Understanding the Importance of Loss of Income Forms

Introduction to Loss of Income Forms

A loss of income form is an official document used to report a reduction or cessation of an individual’s income. It is required in various situations where individuals need to provide proof of income loss. This form serves as a formal declaration of income reduction, often used to apply for financial assistance, loans, unemployment benefits, or insurance claims.

When a person experiences a significant reduction in their income—due to job loss, illness, disability, or other circumstances—the form helps verify their situation and supports their eligibility for financial assistance programs or benefits.

Why is a Loss of Income Form Required?

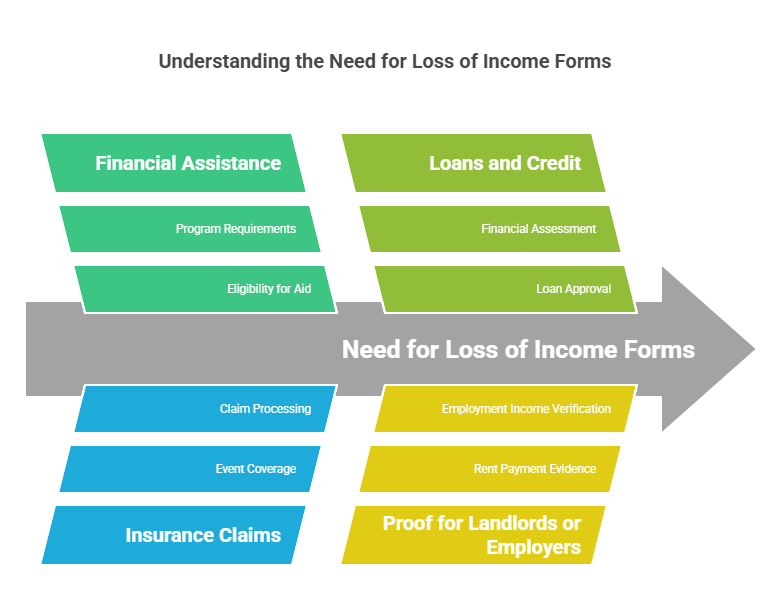

Loss of income forms are crucial for several reasons:

- Financial Assistance: Government programs or charitable organizations may require a loss of income form to evaluate eligibility for financial aid. This could include unemployment benefits, food assistance, or disaster relief.

- Insurance Claims: If an individual’s income loss is due to an event covered by insurance (e.g., a car accident, illness, or disability), an insurance company may require the form to process a claim.

- Loans and Credit: In times of income loss, individuals may apply for loans or credit, and financial institutions may request a loss of income form to assess the applicant’s financial situation.

- Proof for Landlords or Employers: If someone needs to show they can’t pay rent or maintain their previous income levels, they may need a loss of income form to provide evidence to landlords or potential employers.

Types of Situations Requiring a Loss of Income Form

A loss of income form may be required in the following scenarios:

| Situation | Purpose of Loss of Income Form |

|---|---|

| Unemployment Benefits | To confirm the loss of income due to unemployment. |

| Disability Claims | To verify income loss caused by illness or disability. |

| Insurance Claims | To provide evidence of income reduction for claims. |

| Government Assistance Programs | To assess eligibility for food stamps, housing benefits, etc. |

| Loan Applications | To justify the need for a loan due to loss of income. |

| Tax Relief or Deferred Payment | To request relief from taxes or delayed payments based on income loss. |

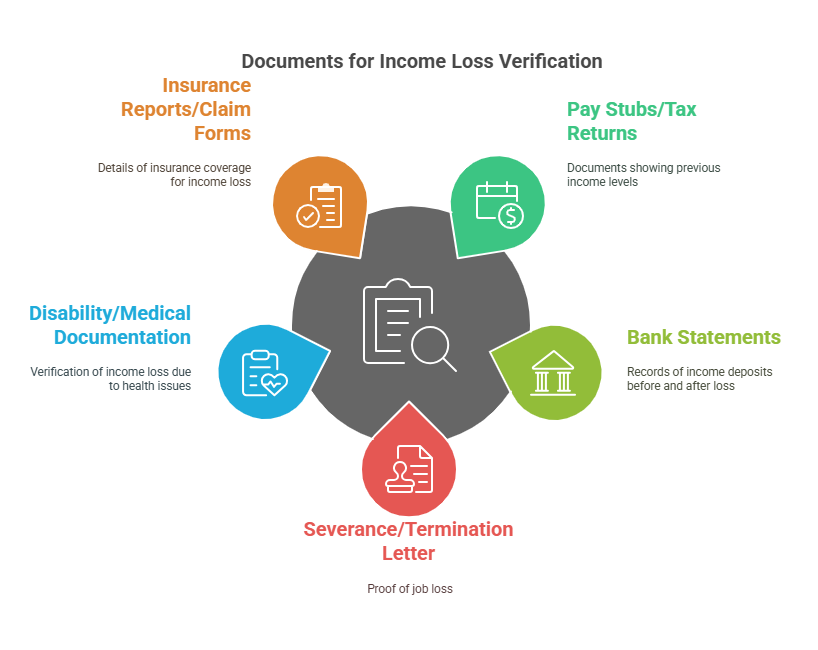

Income Verification Documents Required

To accompany a loss of income form, you may be required to provide additional verification of income loss. These documents might include:

- Pay stubs or tax returns: Proof of previous income before the loss occurred.

- Bank statements: To show income deposits prior to and after the loss.

- Severance or termination letter: For job loss verification.

- Disability or medical leave documentation: To confirm loss due to illness or injury.

- Insurance reports or claim forms: If the income loss is covered by an insurance policy.

Key Information Typically Included in a Loss of Income Form

A well-structured loss of income form typically includes the following details:

| Information Section | Details Included |

|---|---|

| Personal Information | Full name, contact details, and social security number (SSN). |

| Reason for Income Loss | Job loss, medical reasons, accident, or other circumstances. |

| Date of Income Loss | The date when the income loss occurred or began. |

| Previous Income Level | The amount of income prior to the loss (usually last 3-6 months). |

| Duration of Income Loss | Estimated time period for which the income will be lost. |

| Current Employment Status | Whether the individual is actively seeking work or temporarily unable to work. |

| Supporting Documents | Any required income verification documents such as pay stubs, tax returns, etc. |

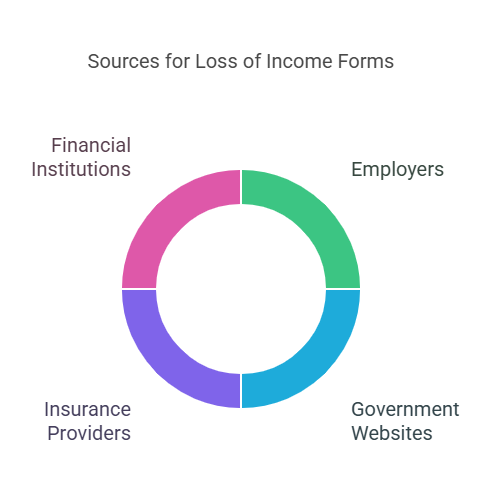

Where to Obtain a Loss of Income Form

Obtaining a loss of income form depends on the institution or entity requiring it. Here are some typical sources:

- Employers: If the income loss is due to job termination, furlough, or disability leave, your employer may provide you with an official letter or a form for income verification. If no specific form is provided, you can usually request a standard employment verification letter.

- Government Websites: Some government assistance programs, such as unemployment benefits or disability assistance, have downloadable loss of income forms available on their official websites.

- Insurance Providers: For those applying for insurance claims, the insurance company may provide a loss of income form or a similar claim submission form.

- Financial Institutions: Banks or credit lenders may have their own forms to verify income loss when applying for financial aid or loans during periods of income hardship.

How to Complete the Loss of Income Form

Filling out a loss of income form requires attention to detail, as the information you provide will determine whether your application for assistance, benefits, or a claim is successful. Here are the steps:

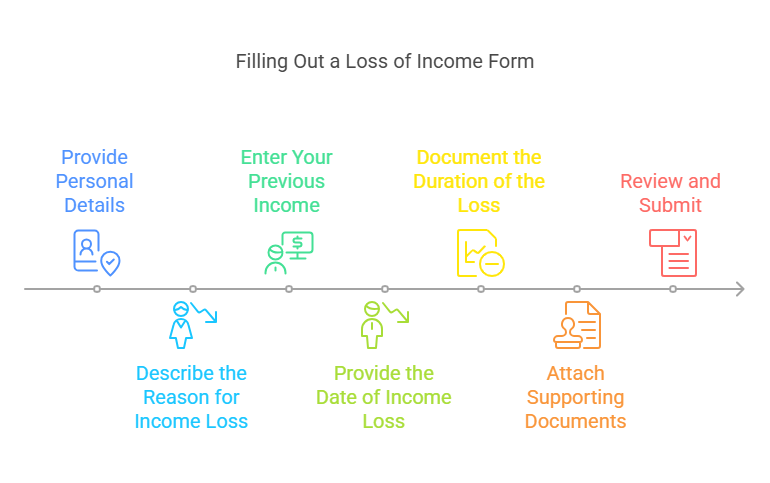

Step-by-Step Instructions for Filling Out a Loss of Income Form

- Provide Personal Details:

Include your full name, contact information, social security number (SSN), and any other requested identification information. Be accurate to avoid delays. - Describe the Reason for Income Loss:

Clearly explain why your income has been reduced or stopped. If the reason is medical, attach any doctor’s notes or medical records to support your claim. - Enter Your Previous Income:

List the amount of income you were earning prior to the loss. This can include wages, salary, or other sources of income such as freelance work, rental income, or business profits. - Provide the Date of Income Loss:

Enter the exact date when your income loss occurred. This is important for determining eligibility for benefits, as some programs require proof of recent income loss. - Document the Duration of the Loss:

Estimate how long you expect to experience the income loss. Some programs may offer short-term assistance, while others may provide extended benefits. - Attach Supporting Documents:

Include all necessary supporting documents such as pay stubs, tax returns, bank statements, termination letters, and medical reports. Make sure they are legible and up to date. - Review and Submit:

Double-check your form for any errors before submitting. Ensure that all sections are filled out completely, and submit the form to the appropriate authority or agency.

How ExactBackgroundChecks.com Can Help

At ExactBackgroundChecks.com, we specialize in providing verification services to both individuals and businesses. We can help individuals by:

- Verifying income for loss of income forms, ensuring that the documentation you provide is accurate and credible.

- Assisting businesses in completing income verification forms or other necessary documents related to financial assistance.

- Providing fast, reliable, and compliant services for completing loss of income forms, helping you save time and avoid errors.

Legal Aspects of Submitting a Loss of Income Form

When submitting a loss of income form, it’s essential to be aware of the legal requirements to ensure your submission is valid and your rights are protected:

1. Privacy and Data Protection

Loss of income forms often require the submission of sensitive personal and financial information. As such, it’s critical that this data is handled with care. Ensure that the institution or entity requesting the form has appropriate privacy protection protocols in place to safeguard your information. The Fair Credit Reporting Act (FCRA) and other privacy laws may govern how your personal data is used and stored.

2. Truthful Reporting

It’s important to report your income loss accurately. Providing false or misleading information on a loss of income form can result in delays, denial of benefits, or even legal penalties. Always ensure that the documentation you provide supports the information on the form.

3. Compliance with Specific Program Requirements

Different assistance programs and insurance policies may have different requirements for verifying income loss. Be sure to review the program’s guidelines thoroughly before submitting the form, as each may have unique eligibility criteria and documentation requests.

Frequently Asked Questions (FAQs)

What is the typical processing time for a loss of income form?

Processing times can vary depending on the institution or program. It typically takes anywhere from a few days to several weeks, depending on the complexity of the case and the volume of applications.

Do I need to provide proof of income loss when submitting the form?

Yes, most programs and services require supporting documentation to verify your claim, such as pay stubs, bank statements, or a termination letter.

Can I submit the form digitally?

Yes, many institutions allow digital submission of loss of income forms via email, web portals, or online applications. Be sure to check the submission guidelines.

What should I do if there is a mistake on the loss of income form?

If you notice an error, contact the relevant authority immediately to rectify the mistake. Some programs may allow you to submit a corrected form.

Is a loss of income form required for all types of financial assistance?

While not all programs require a loss of income form, it is common for government benefits, insurance claims, and loan applications to ask for this form as part of the application process.

Conclusion

Loss of income forms play a vital role in helping individuals access financial assistance, insurance benefits, and loans during times of income hardship. Ensuring accuracy and providing the necessary documentation will streamline the process, allowing you to receive the support you need. By following the steps outlined in this guide and utilizing services like ExactBackgroundChecks, individuals and businesses can navigate the complexities of loss of income verification with confidence.