How the Fair Credit Reporting Act affect Background Checks

What is the Fair Credit Reporting Act (FCRA) and How Does It Affect Criminal Background Checks?

The Fair Credit Reporting Act (FCRA) is a key piece of federal legislation in the United States that regulates how personal information, including criminal records, is collected, shared, and used, particularly in the employment context. Enacted in 1970, the FCRA was designed to ensure that consumer information is handled fairly, accurately, and transparently.

When it comes to criminal background checks, the FCRA plays a crucial role in ensuring that employers use this information appropriately and within the bounds of the law. In this article, we will explore how the FCRA governs criminal background checks, its implications for employers, and how businesses can navigate the complex requirements of the law.

Introduction to the Fair Credit Reporting Act (FCRA)

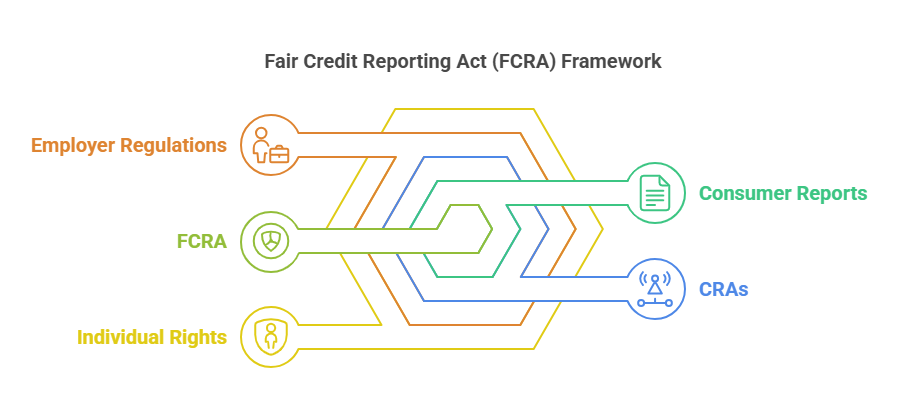

The FCRA governs the use of consumer reports, which include criminal background checks, credit reports, and other personal data. This law was created to promote fairness, accuracy, and privacy in how consumer information is gathered and shared by consumer reporting agencies (CRAs). The FCRA regulates how employers can access and use criminal records during the hiring process, ensuring that background checks are not misused and that candidates are treated fairly.

The law provides a set of rules and protections for individuals, including the right to know what information is being reported about them and the ability to dispute inaccuracies. Importantly, the FCRA requires employers to obtain written consent from candidates before conducting criminal background checks and to notify candidates if adverse decisions are made based on those checks.

The Role of the FCRA in Background Checks

The FCRA directly impacts how criminal background checks are conducted in the hiring process. Employers who wish to conduct background checks on potential employees must comply with several key provisions of the FCRA. These provisions ensure that the information collected is accurate, relevant, and used fairly.

Here are the main ways the FCRA affects criminal background checks:

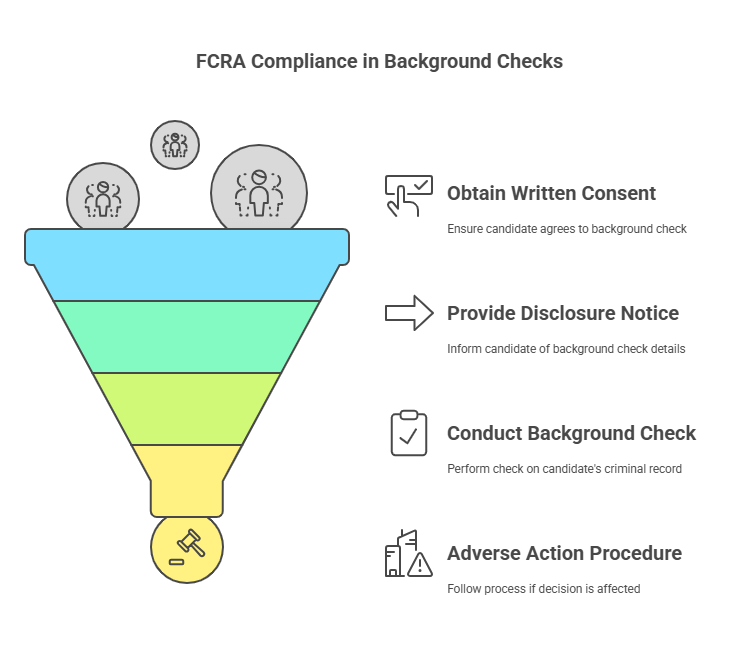

- Written Consent: Employers must obtain written consent from candidates before conducting any criminal background check. This ensures transparency in the hiring process.

- Disclosure Requirements: Employers are required to provide candidates with a disclosure notice if they plan to conduct a criminal background check. This notice must be separate from the job application and clearly state that a background check will be performed.

- Adverse Action Procedures: If a criminal background check leads to an adverse employment decision (such as not hiring a candidate), the FCRA mandates that employers must follow a specific process. This includes providing a pre-adverse action notice and a final adverse action notice to the candidate.

Consumer Reporting Agencies (CRAs) and FCRA Compliance

Consumer reporting agencies (CRAs) are responsible for gathering and maintaining information about individuals, including criminal records. These agencies compile data from various sources, such as courts, law enforcement, and correctional facilities, and provide employers with background check reports.

Under the FCRA, CRAs must ensure that the information they provide is accurate, up-to-date, and reported in a way that complies with the law. Employers are prohibited from using inaccurate or outdated criminal background information in their hiring decisions. CRAs must also allow individuals to dispute any inaccuracies in the reports they receive.

Why Employers Need to Follow FCRA Regulations

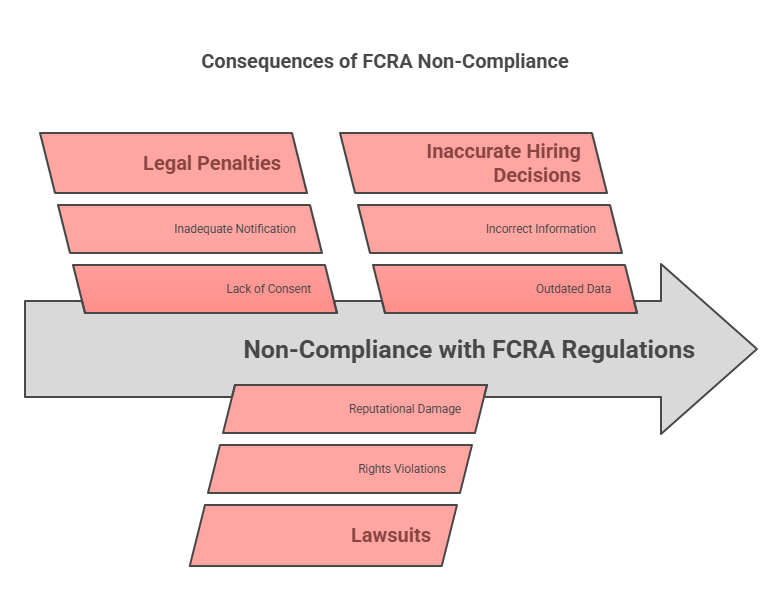

Employers have a legal obligation to follow the FCRA when using criminal background checks during the hiring process. Failure to comply with these regulations can lead to serious consequences, including:

- Legal Penalties: Employers who fail to obtain consent or notify candidates appropriately may face legal action or financial penalties.

- Lawsuits: Candidates who believe their rights under the FCRA have been violated may file lawsuits against the employer, potentially resulting in reputational damage and financial costs.

- Inaccurate Hiring Decisions: Not following FCRA guidelines can lead to hiring decisions based on incorrect or outdated information, which can result in hiring unqualified candidates or wrongfully rejecting qualified ones.

For these reasons, it is essential for employers to understand the FCRA’s impact on criminal background checks and to ensure compliance throughout the hiring process.

Now that we’ve covered the FCRA’s role in regulating criminal background checks, let’s delve into how the process works step-by-step and explore the best practices employers should follow to stay compliant with the law.

How Criminal Background Checks Are Conducted Under FCRA

1. Obtaining Candidate Consent

The FCRA requires employers to obtain written consent from candidates before conducting a criminal background check. This is a crucial step in ensuring transparency and giving candidates the opportunity to consent to or refuse the background check.

- Disclosure Notice: The consent must be part of a separate document from the job application to avoid confusion and ensure that candidates understand what they are agreeing to. The notice should explicitly state that a background check will be conducted.

2. Notification of Adverse Action

If the criminal background check reveals information that could impact the hiring decision (e.g., a felony conviction), the FCRA requires the employer to provide the candidate with a pre-adverse action notice. This notice informs the candidate that their criminal history is being considered and that it may affect the hiring decision.

- The candidate must be given a reasonable amount of time (typically 5 business days) to dispute the information or explain the circumstances before the final decision is made.

If the employer proceeds with an adverse action (e.g., not hiring the candidate) based on the background check, they must send a final adverse action notice. This notice includes a copy of the background check report, the contact details of the CRA, and a statement of the candidate’s right to dispute the report.

What Employers Can and Cannot Do with Background Check Information

Employers must be cautious about how they use criminal background information. The FCRA provides guidelines to ensure that this information is only used when relevant and appropriate:

- Relevance: Employers must consider the nature of the offense, time elapsed, and the candidate’s qualifications before making a decision. For example, a misdemeanor conviction from 10 years ago may not be relevant to a job in a different field.

- Limitations on Criminal Records: Some states and cities have additional restrictions on how employers can use criminal records. For example, many jurisdictions prohibit employers from asking about arrests that did not lead to convictions or about criminal records that are sealed or expunged.

Employers should develop clear policies for how criminal background checks will be used in hiring decisions, ensuring consistency and fairness in the process.

Using Third-Party Services for Criminal Background Checks

To ensure compliance with the FCRA, many employers rely on third-party services to conduct criminal background checks. ExactBackgroundChecks.com is one such service that specializes in providing thorough, accurate, and compliant background checks for businesses. By using services like ExactBackgroundChecks.com, employers can:

- Ensure Compliance: ExactBackgroundChecks.com helps businesses navigate the complex legal requirements of the FCRA, ensuring that background checks are conducted legally and ethically.

- Streamline the Process: These services handle the entire background check process, from obtaining consent to sending adverse action notices, saving employers time and reducing the risk of errors.

- Access to Accurate Data: Services like ExactBackgroundChecks.com have access to national and state databases, ensuring that criminal records are up-to-date and accurate.

By outsourcing background checks to a trusted service, employers can focus on hiring the best candidates while maintaining compliance with the FCRA.

International Criminal Background Checks

For employers hiring candidates from outside the United States, conducting criminal background checks can be more complex. FCRA guidelines still apply, but international criminal background checks often require additional steps:

- Working with International Agencies: Employers may need to partner with international background check agencies that specialize in gathering criminal records from foreign countries.

- Adhering to Local Laws: Different countries have different laws regarding the disclosure and use of criminal records. Employers must ensure they comply with these laws while also following FCRA guidelines when applicable.

Best Practices for Employers

To stay compliant with the FCRA, employers should:

- Obtain Written Consent: Always get written consent from candidates before conducting criminal background checks.

- Provide Proper Notices: Ensure candidates receive pre-adverse and final adverse action notices if decisions are made based on background checks.

- Keep Records: Maintain documentation of all notices sent and ensure that decisions are based on relevant information.

- Regularly Review Policies: Regularly review and update hiring policies to ensure they remain compliant with changing FCRA regulations.

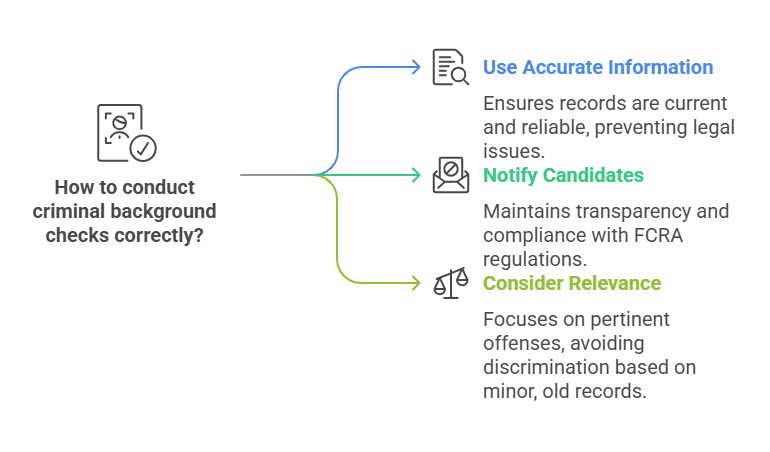

Pitfalls to Avoid in Criminal Background Checks

Employers should be aware of common mistakes that could lead to FCRA violations:

- Using Outdated or Inaccurate Information: Always verify that criminal records are up-to-date and accurate.

- Failure to Notify Candidates: Ensure that candidates are properly notified if an adverse decision is made based on their background check.

- Not Considering Relevance: Avoid making decisions based on irrelevant or minor criminal offenses that occurred many years ago.

Legal Aspects of Criminal Background Checks under the FCRA

Employers must understand the legal consequences of failing to comply with the FCRA when conducting criminal background checks. Some of the potential consequences include:

- Penalties and Lawsuits: Employers who violate the FCRA may face legal action, financial penalties, and reputational damage.

- Reputational Risk: Non-compliance with the FCRA can damage a company’s reputation and cause candidates to lose trust in the hiring process.

Ban the Box and Other State Laws

Several states and localities have enacted Ban the Box laws, which restrict when employers can inquire about a candidate’s criminal history. These laws interact with FCRA guidelines and may require employers to modify their hiring procedures.

Adverse Action and the FCRA

The FCRA provides a specific process for employers to follow if they decide to take adverse action based on a criminal background check. This process includes:

- Pre-Adverse Action Notice: Inform the candidate that their criminal history is being considered.

- Waiting Period: Provide the candidate a reasonable amount of time to dispute the information.

- Final Adverse Action Notice: If the decision is not reversed, send a final notice to the candidate, including details about the background check and their right to dispute the information.

FAQs About Criminal Background Checks and the FCRA

What is the Fair Credit Reporting Act (FCRA) and what does it regulate?

The FCRA is a federal law that regulates how personal information, including criminal records, credit reports, and other data, is collected, shared, and used, particularly in employment contexts, to ensure fairness and accuracy.

How does the FCRA affect criminal background checks in the hiring process?

The FCRA requires employers to obtain written consent before conducting background checks, provide disclosure notices, and follow adverse action procedures if a background check leads to a negative hiring decision.

What are the obligations of employers regarding adverse action based on criminal background checks?

Employers must provide a pre-adverse action notice, allow time for the candidate to dispute information, and issue a final adverse action notice with a copy of the report and contact details of the CRA.

Why is it important for employers to use compliant third-party services for criminal background checks?

Using compliant services ensures adherence to FCRA regulations, streamlines the background check process, provides access to accurate data, and reduces the risk of legal penalties and inaccurate hiring decisions.

What are some best practices for employers to follow to ensure FCRA compliance when conducting criminal background checks?

Best practices include obtaining written consent, providing proper notices, keeping records, regularly reviewing policies, and avoiding the use of outdated or irrelevant criminal information.

Conclusion

The Fair Credit Reporting Act plays a crucial role in regulating criminal background checks during the hiring process. Employers must follow its guidelines to ensure fairness, transparency, and legal compliance. By working with compliant background check services like ExactBackgroundChecks.com, businesses can streamline the process and avoid common pitfalls.

Staying informed about the FCRA and local laws is vital for businesses to make informed, legal hiring decisions and maintain a fair and transparent recruitment process.