Best Identity Verification Services Reviewed

Best Identity Verification: Comprehensive Guide to Secure Solutions

Identity verification is the process of confirming that an individual is who they claim to be, using various methods to validate their identity credentials. This process is integral to maintaining trust in both online and offline interactions. By verifying identities, organizations can ensure the legitimacy of their users, protect sensitive information, and comply with legal regulations.

The Importance of Identity Verification in Today’s World

The increasing shift to digital platforms has amplified the need for robust identity verification processes. As businesses and services move online, the risks of identity fraud and cybercrime have grown exponentially. Effective identity verification safeguards organizations against these risks while enabling seamless user experiences.

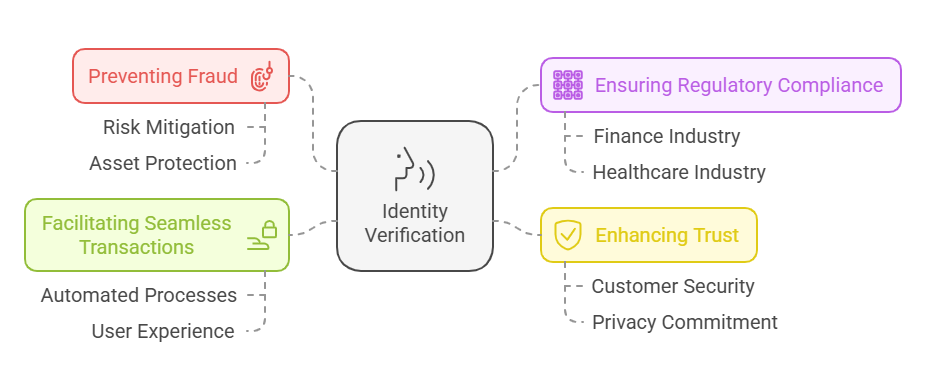

Here are a few key reasons why identity verification is crucial:

- Preventing Fraud: Identity theft and impersonation are significant threats. By verifying identities, businesses can mitigate these risks and protect their assets.

- Ensuring Regulatory Compliance: Many industries, especially finance and healthcare, are subject to strict regulations requiring identity verification to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

- Enhancing Trust: Reliable verification systems help build trust with customers by demonstrating a commitment to their security and privacy.

- Facilitating Seamless Transactions: Automated and accurate verification processes reduce friction for users while maintaining security.

Key Use Cases for Identity Verification

Identity verification is essential in numerous sectors, including:

- Financial Institutions:

- Use Case: Opening new accounts, conducting high-value transactions, and ensuring KYC compliance.

- Impact: Prevents fraud, reduces risks, and adheres to AML guidelines.

- E-Commerce and Online Marketplaces:

- Use Case: Verifying buyers and sellers to reduce fraudulent transactions and secure payments.

- Impact: Enhances customer trust and minimizes chargebacks.

- Healthcare:

- Use Case: Protecting patient data and ensuring authorized access to sensitive health records.

- Impact: Ensures data privacy and compliance with healthcare regulations like HIPAA.

- Gig Economy Platforms:

- Use Case: Verifying the identities of freelancers and service users to maintain platform integrity.

- Impact: Creates a safer environment for transactions and collaborations.

- Government and Public Sector Services:

- Use Case: Issuing official documents such as passports and driver’s licenses.

- Impact: Reduces fraud and streamlines citizen services.

Consequences of Not Implementing Robust Identity Verification

Ignoring identity verification can lead to:

- Increased Fraud Risks: Without verification, organizations are vulnerable to scams, identity theft, and financial crimes.

- Legal Penalties: Non-compliance with regulations such as GDPR, CCPA, or FCRA can result in hefty fines.

- Data Breaches: Weak identity verification systems can expose sensitive customer information, damaging reputation and trust.

- Operational Inefficiencies: Manual verification methods can delay processes, causing frustration for customers and employees alike.

Characteristics of the Best Identity Verification Systems

When evaluating identity verification solutions, consider the following characteristics:

- Speed: Modern solutions should offer real-time or near-instantaneous verification to enhance user satisfaction.

- Accuracy: Reliable systems minimize errors, such as false positives or negatives.

- Scalability: Solutions must adapt to handle increasing user volumes without compromising performance.

- Compliance: Top-tier systems adhere to regulations like KYC, AML, GDPR, and CCPA.

- User Experience: Seamless integration and intuitive processes ensure minimal disruption for end users.

- Multi-Factor Authentication (MFA): Adding layers of security, such as biometrics or OTPs, strengthens identity verification.

Traditional vs. Modern Identity Verification Methods

To appreciate the evolution of identity verification, consider the following comparison:

| Aspect | Traditional Methods | Modern Methods |

|---|---|---|

| Verification Speed | Manual, time-consuming | Automated, real-time |

| Accuracy | Prone to human errors | Enhanced by AI and machine learning |

| Fraud Prevention | Reactive (after fraud occurs) | Proactive (detects anomalies early) |

| User Experience | Cumbersome and lengthy | Streamlined and user-friendly |

| Compliance | Limited support for legal standards | Fully compliant with global regulations |

Modern Identity Verification Technologies

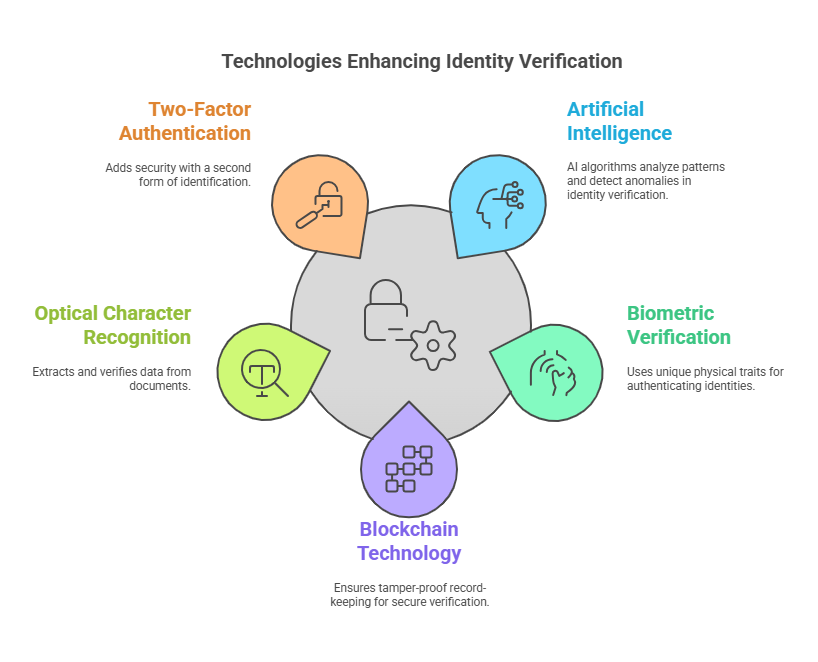

Recent advancements have revolutionized the identity verification landscape, introducing technologies that enhance security and efficiency:

- Artificial Intelligence (AI):

- AI algorithms detect anomalies, analyze patterns, and enhance the accuracy of identity verification.

- Example: Detecting fake IDs by analyzing micro-details such as font inconsistencies or holograms.

- Biometric Verification:

- Uses unique physical traits (e.g., fingerprints, facial recognition, iris scans) to authenticate identities.

- Example: Facial recognition for unlocking smartphones or verifying online transactions.

- Blockchain Technology:

- Ensures tamper-proof record-keeping, enabling decentralized and transparent verification.

- Example: Blockchain-based digital ID systems for secure cross-border transactions.

- Optical Character Recognition (OCR):

- Extracts and verifies data from documents like passports and driver’s licenses.

- Example: Scanning and validating government-issued IDs during onboarding.

- Two-Factor Authentication (2FA):

- Adds an extra layer of security by requiring a second form of identification (e.g., OTPs).

- Example: Verifying identity through a combination of passwords and SMS codes.

Benefits of Modern Identity Verification

Modern identity verification systems provide:

- Security:

- Advanced technologies like AI and biometrics ensure robust protection against fraud and cyberattacks.

- Efficiency:

- Automated processes reduce wait times, improving customer experiences and operational workflows.

- Scalability:

- Supports growing user bases without compromising accuracy or performance.

- Cost-Effectiveness:

- Reduces reliance on manual verification, cutting labor and administrative costs.

Key Trends Driving the Future of Identity Verification

- Biometric Adoption: Increasing reliance on biometrics for secure, frictionless authentication.

- AI-Powered Solutions: Leveraging AI to enhance fraud detection and streamline verification.

- Global Interoperability: Solutions supporting multiple languages and compliance standards for cross-border operations.

- Privacy-First Approaches: Emphasis on data minimization and user-controlled verification processes.

Features and Benefits of the Best Identity Verification Solutions

Introduction: The Need for Advanced Identity Verification

In the modern digital era, businesses must navigate a landscape filled with security threats, stringent regulations, and customer expectations for seamless experiences. Identity verification has emerged as a critical tool for ensuring both security and compliance while fostering trust and efficiency. Choosing the right solution involves understanding the key features and benefits that define the best systems.

Key Features of Top Identity Verification Solutions

Modern identity verification solutions offer a suite of advanced features that cater to various industries and business needs.

1. Artificial Intelligence (AI) Integration

AI is the backbone of many top-tier identity verification systems. It enhances accuracy, speeds up processes, and provides insights into potential fraud patterns.

- Capabilities of AI in Identity Verification:

- Pattern Analysis: AI identifies anomalies in user behavior, such as login attempts from unusual locations.

- Fraud Detection: Machine learning flags fraudulent documents or suspicious activities by comparing them with billions of data points.

- Automated Document Analysis: AI extracts information from government-issued IDs using Optical Character Recognition (OCR) and cross-references it with databases.

- Infographic Idea: A visual flowchart showing how AI processes an ID document, flags inconsistencies, and ensures real-time verification.

2. Biometric Authentication

Biometrics revolutionizes identity verification by leveraging unique physical traits, providing an unparalleled layer of security.

- Types of Biometric Methods:

- Facial Recognition: Uses AI to match a live user’s face with an ID photo.

- Fingerprint Scanning: Compares stored fingerprint data for fast and secure verification.

- Iris Recognition: Often used in high-security scenarios, offering nearly foolproof authentication.

- Benefits of Biometrics:

- Reduces reliance on physical documents.

- Prevents impersonation by requiring the individual’s physical presence.

- Improves user convenience with touchless or rapid scans.

- Infographic Idea: A comparative chart showing accuracy and speed metrics for different biometric methods (facial, fingerprint, iris).

3. Real-Time Processing

Today’s users demand instantaneous service. Real-time identity verification enables businesses to offer rapid yet secure onboarding experiences.

- Key Benefits:

- Speed: Reduces processing time from days to seconds.

- Customer Retention: Ensures that users complete registrations without frustration.

- Fraud Mitigation: Identifies suspicious activity immediately, blocking access before damage occurs.

- Use Case: E-commerce platforms verify buyers during checkout to prevent fraudulent transactions.

- Infographic Idea: A side-by-side comparison of traditional manual verification (3-5 days) vs. modern real-time solutions (instant).

4. Document Verification with OCR

OCR technology automates the validation of official documents, ensuring their authenticity and accuracy.

- How It Works:

- Scans and extracts data from government-issued IDs (e.g., passports, driver’s licenses).

- Verifies the extracted data against secure databases.

- Detects alterations such as tampering with text or images.

- Industries Benefiting from OCR:

- Financial Services: For KYC and AML compliance.

- Healthcare: To verify patients’ identities.

- Gig Economy: For freelancer onboarding.

- Infographic Idea: A diagram showing how OCR captures details from a sample ID, compares them with a database, and flags issues.

5. Fraud Detection and Risk Scoring

Proactive fraud prevention is essential for safeguarding business operations. Advanced risk scoring systems analyze multiple data points to assess the likelihood of fraud.

- Core Features:

- Behavioral Analytics: Monitors user actions, such as typing speed or device usage.

- Geo-Fencing: Detects location inconsistencies, blocking high-risk regions.

- Historical Patterns: Leverages past data to identify unusual activities.

- Example: A system may flag an account that suddenly logs in from a foreign country without prior travel history.

- Infographic Idea: A heat map illustrating fraud hotspots and how a risk scoring system evaluates threats.

6. Global Coverage and Localization

For businesses with international reach, identity verification systems must cater to diverse user bases.

- Core Features:

- Support for multiple languages and character sets.

- Compatibility with regional ID formats.

- Compliance with local regulations.

- Example: An identity verification solution that supports Aadhaar verification in India, alongside Social Security verification in the U.S.

- Infographic Idea: A global map showcasing the system’s coverage and compliance across various countries.

Benefits of Modern Identity Verification Solutions

Understanding the benefits of advanced identity verification is critical for businesses aiming to optimize security, efficiency, and user satisfaction.

1. Enhanced Security

With fraud on the rise, businesses require robust systems to protect sensitive data and transactions.

- How Modern Systems Provide Security:

- AI and biometrics ensure that only legitimate users gain access.

- Proactive fraud detection mechanisms block threats before they escalate.

- Statistic: Identity fraud caused $56 billion in losses in 2022 alone, emphasizing the need for strong security measures.

2. Improved Customer Experience

Seamless verification processes reduce friction, fostering user trust and retention.

- Customer Benefits:

- Instantaneous account creation.

- Simplified document submission.

- Reduced delays in accessing services.

- Infographic Idea: A customer journey map showing frictionless onboarding steps using modern verification tools.

3. Regulatory Compliance

Non-compliance with regulations like GDPR, CCPA, or KYC can result in hefty fines and damaged reputations.

- Benefits of Compliance:

- Avoids legal penalties.

- Builds trust with regulators and customers.

- Streamlines audits with automated record-keeping.

4. Cost Savings

While advanced systems require upfront investment, they save costs by reducing fraud-related losses and administrative overhead.

- Example: Automated verification minimizes the need for manual reviews, cutting labor costs by up to 50%.

5. Scalability and Flexibility

Scalable systems grow with your business, handling increased user volumes without disruptions.

- Ideal for:

- Expanding startups.

- Enterprises operating in multiple regions.

How to Select the Best Identity Verification Solution

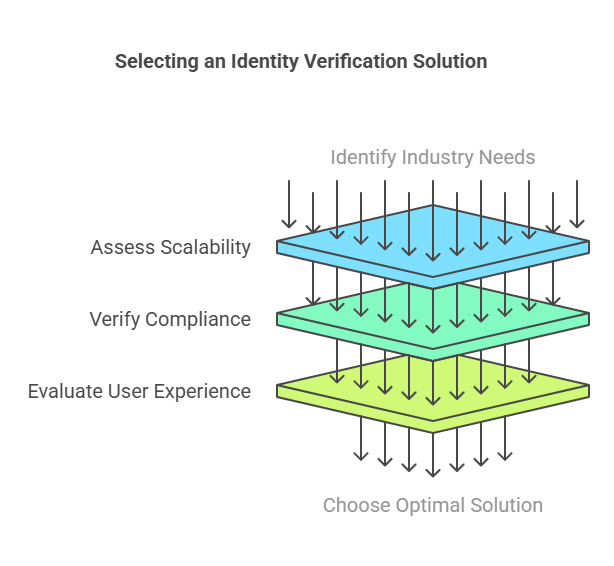

Businesses should consider several factors when choosing an identity verification system:

- Understand Your Industry Needs

Identify whether you prioritize speed, accuracy, or compliance. - Check Scalability

Ensure the solution can handle growth without sacrificing performance. - Review Compliance Standards

Verify adherence to regulations like GDPR, AML, or industry-specific laws. - Evaluate User Experience

Look for intuitive systems that streamline both customer and employee workflows.

Exact Background Checks: Your Trusted Partner

Exact Background Checks provides best-in-class identity verification solutions, offering:

- AI and Biometric Capabilities: For accurate, real-time verification.

- Compliance Assurance: Adherence to GDPR, KYC, AML, and HIPAA standards.

- Scalable Solutions: Designed for startups, enterprises, and global organizations.

Summary Table of Features and Benefits

| Feature | Benefit |

|---|---|

| AI Integration | Detects fraud and automates processes. |

| Biometric Verification | Prevents impersonation and enhances security. |

| Real-Time Processing | Improves user experience with instant results. |

| OCR and Document Verification | Ensures data accuracy and prevents tampering. |

| Fraud Detection | Proactively mitigates risks. |

| Global Coverage | Supports international operations. |

Legal Aspects of Identity Verification

Legal compliance is a cornerstone of identity verification. Failure to adhere to relevant laws can result in severe penalties and reputational damage. Below, we explore key legal frameworks and considerations surrounding identity verification.

1. Global Data Privacy Regulations

Modern identity verification systems must comply with stringent data privacy regulations worldwide. Key laws include:

- General Data Protection Regulation (GDPR) (Europe): Mandates that organizations safeguard user data, obtain explicit consent, and allow users to access, correct, or delete their information.

- California Consumer Privacy Act (CCPA) (United States): Grants California residents control over their personal data and requires businesses to disclose how data is used.

- Personal Data Protection Law (PDPL) (Middle East): Governs data collection, processing, and sharing to ensure individuals’ privacy is respected.

How Compliance is Achieved:

The best identity verification providers implement encryption, data minimization, and user consent protocols to meet these requirements.

2. Know Your Customer (KYC) Regulations

KYC requirements are critical for industries such as banking, fintech, and insurance. They ensure that organizations verify the identities of their customers to prevent money laundering and fraud.

- Key Components of KYC:

- Customer Identification Program (CIP): Requires collecting valid government-issued IDs.

- Customer Due Diligence (CDD): Analyzes the risk profile of customers based on their behavior and transactions.

- Ongoing Monitoring: Tracks customer activity for suspicious patterns.

Example: A financial institution may use AI-driven identity verification to quickly authenticate new account holders while ensuring compliance with KYC.

3. Anti-Money Laundering (AML) Regulations

AML laws aim to prevent criminals from using legitimate channels to launder illicit funds. Identity verification systems help organizations detect and report suspicious activity.

- Standards to Note:

- Financial Action Task Force (FATF): Provides international guidelines for AML measures.

- Bank Secrecy Act (BSA): U.S. law requiring financial institutions to report large cash transactions and suspicious activities.

4. Fair Credit Reporting Act (FCRA)

The FCRA regulates the use of consumer information to ensure accuracy and fairness in identity verification and credit reporting. Companies offering identity verification services must comply when their processes affect employment, lending, or housing decisions.

5. Industry-Specific Compliance

Certain industries face additional legal requirements:

- Healthcare: Compliance with HIPAA ensures that patient information is handled securely.

- E-Commerce: Verification systems must adhere to PCI DSS for payment security.

- Travel and Hospitality: Regulations like TSA PreCheck require identity verification for passenger screening.

Frequently Asked Questions (FAQs)

Here are answers to common questions about identity verification:

What is the most reliable identity verification method?

Biometric verification is among the most reliable methods. By leveraging unique physical attributes like fingerprints or facial recognition, biometric systems ensure accuracy and security. AI-enhanced biometric tools further reduce false positives and negatives.

How does biometric identity verification work?

Biometric systems scan and analyze unique characteristics such as fingerprints, facial features, or voice patterns. These attributes are compared to stored templates to confirm identity. For example, facial recognition compares the geometry of facial features using advanced algorithms.

Why is identity verification essential for financial institutions?

Financial institutions use identity verification to prevent fraud, ensure compliance with KYC/AML regulations, and protect sensitive customer data. Verification processes safeguard transactions, reduce risks, and build trust with customers.

What industries benefit the most from identity verification solutions?

While all industries can benefit, key sectors include:

- Finance: For fraud prevention and compliance.

- E-Commerce: To secure transactions and combat identity theft.

- Healthcare: To protect sensitive patient data.

- Gig Economy: To validate service providers and users.

- Government Services: To ensure accurate issuance of documents.

How does Exact Background Checks provide superior identity verification services?

Exact Background Checks delivers cutting-edge solutions featuring AI integration, real-time processing, and compliance with global standards. Their tools are designed to balance security with user experience, offering scalability for businesses of all sizes.

Conclusion

In today’s digital-first world, robust identity verification is not optional—it’s a necessity. Organizations that prioritize advanced identity verification solutions benefit from enhanced security, seamless user experiences, and regulatory compliance.

By implementing modern verification tools featuring AI, biometrics, and blockchain technology, businesses can proactively combat fraud and safeguard sensitive information. Compliance with global laws like GDPR, CCPA, and KYC/AML regulations ensures that these systems operate within legal frameworks.

Partnering with Exact Background Checks is a step toward future-proofing your operations. Their state-of-the-art solutions guarantee speed, accuracy, and security, making them an ideal choice for businesses seeking reliable identity verification.