How to Conduct a Rental Background Check on Yourself

What Is a Rental Background Check on Yourself?

A rental background check on yourself is a personal review of your rental history, credit report, criminal records, and other relevant details that landlords typically assess before approving a lease application. By conducting this check proactively, you can identify any potential red flags and take steps to correct errors or improve your rental profile.

Landlords and property managers use background checks to evaluate potential tenants, ensuring they are financially responsible and have a reliable rental history. Running a self-check allows you to see what they see, giving you a competitive edge when applying for a lease.

Why Is a Rental Background Check Important?

When applying for a rental property, landlords use background checks to assess whether you are a trustworthy tenant. If your report contains inaccuracies, old debts, or unexpected issues, it could lead to a denied rental application. Checking your background report beforehand ensures you can address any problems and improve your chances of securing a lease.

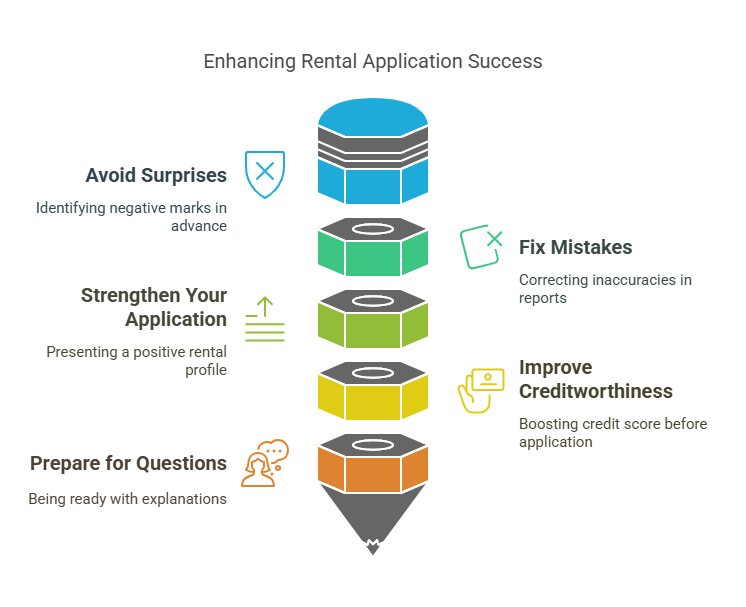

Here are the key reasons why a self-background check is important:

- Avoid Surprises – Identify any negative marks, such as eviction history or errors on your credit report.

- Fix Mistakes – Credit reports and background checks can sometimes contain incorrect information that needs correction.

- Strengthen Your Application – Knowing your rental profile allows you to present yourself in the best light to landlords.

- Improve Creditworthiness – If your credit score is low, checking in advance gives you time to take steps to boost it.

- Prepare for Questions – If a landlord asks about certain details in your report, you’ll be ready with explanations and solutions.

Benefits of Checking Your Rental Background Before Applying for a Lease

Conducting a rental background check on yourself provides several advantages:

| Benefit | Why It Matters |

|---|---|

| Early Error Detection | Find and dispute inaccuracies in your records before landlords see them. |

| Better Application Approval Odds | Strengthen your rental application by addressing weak areas. |

| Financial Awareness | Understand your credit standing and how it affects your renting potential. |

| Eviction Prevention | If past eviction records exist, you can work on explaining or disputing them. |

| Fraud Protection | Ensure your identity hasn’t been misused or falsely linked to rental debts. |

Rental Background Check vs. Other Types of Personal Background Checks

A rental background check is specifically tailored to a landlord’s needs, but how does it compare to other types of background checks?

| Type of Background Check | Purpose | Commonly Used By |

|---|---|---|

| Rental Background Check | Assesses rental history, credit score, criminal records, and eviction reports. | Landlords, property managers |

| Employment Background Check | Reviews criminal history, credit reports, employment verification, and education history. | Employers, HR departments |

| Financial Credit Check | Evaluates credit scores, debt levels, and payment history. | Banks, lenders, credit card companies |

| Criminal Background Check | Checks for past convictions, pending charges, and legal infractions. | Employers, landlords, law enforcement |

A rental background check focuses on information relevant to housing applications, such as rental payment history, evictions, and creditworthiness, while an employment background check may include work history and professional references. Understanding these differences helps you prepare the right documentation for landlords.

How to Conduct a Rental Background Check on Yourself

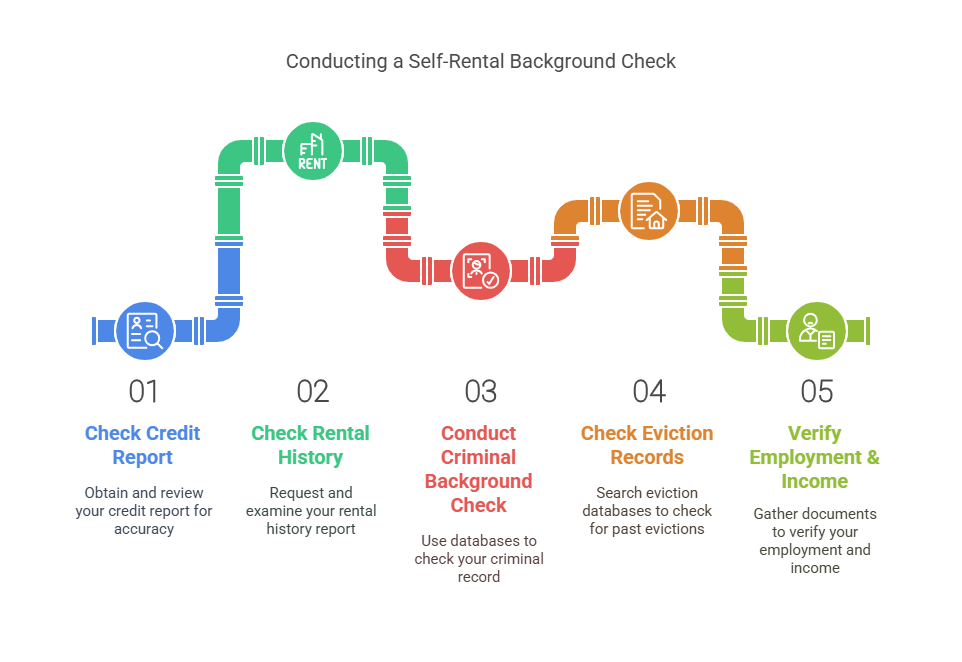

Running a rental background check on yourself is a straightforward process that ensures you are fully prepared before submitting a lease application. Follow these step-by-step instructions to check your rental history, credit score, and criminal records.

Step 1: Check Your Credit Report

Your credit score and payment history play a crucial role in your rental approval. Most landlords check credit reports to assess whether you are financially responsible.

✔️ How to do it:

- Obtain a free credit report from AnnualCreditReport.com (available once per year from each major credit bureau: Equifax, Experian, and TransUnion).

- Review your report for late payments, collections, outstanding debts, or errors that could impact your rental application.

- Dispute inaccuracies through the credit bureau’s website if needed.

Step 2: Check Your Rental History

Landlords often use rental history reports to see if you’ve been a responsible tenant. These reports include past landlords, rental payment records, and eviction history.

✔️ How to do it:

- Request a rental history report from services like TransUnion SmartMove, Experian RentBureau, or a tenant screening company.

- Look for past addresses, payment history, and any evictions or disputes listed.

- If you find incorrect information, contact the reporting agency or your former landlord to correct or dispute the errors.

Step 3: Conduct a Criminal Background Check

Many landlords check criminal records to assess risk before renting to a tenant. Having a criminal record doesn’t always disqualify you, but it helps to know what appears on your background check.

✔️ How to do it:

- Use state and federal databases, or background check services like Exact Background Checks to review your criminal history.

- If you have a sealed or expunged record, ensure it no longer appears in public databases.

- Be prepared to explain past offenses if needed and highlight rehabilitation efforts.

Step 4: Check Eviction Records

An eviction record is a red flag for landlords. If you’ve been evicted before, it could lower your chances of securing a lease.

✔️ How to do it:

- Search eviction databases or request a tenant background check from sites like LexisNexis or Experian.

- If you find past evictions, be ready to explain why they happened and how you’ve improved your rental habits.

Step 5: Verify Employment & Income History

Landlords often require proof of stable employment and income to ensure you can pay rent.

✔️ How to do it:

- Gather recent pay stubs, tax returns, or bank statements to verify income.

- Ensure past employers listed in background reports are accurate.

- If you’re self-employed, prepare profit and loss statements or 1099 tax forms.

What’s Included in a Rental Background Check?

A rental background check typically includes:

| Category | What Landlords Look For |

|---|---|

| Credit Report | Credit score, payment history, outstanding debts |

| Rental History | Previous addresses, landlord references, eviction records |

| Criminal Background | Arrests, convictions, felonies, misdemeanors |

| Eviction History | Past evictions, court judgments related to rentals |

| Employment & Income | Proof of income, job stability, employer references |

Knowing what’s in your report allows you to fix errors, explain issues, and strengthen your rental application.

Who Should Conduct a Self-Background Check Before Renting?

Running a rental background check on yourself is useful for:

✅ First-time renters – If you’re new to renting, checking your report helps you understand what landlords will see.

✅ People with past evictions – If you’ve been evicted before, you can review your records and prepare explanations.

✅ Those with bad credit – A self-check allows you to improve your credit score before applying.

✅ Anyone applying for high-demand rentals – In competitive markets, having a clean rental history boosts your chances.

✅ Self-employed individuals – Since proving income can be harder, reviewing your financial records ensures you’re prepared.

Benefits of Reviewing Your Rental Background Report Before Applying

Checking your own rental background before applying for an apartment can help you avoid surprises, correct errors, and improve your chances of securing a lease.

Here are the key benefits:

✅ Prevent Application Rejection – Spot and resolve any issues before landlords review your history.

✅ Fix Mistakes in Your Record – Dispute inaccurate credit, eviction, or criminal records.

✅ Boost Your Rental Application – Strengthen your case with positive credit and rental history.

✅ Prepare for Landlord Questions – If there are red flags, you’ll have explanations ready.

✅ Improve Your Credit Score – If credit issues exist, you can take steps to fix them before applying.

✅ Secure Better Rental Terms – A strong rental background could help negotiate lower deposits or better lease terms.

Exact Background Checks: Your Trusted Screening Service

If you want a thorough and accurate rental background check, consider using Exact Background Checks. Their services include:

- Comprehensive credit and rental history reports

- Criminal background checks across state and federal databases

- Eviction and landlord reference verification

- Fast and accurate results to help you prepare for lease applications

Using a reliable screening service ensures you get a complete picture of your rental background before applying for housing.

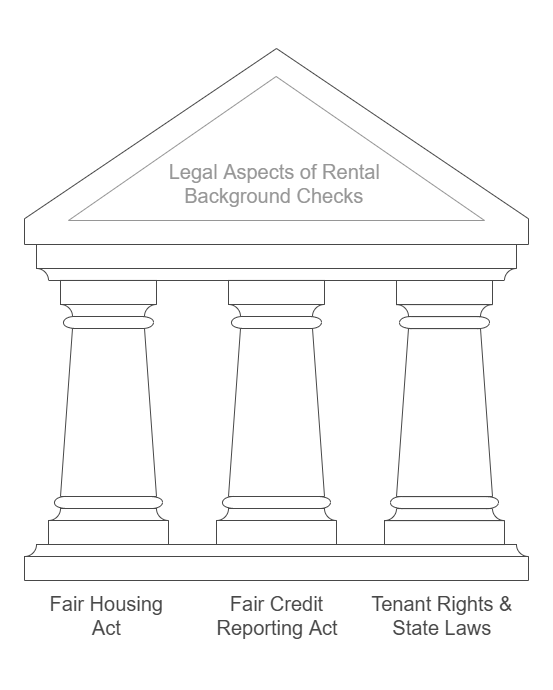

Legal Aspects of Rental Background Checks

When conducting a rental background check on yourself, it’s important to understand the legal protections and regulations that govern tenant screening. Here are some key laws that impact rental background checks:

1. Fair Housing Act (FHA)

The Fair Housing Act (FHA) prohibits discrimination in housing decisions based on race, color, religion, sex, disability, familial status, or national origin. This means:

- Landlords cannot reject you based on personal characteristics unrelated to your rental history.

- If a landlord denies your application due to your background check, they must ensure the decision is not discriminatory.

2. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) regulates how consumer reports, including rental background checks, are used. Under the FCRA:

- You have the right to access your credit and background check reports.

- If your application is denied due to a background check, the landlord must notify you and provide information on how to dispute errors.

- You can request a free credit report once a year from AnnualCreditReport.com.

3. Tenant Rights & State Laws

Each state has specific laws governing tenant rights, eviction records, and rental screening processes. Some states have:

- Restrictions on using criminal history for rental decisions.

- Limitations on how far back an eviction record can be checked.

- Laws requiring landlords to provide reasons for rejecting a rental application.

💡 Tip: Check your state’s tenant rights laws to understand how background checks impact your rental application.

FAQs: Rental Background Checks and Tenant Screening

Why is it important to conduct a rental background check on yourself before applying for a lease?

- Conducting a rental background check on yourself allows you to identify potential red flags, correct errors in your records, strengthen your application, improve your creditworthiness, and prepare explanations for any issues a landlord might find.

What types of information are typically included in a rental background check?

- A rental background check typically includes your credit report (credit score, payment history, debts), rental history (previous addresses, landlord references, evictions), criminal background (arrests, convictions), eviction records, and verification of employment and income.

How can you conduct a rental background check on yourself?

- You can conduct a rental background check by checking your credit report at AnnualCreditReport.com, requesting a rental history report from services like TransUnion SmartMove or Experian RentBureau, conducting a criminal background check through state and federal databases or services like Exact Background Checks, checking eviction records, and verifying your employment and income history.

What are the benefits of reviewing your rental background report before applying for a lease?

- The benefits include preventing application rejection by spotting and resolving issues, fixing mistakes in your record, boosting your rental application, preparing for landlord questions, improving your credit score, and potentially securing better rental terms.

What legal aspects should you be aware of when conducting a rental background check on yourself?

- You should be aware of the Fair Housing Act (FHA), which prohibits discrimination; the Fair Credit Reporting Act (FCRA), which regulates consumer reports and provides you with rights to access and dispute your reports; and state-specific tenant rights and laws that govern eviction records and rental screening processes.

Why is it important to conduct a rental background check on yourself before applying for a lease?

- Conducting a rental background check on yourself allows you to identify potential red flags, correct errors in your records, strengthen your application, improve your creditworthiness, and prepare explanations for any issues a landlord might find.

What types of information are typically included in a rental background check?

- A rental background check typically includes your credit report (credit score, payment history, debts), rental history (previous addresses, landlord references, evictions), criminal background (arrests, convictions), eviction records, and verification of employment and income.

How can you conduct a rental background check on yourself?

- You can conduct a rental background check by checking your credit report at AnnualCreditReport.com, requesting a rental history report from services like TransUnion SmartMove or Experian RentBureau, conducting a criminal background check through state and federal databases or services like Exact Background Checks, checking eviction records, and verifying your employment and income history.

What are the benefits of reviewing your rental background report before applying for a lease?

- The benefits include preventing application rejection by spotting and resolving issues, fixing mistakes in your record, boosting your rental application, preparing for landlord questions, improving your credit score, and potentially securing better rental terms.

What legal aspects should you be aware of when conducting a rental background check on yourself?

- You should be aware of the Fair Housing Act (FHA), which prohibits discrimination; the Fair Credit Reporting Act (FCRA), which regulates consumer reports and provides you with rights to access and dispute your reports; and state-specific tenant rights and laws that govern eviction records and rental screening processes.

Conclusion

Conducting a rental background check on yourself is a smart step before applying for a lease. It helps you:

✔️ Identify potential red flags before landlords do.

✔️ Fix errors in your credit or rental history.

✔️ Improve your chances of rental approval.

✔️ Understand your legal rights as a tenant.

By taking control of your background check, you can prepare a stronger rental application and avoid unexpected rejections. Services like Exact Background Checks can provide accurate and reliable reports to help you navigate the process smoothly.

🔎 Final Tip: Review your background check at least 30 days before applying for a rental to allow time for corrections if needed!

Great tips! Running a self-background check is essential for a smooth rental application.