How to Choose the Best Identity Verification Software

Introduction to Identity Verification Software: What Is It and Why It Matters?

Identity verification software refers to a digital tool designed to authenticate the identity of individuals, ensuring they are who they claim to be. This process is essential in today’s digital world, where online transactions, services, and communication have become the norm. The software uses various methods such as biometric recognition, document verification, and behavioral analysis to verify the identity of users, enhancing security and trust in online platforms.

By leveraging sophisticated algorithms and technologies, identity verification software helps businesses prevent fraud, protect sensitive data, and meet regulatory requirements. These solutions are widely adopted across multiple industries, including financial services, healthcare, e-commerce, and the sharing economy, to verify users during account creation, transactions, or service access.

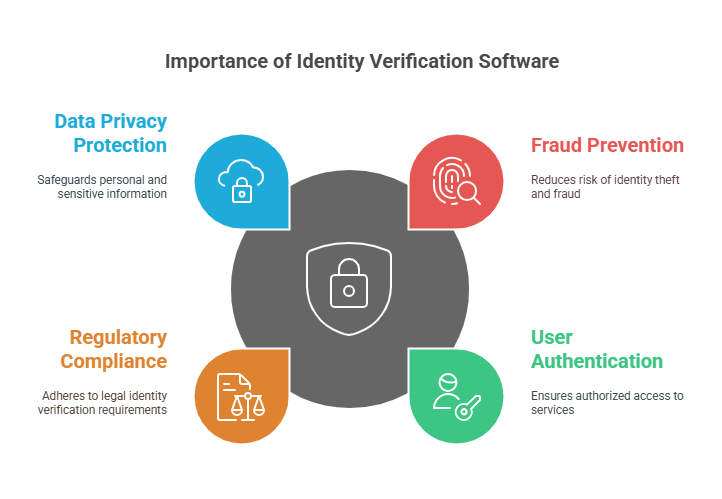

Why Is Identity Verification Software Important?

The rise of digital services and online transactions has increased the risk of fraud, identity theft, and unauthorized access to sensitive information. This has made identity verification a crucial aspect of online security for both businesses and consumers. Here are several key reasons why businesses rely on identity verification software:

- Fraud Prevention: Fraudulent activities such as identity theft, account takeovers, and fake account creation have become prevalent in online environments. By using identity verification software, businesses can ensure that the individual accessing their services is indeed the person they claim to be. This helps minimize the risk of fraud and protects both the business and its customers from financial and reputational damage.

- User Authentication: Identity verification software helps businesses authenticate users, ensuring that only authorized individuals can access sensitive information, make transactions, or use services. This is particularly important for online banking, e-commerce, healthcare services, and other platforms where privacy and security are paramount.

- Regulatory Compliance: In many industries, businesses are legally required to verify the identity of their customers to comply with various laws and regulations. For example, in the financial sector, regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML) laws require businesses to verify the identity of their clients to prevent fraud and illegal activities. Failure to comply with such regulations can lead to hefty fines and damage a business’s reputation.

- Protecting Data Privacy: With an increasing amount of personal data being shared online, protecting user privacy is more important than ever. Identity verification software ensures that only the right individuals are granted access to private and sensitive data, thus minimizing the risk of data breaches.

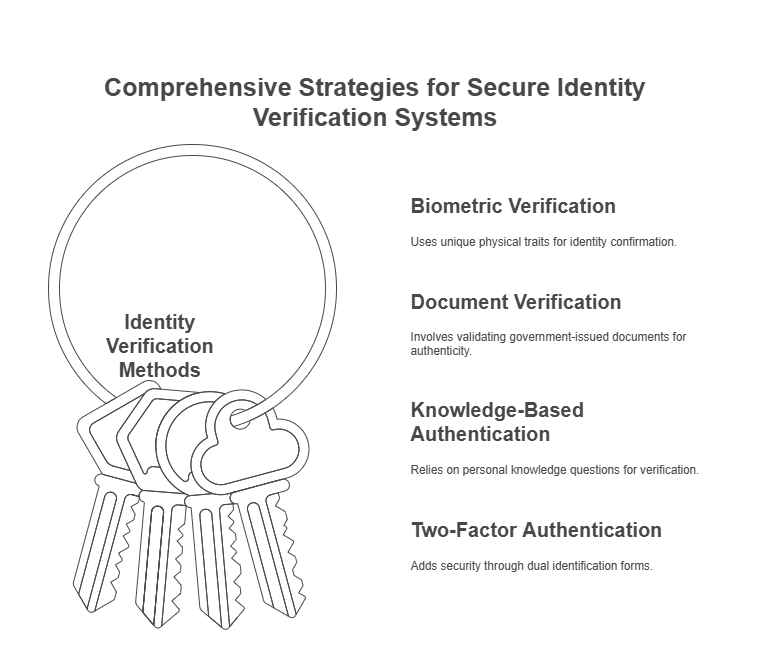

Common Types of Identity Verification Methods

There are several methods used in identity verification, each designed to provide a different level of security and convenience for businesses and consumers. The most common types of identity verification methods include:

- Biometric Verification:

- Facial Recognition: One of the most popular biometric methods, facial recognition uses unique facial features to verify a person’s identity. This technology analyzes various points on the face, such as the distance between the eyes or the shape of the jawline, to match the individual against a database of images.

- Fingerprint Scanning: Another widely used biometric method, fingerprint scanning compares the unique ridges and patterns on a person’s finger with stored data to confirm their identity.

- Voice Recognition: Voice-based identity verification analyzes the unique patterns in a person’s voice to confirm their identity. This method is often used in call centers or for phone-based authentication.

- Document Verification:

- Document-based verification involves scanning and validating government-issued documents such as passports, driver’s licenses, or national ID cards. The software ensures that the document is authentic, hasn’t been tampered with, and matches the information provided by the individual.

- Optical Character Recognition (OCR) is commonly used in document verification to read and extract information from documents, making the process faster and more accurate.

- Knowledge-Based Authentication (KBA):

- KBA is a method in which users are asked a series of security questions based on their personal information. For example, questions might include the name of a previous employer or the address of a past residence. While KBA can be an effective method, it is less secure than biometrics and is more prone to social engineering attacks.

- Two-Factor Authentication (2FA):

- Two-factor authentication (2FA) adds an extra layer of security by requiring two forms of identification: something the user knows (like a password) and something the user has (such as a mobile phone or authentication app). 2FA is commonly used in combination with other identity verification methods to ensure higher levels of security.

Why Businesses Use Identity Verification Software

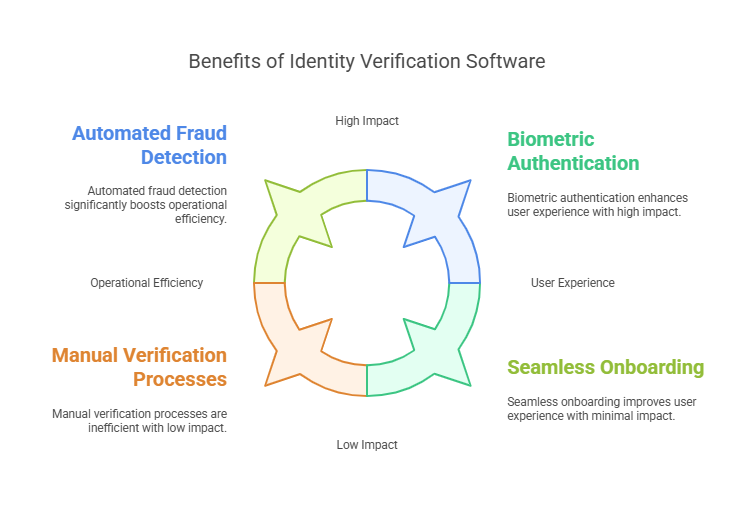

Identity verification software plays a crucial role in helping businesses maintain security, comply with regulations, and enhance user experience. Here’s why businesses choose to implement this technology:

- Fraud Prevention: Fraud is a major concern for businesses, especially in industries like finance, e-commerce, and healthcare. Identity verification software helps to ensure that only legitimate users are accessing accounts, making transactions, or using services. This is essential for protecting both financial assets and customer data.

- Enhanced User Experience: Consumers expect seamless, frictionless experiences when engaging with online platforms. Identity verification software allows businesses to offer a smooth user experience by enabling quick and accurate authentication. Methods like biometric authentication provide fast and user-friendly solutions that improve customer satisfaction.

- Cost Savings: Manual identity verification processes can be time-consuming and expensive. By automating the process with identity verification software, businesses can reduce operational costs, improve efficiency, and allocate resources to other areas of their operations.

- Regulatory Compliance: For businesses operating in highly regulated sectors, identity verification software is necessary to ensure compliance with laws like KYC, AML, and GDPR (General Data Protection Regulation). This helps businesses avoid penalties and reputational damage while fostering trust with customers by demonstrating their commitment to privacy and security.

Benefits for Businesses and Consumers

For businesses, the advantages of using identity verification software include:

- Improved Security: Protects businesses from fraud, unauthorized access, and data breaches.

- Regulatory Compliance: Ensures businesses comply with laws and industry standards, avoiding penalties.

- Increased Operational Efficiency: Reduces the time and cost involved in manual identity verification processes, allowing businesses to focus on other critical tasks.

For consumers, identity verification software offers the following benefits:

- Convenience: Simplifies the process of verifying identity, making it quicker and easier for users to access services.

- Enhanced Privacy: Secure handling of personal data and protection against identity theft.

- Trust and Confidence: Consumers feel more confident engaging with businesses that prioritize security and protect their data.

Best Identity Verification Software: Top Providers and Features

In today’s digital world, the need for secure and efficient identity verification is greater than ever. Fortunately, numerous identity verification software providers are available, offering innovative solutions to meet the growing demand for security and compliance. In this section, we’ll explore some of the best identity verification software providers, discuss their key features, and explain why they stand out in the market. We will also highlight ExactBackgroundChecks.com and their identity verification services, which help businesses reduce employment-related risks as part of their background check solutions.

Top Identity Verification Software Providers

Here’s a list of the top identity verification software providers, each offering a unique set of features tailored to different business needs:

1. Jumio

Jumio is a leader in identity verification and offers a wide range of services, including biometric verification, document verification, and fraud prevention. It uses artificial intelligence (AI) and machine learning (ML) algorithms to perform real-time identity verification, ensuring accuracy and efficiency.

Key Features:

- Biometric Authentication: Jumio uses facial recognition technology to match the user’s face with the photo on their ID document.

- Document Verification: Supports the verification of government-issued IDs, passports, and driver’s licenses, with OCR to extract and validate information.

- AML/KYC Compliance: Helps businesses comply with anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Global Coverage: Jumio operates in over 200 countries and supports various languages and ID documents from around the world.

Why It Stands Out: Jumio is known for its high accuracy and speed, making it ideal for industries that require quick, secure user verification, such as finance, e-commerce, and healthcare.

2. Onfido

Onfido provides a comprehensive identity verification platform with a focus on security and ease of integration. The company offers a combination of biometric and document verification methods, making it a popular choice for businesses looking to streamline the onboarding process.

Key Features:

- Facial Recognition: Onfido’s AI-driven facial recognition system matches selfies with ID photos.

- Document Authentication: Verifies passports, driver’s licenses, and other government-issued IDs.

- AML/KYC Compliance: Ensures businesses meet regulatory requirements, particularly in the finance and fintech sectors.

- Mobile Integration: Onfido provides mobile-friendly solutions, allowing businesses to offer an easy verification process via smartphones.

Why It Stands Out: Onfido is well-regarded for its seamless integration with existing business systems, and its highly customizable solutions allow companies to tailor the verification process to their specific needs.

3. Veriff

Veriff is another leading provider of identity verification services that leverages AI and machine learning to verify users’ identities quickly and accurately. Veriff is known for its user-friendly interface and the high level of security it provides to businesses looking to protect sensitive data.

Key Features:

- Facial Recognition and Liveness Detection: Veriff’s facial recognition software includes advanced liveness detection to ensure that the user is physically present during the verification process.

- Document Authentication: Verifies documents such as IDs, passports, and utility bills using OCR and image analysis.

- Global Coverage: Supports identity verification for users from over 190 countries.

- Fraud Detection: Veriff’s software includes fraud detection tools that identify suspicious activity and prevent fraudulent access.

Why It Stands Out: Veriff excels in providing a high level of security while offering a fast and user-friendly experience, making it an ideal choice for businesses in industries like online gaming, fintech, and travel.

4. IDnow

IDnow offers a comprehensive identity verification platform with a focus on regulatory compliance and high-security standards. IDnow provides businesses with solutions for both online and in-person identity verification.

Key Features:

- Video Identification: IDnow’s video identification feature allows users to verify their identity by video call with a trained agent, providing a higher level of security.

- Document Verification: Provides automated document verification, including OCR and checks for document authenticity.

- KYC Compliance: Ensures compliance with KYC and AML regulations, especially for financial institutions.

- Security Features: IDnow uses advanced encryption and multi-factor authentication (MFA) to secure the identity verification process.

Why It Stands Out: IDnow is particularly favored by regulated industries such as banking and financial services because of its strong focus on compliance and robust security features.

5. ExactBackgroundChecks.com

While the other providers are known for their extensive identity verification services, ExactBackgroundChecks.com specializes in offering identity verification as part of its comprehensive background check solutions for businesses. Their services are specifically tailored for the employment sector, ensuring businesses can screen candidates thoroughly before making hiring decisions.

Key Features:

- Identity Verification for Employment: ExactBackgroundChecks.com verifies the identity of job candidates through document verification and biometric authentication to prevent hiring fraud.

- Comprehensive Background Checks: Along with identity verification, ExactBackgroundChecks.com offers criminal background checks, employment history verification, and drug testing.

- Easy Integration: Their platform integrates seamlessly with existing HR systems, making it easy for businesses to incorporate identity verification into the hiring process.

- Customizable Solutions: ExactBackgroundChecks.com offers customizable identity verification packages that can be tailored to suit the specific needs of businesses across various industries.

Why It Stands Out: ExactBackgroundChecks.com is ideal for companies that want to mitigate employment-related risks by ensuring that all candidates undergo thorough identity verification as part of the hiring process. Their focus on the employment sector and the ability to offer a full suite of background check services makes them a one-stop solution for employers looking to hire securely.

Comparison Table: Key Providers and Features

| Provider | Key Features | Best For |

|---|---|---|

| Jumio | Biometric authentication, document verification, AML/KYC compliance, global coverage | Financial services, healthcare, e-commerce |

| Onfido | Facial recognition, document authentication, mobile integration, AML/KYC compliance | Fintech, sharing economy, mobility |

| Veriff | Facial recognition, liveness detection, global coverage, fraud detection | Online gaming, travel, fintech |

| IDnow | Video identification, document verification, strong security, KYC compliance | Banking, finance, regulated industries |

| ExactBackgroundChecks | Employment-focused identity verification, criminal background checks, customizable solutions | Employers, HR departments, recruitment |

Why Choosing the Right Identity Verification Software Matters

The right identity verification software is essential to ensuring secure transactions, user trust, and compliance with regulations. While providers like Jumio, Onfido, and Veriff offer excellent solutions for a wide range of industries, ExactBackgroundChecks stands out for businesses specifically focused on employment screening. By leveraging these tools, businesses can streamline their processes, reduce risks, and ensure that they’re hiring only qualified and legitimate candidates.

Legal Aspects, FAQs, and Conclusion

When implementing identity verification software, businesses must ensure they meet various legal and regulatory requirements to avoid potential legal challenges. In this section, we will discuss the legal aspects that businesses should consider when using identity verification software, focusing on data privacy laws, industry regulations, and compliance. Additionally, we will address common frequently asked questions (FAQs) related to identity verification software, including concerns about security, data protection, and integration.

Legal Considerations for Using Identity Verification Software

As identity verification software involves the collection and processing of sensitive personal information, it is essential for businesses to understand and comply with various data protection laws and regulations. Here are the key legal considerations to keep in mind when using identity verification software:

1. General Data Protection Regulation (GDPR)

The General Data Protection Regulation (GDPR) is one of the most important data protection laws in the European Union (EU), applicable to any business that collects or processes personal data from EU citizens, regardless of where the business is located. GDPR mandates strict rules on how businesses should collect, store, and use personal data.

Key requirements include:

- Informed Consent: Businesses must obtain explicit consent from individuals before processing their personal data.

- Data Minimization: Only the necessary data should be collected, and businesses must limit how long data is stored.

- Transparency: Individuals must be informed about how their data will be used.

- Data Security: Businesses must implement adequate security measures to protect personal data.

Identity verification software providers, such as Jumio, Onfido, and ExactBackgroundChecks.com, should offer features that align with GDPR requirements, including secure data encryption, secure storage, and the ability to manage consent from users.

2. California Consumer Privacy Act (CCPA)

The California Consumer Privacy Act (CCPA) applies to businesses operating in California and provides California residents with the right to access, delete, and opt out of the sale of their personal information. For businesses using identity verification software, compliance with the CCPA involves ensuring that users have access to their data and can request its deletion.

Key CCPA requirements include:

- Transparency: Businesses must disclose what personal data they collect and how it is used.

- Consumer Rights: California residents can request to access, delete, or opt out of the sale of their personal data.

- Data Security: Businesses must implement reasonable security measures to protect consumers’ personal data.

By using identity verification software that prioritizes user consent and data security, businesses can ensure compliance with CCPA and protect consumer privacy.

3. Industry-Specific Regulations (KYC, AML)

Certain industries, such as financial services and healthcare, are governed by specific regulations like Know Your Customer (KYC) and Anti-Money Laundering (AML). These regulations require businesses to verify the identity of their customers to prevent fraud, money laundering, and other illegal activities.

- KYC: Ensures businesses verify the identity of their clients before providing services. Identity verification software helps businesses automate this process, ensuring compliance with KYC regulations.

- AML: Requires businesses to monitor financial transactions to detect suspicious activity. Identity verification software providers often offer AML-compliant solutions to identify and report suspicious users or activities.

For companies in regulated industries, choosing identity verification software that includes built-in compliance with KYC and AML requirements is essential.

FAQs About Identity Verification Software

Here are some frequently asked questions about identity verification software, along with their answers:

How does identity verification software ensure data privacy and security?

Identity verification software ensures data privacy and security by using advanced encryption methods, secure data storage, and compliance with data protection regulations like GDPR and CCPA. Providers often implement multi-factor authentication (MFA), facial recognition, and liveness detection to reduce the risk of fraud and protect users’ personal data. Additionally, businesses are required to follow best practices, including regularly auditing their data security measures.

What are the legal requirements for using identity verification software in different industries?

The legal requirements for using identity verification software vary depending on the industry and region. For example, businesses in financial services must comply with KYC and AML regulations, while those operating in the EU must adhere to GDPR guidelines. The key is ensuring that the software provider meets industry-specific compliance standards and offers secure solutions that protect users’ personal data.

How does identity verification software prevent fraud in online transactions?

Identity verification software prevents fraud by verifying that users are who they claim to be. It uses biometric data (e.g., facial recognition), document verification, and liveness detection to ensure that the person submitting the identity is physically present. Many providers also incorporate fraud detection tools that monitor suspicious activity, helping businesses detect and prevent fraudulent transactions in real-time.

Can identity verification software be integrated into existing business systems?

Yes, most identity verification software solutions are designed to integrate seamlessly with existing business systems, such as Customer Relationship Management (CRM) tools, payment systems, and HR platforms. This integration allows businesses to streamline their verification processes, improve user experience, and maintain data security across all systems. Solutions like Onfido and ExactBackgroundChecks.com offer flexible integration options to meet the needs of various industries.

What should businesses consider when selecting identity verification software for compliance?

When selecting identity verification software, businesses should consider factors such as:

- Regulatory Compliance: Ensure that the software complies with industry-specific regulations (e.g., KYC, AML, GDPR).

- Security Features: Look for features such as encryption, multi-factor authentication, and fraud detection to protect users’ data.

- Ease of Integration: Choose a solution that integrates easily with existing business systems and workflows.

- User Experience: Opt for a platform that offers a seamless and user-friendly experience for both businesses and their customers.

- Customer Support: Choose a provider that offers reliable customer support in case of issues or concerns.

How does identity verification software ensure data privacy and security?

Identity verification software ensures data privacy and security by using advanced encryption methods, secure data storage, and compliance with data protection regulations like GDPR and CCPA. Providers often implement multi-factor authentication (MFA), facial recognition, and liveness detection to reduce the risk of fraud and protect users’ personal data. Additionally, businesses are required to follow best practices, including regularly auditing their data security measures.

What are the legal requirements for using identity verification software in different industries?

The legal requirements for using identity verification software vary depending on the industry and region. For example, businesses in financial services must comply with KYC and AML regulations, while those operating in the EU must adhere to GDPR guidelines. The key is ensuring that the software provider meets industry-specific compliance standards and offers secure solutions that protect users’ personal data.

How does identity verification software prevent fraud in online transactions?

Identity verification software prevents fraud by verifying that users are who they claim to be. It uses biometric data (e.g., facial recognition), document verification, and liveness detection to ensure that the person submitting the identity is physically present. Many providers also incorporate fraud detection tools that monitor suspicious activity, helping businesses detect and prevent fraudulent transactions in real-time.

Can identity verification software be integrated into existing business systems?

Yes, most identity verification software solutions are designed to integrate seamlessly with existing business systems, such as Customer Relationship Management (CRM) tools, payment systems, and HR platforms. This integration allows businesses to streamline their verification processes, improve user experience, and maintain data security across all systems. Solutions like Onfido and ExactBackgroundChecks.com offer flexible integration options to meet the needs of various industries.

What should businesses consider when selecting identity verification software for compliance?

When selecting identity verification software, businesses should consider factors such as:

- Regulatory Compliance: Ensure that the software complies with industry-specific regulations (e.g., KYC, AML, GDPR).

- Security Features: Look for features such as encryption, multi-factor authentication, and fraud detection to protect users’ data.

- Ease of Integration: Choose a solution that integrates easily with existing business systems and workflows.

- User Experience: Opt for a platform that offers a seamless and user-friendly experience for both businesses and their customers.

- Customer Support: Choose a provider that offers reliable customer support in case of issues or concerns.

Conclusion

In conclusion, identity verification software plays a critical role in enhancing security, preventing fraud, and ensuring compliance with regulatory requirements across various industries. By choosing the best identity verification software, businesses can safeguard their operations, protect customer data, and maintain compliance with privacy laws such as GDPR and CCPA. Whether you’re in financial services, e-commerce, or human resources, selecting the right identity verification solution—like Jumio, Onfido, or ExactBackgroundChecks.com—is essential for secure and seamless operations.