Steps to Compile a Comprehensive Background Report

Introduction and Overview

A background report is a comprehensive document that provides detailed insights into an individual’s personal, professional, and sometimes financial history. It is a vital tool used across various industries to assess the credibility, reliability, and trustworthiness of an individual. Whether you’re an employer hiring a new candidate, a landlord screening a prospective tenant, or a lender evaluating a loan application, background reports play a critical role in decision-making.

What is a Background Report?

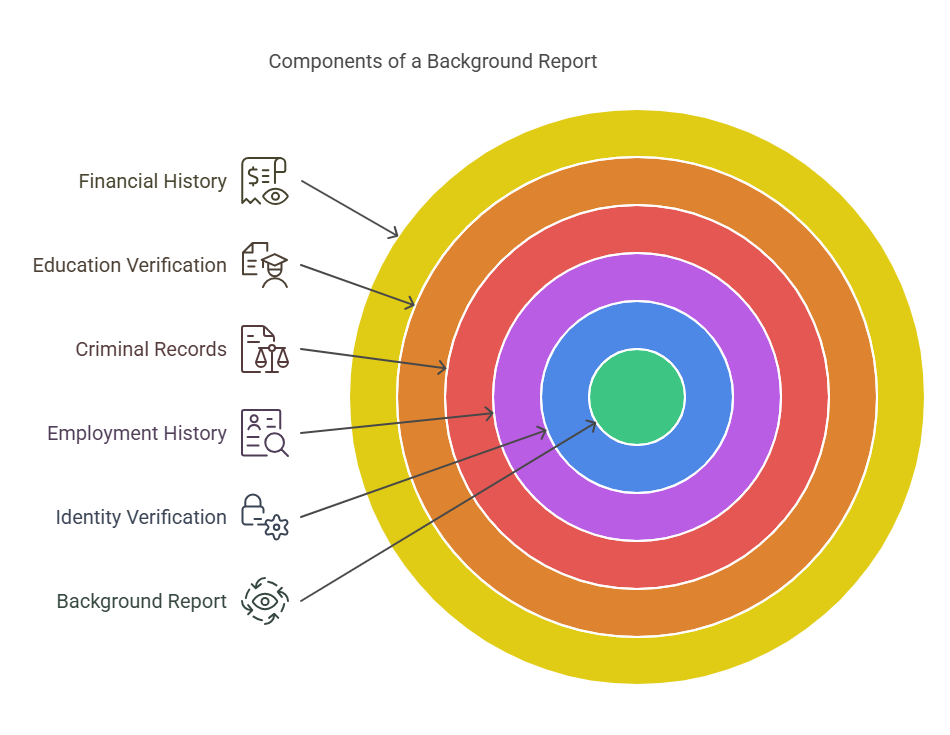

At its core, a background report is a compilation of data that highlights various aspects of an individual’s life. This information is gathered from public records, official databases, and sometimes private investigations, depending on the depth of the report. It typically includes the following components:

- Employment History: Verifies previous job titles, roles, and tenures to confirm the accuracy of the candidate’s resume.

- Criminal Records: Checks for any history of legal infractions, including misdemeanors, felonies, or pending cases.

- Education Verification: Confirms degrees, certifications, and academic achievements claimed by an individual.

- Financial History: Includes credit reports, bankruptcies, or liens, often necessary for roles involving financial responsibilities or tenancy approvals.

- Identity Verification: Ensures the individual’s Social Security number or other identification documents are valid and not tied to fraudulent activity.

Why Are Background Reports Important?

Background reports provide a foundation for informed decision-making. In today’s world, where trust and transparency are paramount, these reports serve as a layer of protection for businesses, property owners, and individuals. Here’s why they are essential:

- Risk Mitigation: Identifying potential red flags early can prevent financial loss, reputational damage, or legal liabilities.

- Trust Building: A thorough vetting process reassures stakeholders about the reliability and honesty of the person involved.

- Compliance Assurance: Many industries, especially healthcare, education, and finance, are legally obligated to conduct background checks to ensure compliance with regulatory standards.

How Background Reports Are Used Across Industries

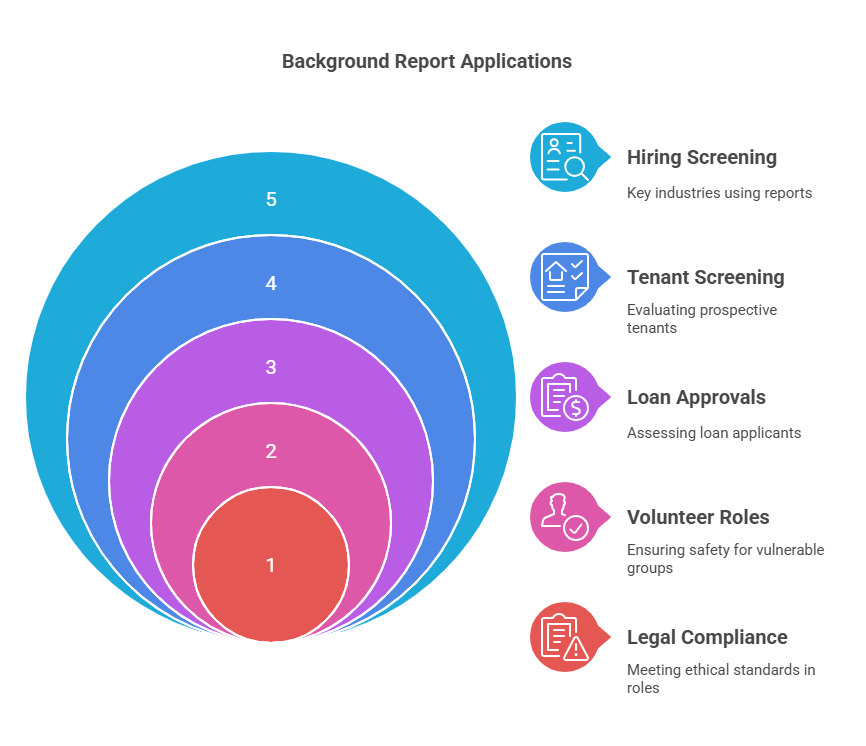

Background reports are tailored to the specific needs of various industries. Here’s a closer look at their applications:

- Hiring and Employment Screening

Employers use background reports to validate the credentials of potential hires, assess their character, and ensure they align with the company’s values. Background checks are particularly crucial for positions involving sensitive data, financial responsibilities, or customer interaction. - Tenant Screening

For landlords and property managers, a tenant background report helps determine the reliability of prospective tenants. Key aspects like rental history, creditworthiness, and any eviction records are evaluated to avoid issues like missed rent payments or property damage. - Loan and Financial Approvals

Lenders assess financial background reports to gauge an applicant’s ability to repay loans. Credit history, outstanding debts, and income verification are essential components of these reports. - Volunteer and Nonprofit Roles

Nonprofit organizations often require background reports to ensure that volunteers or staff members pose no risk to vulnerable populations, such as children or the elderly. - Legal and Regulatory Compliance

Some roles, especially those in healthcare or law enforcement, mandate background checks to ensure individuals meet the strict ethical and professional standards required by law.

The Growing Demand for Background Reports

The increasing emphasis on accountability and safety in professional and personal transactions has fueled the demand for background checks. With the rise of remote work, global hiring, and online interactions, background reports have become more accessible and thorough than ever before.

Types of Background Reports

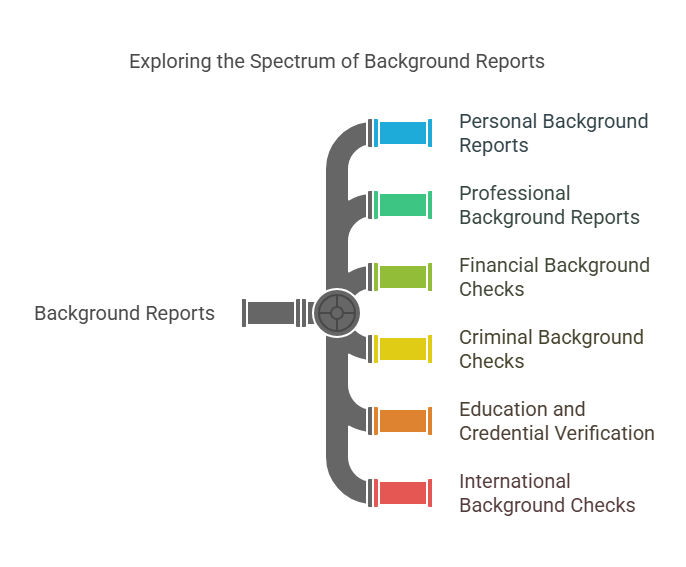

Background reports come in various forms, each tailored to meet specific needs. Below are the most common types:

- Personal Background Reports

These reports are typically generated by individuals for self-assessment. They can help identify errors in public records or ensure data accuracy before applying for a job or renting a property. - Professional Background Reports

Employers use professional reports to evaluate candidates during the hiring process. These include employment history verification, criminal record checks, and reference validation. - Financial Background Checks

Focused on an individual’s financial history, these reports are used for tenant screening, loan approvals, and financial-sector hiring. They include credit scores, bankruptcies, liens, and payment histories. - Criminal Background Checks

These reports identify an individual’s criminal history, including past arrests, convictions, and pending charges. Employers, landlords, and organizations working with vulnerable populations often rely on these checks. - Education and Credential Verification

These checks confirm the validity of academic qualifications and certifications claimed by an individual. They are commonly used in industries requiring specialized training, such as healthcare and engineering. - International Background Checks

For global organizations hiring candidates from different countries, international background checks ensure compliance with local regulations and validate the individual’s history abroad.

Benefits of Background Reports

Background reports provide numerous advantages, ensuring safety, compliance, and trust in various scenarios. Below are the key benefits for different stakeholders:

For Employers

- Improved Hiring Decisions: Validate candidates’ qualifications and ensure they align with company needs.

- Reduced Turnover Rates: Avoid costly mistakes by hiring the right person for the job.

- Workplace Safety: Prevent potential risks by identifying criminal or unethical behavior.

For Landlords

- Reliable Tenants: Screen tenants to ensure timely rent payments and property upkeep.

- Minimized Legal Risks: Avoid disputes and legal complications by renting to trustworthy individuals.

For Individuals

- Enhanced Credibility: Demonstrate integrity by proactively sharing accurate personal information.

- Error Correction: Identify and resolve inaccuracies in public records that could impact future opportunities.

For Financial Institutions

- Informed Lending Decisions: Assess the creditworthiness of loan applicants to minimize default risks.

- Compliance with Regulations: Ensure adherence to legal standards in financial operations.

Our Background Check Services

At Exact Background Checks, we specialize in delivering reliable, comprehensive, and fast background reports tailored to your specific needs. Whether you’re an employer, landlord, or individual, our services are designed to provide you with accurate and actionable insights.

Here’s what sets us apart:

- Customizable Solutions

We offer various background check packages, from basic screenings to in-depth reports, ensuring you only pay for what you need. - Fast Turnaround Times

Our advanced technology ensures you receive reports quickly, without compromising on accuracy. - Compliance with Legal Standards

We adhere to FCRA (Fair Credit Reporting Act) guidelines and other legal requirements, so you can trust that our processes are ethical and lawful. - Comprehensive Coverage

Our reports include employment verification, criminal record checks, financial history, education validation, and more.

Key Features of Our Background Reports

Below is a table summarizing the features and benefits of our background report services:

| Feature | Details |

|---|---|

| Employment History | Verifies previous roles, durations, and employers. |

| Criminal Records | Includes local, state, and federal databases for accurate checks. |

| Financial Background | Provides credit scores, bankruptcy filings, and debt details. |

| Education Verification | Confirms degrees, certifications, and academic achievements. |

| Fast Turnaround | Reports delivered in as little as 24-48 hours. |

| Customizable Packages | Tailored solutions for employers, landlords, and individuals. |

| Compliance Assurance | Adherence to FCRA, EEOC, and other data privacy laws. |

| Global Reach | International background checks for global candidates and businesses. |

At Exact Background Checks, our mission is to simplify the screening process while ensuring maximum reliability. Whether you’re hiring for a sensitive role, screening a tenant, or verifying your own records, we provide the insights you need to make confident decisions.

Legal Aspects of Background Reports

Conducting background checks is not just about gathering data; it’s about doing so legally and ethically. Understanding and adhering to the laws that govern background reports is essential to avoid legal repercussions. Below are the key legal frameworks to consider when conducting or requesting background reports:

1. Fair Credit Reporting Act (FCRA)

The FCRA is a federal law in the United States that governs how background checks are conducted. It ensures fairness, accuracy, and privacy when handling consumer information. Key provisions include:

- Consent Requirement: Employers or landlords must obtain written consent from the individual before running a background check.

- Notification of Adverse Action: If a decision (e.g., not hiring or renting) is based on the report, the individual must be informed and provided a copy of the report along with their rights.

- Dispute Resolution: Individuals have the right to dispute inaccuracies in their background report.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC provides regulations to prevent discriminatory practices during employment screening. Employers must ensure that background checks are conducted fairly, without disproportionately affecting individuals based on race, gender, age, or other protected characteristics.

3. Data Privacy Laws

Various state and international laws, such as the California Consumer Privacy Act (CCPA) or the General Data Protection Regulation (GDPR) for European candidates, emphasize the secure handling of personal data. These laws require transparency, restricted use, and protection of sensitive information in background reports.

4. State-Specific Regulations

Some U.S. states have additional laws governing the use of criminal records, credit checks, and drug testing in background reports. Employers and landlords must ensure compliance with these regional requirements.

5. Industry-Specific Compliance

Certain industries, such as healthcare, education, and finance, may have additional regulations for background checks. For example, healthcare employers must adhere to HIPAA standards, while financial institutions must comply with FINRA rules.

Frequently Asked Questions (FAQs)

What are the main components typically included in a background report?

A background report typically includes:

- Employment History: Verifies previous job titles and tenures.

- Criminal Records: Checks for legal infractions.

- Education Verification: Confirms degrees and certifications.

- Financial History: Includes credit reports and bankruptcies.

- Identity Verification: Ensures valid identification.

Why are background reports important for employers, landlords, and financial institutions?

- Employers: Mitigate risks, build trust, and ensure compliance.

- Landlords: Screen reliable tenants to avoid missed payments or property damage.

- Financial Institutions: Assess creditworthiness and ensure regulatory compliance.

What are the different types of background reports available?

Types include:

- Personal Background Reports: For self-assessment.

- Professional Background Reports: For employment screening.

- Financial Background Checks: For loan approvals and tenant screening.

- Criminal Background Checks: For identifying criminal history.

- Education and Credential Verification: For confirming qualifications.

- International Background Checks: For global candidates.

What legal aspects must be considered when conducting background checks?

Legal aspects include:

- Compliance with the Fair Credit Reporting Act (FCRA).

- Adherence to Equal Employment Opportunity Commission (EEOC) guidelines.

- Compliance with data privacy laws (e.g., CCPA, GDPR).

- Adherence to state-specific regulations.

- Compliance with industry-specific regulations (e.g., HIPAA, FINRA).

What are the key benefits of using a professional background check service like Exact Background Checks?

Benefits include:

- Customizable solutions tailored to specific needs.

- Fast turnaround times for quick decision-making.

- Assurance of compliance with legal standards.

- Comprehensive coverage of various background checks.

- Access to reliable and accurate information.

What are the main components typically included in a background report?

A background report typically includes:

- Employment History: Verifies previous job titles and tenures.

- Criminal Records: Checks for legal infractions.

- Education Verification: Confirms degrees and certifications.

- Financial History: Includes credit reports and bankruptcies.

- Identity Verification: Ensures valid identification.

Why are background reports important for employers, landlords, and financial institutions?

- Employers: Mitigate risks, build trust, and ensure compliance.

- Landlords: Screen reliable tenants to avoid missed payments or property damage.

- Financial Institutions: Assess creditworthiness and ensure regulatory compliance.

What are the different types of background reports available?

Types include:

- Personal Background Reports: For self-assessment.

- Professional Background Reports: For employment screening.

- Financial Background Checks: For loan approvals and tenant screening.

- Criminal Background Checks: For identifying criminal history.

- Education and Credential Verification: For confirming qualifications.

- International Background Checks: For global candidates.

What legal aspects must be considered when conducting background checks?

Legal aspects include:

- Compliance with the Fair Credit Reporting Act (FCRA).

- Adherence to Equal Employment Opportunity Commission (EEOC) guidelines.

- Compliance with data privacy laws (e.g., CCPA, GDPR).

- Adherence to state-specific regulations.

- Compliance with industry-specific regulations (e.g., HIPAA, FINRA).

What are the key benefits of using a professional background check service like Exact Background Checks?

Benefits include:

- Customizable solutions tailored to specific needs.

- Fast turnaround times for quick decision-making.

- Assurance of compliance with legal standards.

- Comprehensive coverage of various background checks.

- Access to reliable and accurate information.

Conclusion

Background reports are invaluable tools in today’s fast-paced and interconnected world. Whether you’re an employer ensuring you hire trustworthy talent, a landlord selecting a reliable tenant, or an individual verifying your personal data, these reports provide crucial insights that guide better decision-making.

From verifying employment history and education to uncovering criminal or financial records, background reports mitigate risks and build trust in professional and personal interactions. However, conducting background checks requires careful attention to legal frameworks like the FCRA, EEOC guidelines, and privacy laws to ensure compliance and fairness.

At Exact Background Checks, we are committed to delivering accurate, reliable, and legally compliant background reports tailored to your specific needs. Our services cater to employers, landlords, and individuals, offering a seamless and fast screening process. With customizable solutions, fast turnaround times, and compliance at the forefront, we empower you to make informed decisions with confidence.

Proper screening practices are not just a necessity—they are a safeguard for trust, safety, and success. Start your journey with a trusted background check provider today and experience the difference that precision and professionalism can make.