Essential Risk Mitigation Tools for Businesses

Introduction to Risk Mitigation Tools: What They Are and Why They’re Important

In today’s fast-paced business environment, organizations must navigate a wide range of potential risks. These risks can arise from multiple sources, including financial instability, cybersecurity threats, operational inefficiencies, and even reputational damage. To manage and minimize these risks, businesses rely on risk mitigation tools. These tools are designed to identify, assess, and address risks proactively, helping organizations maintain stability and achieve their strategic goals.

What Are Risk Mitigation Tools?

Risk mitigation tools refer to strategies, methodologies, technologies, and processes that businesses use to reduce the likelihood of a risk occurring, minimize its impact, or eliminate it entirely. These tools enable organizations to take a proactive approach to risk management by identifying risks before they escalate, implementing preventive measures, and ensuring that appropriate responses are in place if risks materialize.

By utilizing these tools, businesses can create safer working environments, protect sensitive data, comply with regulations, and safeguard their reputation. In essence, risk mitigation tools are the foundation of an effective risk management strategy, ensuring that risks are not only identified but also addressed efficiently and effectively.

The Importance of Using Risk Mitigation Tools in Businesses and Organizations

Risk mitigation is essential for all organizations, regardless of size or industry. Effective use of risk mitigation tools can help businesses:

- Avoid Financial Loss: Businesses face various financial risks, from fluctuations in market prices to the risk of bankruptcy. Risk mitigation tools like financial forecasting software, insurance, and hedging strategies help protect against financial losses.

- Ensure Business Continuity: Operational risks, such as system failures or supply chain disruptions, can severely impact day-to-day operations. Risk mitigation tools, such as business continuity planning and disaster recovery solutions, help ensure that businesses can continue operating even in the face of these challenges.

- Enhance Reputation: Reputational risks can arise from poor customer experiences, negative media coverage, or ethical breaches. By implementing tools for public relations management, monitoring brand sentiment, and adhering to ethical guidelines, companies can protect their reputation.

- Maintain Regulatory Compliance: Legal and regulatory risks are becoming more prevalent with the increase in data protection regulations like GDPR and CCPA. Risk mitigation tools such as compliance software and audit tools help organizations stay compliant with these laws.

Types of Risks Businesses Commonly Face

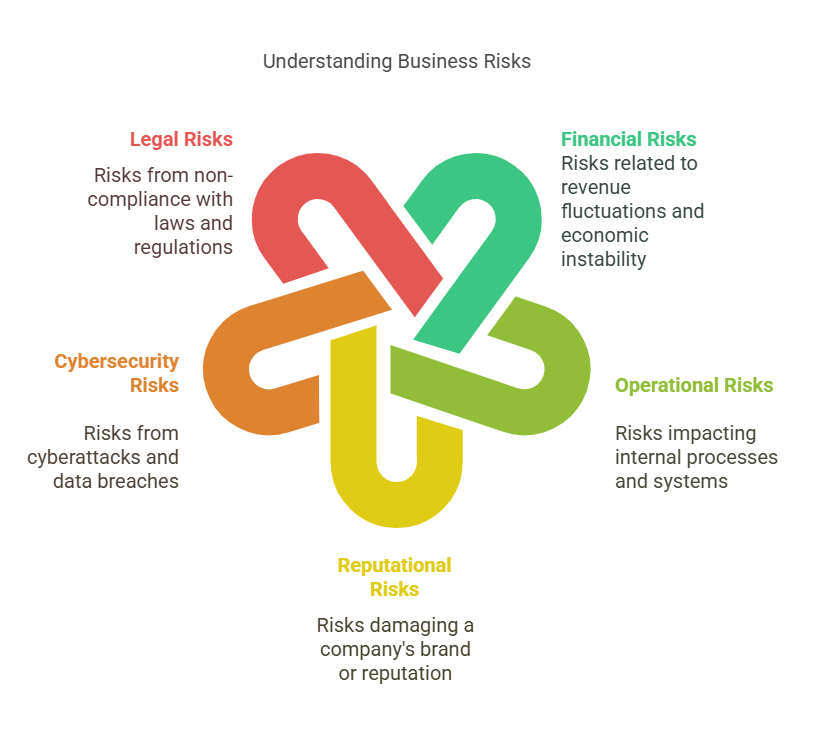

Businesses face a wide range of risks, each of which requires different risk mitigation tools. The most common types of risks include:

- Financial Risks: These risks are related to fluctuations in revenue, unexpected expenses, economic downturns, and financial instability. Examples include credit risk, liquidity risk, and interest rate risk.

- Operational Risks: These involve risks that impact a company’s internal processes, systems, and resources. Examples include supply chain disruptions, equipment failures, and human errors.

- Reputational Risks: These are risks that damage a company’s brand or reputation. Poor customer service, negative reviews, and unethical behavior can lead to reputational harm.

- Cybersecurity Risks: As businesses increasingly rely on digital platforms, they are exposed to risks related to cyberattacks, data breaches, and hacking. These risks can result in the loss of sensitive data, financial losses, and damaged customer trust.

- Legal Risks: Legal risks arise from a failure to comply with laws, regulations, or contractual obligations. These risks can lead to lawsuits, fines, or reputational damage.

How Risk Mitigation Tools Help Manage These Risks

Risk mitigation tools help businesses reduce or eliminate these risks through various strategies and methods. Some examples include:

- Insurance: Businesses often use insurance as a financial safety net to mitigate the financial impact of risks such as property damage, liability, and employee injuries.

- Software Solutions: Technologies such as cybersecurity software, financial management tools, and enterprise resource planning (ERP) systems can help mitigate operational and financial risks by automating processes, securing data, and optimizing workflows.

- Protocols and Frameworks: Established frameworks, such as ISO standards, Six Sigma, and the COSO ERM framework, provide structured approaches to identifying, assessing, and managing risks.

- Employee Training and Safety Protocols: Operational risks can be mitigated by training employees to identify and prevent risks related to workplace safety, compliance, and process inefficiencies.

General Categories of Risk Mitigation Tools

Risk mitigation tools generally fall into several categories:

- Risk Management Software: These tools allow businesses to track, assess, and prioritize risks across the organization. Examples include risk registers, dashboards, and reporting systems.

- Cybersecurity Tools: This category includes tools that protect against cyber threats, such as firewalls, intrusion detection systems, and encryption software.

- Compliance Tools: These tools help businesses stay compliant with laws and regulations, such as GDPR compliance software, audit management tools, and policy management systems.

- Financial Tools: Businesses can mitigate financial risks with forecasting tools, budgeting software, and investment management platforms.

- Human Resources Tools: Tools like background checks, employment screening, and employee performance tracking systems help mitigate risks associated with hiring and managing employees.

Top Risk Mitigation Tools: Features, Benefits, and Use Cases

In the rapidly evolving landscape of business risk management, the availability of specialized risk mitigation tools plays a crucial role in helping organizations reduce, manage, and even eliminate risks. These tools are designed to tackle specific types of risks, such as financial, cybersecurity, operational, and legal. In this section, we will delve into the top risk mitigation tools currently available, explore their features and benefits, and examine real-world use cases for each.

Additionally, we will highlight ExactBackgroundChecks.com, a service that specializes in employment-related risk mitigation, providing background checks and employee screening solutions to reduce the risks associated with hiring.

Top Risk Mitigation Tools in Various Categories

1. Cybersecurity Risk Mitigation Tools

Cybersecurity is one of the most critical areas where businesses need strong risk mitigation tools due to the growing threats of cyberattacks, data breaches, and ransomware.

Key Tools for Cybersecurity Risk Mitigation:

- Firewalls and Intrusion Detection Systems (IDS): Tools like Cisco ASA and Palo Alto Networks firewalls provide a robust defense against unauthorized access to a company’s network. Intrusion detection systems, such as Snort, monitor network traffic for suspicious activity, alerting administrators to potential threats.

- Features: Traffic monitoring, malware blocking, real-time alerts.

- Benefits: Prevention of unauthorized data access, proactive threat detection.

- Use Case: A financial institution could implement firewalls and IDS to prevent external hackers from accessing sensitive customer data.

- Encryption Software: Tools like BitLocker and VeraCrypt are crucial for encrypting sensitive data, making it unreadable to unauthorized individuals, even if they manage to breach security systems.

- Features: Full disk encryption, file and folder encryption.

- Benefits: Protection of sensitive customer data, compliance with data protection regulations.

- Use Case: A healthcare provider uses encryption to protect patient records from unauthorized access.

2. Financial Risk Mitigation Tools

Financial risk management is critical to safeguarding an organization’s assets and ensuring its continued profitability. Various financial tools help reduce risks associated with market fluctuations, credit, and investment.

Key Tools for Financial Risk Mitigation:

- Hedging Software: Tools like Kyriba and Reval help businesses manage currency exchange risks, commodity price fluctuations, and interest rate changes through hedging strategies.

- Features: Risk assessment, forecasting, derivative trading.

- Benefits: Minimizes exposure to market volatility, secures profits.

- Use Case: A multinational corporation uses hedging tools to mitigate risks related to foreign currency exchange when operating in multiple countries.

- Credit Risk Management Platforms: Software such as Moody’s CreditLens and S&P Global Market Intelligence offers tools to assess the creditworthiness of potential borrowers, suppliers, and partners.

- Features: Credit scoring, financial statement analysis, risk analysis.

- Benefits: Reduces the risk of bad debts, ensures financial stability.

- Use Case: A bank uses these platforms to evaluate loan applicants and ensure they meet creditworthiness criteria before approval.

3. Operational Risk Mitigation Tools

Operational risks arise from failed internal processes, people, or systems. Tools designed for operational risk management help businesses optimize workflows, reduce human error, and prevent disruptions.

Key Tools for Operational Risk Mitigation:

- Enterprise Resource Planning (ERP) Systems: ERP tools like SAP S/4HANA and Oracle ERP Cloud streamline business operations, from inventory management to human resources and finance.

- Features: Data centralization, workflow automation, performance tracking.

- Benefits: Increases efficiency, minimizes process errors, and improves decision-making.

- Use Case: A manufacturing company uses an ERP system to track inventory, improve supply chain management, and reduce operational bottlenecks.

- Business Continuity and Disaster Recovery Software: Tools like Veeam and Zerto provide backup, recovery, and failover solutions to ensure businesses can maintain operations during and after unexpected events, such as natural disasters or system failures.

- Features: Automated backups, cloud-based storage, recovery simulations.

- Benefits: Prevents data loss, minimizes downtime, ensures business continuity.

- Use Case: A retail company uses business continuity software to maintain access to its online store and customer data in the event of a system crash.

4. Legal and Compliance Risk Mitigation Tools

Legal and regulatory compliance is critical for organizations that need to navigate complex regulations such as GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and industry-specific standards.

Key Tools for Legal and Compliance Risk Mitigation:

- Compliance Management Software: Platforms like LogicGate and Comply365 help businesses stay compliant by automating workflows related to regulatory requirements, internal audits, and reporting.

- Features: Compliance tracking, audit management, real-time reporting.

- Benefits: Streamlined compliance processes, reduced risk of penalties.

- Use Case: A fintech company uses compliance management tools to track and report on its adherence to financial regulations.

- Data Privacy Tools: Tools such as OneTrust and TrustArc are designed to help businesses manage data privacy risks, ensuring that personal information is collected, stored, and used in accordance with privacy laws.

- Features: Privacy impact assessments, consent management, automated compliance reporting.

- Benefits: Protects consumer data, ensures compliance with privacy regulations.

- Use Case: A global e-commerce business uses data privacy tools to manage customer data and ensure GDPR compliance.

Risk Mitigation Tools for Hiring and Employment: ExactBackgroundChecks.com

One of the most significant risks businesses face today is associated with employee hiring. ExactBackgroundChecks.com provides essential services for employment screening and background checks to mitigate these hiring risks. By verifying the identity, qualifications, and criminal history of potential employees, businesses can reduce the chances of hiring unsuitable candidates who may harm the company’s reputation, security, or legal standing.

ExactBackgroundChecks offers various services tailored to meet the needs of businesses across industries, including:

- Criminal Background Checks: Mitigating the risk of hiring employees with a history of criminal activity that could impact the workplace or company reputation.

- Employment Verification: Ensuring that candidates possess the skills and experience they claim, reducing the risk of hiring individuals who may be unqualified.

- Reference Checks: Verifying past employment references to confirm a candidate’s professional integrity.

- Credit Checks: For positions involving financial responsibility, checking an individual’s credit history can help mitigate the risk of fraud or financial mismanagement.

By using ExactBackgroundChecks.com as a risk mitigation tool, businesses can make more informed hiring decisions and avoid potential issues that could affect productivity, safety, and legal compliance.

Risk Mitigation Tools Comparison Table

| Tool Category | Tool Example(s) | Key Features | Benefits | Use Case |

|---|---|---|---|---|

| Cybersecurity Tools | Cisco ASA, Palo Alto Networks | Intrusion detection, firewalls | Prevent unauthorized access, threat detection | Protects customer data in financial institutions |

| Financial Tools | Kyriba, Moody’s CreditLens | Hedging, credit risk assessment | Mitigates financial risks, secures profits | Reduces exposure to currency fluctuations in multinational companies |

| Operational Tools | SAP S/4HANA, Oracle ERP Cloud | Data centralization, automation | Increases operational efficiency, reduces errors | Streamlines operations in manufacturing companies |

| Legal & Compliance Tools | LogicGate, OneTrust | Compliance tracking, data privacy | Ensures legal compliance, minimizes fines | Assists fintech companies in adhering to financial regulations |

| Hiring & Employment Tools | ExactBackgroundChecks | Criminal background checks, reference verification | Reduces hiring risks, ensures qualified candidates | Prevents hiring unsuitable employees in all sectors |