Guide to Performing Thorough Company Background Check

Introduction to Company Background Checks and Why They Are Important

Background checks have become a critical component of the hiring process for companies in nearly every industry. These checks help businesses ensure they are hiring individuals who meet their specific standards and who align with the company’s values and goals. But what exactly is a company background check, and why is it so essential for businesses?

In this part of the article, we’ll define what a company background check is, explain the different types of checks companies conduct, and discuss the various reasons why these checks are crucial in ensuring the integrity and safety of a business.

What is a Company Background Check?

A company background check refers to the process of verifying the history and credentials of an individual before making decisions such as hiring, promoting, or entering into a business relationship with them. This screening process is a standard practice used by employers to assess an individual’s suitability for a role based on their past activities, behavior, and reputation.

Background checks may cover several areas, such as:

- Criminal history (misdemeanors and felonies)

- Employment history (previous employers, job titles, and dates of employment)

- Educational history (degrees, institutions attended, and academic records)

- Credit history (for positions involving financial responsibility)

- Driving records (for roles that require operating vehicles)

- Drug screening (pre-employment or random checks)

By conducting a background check, a company can gain insight into an applicant’s qualifications, character, and potential risks. It helps ensure that employees have the necessary skills, qualifications, and trustworthiness required for their roles.

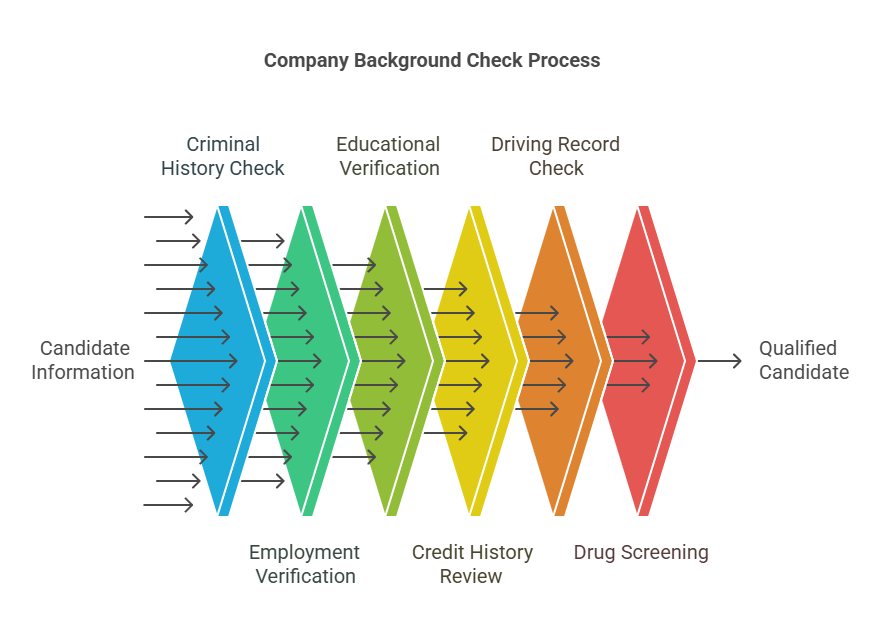

Types of Company Background Checks

Companies can conduct various types of background checks, each aimed at verifying specific aspects of a candidate’s history. Here are the most common types:

1. Criminal Background Check

A criminal background check searches local, state, and federal databases to see if an individual has any past criminal convictions. This type of check helps companies assess whether a candidate has any criminal history that could pose a risk to the workplace, co-workers, or clients.

2. Credit History Check

A credit check involves reviewing a candidate’s credit report to assess their financial responsibility. This type of background check is typically performed for positions that involve financial duties or decision-making, such as accounting or managerial roles. It helps companies determine whether an applicant is likely to handle finances responsibly and whether they may present a risk for financial misconduct.

3. Employment Verification

Employment verification is used to confirm the accuracy of the information provided by the candidate regarding their previous job titles, employers, and work dates. This process is crucial to ensure that an applicant has the qualifications and experience they claim to have, and it helps prevent resume fraud.

4. Education Verification

Education verification is another standard component of a company background check. It verifies whether an applicant has the educational qualifications they claim to have, such as degrees, certifications, and the institutions they attended.

5. Drug Testing

Some companies require applicants to pass a drug test as part of their background check. This is particularly common in industries that require safety-sensitive positions, such as transportation, healthcare, or construction. Drug testing ensures that employees will be able to perform their duties without impairment.

6. Driving Record Check

For jobs that involve driving, such as delivery drivers or truckers, employers often check the applicant’s driving record. This ensures the individual has a safe driving history and is not a liability on the road.

Who Conducts Company Background Checks?

Background checks can be performed by a company’s internal human resources (HR) department, or, more commonly, by third-party background check providers. These providers specialize in conducting thorough background screenings and generating detailed reports for businesses.

The process is typically managed by HR professionals who work closely with these third-party services to ensure that background checks are conducted correctly and comply with relevant legal standards.

Third-party background check providers often use proprietary tools to gather and compile information from various databases. They are equipped to handle the various elements of the background check process, and they also provide assistance with interpreting and analyzing the results.

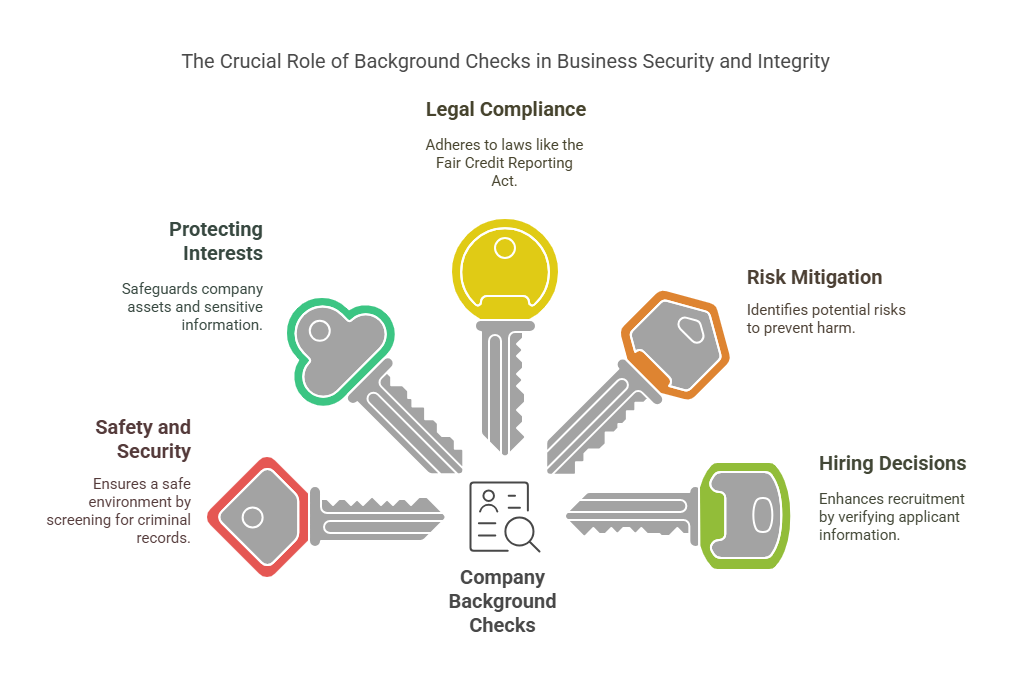

Why Are Company Background Checks Important?

Company background checks serve multiple purposes and are critical for businesses in several ways. Below are some of the key reasons why companies conduct these checks:

1. Ensuring Safety and Security

One of the most important reasons for conducting a background check is ensuring the safety and security of employees, customers, and the business as a whole. By screening candidates for criminal records, companies can identify potential threats and avoid hiring individuals with a history of violent crime, theft, or dishonesty.

2. Protecting Business Interests

A background check helps protect the company’s assets, especially when hiring individuals who will have access to sensitive information, financial data, or company property. For example, in industries like finance or healthcare, where confidentiality and trust are paramount, performing thorough background checks is essential to avoid data breaches or financial fraud.

3. Compliance with Legal Requirements

In certain industries, background checks are mandatory to comply with federal, state, or local laws. For example, the Fair Credit Reporting Act (FCRA) requires employers to obtain written consent from applicants before conducting background checks. Compliance with these regulations is critical to avoid legal consequences, such as lawsuits or fines.

4. Mitigating Risks

Background checks help companies mitigate risks by assessing whether an applicant poses any potential danger or liability. They can identify red flags like a history of substance abuse, criminal convictions, or financial mismanagement that could harm the company’s operations or reputation.

5. Improving Hiring Decisions

Lastly, background checks help companies make informed decisions about potential hires. By verifying the information provided by applicants and assessing their qualifications and background, employers can ensure they are selecting the most suitable candidates for the job. This is particularly important for high-stakes or sensitive positions.

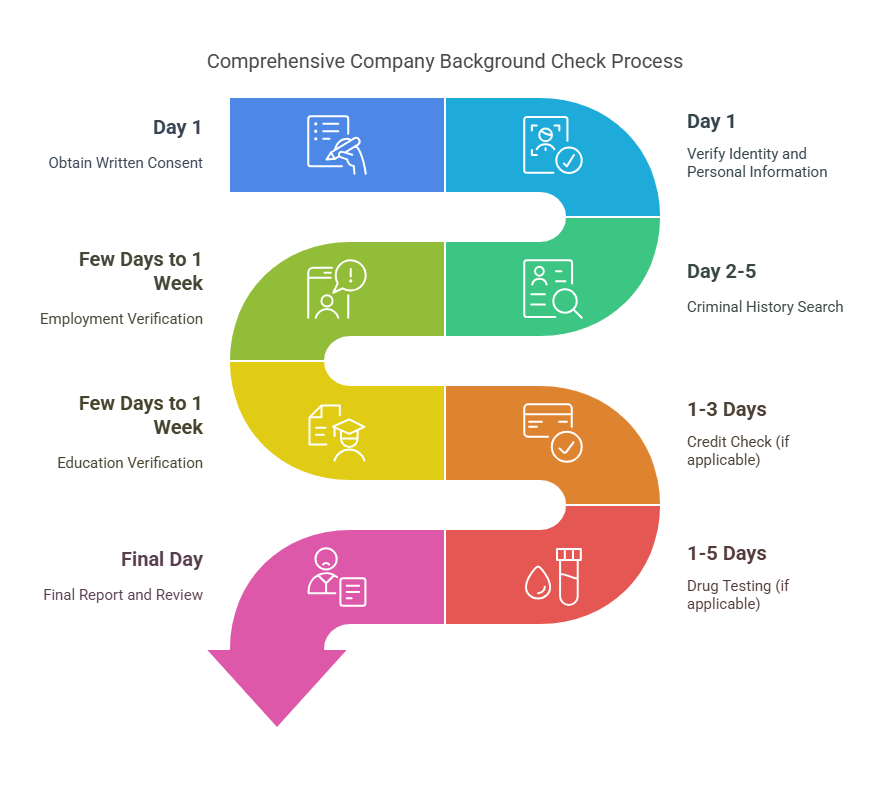

Estimated Timeline for Completing a Company Background Check

The length of time it takes to complete a company background check can vary depending on the type of checks being conducted, the accuracy of the information provided, and the provider being used.

- Criminal background checks typically take between 2 to 5 days, depending on the depth and location of the search.

- Employment and education verifications can take a few days to a week, depending on the speed of the institutions or previous employers involved.

- Credit checks often take only 1 to 3 days, as they rely on established databases.

- Drug testing results can take anywhere from 1 to 5 days, depending on the type of test and laboratory processing time.

In general, most background checks are completed within 1 to 2 weeks, but factors like location, the complexity of the report, and third-party service response times can extend this timeline.

Step-by-Step Process for Conducting a Company Background Check

When conducting a company background check, businesses generally follow a systematic process to ensure that all relevant aspects of an applicant’s background are properly screened. Here is a typical workflow for conducting a company background check:

1. Obtain Written Consent

The first step in conducting any background check is obtaining written consent from the applicant. According to the Fair Credit Reporting Act (FCRA), companies must notify the applicant that a background check will be conducted and obtain their consent before proceeding. Without this consent, the company cannot legally proceed with the check.

2. Verify Identity and Personal Information

Once consent is obtained, the next step is verifying the individual’s identity and personal information. This may involve verifying their name, address, social security number (SSN), date of birth, and other essential details. Accurate personal information is crucial to ensure the correct background check is conducted.

- Documents required for verification: Social security card, government-issued ID, utility bills, etc.

3. Criminal History Search

A criminal background check is one of the most important components of the process. The HR team or third-party provider will search local, state, and federal databases to determine if the applicant has any criminal convictions, arrests, or pending charges.

- Duration of the search: Criminal background checks typically take anywhere from 2 to 5 days, depending on the jurisdiction.

4. Employment Verification

Employment verification is another key part of the background check process. The company will reach out to previous employers listed by the candidate to confirm their job titles, employment dates, and job performance. This step is essential for verifying the applicant’s work history and ensuring that they have the qualifications they claim.

- Duration of the search: This process can take anywhere from a few days to a week depending on the response time of previous employers.

5. Education Verification

In addition to verifying employment, many companies also conduct education verification to ensure that the applicant holds the degrees and certifications they claim. The background check provider will contact educational institutions or use online databases to confirm the applicant’s academic records.

- Duration of the search: This can take a few days to a week, depending on the institution.

6. Credit Check (if applicable)

For positions that require handling financial responsibilities, companies often conduct a credit check. The credit check will evaluate the applicant’s credit history, including outstanding debts, credit score, bankruptcies, and any recent financial transactions that may indicate financial responsibility issues.

- Duration of the search: Credit checks generally take 1 to 3 days.

7. Drug Testing (if applicable)

For positions that require working with sensitive equipment or machinery, such as construction or transportation, a drug test may be part of the background check process. Applicants are asked to submit a sample (e.g., urine or hair follicle test) to detect the presence of drugs or alcohol in their system.

- Duration of the search: Results can take anywhere from 1 to 5 days, depending on the type of test and laboratory processing times.

8. Final Report and Review

Once all the checks have been completed, the background check provider compiles the information into a comprehensive report. The report will outline the results of each check and flag any discrepancies or red flags. The company’s HR team will review the report to make an informed decision on whether to move forward with the applicant.

Common Requirements for Conducting Background Checks

To conduct a company background check, certain requirements must be met to ensure that the process is legal, efficient, and compliant with industry regulations. Here are the key requirements:

1. Written Consent

As mentioned earlier, obtaining written consent from the applicant is essential. Without this consent, conducting a background check is prohibited under federal law.

2. Personal Information

Companies need to collect the applicant’s personal information, including their name, date of birth, address, Social Security number, and employment history. This information is required to accurately verify the candidate’s background.

3. Compliance with Local and State Laws

Different states have different laws governing the types of information that can be included in a background check. For example, some states may restrict the use of criminal history or credit reports when making hiring decisions. Employers must ensure they are compliant with these regulations.

4. Verification Documents

To ensure accuracy, companies may require applicants to submit various documents, such as:

- Government-issued ID (e.g., driver’s license or passport)

- Social Security card

- Utility bills or bank statements (to confirm address)

- Educational certificates

- Previous employer contact information

5. Specific Data for Industry-Specific Checks

Some industries require additional checks that are unique to the role. For example, healthcare positions may require drug screenings or licensure verification, while positions in transportation may require a driving record check.

Why Background Checks May Differ by Company, Role, or Location

While the general process for background checks is similar across industries, the specifics of what is included can vary depending on several factors:

1. Industry Regulations

Certain industries are subject to specific regulations that require additional checks. For example, healthcare organizations must verify medical licenses, while financial institutions often require credit checks for roles with access to financial data.

2. Company Policies

Companies may have specific policies regarding the types of background checks they conduct. Some companies may choose to conduct more comprehensive checks, while others may focus on only a few key areas (e.g., criminal and employment history).

3. Location and State Laws

Different states and localities have varying regulations that affect what information can be included in a background check. For example, some states may restrict employers from considering criminal records older than a certain number of years, while others may have more lenient regulations.

Exact Background Checks: Our Services

At Exact Background Checks, we provide comprehensive and reliable background screening services for companies across various industries. We understand the importance of conducting thorough and legally compliant background checks to ensure that businesses are making informed hiring decisions.

Our services include:

- Criminal Background Checks

- Employment Verification

- Education Verification

- Credit Reports

- Drug Testing

- Driving Record Checks

Why Choose Exact Background Checks?

- Accuracy: We pride ourselves on providing accurate and timely results, ensuring that your background checks are comprehensive and reliable.

- Compliance: Our services are fully compliant with federal and state regulations, including the Fair Credit Reporting Act (FCRA) and Equal Employment Opportunity Commission (EEOC) guidelines.

- Customization: We tailor our background check services to meet the specific needs of your business, ensuring that you receive the information that matters most to your hiring decisions.

- Fast Turnaround: We work quickly to provide you with the results you need to make informed decisions in a timely manner.

Summary Table: Key Factors for Selecting a Background Check Provider

| Factor | Description |

|---|---|

| Accuracy | Ensure the background check provider delivers reliable and error-free results. |

| Compliance | Choose a provider that complies with FCRA and EEOC guidelines. |

| Industry-Specific Knowledge | A provider with expertise in your industry ensures all relevant checks are included. |

| Turnaround Time | Fast processing times to meet your hiring deadlines. |

| Cost-Effectiveness | Compare pricing structures to ensure the service fits within your budget. |

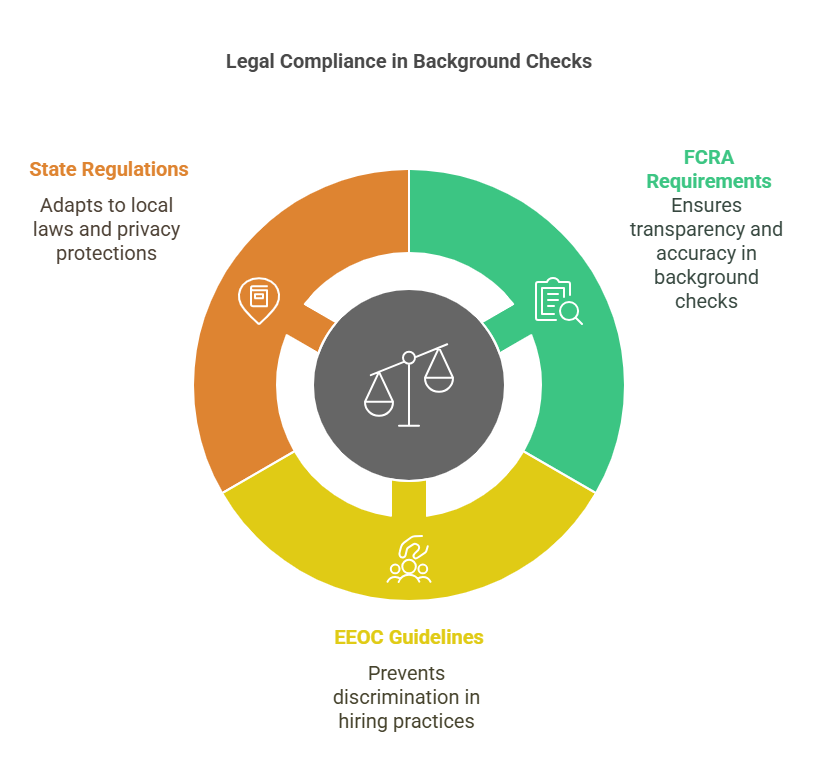

Legal Aspects of Company Background Checks

When conducting a company background check, it is crucial to adhere to various federal and state regulations to ensure that the process is fair, transparent, and non-discriminatory. Legal compliance protects businesses from potential legal risks and ensures that the rights of applicants are respected.

1. Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is one of the most significant federal laws that govern background checks. This law regulates how companies can collect, use, and share information from consumer reporting agencies (CRAs), including credit reports, criminal records, and employment history. Key provisions of the FCRA that companies must follow include:

- Disclosure and Consent: Before conducting a background check, companies must inform the applicant in writing and obtain their explicit consent. Failure to obtain consent may result in legal consequences.

- Adverse Action Notification: If a company decides not to hire an applicant based on the results of a background check, the FCRA requires the employer to provide an adverse action notice. This informs the applicant that the decision was made based on information from a consumer report and provides them with a copy of the report and the opportunity to dispute any inaccuracies.

- Accuracy of Information: Companies must ensure that the information used in the background check is accurate and up to date. If an applicant disputes the findings, the company must investigate and correct any errors.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC enforces federal laws prohibiting discrimination in the workplace. When conducting background checks, companies must ensure that they do not discriminate against applicants based on protected characteristics such as race, color, religion, gender, national origin, disability, or age.

- Consistency: Employers should apply background checks consistently across all applicants to avoid claims of discrimination.

- Consideration of Criminal Records: The EEOC has specific guidelines for considering criminal history during the hiring process. For example, employers should not automatically disqualify applicants with criminal records but should instead assess the nature of the offense, its relation to the job, and how long ago it occurred.

- Ban-the-Box Laws: Some states and municipalities have passed ban-the-box laws, which prohibit employers from asking about an applicant’s criminal history on initial job applications. These laws aim to give applicants a fair chance at employment before their criminal history is considered.

3. State-Specific Regulations

In addition to federal laws, companies must also comply with state-specific regulations governing background checks. Some states have stricter rules regarding:

- Criminal Record Considerations: Some states limit how far back an employer can look into an applicant’s criminal history or restrict the types of offenses that can be considered.

- Credit Reports: Several states prohibit employers from using credit reports in hiring decisions unless the position specifically requires access to financial information.

- Privacy Protections: Some states have enhanced privacy laws that limit the collection of personal data and the sharing of background check results.

It’s important for employers to stay up to date on these state-specific regulations to avoid legal pitfalls.

Frequently Asked Questions (FAQs) About Company Background Checks

Here are some frequently asked questions about company background checks and employment screening, along with detailed answers to help clarify common concerns:

What are the key components of a company background check?

- Company background checks typically include criminal history checks, employment verification, education verification, credit history checks (for relevant positions), drug testing, and driving record checks (for driving roles).

Why are company background checks important for businesses?

- They are crucial for ensuring safety and security, protecting business interests, complying with legal requirements, mitigating risks, and improving hiring decisions.

Who conducts company background checks, and what is the typical process?

- Background checks can be conducted by a company's internal HR department or, more commonly, by third-party background check providers. The process includes obtaining written consent, verifying identity, conducting various checks (criminal, employment, education, etc.), compiling a report, and reviewing the results.

What legal aspects govern company background checks?

- Background checks are governed by the Fair Credit Reporting Act (FCRA), which regulates the collection and use of consumer information; Equal Employment Opportunity Commission (EEOC) guidelines, which prevent discrimination; and state-specific regulations that vary by jurisdiction.

How long does a company background check typically take, and what factors affect the timeline?

- Most background checks are completed within 1 to 2 weeks. Factors affecting the timeline include the type of checks being conducted, the accuracy of the information provided, and the response time of institutions or previous employers. Criminal background checks typically take 2-5 days, employment and education verifications can take a few days to a week, credit checks 1-3 days, and drug testing 1-5 days.

What are the key components of a company background check?

- Company background checks typically include criminal history checks, employment verification, education verification, credit history checks (for relevant positions), drug testing, and driving record checks (for driving roles).

Why are company background checks important for businesses?

- They are crucial for ensuring safety and security, protecting business interests, complying with legal requirements, mitigating risks, and improving hiring decisions.

Who conducts company background checks, and what is the typical process?

- Background checks can be conducted by a company's internal HR department or, more commonly, by third-party background check providers. The process includes obtaining written consent, verifying identity, conducting various checks (criminal, employment, education, etc.), compiling a report, and reviewing the results.

What legal aspects govern company background checks?

- Background checks are governed by the Fair Credit Reporting Act (FCRA), which regulates the collection and use of consumer information; Equal Employment Opportunity Commission (EEOC) guidelines, which prevent discrimination; and state-specific regulations that vary by jurisdiction.

How long does a company background check typically take, and what factors affect the timeline?

- Most background checks are completed within 1 to 2 weeks. Factors affecting the timeline include the type of checks being conducted, the accuracy of the information provided, and the response time of institutions or previous employers. Criminal background checks typically take 2-5 days, employment and education verifications can take a few days to a week, credit checks 1-3 days, and drug testing 1-5 days.

Conclusion

Company background checks are a crucial part of the hiring process. By ensuring that background checks are conducted thoroughly and in compliance with relevant laws and regulations, businesses can make informed hiring decisions while maintaining a fair and non-discriminatory approach.

Key Takeaways:

- Background checks help businesses ensure the safety and security of their workforce by verifying criminal history, employment credentials, and other relevant data.

- Employers must obtain written consent from applicants and comply with federal regulations such as the FCRA and EEOC guidelines to ensure fairness and legal compliance.

- State-specific laws, industry regulations, and the type of job role also impact how background checks are conducted and what information can be included.

- Working with a reliable and compliant background check provider like Exact Background Checks ensures that your company conducts thorough, accurate, and legally sound screening processes.

By adhering to proper procedures and staying informed about legal requirements, employers can avoid costly mistakes and maintain a trustworthy, secure workforce.