- Problems with facial recognition: ID.me uses facial recognition technology to match your photo to your submitted documents. If the system has difficulty verifying your image due to lighting, poor-quality photos, or mismatches between your submitted documents and the live selfie, your verification may be rejected.

How to Resolve ID.me Issues

To resolve issues with ID.me or any third-party verification service, follow these steps:

- Check your internet connection: Ensure that your internet connection is stable and fast enough to handle uploading files and photos.

- Follow instructions carefully: ID.me provides a detailed guide on how to upload the correct documentation, such as driver’s license or passport, and take a clear, well-lit selfie. Follow these instructions closely.

- Contact ID.me support: If you’re still having trouble, reach out to ID.me’s support team. They offer assistance with resolving verification issues, including document resubmission and technical troubleshooting.

- Consider alternatives: If ID.me continues to cause difficulties, you can reach out to the CDLE to discuss alternative verification methods.

4. Fraudulent Activity or Identity Theft

Another significant cause of unemployment identity verification issues is fraudulent activity or identity theft. During periods of high unemployment, fraudsters may attempt to steal the personal information of individuals and file false claims for benefits. As a result, genuine claimants may find themselves facing delays as the CDLE investigates suspected fraud.

If your identity has been compromised and someone has filed an unemployment claim in your name, you may face serious complications in getting your benefits processed. The CDLE may flag your claim as fraudulent, requiring additional identity verification steps.

How to Resolve Identity Theft or Fraud Issues

If you suspect that your identity has been stolen or used fraudulently during the unemployment claims process, take the following steps:

- Report the fraud to the CDLE immediately. You can contact the CDLE’s fraud hotline or use their online reporting tools to file a complaint.

- Contact the Federal Trade Commission (FTC) to report identity theft. File a report with the FTC’s IdentityTheft.gov website.

- Notify your bank and credit reporting agencies (Experian, Equifax, TransUnion). Request a fraud alert on your credit report to prevent further damage.

- Provide additional documentation to verify your identity. You may need to submit government-issued identification and proof of your social security number to confirm that the claim was not filed by you.

5. Lack of Proper Documentation

A common issue that may delay or prevent identity verification during the unemployment claims process is the lack of proper documentation. When claimants do not provide the necessary documents, such as a Social Security card, driver’s license, or tax returns, the verification process can be stalled or flagged as incomplete.

Inaccurate or incomplete documents—such as blurry images or expired IDs—can also cause verification failures.

How to Resolve Lack of Proper Documentation

To resolve this issue, ensure that you provide clear, current documentation when requested by the CDLE. Some of the documents that may be required include:

- A Social Security card or number

- A driver’s license or state-issued ID

- Tax returns or pay stubs to prove employment

- A selfie or photo verification if required by third-party services like ID.me

By providing accurate and legible documents, you can significantly reduce the chances of your identity verification being delayed.

6. System Errors or High Volumes of Claims

Occasionally, system errors or high volumes of claims can also lead to identity verification issues. During periods of high unemployment, the CDLE may experience an influx of claims, leading to system glitches or errors in processing individual claims. These errors can cause delays in verification and the disbursement of benefits.

How to Resolve System Errors or High Volume Delays

If you suspect that a system error or high claim volume is causing delays:

- Be patient. During high-demand periods, it may take longer for the CDLE to process claims and resolve verification issues.

- Monitor your claim status regularly. Check your claim status on the CDLE website or through their customer support channels for updates.

- Contact customer support if you believe there has been an error in the system that has impacted your claim.

Legal Aspects of Identity Verification in Colorado

Identity verification plays a critical role in ensuring the integrity of the unemployment insurance (UI) system in Colorado. The Colorado Department of Labor and Employment (CDLE) takes every step to verify the identity of individuals to ensure that the rightful recipients receive unemployment benefits. Understanding the legal framework surrounding identity verification can help claimants navigate issues effectively.

1. State and Federal Laws Regarding Unemployment Benefits and Identity Verification

Both state and federal laws govern the verification process for unemployment claims. These laws aim to prevent fraud and ensure that benefits are awarded to those who truly qualify. Some key aspects of these laws include:

- Unemployment Insurance (UI) Law: Colorado’s unemployment insurance program is primarily governed by State of Colorado unemployment insurance laws. These laws require the CDLE to verify the identity of all applicants to prevent fraudulent claims.

- Identity Verification Laws: Federal laws, such as the Identity Theft Protection Act and the Fraud Prevention and Detection Act, mandate that states implement procedures to verify the identity of claimants to prevent fraudulent claims.

- The Social Security Act: The Social Security Administration (SSA) regulates the use of Social Security numbers (SSNs) and their role in unemployment identity verification. Colorado follows these guidelines to ensure that unemployment claims are processed based on valid and legal SSNs.

2. Identity Theft Laws and How They Relate to Unemployment Claims

Identity theft is a serious concern in the unemployment claims process. If a claimant’s identity is stolen and used to file fraudulent claims, both state and federal laws have provisions for dealing with such violations. Colorado’s identity theft laws and fraud prevention regulations include:

- Colorado’s Identity Theft Act: This law makes it a criminal offense to knowingly steal another person’s identity to gain benefits or financial advantages, including unemployment benefits.

- The Fair Credit Reporting Act (FCRA): The FCRA ensures that consumer credit information is used fairly and responsibly. It also governs how personal information should be handled during the identity verification process to prevent misuse or fraud.

- Reporting Fraud: Claimants who suspect that their identity has been stolen or misused to file a fraudulent claim are legally protected. They have the right to report fraud to the CDLE and the Federal Trade Commission (FTC) for investigation.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about Colorado unemployment identity verification issues along with their detailed answers.

What is unemployment identity verification and why is it important?

Unemployment identity verification is the process of confirming a claimant's identity to prevent fraud and ensure only eligible individuals receive benefits. It's crucial for maintaining the integrity of the unemployment insurance system.

What are some common issues people face with Colorado unemployment identity verification?

Common issues include mismatched personal information, problems with third-party verification tools like ID.me, identity theft, and errors in public records or government databases.

How can I resolve mismatched personal information in my unemployment claim?

Double-check your submitted information against official documents, update your personal details with the Colorado Department of Labor and Employment (CDLE), and verify your details with ID.me if applicable.

What should I do if I suspect identity theft related to my unemployment claim?

Report the fraud to the CDLE immediately, contact the Federal Trade Commission (FTC), notify your bank and credit reporting agencies, and provide additional documentation to verify your identity.

What legal protections are in place for identity verification during unemployment claims in Colorado?

State and federal laws, including Colorado’s Identity Theft Act, the Fair Credit Reporting Act (FCRA), and the Social Security Act, protect claimants and aim to prevent fraud during the identity verification process.

What is unemployment identity verification and why is it important?

Unemployment identity verification is the process of confirming a claimant's identity to prevent fraud and ensure only eligible individuals receive benefits. It's crucial for maintaining the integrity of the unemployment insurance system.

What are some common issues people face with Colorado unemployment identity verification?

Common issues include mismatched personal information, problems with third-party verification tools like ID.me, identity theft, and errors in public records or government databases.

How can I resolve mismatched personal information in my unemployment claim?

Double-check your submitted information against official documents, update your personal details with the Colorado Department of Labor and Employment (CDLE), and verify your details with ID.me if applicable.

What should I do if I suspect identity theft related to my unemployment claim?

Report the fraud to the CDLE immediately, contact the Federal Trade Commission (FTC), notify your bank and credit reporting agencies, and provide additional documentation to verify your identity.

What legal protections are in place for identity verification during unemployment claims in Colorado?

State and federal laws, including Colorado’s Identity Theft Act, the Fair Credit Reporting Act (FCRA), and the Social Security Act, protect claimants and aim to prevent fraud during the identity verification process.

Conclusion: Ensuring Accurate Unemployment Identity Verification

If you face identity verification issues, be proactive about correcting errors, providing documentation, and reporting fraud when necessary. Exact Background Checks offers valuable services to help ensure that the identity verification process is smooth and error-free. By taking the right steps, you can minimize delays and ensure that you receive the unemployment benefits you deserve.

Key Takeaways:

- Identity verification is crucial for preventing fraud and ensuring the proper distribution of unemployment benefits in Colorado.

- Common issues include data entry errors, outdated information, fraud, and issues with third-party verification services like ID.me.

- Claimants should update their information, provide accurate documentation, and contact the CDLE for help with verification issues.

- The Fair Credit Reporting Act (FCRA) and Colorado’s identity theft laws protect claimants’ rights in the verification process.

By understanding these legal aspects and following the proper procedures, you can ensure a smooth and timely verification process for your unemployment claim in Colorado.