How to Accurately Fill Out Florida’s Loss of Income Form

Understanding the Verification of Employment/Loss of Income Form

The Verification of Employment/Loss of Income Form is a formal document that verifies an individual’s employment status and income. It is typically completed by the individual seeking verification, with portions filled out by their employer or former employer. This form serves as a key resource for confirming financial and employment details, allowing agencies, landlords, or lenders to assess the applicant’s eligibility for various services.

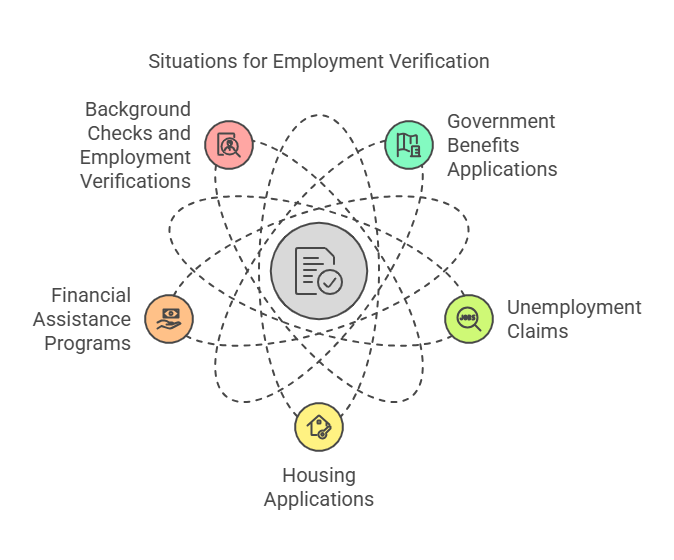

In Florida, this form is commonly used in scenarios where financial status impacts eligibility for programs, such as government benefits, housing applications, or unemployment claims. It also serves as a reliable tool for background checks and income verification.

When Is This Form Required?

The Verification of Employment/Loss of Income Form is required in several situations, including:

- Government Benefits Applications

- Programs like Medicaid, Temporary Assistance for Needy Families (TANF), or the Supplemental Nutrition Assistance Program (SNAP) often require proof of income or job loss to determine eligibility.

- Unemployment Claims

- For individuals who have recently lost their job, this form is necessary to verify income loss and determine unemployment compensation eligibility under Florida’s Reemployment Assistance Program.

- Housing Applications

- Landlords and mortgage lenders use this form to confirm an applicant’s ability to meet financial obligations, such as paying rent or mortgage installments.

- Financial Assistance Programs

- Nonprofit organizations, insurance companies, and other entities may require this form for applicants seeking financial aid or compensation due to income changes.

- Background Checks and Employment Verifications

- Employers may require this form to verify past employment or income details during the hiring process.

Purpose of the Verification of Employment/Loss of Income Form

The main goal of this form is to provide a clear and factual record of an individual’s financial and employment status. It ensures that the information presented aligns with the needs of the requesting party, whether it’s an employer, a government agency, or a private organization. Some of the key purposes include:

- Confirming the accuracy of income statements.

- Validating job history for background checks.

- Documenting loss of income for compensation or benefit claims.

Key Sections of the Form and How to Complete Them

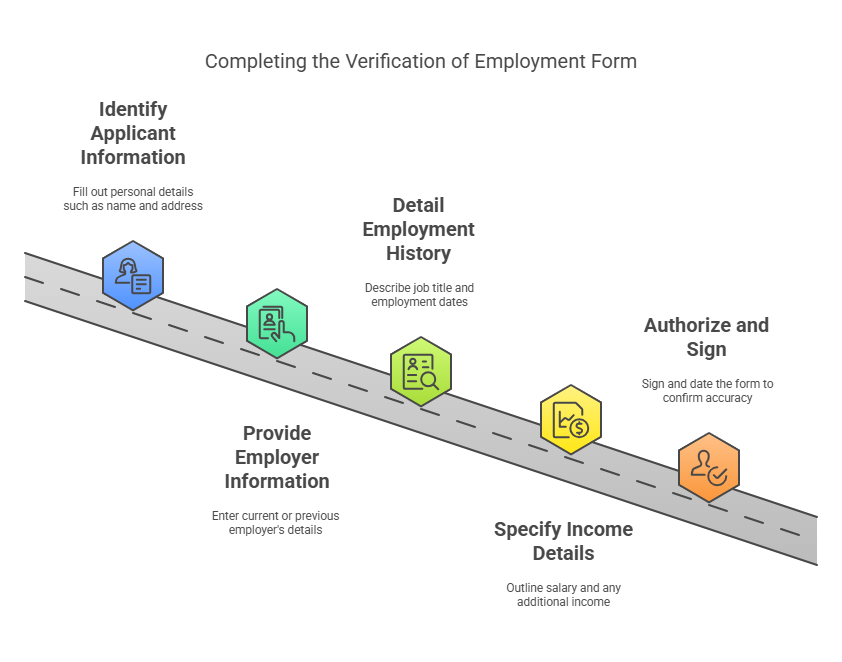

To fill out the Verification of Employment/Loss of Income Form accurately, follow this detailed step-by-step guide:

Section 1: Applicant Information

This section collects the individual’s personal information. Be sure to fill out:

- Full Name: Enter your legal name as it appears on official documents.

- Current Address: Provide your residential address, including street, city, state, and ZIP code.

- Contact Information: Include a valid phone number and email address.

- Social Security Number (SSN): Some forms may require your SSN for verification purposes. If you are uncomfortable providing this, consult with the requesting agency.

Section 2: Employer or Previous Employer Information

In this section, the employer verifies the applicant’s employment status or loss of income. You will need to provide:

- Employer’s Name: The official name of your current or previous employer.

- Employer’s Address: The business address, including street, city, state, and ZIP code.

- Contact Information: Include the name, phone number, and email of the employer’s HR representative or manager.

Section 3: Employment Details

This section focuses on the applicant’s employment history and current or past role. Fill out:

- Job Title/Position: State your official job title during employment.

- Dates of Employment: Provide the start and end dates. If you’re still employed, write “Present.”

- Reason for Job Loss: If applicable, include a brief explanation (e.g., “Company downsizing,” “COVID-19-related layoff,” or “Resigned due to personal reasons”).

Section 4: Income Verification

This critical section outlines your income and loss of earnings:

- Hourly Rate/Salary: State your earnings during employment, specifying whether the amount is hourly, weekly, monthly, or annual.

- Additional Income: Include information on bonuses, overtime pay, or commissions, if applicable.

- Loss of Income: Specify the total income lost and the date on which income loss began.

Section 5: Authorization and Signature

Finally, authorize the release of your information by:

- Signing the Form: Your signature confirms that the information provided is accurate to the best of your knowledge.

- Including the Date: Write the date you signed the form.

Checklist of Required Information

To simplify the process, ensure you have the following details on hand before filling out the form:

| Category | Details Required |

|---|---|

| Applicant Information | Full name, address, contact details, and SSN |

| Employer Details | Company name, address, and HR contact information |

| Employment Details | Job title, employment dates, and reason for job loss |

| Income Verification | Salary, additional income, and total income lost |

| Authorization | Signature and date of completion |

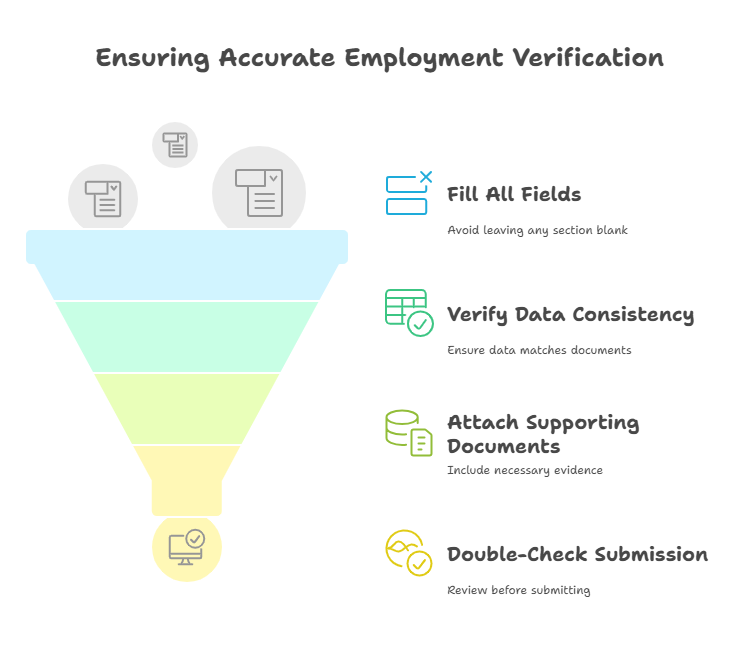

Common Errors to Avoid

When completing the Verification of Employment/Loss of Income Form, avoid these common mistakes:

- Leaving Fields Blank: Ensure every applicable section is filled out. Missing details can delay processing.

- Providing Inconsistent Information: Verify all data matches your pay stubs, tax returns, or other financial documents.

- Failing to Attach Supporting Documents: Include necessary evidence, such as termination letters or pay stubs, to substantiate your claims.

- Rushing the Process: Double-check all sections before submitting the form.

Importance and Best Practices for Filling Out the Verification of Employment/Loss of Income Form

Accurately completing the Verification of Employment/Loss of Income Form is crucial to ensure the smooth processing of your application, whether it’s for government benefits, housing, or financial assistance. A single error or omission can lead to delays, rejections, or even legal complications. In this section, we’ll discuss the importance of getting this form right and provide practical tips and best practices to streamline the process.

Why Accuracy Matters

Avoiding Delays

Errors or missing information on the form can lead to significant processing delays. Agencies, employers, or landlords reviewing your application may require clarification or additional documentation, which extends timelines.

Preventing Rejections

If the information provided is inconsistent with records from your employer or other official sources, your application may be rejected outright. Ensuring accuracy reduces the risk of having to resubmit the form multiple times.

Building Credibility

A well-completed form demonstrates professionalism and reliability. When agencies or organizations see that all details are accurate and consistent, it builds trust and confidence in your application.

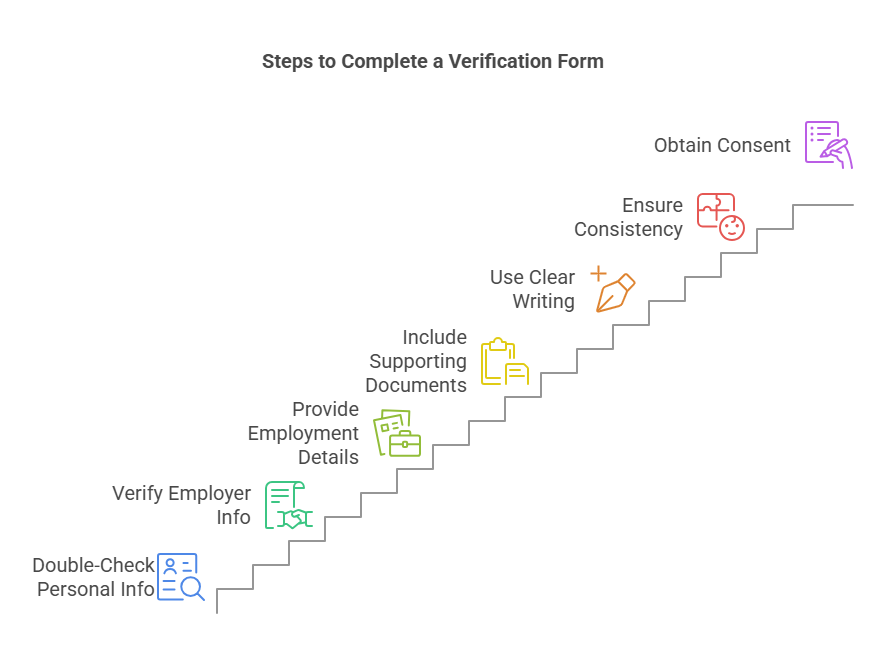

Best Practices for Completing the Form

1. Double-Check All Personal Information

Ensure that your name, address, contact details, and Social Security Number (if required) are entered correctly. Mistakes in personal details can lead to identity verification issues.

2. Verify Employer Information

- Confirm the exact name and address of your employer or former employer.

- Obtain the correct contact information for the HR department or a manager who can verify your employment.

- If your employer has closed or is unresponsive, include any relevant documentation, such as termination letters or pay stubs, to support your claim.

3. Provide Complete Employment Details

- Clearly outline your job title, start and end dates, and the reason for job loss (if applicable).

- Be transparent about any breaks in employment or changes in position, as these may be questioned during verification.

4. Include Supporting Documents

Attach copies of any relevant documents to substantiate your claims, such as:

- Recent pay stubs

- Termination letters

- W-2 or 1099 forms

- Bank statements reflecting income deposits

These documents provide additional proof of your employment or income loss and reduce the likelihood of disputes.

5. Use Clear and Legible Writing

If you’re completing a physical form, ensure your handwriting is neat and legible. For online submissions, double-check for typos or formatting errors.

6. Ensure Consistency Across All Documents

If you’re submitting multiple forms or documents, ensure that the details match across all of them. Inconsistencies can raise red flags and may require additional verification.

7. Obtain Consent and Authorization from All Parties

If your employer is required to fill out a section of the form, ensure they complete it promptly and sign where needed. Without the employer’s input, the form may be considered incomplete.

How Exact Background Checks Can Help

Streamlining the Employment Verification Process

At Exact Background Checks, we specialize in employment verification and income validation, making the process easier for individuals and businesses. Our services ensure that all necessary details are accurate and compliant with regulations, reducing the risk of errors.

Comprehensive Services We Offer

- Employment Verification: We contact current or former employers to confirm job titles, dates of employment, and income details.

- Income Verification: We provide accurate reports to validate income, including bonuses and commissions.

- Background Screening: Our comprehensive background checks ensure all employment and financial records align with your history.

Benefits of Choosing Exact Background Checks

- Accuracy: Our reports are thoroughly vetted to ensure accuracy and reliability.

- Efficiency: We process requests quickly, helping you meet deadlines and avoid delays.

- Compliance: We adhere to all federal and state regulations, including the Fair Credit Reporting Act (FCRA), ensuring that our practices are legally sound.

By partnering with Exact Background Checks, individuals and businesses can streamline the verification process and minimize the risk of errors or delays.

Tips for Employers

If you’re an employer tasked with completing the Verification of Employment/Loss of Income Form for a current or former employee, follow these tips:

- Respond Promptly: Delays in completing the form can negatively impact the employee’s application for benefits or services.

- Provide Accurate Information: Double-check employment details, including job titles, dates, and income figures.

- Maintain Records: Keep organized records of employee information to ensure quick and accurate responses to verification requests.

- Consult Experts: Use services like Exact Background Checks to manage employment verification requests efficiently and professionally.

Common Challenges and How to Overcome Them

Missing or Incomplete Employer Responses

- Solution: If your employer is unresponsive, reach out to other contacts within the organization or provide alternative documentation (e.g., pay stubs or tax forms).

Unclear Income Details

- Solution: Review your records carefully and use multiple sources (e.g., bank statements, W-2 forms) to ensure accuracy.

Legal and Privacy Concerns

- Solution: Understand your rights under the FCRA and other applicable laws. Services like Exact Background Checks ensure compliance with privacy regulations.

Miscommunication Between Parties

- Solution: Maintain open communication with your employer, landlord, or agency to clarify any questions or concerns during the verification process.

Legal Aspects of Filling Out the Form

Compliance with State and Federal Laws

Fair Credit Reporting Act (FCRA)

The FCRA governs how employment and income verification data is collected, shared, and used. Under this law:

- Written Consent: Employers must obtain written consent from individuals before accessing their employment or income records.

- Accurate Reporting: Employers and verification agencies are required to ensure the accuracy of the information they provide.

- Right to Dispute: Individuals have the right to dispute incorrect information in their employment verification reports.

Florida-Specific Regulations

While federal laws like the FCRA set the standard, Florida may have additional requirements regarding employment and income verification. For instance:

- Employers in Florida must adhere to the state’s privacy laws when handling employee information.

- Agencies requesting the form may require specific details about income or employment duration, depending on the purpose (e.g., housing assistance or public benefits).

Employer Responsibilities

Employers who complete the form have a legal obligation to:

- Provide Accurate Information: Deliberately falsifying data can lead to legal penalties.

- Maintain Confidentiality: Employers must safeguard employee information and ensure it is only shared with authorized parties.

- Respond Promptly: Delays in completing the form can result in legal or financial consequences for employees.

Employee Rights

Individuals completing the form or having their employment verified should know their rights:

- Access to Records: Employees have the right to request and review their employment or income records.

- Dispute Incorrect Data: Any inaccuracies in the form can be disputed with the employer or verification agency.

- Protection Against Discrimination: The form’s contents cannot be used to discriminate against employees or applicants based on protected characteristics like race, gender, or disability.

Frequently Asked Questions

What is the Verification of Employment/Loss of Income Form and when is it typically required?

It's a formal document verifying an individual's employment status and income, required for government benefits, unemployment claims, housing applications, financial assistance programs, and background checks.

What are the key sections of the form and what information is needed for each?

The key sections include: Applicant Information (personal details), Employer Information (company details), Employment Details (job title, dates, reason for loss), Income Verification (salary, additional income, loss), and Authorization (signature and date).

What common errors should be avoided when filling out the form?

Avoid leaving fields blank, providing inconsistent information, failing to attach supporting documents, and rushing the process.

What are the legal aspects to consider when filling out this form?

Compliance with the Fair Credit Reporting Act (FCRA), Florida-specific regulations, employer responsibilities (accurate information, confidentiality), and employee rights (access to records, dispute errors, protection against discrimination).

How can services like Exact Background Checks assist with the verification process?

They streamline employment and income verification, ensure accuracy and compliance, provide background screening, and offer efficient processing to avoid delays.

What is the Verification of Employment/Loss of Income Form and when is it typically required?

It's a formal document verifying an individual's employment status and income, required for government benefits, unemployment claims, housing applications, financial assistance programs, and background checks.

What are the key sections of the form and what information is needed for each?

The key sections include: Applicant Information (personal details), Employer Information (company details), Employment Details (job title, dates, reason for loss), Income Verification (salary, additional income, loss), and Authorization (signature and date).

What common errors should be avoided when filling out the form?

Avoid leaving fields blank, providing inconsistent information, failing to attach supporting documents, and rushing the process.

What are the legal aspects to consider when filling out this form?

Compliance with the Fair Credit Reporting Act (FCRA), Florida-specific regulations, employer responsibilities (accurate information, confidentiality), and employee rights (access to records, dispute errors, protection against discrimination).

How can services like Exact Background Checks assist with the verification process?

They streamline employment and income verification, ensure accuracy and compliance, provide background screening, and offer efficient processing to avoid delays.

Conclusion

The Verification of Employment/Loss of Income Form is a critical document for individuals in Florida seeking to verify their financial and employment status. Whether you’re applying for public benefits, housing, or financial aid, completing this form accurately is essential to avoid delays and ensure successful processing.

Key Takeaways

- Understand the Purpose: The form is required in various scenarios, including benefit applications, housing eligibility, and financial assistance requests.

- Accuracy Matters: Providing complete and accurate information is crucial to prevent delays or rejections.

- Leverage Professional Services: Companies like Exact Background Checks streamline the verification process by providing reliable and compliant services.

- Know Your Rights: Employees have the right to access and dispute their verification data, ensuring that the process remains fair and accurate.

- Follow Legal Guidelines: Employers and employees must comply with state and federal laws, including the FCRA and Florida-specific regulations.

By following the steps, best practices, and legal considerations outlined in this guide, you can navigate the verification process with confidence. Partnering with a trusted service like Exact Background Checks ensures that your employment and income verification needs are met efficiently, accurately, and in compliance with all applicable laws.