A Guide to Small Business Background Check Procedures

The Importance and Overview of Small Business Background Checks

For small businesses, every hiring decision is vital. Unlike large corporations with thousands of employees, small businesses often operate with lean teams where every individual significantly impacts operations. A single bad hire can result in financial losses, reputational damage, reduced productivity, and even legal troubles. This makes the hiring process one of the most crucial aspects of running a successful small business.

One of the most effective tools to safeguard your business from these risks is conducting background checks. Background checks not only provide a detailed history of potential employees but also help ensure you’re making informed decisions. They are a proactive way to mitigate risks and create a safe, efficient, and productive workplace.

In this section, we will explore the significance of background checks for small businesses, the risks of bypassing this step, the benefits of implementing them, and what a standard background check entails.

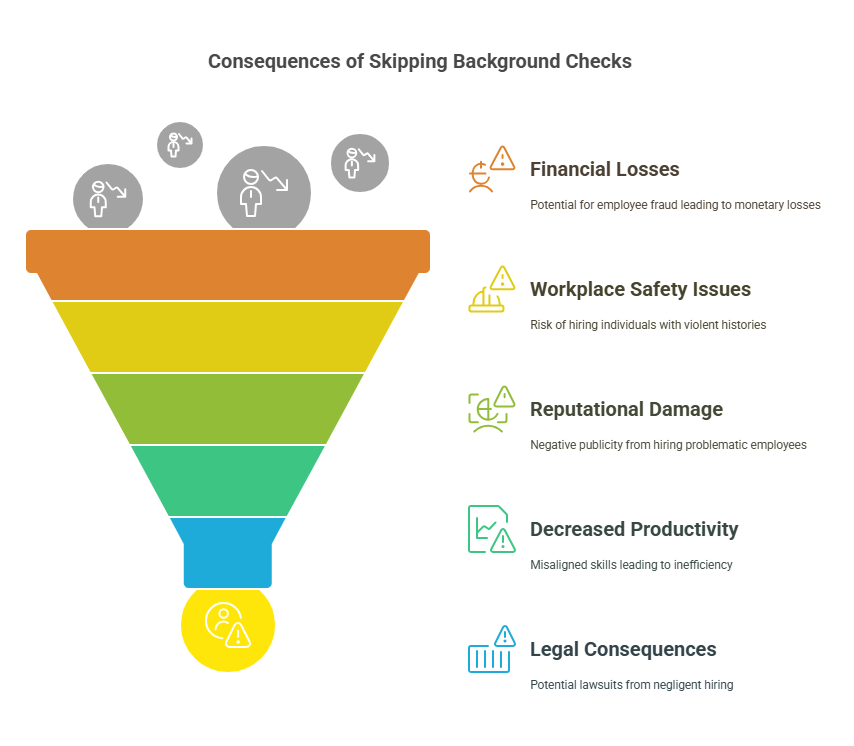

The Risks of Skipping Background Checks

Many small business owners, especially those new to hiring, may overlook background checks, often due to a lack of time, resources, or understanding of their importance. However, skipping this critical step can lead to significant consequences, including:

- Financial Losses

Hiring someone with a history of theft, fraud, or embezzlement can result in monetary losses for your business. According to a study by the Association of Certified Fraud Examiners, small businesses lose an average of 5% of their annual revenue to employee fraud. - Workplace Safety Issues

Without a proper background check, there’s no way to identify if a candidate has a history of violent behavior, which could endanger your employees and customers. An unsafe work environment can lead to higher turnover rates, legal liability, and damaged morale. - Reputational Damage

Imagine hiring an employee who later becomes involved in a public scandal due to their past behavior. The negative publicity can tarnish your brand’s image, making it harder to attract customers and high-quality talent in the future. - Decreased Productivity

Candidates who misrepresent their skills or qualifications on their resumes may struggle to meet job expectations, leading to decreased efficiency and additional training costs. - Legal Consequences

In some cases, negligent hiring lawsuits can arise if an employer fails to conduct due diligence and an employee causes harm. Background checks demonstrate that you’ve taken reasonable steps to ensure the safety and integrity of your workforce.

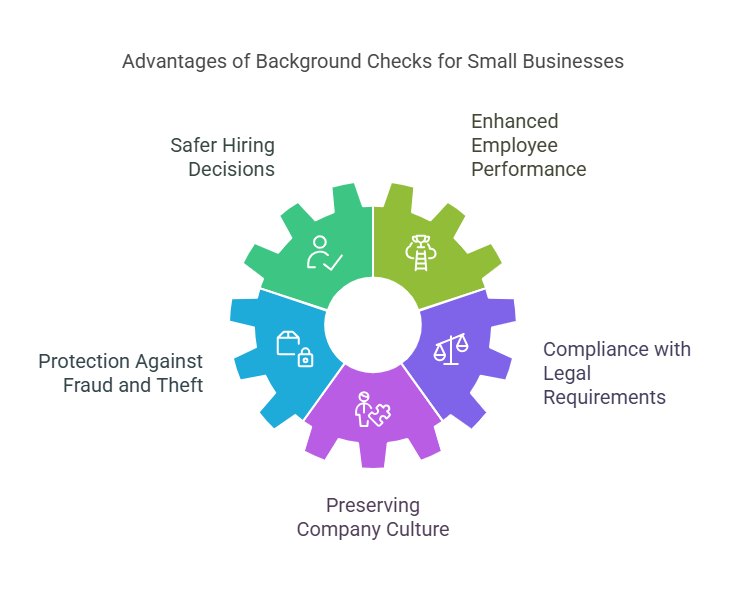

The Benefits of Background Checks for Small Businesses

- Safer Hiring Decisions

Background checks help you identify potential red flags in a candidate’s history, such as a criminal record, financial irresponsibility, or discrepancies in their resume. This allows you to make better-informed decisions and avoid hiring individuals who may pose a risk to your business. - Enhanced Employee Performance

When you verify a candidate’s credentials, you’re ensuring they possess the skills, education, and experience required for the role. This leads to higher performance levels and reduced turnover, saving your business time and money in the long run. - Protection Against Fraud and Theft

Financial misconduct can cripple small businesses. Background checks can reveal issues such as a history of embezzlement, fraud, or other financial crimes, helping you avoid risky hires. - Compliance with Legal Requirements

In some industries, such as healthcare, education, and finance, background checks are legally mandated. Conducting them ensures you remain compliant with industry regulations and avoid costly penalties. - Preserving Company Culture

Hiring employees whose values align with your company culture is essential for maintaining a cohesive work environment. Background checks can provide insights into a candidate’s character, helping you select individuals who fit your business’s ethos.

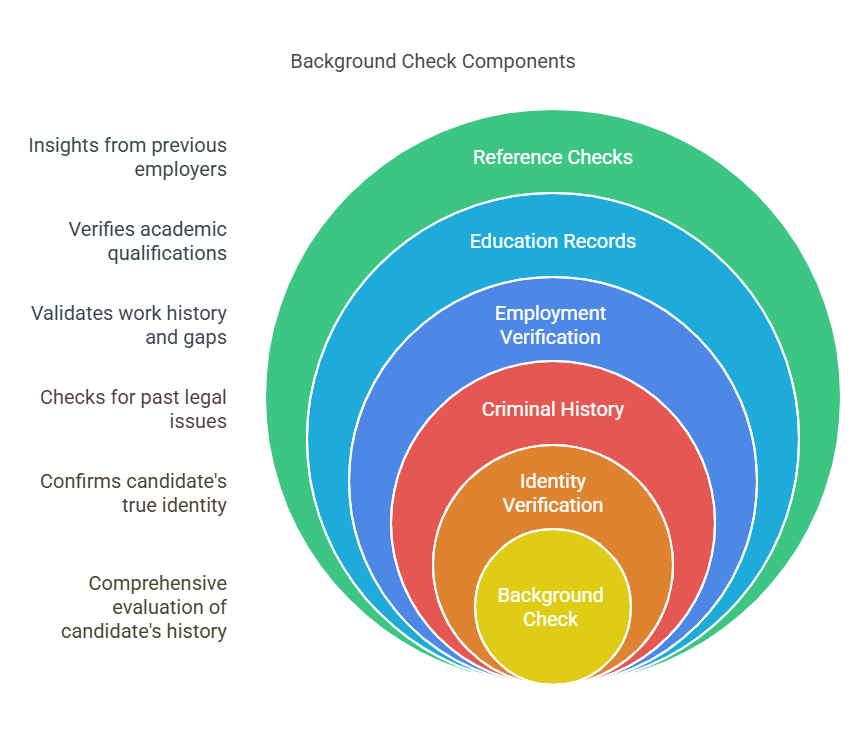

What Does a Background Check Entail?

A thorough background check involves verifying multiple aspects of a candidate’s history. The specific elements can vary depending on the nature of the role, but here’s an overview of the most common components:

- Criminal History

- Checks for past criminal convictions, pending charges, or arrest records.

- Essential for roles involving customer interactions or financial responsibilities.

- Employment Verification

- Confirms the accuracy of a candidate’s work history, including previous roles, employers, and dates of employment.

- Helps identify gaps or inaccuracies in resumes.

- Education Records

- Verifies degrees, certifications, and institutions attended.

- Especially important for positions requiring specialized knowledge or qualifications.

- Reference Checks

- Involves contacting the candidate’s professional references to gain insights into their work ethic, skills, and reliability.

- Credit Reports (if applicable)

- Provides information on the candidate’s financial history, such as debts or bankruptcies.

- Relevant for positions involving financial management or fiduciary responsibilities.

- Identity Verification

- Confirms the candidate’s identity through government-issued documents.

- Ensures the individual is who they claim to be.

- Driving Records (for specific roles)

- Checks for traffic violations, DUIs, or license suspensions.

- Important for roles that involve driving company vehicles.

Statistics Supporting the Importance of Background Checks

If you’re still unsure about the value of background checks, consider the following statistics that illustrate their impact:

- 85% of employers have caught candidates lying on their resumes during the hiring process.

- Businesses that implement background checks experience a 67% reduction in workplace theft.

- A CareerBuilder survey found that 75% of employers report hiring mistakes have negatively impacted their companies, with many citing the lack of a proper screening process as a contributing factor.

- Small businesses, on average, spend $4,129 and 42 days to hire a new employee. Conducting a background check upfront can save money and time by preventing costly rehiring processes.

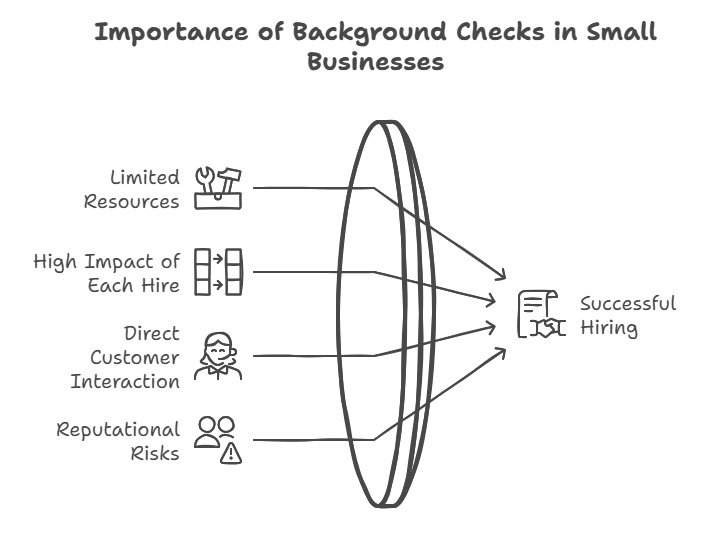

Why Background Checks Are Especially Crucial for Small Businesses

Small businesses operate in an environment where risks and rewards are magnified. Unlike larger corporations that can absorb the impact of a bad hire, small businesses often face more severe consequences. Here’s why background checks are uniquely important for small businesses:

- Limited Resources

Small businesses typically don’t have extensive HR departments or legal teams to handle employee issues. Background checks act as a safeguard, minimizing the chances of hiring someone who could create problems down the line. - High Impact of Each Hire

In a small business, each employee contributes significantly to operations, customer service, and overall company culture. Hiring the wrong person can disrupt workflows and lower team morale. - Direct Customer Interaction

Many small businesses, such as retail stores, restaurants, and service providers, rely on employees to interact directly with customers. A thorough background check ensures your team members represent your brand positively and professionally. - Reputational Risks

Small businesses often rely on word-of-mouth and community trust to grow. Hiring an employee with a problematic history can damage that trust, making it harder to retain customers and attract new ones.

Process and Tools for Conducting Background Checks

Introduction: Streamlining the Background Check Process for Small Businesses

Implementing a robust background check process may seem daunting for small business owners, especially when resources and time are limited. However, conducting thorough checks doesn’t have to be complicated. With a structured approach and the right tools, small businesses can efficiently and effectively screen candidates to ensure they are hiring trustworthy and qualified individuals.

In this section, we’ll explore a step-by-step guide to conducting background checks, provide an overview of the most reliable tools available, and discuss why “Exact Background Checks” is the ideal partner for small business screening. Additionally, we’ll compare popular platforms, highlighting key features to help you make an informed choice.

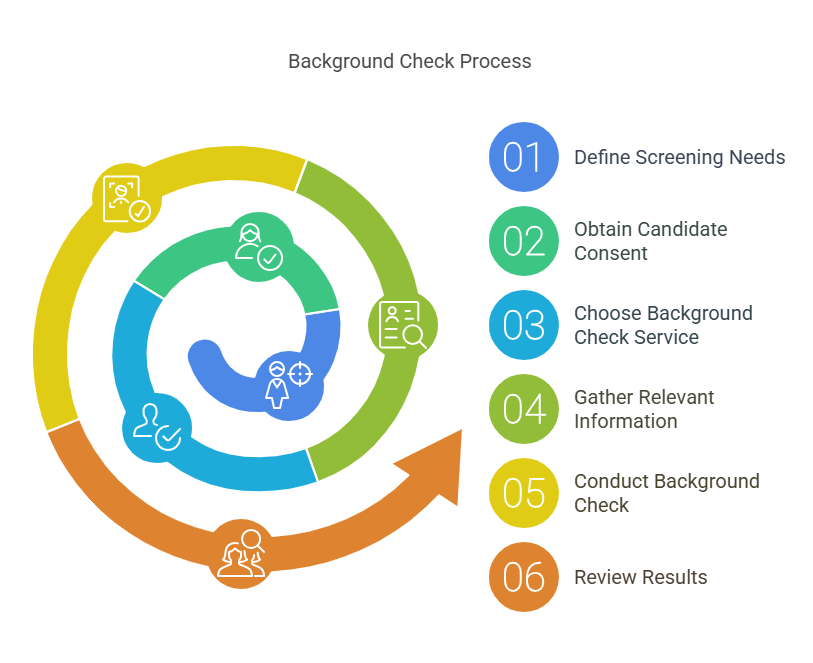

Step-by-Step Process for Conducting Background Checks

1. Define Your Screening Needs

Before initiating a background check, identify the specific information you need to verify based on the job role. For example:

- For roles involving financial management, a credit history check may be necessary.

- For positions requiring driving, review motor vehicle records.

- For customer-facing roles, focus on criminal background and identity verification.

By tailoring the screening process to the job requirements, you can avoid unnecessary costs and ensure you’re gathering relevant information.

2. Obtain Candidate Consent

Background checks involve accessing sensitive personal information, so it’s crucial to secure the candidate’s written consent before proceeding. This step is not only ethical but also a legal requirement under laws such as the Fair Credit Reporting Act (FCRA) in the United States. Provide the candidate with:

- A clear disclosure explaining the purpose of the background check.

- A consent form for their signature.

- A summary of their rights under applicable laws.

3. Choose a Reliable Background Check Service

Partnering with a trusted background check provider is key to obtaining accurate and timely results. Look for services that:

- Comply with local and federal regulations.

- Offer customizable packages to suit small business needs.

- Provide fast turnaround times without compromising accuracy.

4. Gather Relevant Information

To initiate the background check, you’ll need specific details from the candidate, such as:

- Full name and any aliases.

- Date of birth.

- Social Security number (or equivalent identification number).

- Past addresses or places of residence.

Ensure this information is collected securely and kept confidential.

5. Conduct the Background Check

Once you’ve selected a service provider and gathered the necessary details, submit the information and wait for the results. The time required will depend on the depth of the check, but most providers deliver results within 1–5 business days.

6. Review the Results

Carefully analyze the findings to ensure the candidate meets your hiring criteria. Pay attention to any red flags, such as:

- Significant discrepancies in employment or education history.

- Criminal records relevant to the job role.

- Financial issues that may impact their ability to perform specific duties.

If adverse action is required (e.g., rescinding a job offer), follow FCRA guidelines by notifying the candidate, providing a copy of the report, and giving them an opportunity to dispute the findings.

7. Document the Process

Maintain detailed records of the background check process, including:

- Candidate consent forms.

- Copies of the reports obtained.

- Notes on how decisions were made.

Proper documentation not only ensures compliance but also protects your business in case of disputes.

Common Tools and Platforms for Background Checks

Overview of Background Check Tools

With numerous platforms available, choosing the right one for your small business can be challenging. Below is an in-depth look at popular tools and services:

| Tool/Platform | Key Features | Pricing | Best For |

|---|---|---|---|

| Exact Background Checks | Tailored for small businesses, FCRA-compliant, customizable reports, fast results | Affordable, tiered pricing | Comprehensive and budget-friendly screening |

| Checkr | AI-driven screening, user-friendly dashboard, scalable for growing businesses | Starts at $29/check | Small and medium-sized businesses |

| GoodHire | Flexible packages, mobile-friendly interface, compliance-focused | $25–$80/check | Employers seeking customizable options |

| HireRight | Global background checks, industry-specific packages | Custom quotes | International hiring and industry compliance |

| Sterling | High-volume screening, drug testing integration, global reach | Starts at $35/check | Larger small businesses with frequent hires |

Why Choose Exact Background Checks?

Exact Background Checks is a trusted provider specializing in small business background screening. Here’s why it stands out:

- Tailored Solutions for Small Businesses

Unlike many generic platforms, Exact Background Checks is designed with small businesses in mind. We understand the challenges of limited budgets and time constraints, offering cost-effective solutions without compromising quality. - Comprehensive Screening Options

Our services cover all major aspects of background checks, including:

- Criminal history checks.

- Employment and education verification.

- Identity confirmation.

- Credit reports (where applicable).

- FCRA Compliance

We prioritize legal compliance, ensuring every check adheres to the Fair Credit Reporting Act and other relevant regulations. This protects your business from potential lawsuits and ensures ethical hiring practices. - Fast Turnaround Times

We know how important timely hiring decisions are for small businesses. Our streamlined processes deliver accurate results within a matter of days. - Exceptional Customer Support

Our team of experts is always available to guide you through the screening process, answer questions, and address any concerns.

Whether you’re hiring your first employee or expanding your team, Exact Background Checks offers the reliability and peace of mind you need to make informed hiring decisions.

How to Compare Background Check Tools

When selecting a background check service, consider the following factors:

- Cost

Small businesses often operate on tight budgets. Look for platforms with transparent pricing and flexible packages that align with your financial resources. - Features

Assess whether the platform offers the specific checks you need, such as education verification or motor vehicle records. - Compliance

Ensure the service adheres to relevant regulations, such as FCRA and EEOC guidelines, to avoid legal issues. - Turnaround Time

Fast results are critical for keeping your hiring process on track. Opt for services that deliver reports within a few days. - Ease of Use

User-friendly interfaces and customer support can save you time and effort during the screening process. - Scalability

If your business is growing, choose a platform that can accommodate higher volumes of background checks as your hiring needs increase.

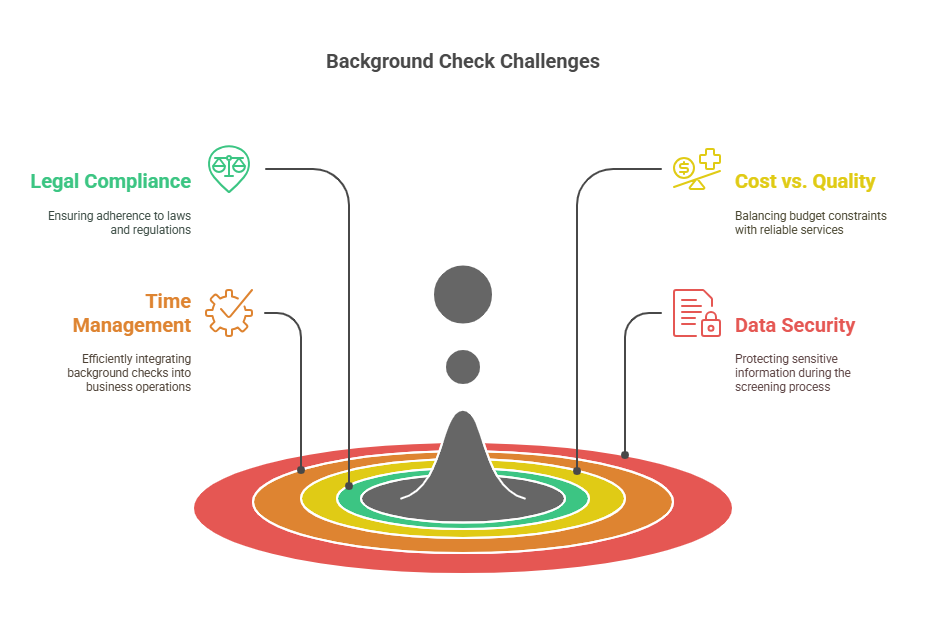

Key Challenges Small Businesses Face in Conducting Background Checks

- Understanding Legal Requirements

Navigating regulations like FCRA can be daunting for small business owners. Partnering with a compliant provider ensures you’re adhering to the law. - Balancing Cost and Quality

While some businesses may be tempted to cut corners by opting for cheaper services, this often results in incomplete or inaccurate reports. Investing in a reliable provider like Exact Background Checks ensures you get value for money. - Time Constraints

Small business owners often wear multiple hats, leaving little time for thorough screenings. Automated tools and professional services streamline the process, allowing you to focus on core business activities. - Data Security Concerns

Handling sensitive candidate information requires robust security measures. Ensure your provider has strong data protection policies in place.

Case Study: The Impact of Background Checks on a Small Business

Sarah’s Cafe, a small-town coffee shop, recently expanded its operations and needed to hire five new employees. Initially, Sarah was hesitant to invest in background checks, considering them an unnecessary expense. However, after partnering with Exact Background Checks, she discovered that one candidate had a history of theft and another had provided false employment references.

By conducting thorough screenings, Sarah avoided potentially costly hiring mistakes and was able to onboard a trustworthy, reliable team. This decision ultimately enhanced her cafe’s reputation and customer satisfaction.

With the right tools and a clear process, background checks can be a seamless part of your hiring strategy. By investing in services like Exact Background Checks, small businesses can ensure safe, compliant, and informed hiring practices that contribute to long-term success.

Legal Aspects of Background Checks for Small Businesses

Conducting background checks is a powerful tool for hiring the right talent, but it also comes with legal responsibilities. Failing to follow applicable laws can lead to lawsuits, penalties, and reputational damage. Small businesses must ensure their screening practices are ethical, fair, and compliant with relevant regulations.

Key Legal Considerations for Small Business Background Checks

1. FCRA Compliance (Fair Credit Reporting Act)

In the United States, the Fair Credit Reporting Act (FCRA) governs how businesses can conduct background checks. Key requirements include:

- Disclosure and Consent: You must inform the candidate in writing that a background check will be conducted and obtain their written consent.

- Adverse Action Process: If you decide not to hire someone based on the background check, you must provide them with:

- A copy of the report.

- A summary of their rights under the FCRA.

- An opportunity to dispute inaccuracies.

2. EEOC Guidelines (Equal Employment Opportunity Commission)

The EEOC ensures that background checks don’t lead to discriminatory practices. To stay compliant:

- Use consistent screening criteria for all candidates.

- Avoid policies that disproportionately exclude specific groups unless the criteria are job-related and consistent with business necessity.

3. Ban-the-Box Laws

Many states and cities have enacted “ban-the-box” laws, which restrict employers from asking about criminal history on job applications. These laws aim to give candidates with prior convictions a fair chance at employment.

- Employers can still conduct criminal background checks but must wait until later in the hiring process.

4. Data Privacy and Security

Handling sensitive personal information comes with significant privacy obligations. Ensure that:

- Candidate data is stored securely.

- You only access the information necessary for the job role.

- You comply with local and federal data protection regulations, such as GDPR (if applicable).

5. Industry-Specific Requirements

Certain industries, such as healthcare, finance, and transportation, have additional background check requirements. Research any specific regulations related to your industry to remain compliant.

FAQs: Common Questions About Background Checks for Small Businesses

Why are background checks particularly important for small businesses?

Small businesses have limited resources, each hire has a high impact, they often involve direct customer interaction, and they face significant reputational risks from bad hires.

What are the risks of skipping background checks for a small business?

Skipping background checks can lead to financial losses from fraud or theft, workplace safety issues, reputational damage, decreased productivity, and legal consequences from negligent hiring.

What does a standard background check typically entail for a small business?

A standard background check includes criminal history checks, employment verification, education records verification, reference checks, and potentially credit reports, identity verification, and driving records.

What are the key legal considerations small businesses must adhere to when conducting background checks?

Key considerations include compliance with the Fair Credit Reporting Act (FCRA), EEOC guidelines to prevent discrimination, adhering to "ban-the-box" laws, ensuring data privacy and security, and complying with industry-specific requirements.

How can a small business streamline its background check process?

Small businesses can streamline the process by defining screening needs, obtaining candidate consent, choosing a reliable background check service like Exact Background Checks, gathering relevant information, conducting the check, reviewing results, and documenting the process.

Why are background checks particularly important for small businesses?

Small businesses have limited resources, each hire has a high impact, they often involve direct customer interaction, and they face significant reputational risks from bad hires.

What are the risks of skipping background checks for a small business?

Skipping background checks can lead to financial losses from fraud or theft, workplace safety issues, reputational damage, decreased productivity, and legal consequences from negligent hiring.

What does a standard background check typically entail for a small business?

A standard background check includes criminal history checks, employment verification, education records verification, reference checks, and potentially credit reports, identity verification, and driving records.

What are the key legal considerations small businesses must adhere to when conducting background checks?

Key considerations include compliance with the Fair Credit Reporting Act (FCRA), EEOC guidelines to prevent discrimination, adhering to "ban-the-box" laws, ensuring data privacy and security, and complying with industry-specific requirements.

How can a small business streamline its background check process?

Small businesses can streamline the process by defining screening needs, obtaining candidate consent, choosing a reliable background check service like Exact Background Checks, gathering relevant information, conducting the check, reviewing results, and documenting the process.

Conclusion

Background checks are an essential tool for small businesses to ensure safe, compliant, and effective hiring practices. By implementing a thorough screening process, businesses can reduce risks, improve employee performance, and protect their reputation.

Key Takeaways

- Background checks mitigate risks such as fraud, theft, and workplace safety issues.

- A well-structured process includes defining screening needs, obtaining consent, and using reliable tools.

- Compliance with laws like the FCRA and EEOC guidelines is critical to avoid legal repercussions.

How Exact Background Checks Can Help Your Business

At Exact Background Checks, we specialize in providing small businesses with:

- Affordable and customizable screening packages.

- Fast and accurate results.

- FCRA-compliant services to ensure legal protection.

Whether you’re hiring your first employee or expanding your team, our tailored solutions simplify the background check process, allowing you to focus on growing your business.

Start making informed hiring decisions today with Exact Background Checks—your trusted partner in employment screening.