Essential Facts About Nationwide Background Checks

What Is a Nationwide Background Check?

A nationwide background check is a comprehensive investigation of an individual’s criminal history, employment history, education, credit history, and other relevant records across the United States. Unlike state or local background checks, which are confined to a specific geographical area, a nationwide background check pulls information from federal, state, and local databases across the entire country. This type of background check provides a broader and more complete view of an individual’s history, making it particularly useful for employers, landlords, and other entities that need a full understanding of a person’s background.

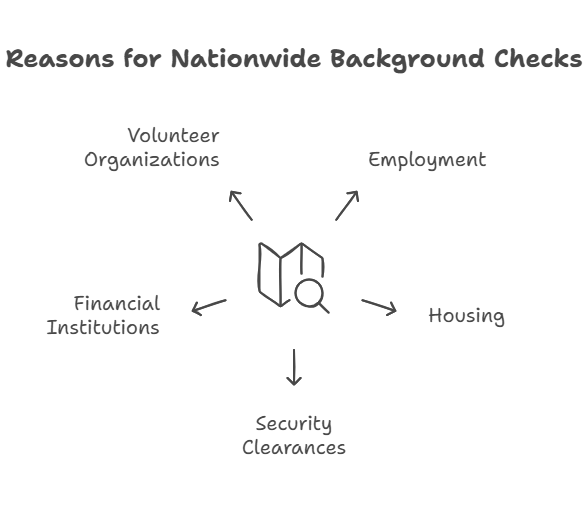

Why Do Employers, Landlords, and Other Entities Opt for Nationwide Background Checks?

Nationwide background checks are an essential tool for many industries that rely on trust, security, and compliance. The reasons for conducting a nationwide background check include:

- Employment: Employers want to ensure they are hiring responsible and trustworthy individuals, especially for positions involving security, sensitive information, or high responsibility.

- Housing: Landlords and property management companies use nationwide background checks to verify a potential tenant’s rental history, criminal background, and financial reliability.

- Security Clearances: Government agencies and contractors require background checks for individuals who are applying for security clearances to access sensitive information or work in high-security environments.

- Financial Institutions: Banks and lenders may use nationwide checks to evaluate an individual’s creditworthiness and financial history before approving loans, credit, or other financial products.

- Volunteer Organizations: Organizations that involve vulnerable populations (such as children or elderly individuals) may conduct these checks to ensure safety and protect against potential abuse or exploitation.

In all these situations, a nationwide background check helps decision-makers assess risk and make informed choices.

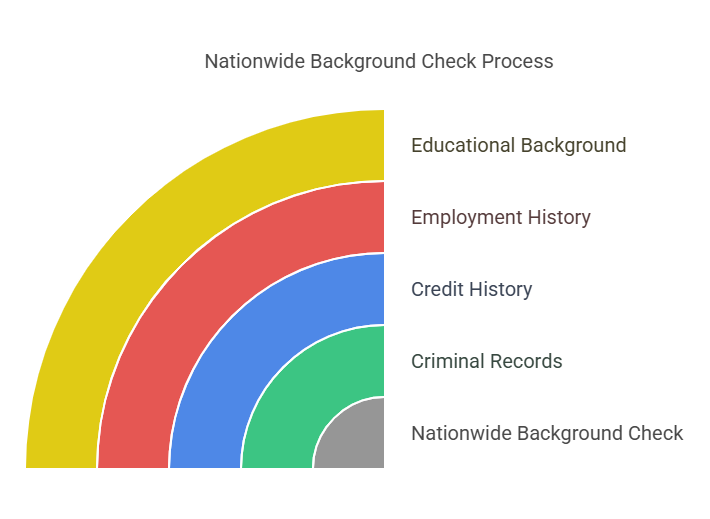

How a Nationwide Background Check Works

The process of conducting a nationwide background check involves gathering information from various sources, including:

- Criminal Records: This includes federal, state, and local criminal records. Federal databases typically contain information on crimes that violate federal laws, while state and local databases hold records on crimes that are under state or local jurisdiction.

- Credit History: This provides a report on an individual’s financial behavior, including credit scores, loan history, bankruptcies, and more.

- Employment History: Employers may verify an individual’s job history, including positions held, dates of employment, and reasons for leaving previous jobs.

- Educational Background: This includes verification of degrees, diplomas, certifications, and other academic credentials claimed by the applicant.

- Drug Testing History: Some employers may also access an individual’s drug test results, particularly in industries that require drug-free workplaces.

- Civil Records: Civil records may include lawsuits, judgments, and other non-criminal legal matters that could impact the individual’s financial standing or reputation.

Benefits and Challenges of Nationwide Background Checks

Benefits

- Comprehensive Coverage: A nationwide background check offers a broader view of an individual’s history, reducing the chances of overlooking critical information.

- Consistency: Nationwide checks ensure a consistent approach to evaluating individuals, making it easier for organizations with multiple locations to maintain uniformity in their hiring practices.

- Risk Mitigation: It helps organizations assess the risk associated with hiring, renting, or working with an individual, providing peace of mind.

Challenges

- Cost: Nationwide background checks can be more expensive than local or state-specific checks due to the need to access a wider range of databases and information.

- Time: These checks can take longer to complete due to the broader scope of information being collected.

- Accuracy: While background check services work to ensure accurate and up-to-date information, errors or discrepancies may arise, especially when dealing with data from multiple sources.

Who Uses Nationwide Background Checks and Why?

Nationwide background checks are utilized by a wide range of organizations:

- Employers: Particularly those in industries such as healthcare, finance, transportation, and security, where employee integrity and safety are critical.

- Landlords and Property Managers: To screen potential tenants for financial reliability and criminal history.

- Government Agencies: For individuals seeking security clearances or employment with the government.

- Volunteer Organizations: Especially those working with vulnerable populations, such as children, elderly individuals, and individuals with disabilities.

- Insurance Companies: To assess risk when providing coverage, especially in industries such as healthcare or transportation.

Types of Data Uncovered by Nationwide Background Checks

Nationwide background checks can reveal a variety of information about an individual, depending on the type of check being conducted. Here’s a breakdown of the key categories of data these checks typically uncover:

1. Criminal Records

A nationwide background check can uncover an individual’s criminal history from multiple jurisdictions across the United States. This can include:

- Felony and Misdemeanor Convictions: Information on any convictions for serious (felonies) or minor (misdemeanors) offenses.

- Arrests and Warrants: Even if a person has not been convicted, a background check may reveal previous arrests or outstanding warrants.

- Federal vs. State Crimes: Some crimes fall under federal jurisdiction (e.g., drug trafficking or federal fraud), while others fall under state or local jurisdictions.

2. Employment Verification

This section verifies the individual’s job history. Employers may check:

- Job Titles: Verification of positions held.

- Dates of Employment: Confirmation of the start and end dates of past employment.

- Reason for Leaving: Whether the individual left voluntarily or was terminated.

3. Education Verification

A nationwide background check may include verification of the applicant’s education, including:

- Degrees and Certifications: Confirmation of the degrees earned from educational institutions.

- Dates of Attendance: Verification of the individual’s academic history.

4. Credit History

A credit report can provide information about the individual’s financial responsibility, including:

- Credit Score: A numerical representation of the individual’s creditworthiness.

- Outstanding Debts: Information on any loans, credit card balances, or outstanding financial obligations.

- Bankruptcies: Any history of bankruptcy filings.

- Foreclosures or Judgments: Financial judgments or legal issues affecting an individual’s finances.

5. Drug Testing History

For industries where drug testing is common, such as transportation, healthcare, or government, a nationwide background check might include:

- Drug Test Results: Previous positive or negative drug test results.

- Substance Abuse Records: Whether the individual has participated in rehabilitation or counseling.

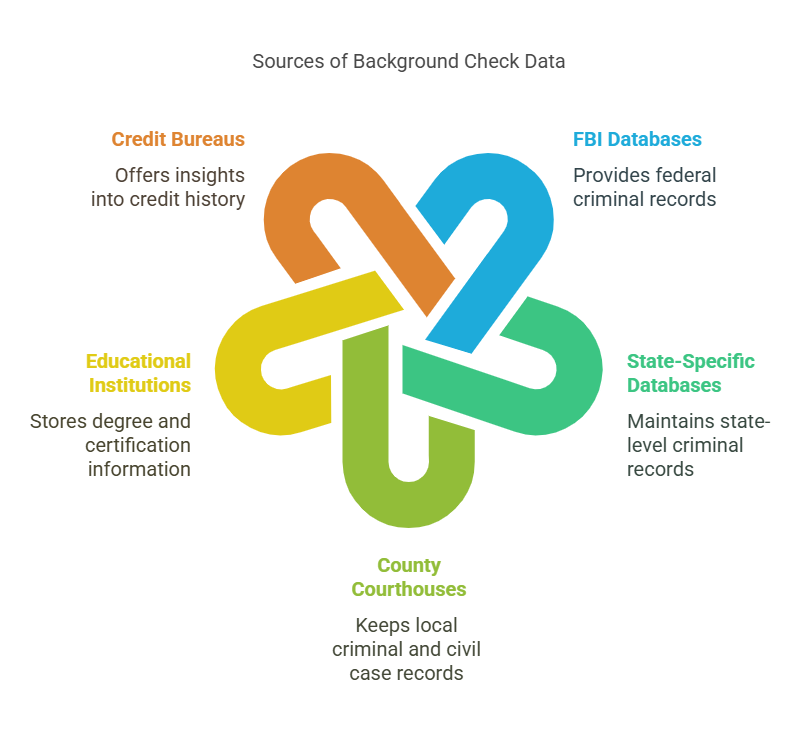

How Information Is Collected

Background check companies collect this information from various federal, state, and local databases, which include:

- FBI Databases: For federal criminal records.

- State-Specific Databases: Each state maintains its own criminal database.

- County Courthouses: Local courthouses keep records of county-specific criminal cases and civil matters.

- Educational Institutions: Colleges and universities store information about degrees and certifications earned.

- Credit Bureaus: Major credit bureaus (Equifax, Experian, and TransUnion) provide information on an individual’s credit history.

Factors That Can Cause Delays

Several factors can cause delays in completing a nationwide background check:

- Inaccurate or Incomplete Data: Discrepancies in the individual’s information (e.g., a common name or incorrect date of birth) can slow the verification process.

- State or County Delays: Some jurisdictions may have slower response times or administrative backlogs.

- Complex Cases: Cases involving sealed records, expungements, or criminal cases that are complicated may take longer to process.

Comparison of Coverage: Nationwide vs. State and County Checks

Here is a table summarizing the key differences between nationwide background checks and more localized checks:

| Type of Check | Scope of Coverage | Key Information Included | Limitations |

|---|---|---|---|

| Nationwide Background Check | National (Federal, State, Local) | Criminal records, credit history, employment, education | May miss certain local records |

| State Background Check | State-wide | State-specific criminal records, some civil records | May miss federal or out-of-state records |

| County Background Check | Local (County-specific) | Local criminal records, county court cases | Misses state and federal information |

Exact Background Checks: Ensuring Accurate and Timely Results

At Exact Background Checks, we offer comprehensive nationwide background check services that provide reliable, accurate, and timely results. By utilizing multiple data sources, including federal, state, and local records, we help employers, landlords, and other organizations make informed decisions based on thorough background investigations. Our services are compliant with legal regulations, ensuring that the screening process is both effective and legally sound.

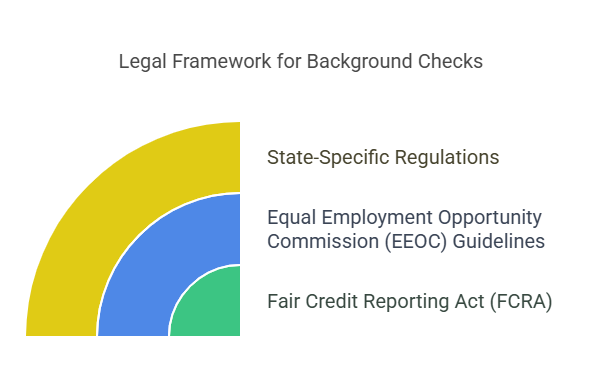

Legal Aspects of Nationwide Background Checks

Several laws govern the use of background checks, including nationwide checks, and understanding these regulations is crucial for both employers and applicants.

1. The Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act (FCRA) is a federal law that regulates the use of background checks in hiring, renting, and other decision-making processes. Key requirements include:

- Consent: Employers must obtain written consent from the individual before conducting a background check.

- Disclosure: If a decision (such as a job offer) is made based on the results of a background check, the individual must be notified and given a chance to dispute any errors.

- Accuracy: Background check companies must ensure that the information they provide is accurate and up-to-date.

2. Equal Employment Opportunity Commission (EEOC) Guidelines

The EEOC provides guidelines to ensure that employers do not discriminate against candidates with criminal records. Employers must evaluate criminal records on a case-by-case basis, considering factors like the nature of the crime, the time that has passed, and whether the offense is relevant to the job in question.

3. State-Specific Regulations

Laws governing background checks can vary by state. Some states have “ban-the-box” laws, which prevent employers from asking about criminal history until later in the hiring process. Others may allow individuals to expunge or seal certain criminal records, which can affect what is visible during a background check.

FAQs

What information does a nationwide background check typically include?

A nationwide background check typically includes:

- Criminal Records: Federal, state, and local records.

- Credit History: Credit scores, loan history, and bankruptcies.

- Employment History: Verification of past jobs and positions.

- Educational Background: Verification of degrees and certifications.

- Drug Testing History: Previous drug test results.

- Civil Records: Lawsuits, judgments, and legal matters.

Why do employers and landlords use nationwide background checks?

- Employers: To ensure responsible and trustworthy hires, particularly in sensitive roles.

- Landlords: To verify potential tenants' rental history, criminal background, and financial reliability.

- Other entities, like Financial institutions, and Volunteer organizations use it for their own risk management purposes.

What are some benefits and challenges of conducting a nationwide background check compared to state or local checks?

- Benefits: Comprehensive coverage, consistency, and risk mitigation.

- Challenges: Higher cost, longer completion time, and potential for data inaccuracies from multiple sources.

What key legal regulations govern nationwide background checks?

Key regulations include:

- The Fair Credit Reporting Act (FCRA): Regulates the use of background checks and ensures accuracy.

- Equal Employment Opportunity Commission (EEOC) Guidelines: Prevents discrimination based on criminal records.

- State-Specific Regulations: Varying state laws, including "ban-the-box" laws and expungement rules.

How does a nationwide background check differ from state and county background checks?

- Nationwide: Covers federal, state, and local records across the entire country.

- State: Covers records within a specific state.

- County: Covers records within a specific county.

This means that a nationwide search is the most comprehensive, whereas the state or county searches are more localized.

What information does a nationwide background check typically include?

A nationwide background check typically includes:

- Criminal Records: Federal, state, and local records.

- Credit History: Credit scores, loan history, and bankruptcies.

- Employment History: Verification of past jobs and positions.

- Educational Background: Verification of degrees and certifications.

- Drug Testing History: Previous drug test results.

- Civil Records: Lawsuits, judgments, and legal matters.

Why do employers and landlords use nationwide background checks?

- Employers: To ensure responsible and trustworthy hires, particularly in sensitive roles.

- Landlords: To verify potential tenants' rental history, criminal background, and financial reliability.

- Other entities, like Financial institutions, and Volunteer organizations use it for their own risk management purposes.

What are some benefits and challenges of conducting a nationwide background check compared to state or local checks?

- Benefits: Comprehensive coverage, consistency, and risk mitigation.

- Challenges: Higher cost, longer completion time, and potential for data inaccuracies from multiple sources.

What key legal regulations govern nationwide background checks?

Key regulations include:

- The Fair Credit Reporting Act (FCRA): Regulates the use of background checks and ensures accuracy.

- Equal Employment Opportunity Commission (EEOC) Guidelines: Prevents discrimination based on criminal records.

- State-Specific Regulations: Varying state laws, including "ban-the-box" laws and expungement rules.

How does a nationwide background check differ from state and county background checks?

- Nationwide: Covers federal, state, and local records across the entire country.

- State: Covers records within a specific state.

- County: Covers records within a specific county.

This means that a nationwide search is the most comprehensive, whereas the state or county searches are more localized.

Conclusion

Nationwide background checks are critical tools for employers, landlords, and other organizations looking to make informed decisions. They provide a comprehensive view of an individual’s criminal history, employment background, financial behavior, and more. Understanding how these checks work, the legal framework surrounding them, and how to ensure compliance with regulations is vital for both organizations and applicants.

For reliable, accurate, and timely background checks, Exact Background Checks is the partner you can trust. Our nationwide background check services ensure compliance, accuracy, and thoroughness, giving you the peace of mind needed for critical decision-making.