4 Essential Types of Risk Mitigation Explained

Understanding Risk Mitigation and Its Importance

Risk is a constant presence in both personal and professional life. Whether it involves financial uncertainty, technological vulnerabilities, operational disruptions, or compliance issues, risks have the potential to derail progress and cause significant losses if not addressed properly. Risk mitigation serves as a structured approach to managing these uncertainties, ensuring that individuals and organizations can achieve their goals while minimizing potential harm.

In this section, we’ll explore the fundamentals of risk mitigation, delve into the four primary types of mitigation strategies, and discuss their importance across industries.

What Is Risk Mitigation?

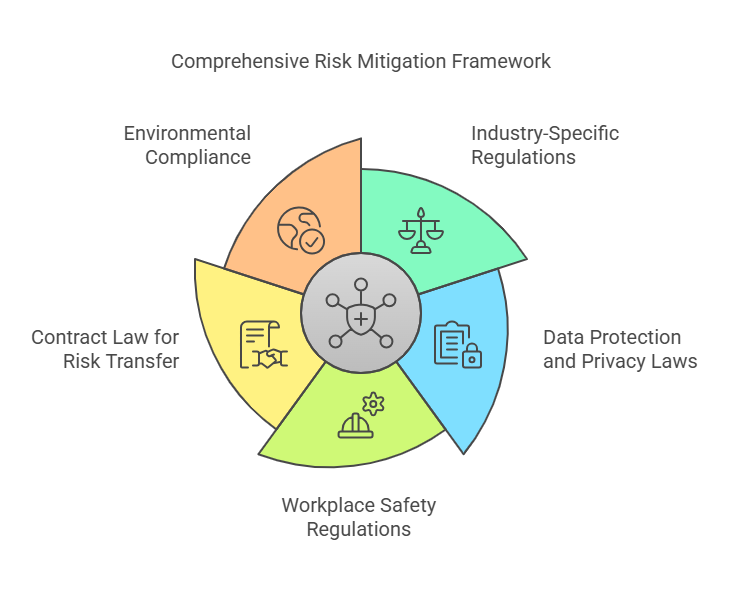

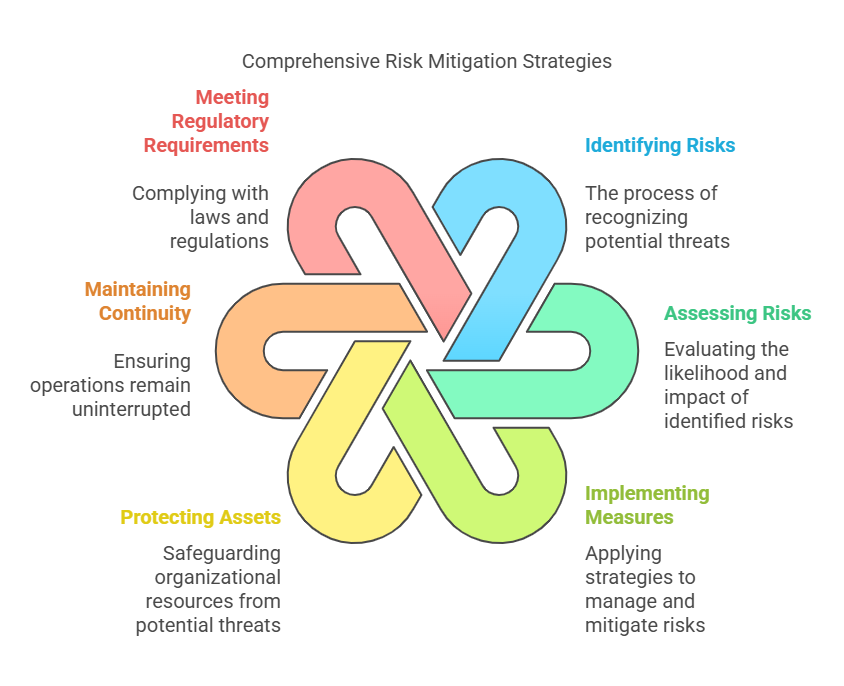

Risk mitigation is the process of identifying, assessing, and implementing measures to manage risks effectively. It is a cornerstone of risk management, focusing on reducing the negative consequences of potential threats or uncertainties.

For organizations, risk mitigation involves creating strategies to protect assets, maintain operational continuity, and meet regulatory requirements. It’s not just about reacting to problems; it’s about proactively planning for them.

Why Is Risk Mitigation Important?

The importance of risk mitigation cannot be overstated. In a world where disruptions can stem from economic instability, technological advancements, natural disasters, or even human error, businesses and individuals alike need robust frameworks to navigate uncertainties. Here are some key reasons why risk mitigation is essential:

- Ensuring Business Continuity:

- Risks like cyberattacks, supply chain disruptions, or regulatory changes can halt operations. Mitigation strategies ensure minimal downtime and quick recovery.

- Protecting Financial Health:

- Unmitigated risks can lead to significant financial losses. For example, a data breach can result in hefty fines, lawsuits, and loss of customer trust.

- Enhancing Decision-Making:

- Identifying risks helps decision-makers evaluate options with a clear understanding of potential outcomes, leading to more informed and confident choices.

- Maintaining Compliance:

- Many industries are subject to strict regulations. Effective risk mitigation ensures that businesses adhere to legal requirements, avoiding penalties and reputational damage.

- Building Stakeholder Confidence:

- Investors, customers, and employees are more likely to trust organizations that demonstrate a proactive approach to managing risks.

The Four Types of Risk Mitigation

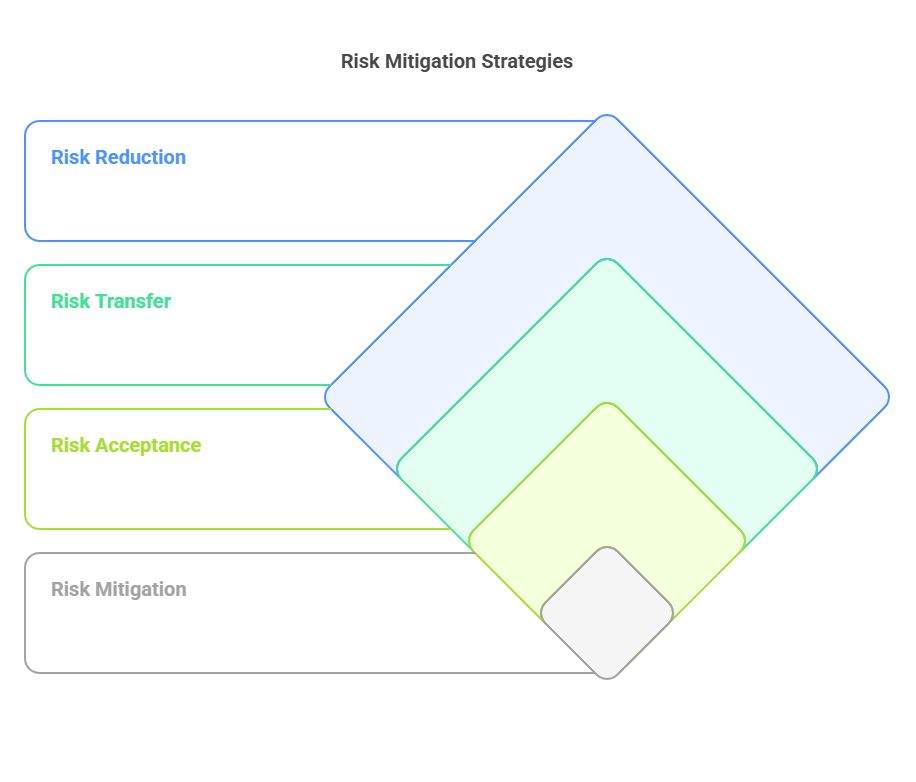

Risk mitigation can be broken down into four primary strategies: Avoidance, Reduction, Transfer, and Acceptance. Each strategy serves a unique purpose and is applied based on the nature of the risk, its potential impact, and the resources available to address it.

1. Risk Avoidance

Definition:

Risk avoidance involves taking deliberate actions to eliminate a potential risk entirely. This strategy is typically employed when the risk poses a significant threat, and the best course of action is to avoid it altogether.

Examples of Risk Avoidance:

- A company decides not to expand into a politically unstable region to avoid operational and financial risks.

- An individual refrains from investing in volatile stocks to avoid potential financial losses.

- An organization opts out of adopting a new technology due to untested reliability and security concerns.

Key Objective:

The primary goal of risk avoidance is to eliminate exposure to the risk, ensuring that it cannot materialize.

2. Risk Reduction

Definition:

Risk reduction focuses on minimizing the likelihood or severity of a risk. This approach involves implementing measures that reduce the potential impact of the risk on an organization or individual.

Examples of Risk Reduction:

- A manufacturing facility installs advanced fire suppression systems to minimize damage from potential fires.

- A company conducts regular cybersecurity training to reduce the likelihood of phishing attacks.

- An individual diversifies their investment portfolio to reduce exposure to market volatility.

Key Objective:

The aim of risk reduction is to control and lessen the potential harm associated with a risk, ensuring it is manageable.

3. Risk Transfer

Definition:

Risk transfer involves shifting the burden of risk to another party, often through contractual agreements or insurance policies. This strategy does not eliminate the risk but ensures that the financial or operational consequences are borne by a different entity.

Examples of Risk Transfer:

- A business purchases liability insurance to cover damages from potential lawsuits.

- A company outsources its IT operations to a managed service provider, transferring the responsibility of system failures or breaches.

- An individual secures travel insurance to cover costs related to trip cancellations or medical emergencies.

Key Objective:

The goal of risk transfer is to share the risk with another party, reducing the direct impact on the original entity.

4. Risk Acceptance

Definition:

Risk acceptance involves acknowledging the presence of a risk and choosing not to take any immediate action to mitigate it. This strategy is typically employed when the cost of mitigation outweighs the potential impact of the risk.

Examples of Risk Acceptance:

- A startup chooses to enter a competitive market, accepting the risk of high competition for the potential of high rewards.

- An organization continues to operate with outdated software, accepting the minor risk of inefficiencies until budget permits an upgrade.

- An individual drives without comprehensive insurance, accepting the risk of minor damages.

Key Objective:

The primary aim of risk acceptance is to tolerate manageable risks while focusing resources on higher-priority areas.

Quick Reference Table: Four Types of Risk Mitigation

| Type | Definition | Example | Key Objective |

|---|---|---|---|

| Avoidance | Eliminating the risk by not engaging in risk-prone activities. | Avoiding expansion into a high-risk market. | Prevent the risk entirely. |

| Reduction | Minimizing the probability or impact of a risk. | Installing advanced security systems. | Lower the severity or likelihood. |

| Transfer | Shifting the risk to another party. | Purchasing liability insurance. | Delegate risk responsibility. |

| Acceptance | Acknowledging and tolerating the risk. | Entering a competitive market knowingly. | Live with manageable risks. |

Why Identifying and Assessing Risks Is Crucial

Before implementing any risk mitigation strategy, it is essential to identify and assess risks thoroughly. This process involves evaluating:

- Likelihood:

How probable is the risk? For example, a company operating in a hurricane-prone area faces a higher likelihood of weather-related disruptions. - Impact:

What are the potential consequences? Understanding the financial, operational, and reputational impact of a risk is critical. - Cost:

What are the resources required to mitigate the risk? Mitigation strategies often involve investments, and their cost-effectiveness must be assessed.

By conducting a comprehensive risk assessment, businesses and individuals can prioritize risks, allocate resources effectively, and choose the most suitable mitigation strategies.

Detailed Analysis of the 4 Types of Risk Mitigation

Effective risk mitigation requires a thorough understanding of the strategies available and their practical applications. Each of the four types of risk mitigation—Avoidance, Reduction, Transfer, and Acceptance—plays a unique role in managing uncertainties. In this section, we’ll examine these strategies in depth, exploring their definitions, real-world examples, advantages, challenges, and guidelines for implementation.

1. Risk Avoidance

Definition:

Risk avoidance is the proactive strategy of completely eliminating a risk by choosing not to engage in activities or decisions that could expose individuals or organizations to potential harm. It is the most straightforward approach, as it seeks to remove the risk entirely rather than manage its effects.

Examples of Risk Avoidance:

- Business Decisions: A company decides not to invest in a high-risk project, such as developing a new product for an untested market.

- Technology Implementation: An organization avoids adopting new, unproven technology to prevent potential operational failures or security breaches.

- Personal Choices: An individual refrains from taking a high-interest loan to avoid financial strain.

Advantages of Risk Avoidance:

- Eliminates Threats: By avoiding the risk entirely, organizations and individuals can ensure the threat will not materialize.

- Reduces Complexity: This strategy simplifies decision-making by removing risky options.

- Protects Resources: Avoidance prevents unnecessary expenditure of time, money, and effort on managing avoidable risks.

Challenges of Risk Avoidance:

- Opportunity Cost: Avoiding risks may mean forgoing potentially lucrative opportunities.

- Not Always Feasible: Some risks are unavoidable in certain industries or situations.

- May Limit Innovation: Avoidance can stifle creativity and progress by discouraging calculated risks.

Best Practices for Risk Avoidance:

- Conduct thorough risk assessments to identify high-impact threats.

- Use data-driven decision-making to evaluate the feasibility of avoidance.

- Balance risk avoidance with strategic opportunities to ensure growth.

2. Risk Reduction

Definition:

Risk reduction focuses on minimizing the likelihood or impact of a risk through preventative measures and proactive planning. Unlike avoidance, this strategy acknowledges the existence of risk but seeks to control it.

Examples of Risk Reduction:

- Workplace Safety: A construction company enforces strict safety protocols and provides training to reduce the likelihood of workplace accidents.

- Cybersecurity: Organizations implement firewalls, encryption, and regular system updates to mitigate the risk of cyberattacks.

- Financial Planning: Individuals diversify their investment portfolios to minimize exposure to market volatility.

Advantages of Risk Reduction:

- Increases Preparedness: By addressing risks directly, organizations can minimize their potential impact.

- Builds Resilience: Reduction strategies improve the ability to recover quickly from adverse events.

- Supports Innovation: Controlled risk reduction enables businesses to explore opportunities while managing potential downsides.

Challenges of Risk Reduction:

- Costs Involved: Implementing reduction measures often requires significant investment in resources, time, and expertise.

- Incomplete Elimination: While risks can be minimized, they are rarely eliminated entirely.

- Complexity: Effective reduction strategies require ongoing monitoring and adaptation to changing conditions.

Best Practices for Risk Reduction:

- Prioritize risks based on their likelihood and potential impact.

- Invest in training, technology, and infrastructure to address vulnerabilities.

- Regularly review and update risk reduction measures to reflect current conditions.

3. Risk Transfer

Definition:

Risk transfer involves shifting the financial or operational burden of a risk to a third party, often through contractual agreements or insurance. While this strategy doesn’t remove the risk, it ensures that the consequences are managed by another entity.

Examples of Risk Transfer:

- Insurance Policies: Companies purchase property insurance to cover damages from natural disasters or theft.

- Outsourcing: Businesses outsource IT services to managed service providers, transferring the responsibility for system maintenance and security.

- Subcontracting: Construction companies transfer liability for specific tasks to subcontractors through contractual agreements.

Advantages of Risk Transfer:

- Financial Protection: Transferring risks to an insurer or third party reduces financial exposure.

- Expertise Utilization: Outsourcing risk management to specialists ensures better handling of complex threats.

- Focus on Core Activities: Transferring risks allows organizations to concentrate on their primary objectives.

Challenges of Risk Transfer:

- Costs: Insurance premiums and outsourcing fees can add to operational expenses.

- Reliance on Third Parties: Dependence on external entities can introduce new risks, such as service delays or disputes.

- Limited Coverage: Not all risks are transferable, and some may require additional internal measures.

Best Practices for Risk Transfer:

- Choose reliable partners and providers with a proven track record.

- Clearly define the scope of risk transfer in contractual agreements.

- Regularly review insurance policies to ensure adequate coverage.

4. Risk Acceptance

Definition:

Risk acceptance is the deliberate decision to acknowledge a risk without taking immediate action to mitigate it. This strategy is typically employed when the cost of addressing the risk exceeds its potential impact.

Examples of Risk Acceptance:

- Startups: A startup enters a competitive market, accepting the risk of initial losses for long-term growth potential.

- IT Systems: An organization delays upgrading its software, accepting minor inefficiencies until budget permits an upgrade.

- Personal Finance: An individual uses a high-interest credit card for emergencies, accepting the short-term financial impact.

Advantages of Risk Acceptance:

- Cost-Effective: Accepting manageable risks avoids unnecessary expenditure on mitigation.

- Supports Strategic Goals: Organizations can focus resources on high-priority areas while tolerating low-impact risks.

- Encourages Flexibility: Acceptance allows businesses to adapt to changing circumstances without rigid mitigation measures.

Challenges of Risk Acceptance:

- Potential Losses: Unaddressed risks can escalate, leading to unexpected consequences.

- Public Perception: Accepting risks, particularly in high-stakes industries, can raise concerns among stakeholders.

- Limited Applicability: This strategy is only viable for low-impact risks.

Best Practices for Risk Acceptance:

- Conduct a thorough cost-benefit analysis to justify acceptance.

- Monitor accepted risks to ensure they remain manageable.

- Communicate the rationale for acceptance to stakeholders transparently.

Comparison Table: Four Types of Risk Mitigation

| Type | Definition | When to Use | Key Benefits | Challenges |

|---|---|---|---|---|

| Avoidance | Eliminating the risk entirely. | High-impact, high-probability risks. | Prevents risk occurrence. | Missed opportunities. |

| Reduction | Minimizing the risk’s likelihood or impact. | Manageable risks that require proactive measures. | Increases resilience. | Requires investment. |

| Transfer | Shifting the risk to a third party. | Financial risks or operational liabilities. | Financial protection. | Costs and reliance on others. |

| Acceptance | Tolerating the risk. | Low-impact, low-probability risks. | Cost-effective and flexible. | Potential for unforeseen losses. |