How to Understand Bankruptcies on Background Check

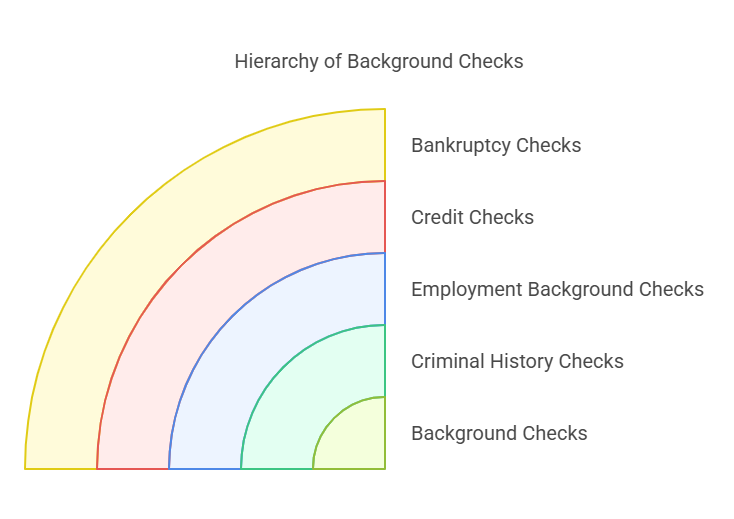

What is a Background Check?

A background check is an investigative process used by employers, landlords, and other entities to assess the history of an individual. Background checks typically seek to verify details such as employment history, criminal activity, creditworthiness, and legal matters. These checks provide essential insights into a person’s character and reliability, helping organizations make informed decisions.

The importance of background checks has grown across various industries. Employers use them to ensure that candidates are trustworthy, while landlords conduct checks to assess potential tenants’ ability to pay rent. Additionally, lenders use background checks to assess the financial stability of loan applicants.

Types of Background Checks

There are several types of background checks commonly used, each focusing on different aspects of an individual’s history. Below are the most common types:

- Criminal History Checks: These checks look into an individual’s criminal background to determine whether they have been convicted of any crimes, including felonies or misdemeanors.

- Employment Background Checks: These checks verify a person’s employment history, qualifications, and professional conduct.

- Credit Checks: A credit background check reviews a person’s financial behavior, including credit score, debt, and payment history. This check is particularly common in the hiring process for positions that involve financial responsibilities.

- Bankruptcy Checks: A bankruptcy background check specifically searches for records related to bankruptcy filings, which can indicate an individual’s financial struggles.

These checks are conducted by employers, landlords, and other organizations to evaluate an individual’s qualifications, financial stability, and risk factors associated with trustworthiness.

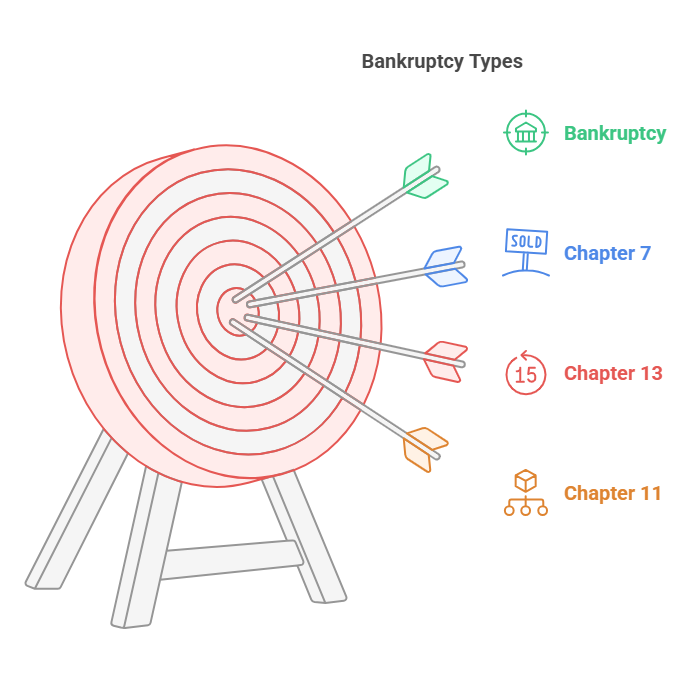

What is Bankruptcy?

Bankruptcy is a legal process that provides individuals or businesses with relief from their financial debts when they are unable to pay them. There are several types of bankruptcy filings, and each type has different implications for an individual’s finances and creditworthiness. Bankruptcy filings are public records, meaning they are available for review by credit reporting agencies, potential employers, and others conducting background checks.

There are three main types of bankruptcy for individuals:

- Chapter 7 Bankruptcy: This is often referred to as “liquidation” bankruptcy. It involves the sale of an individual’s non-exempt assets to pay off creditors. Once this process is complete, the individual’s remaining eligible debts are discharged, meaning they are no longer required to be paid. Chapter 7 bankruptcies generally remain on an individual’s credit report for up to 10 years.

- Chapter 13 Bankruptcy: Also known as a “wage earner’s plan,” Chapter 13 allows individuals to keep their property while they repay their debts over a period of three to five years. Chapter 13 bankruptcies stay on a credit report for up to seven years.

- Chapter 11 Bankruptcy: This type of bankruptcy is typically used by businesses, but individuals with significant debts may also file for Chapter 11. It allows the debtor to reorganize their business or personal finances and develop a plan to repay creditors. Chapter 11 remains on a credit report for up to 10 years.

While bankruptcy can offer relief from overwhelming debts, it can also significantly affect an individual’s financial standing and credit history.

Do Bankruptcies Show Up on Background Checks?

Bankruptcies are typically visible on background checks, but they may appear in different contexts and to varying degrees depending on the type of check being performed. The disclosure of bankruptcy information is governed by laws that vary based on jurisdiction, the type of background check, and the length of time that has passed since the bankruptcy was filed.

Generally speaking, bankruptcies will show up on the following types of background checks:

- Credit Report: Bankruptcy filings are often included on an individual’s credit report. This is especially true for Chapter 7 and Chapter 13 bankruptcies, which impact the person’s credit score and history. Bankruptcy will usually remain on a credit report for several years, depending on the type of filing.

- Employment Background Checks: Employers may check an individual’s credit history as part of an employment background check, particularly for positions involving financial responsibilities. In these cases, bankruptcy information may appear if the employer checks the individual’s credit report.

- Public Record Search: Bankruptcy filings are a matter of public record. In certain background checks, especially those related to legal or financial positions, the public record may reveal bankruptcy filings.

While bankruptcies are generally accessible to those conducting background checks, there are some situations where bankruptcy information may not show up:

- Time Limitations: Bankruptcies have a limited lifespan on credit reports, usually between 7-10 years. After this period, they may no longer appear on background checks unless they are accessed through public records.

- Type of Check: A criminal background check does not include bankruptcy information because bankruptcy is not a criminal offense. Similarly, if a background check is focused solely on employment history or criminal activity, bankruptcy information may not be included.

It is important to note that, although bankruptcy records are accessible, not all employers or organizations conducting background checks will review bankruptcy filings unless it is relevant to the position or role.

How Bankruptcy Affects Your Credit and Financial Record

A bankruptcy filing can have a significant impact on an individual’s financial standing, particularly regarding credit scores and future borrowing. The effects vary depending on the type of bankruptcy filed:

- Impact of Chapter 7 Bankruptcy: Chapter 7 bankruptcies usually result in a substantial drop in credit scores, as they involve the liquidation of assets and the discharge of unsecured debts. However, once the bankruptcy process is complete, individuals may begin rebuilding their credit over time.

- Impact of Chapter 13 Bankruptcy: Although Chapter 13 bankruptcies also affect credit scores, individuals may have the opportunity to keep their property and repay debts over time. As a result, the long-term credit impact may be less severe compared to Chapter 7.

It is important for individuals to understand that while bankruptcy may be legally discharged, it may still impact their ability to obtain credit, secure a loan, or even land certain jobs due to the appearance of bankruptcy on background checks.

Factors That Influence Bankruptcy Disclosure on Background Checks

Whether a bankruptcy shows up on a background check depends on several factors. These include the type of background check being performed, the time that has passed since the bankruptcy filing, and the specific regulations governing bankruptcy disclosures. Below, we’ll explore these factors in detail.

Type of Background Check

The type of background check being performed plays a crucial role in determining whether bankruptcy records are included. Different types of background checks focus on different aspects of a person’s history, and bankruptcy may or may not be relevant in each case. The key types of background checks that may reveal bankruptcy information are:

- Credit Report Checks:

- Bankruptcy filings are most likely to appear on credit reports. A credit report includes detailed information about an individual’s financial history, including open accounts, outstanding debts, payment history, and any bankruptcy filings.

- A bankruptcy may stay on a credit report for 7 to 10 years, depending on the type of bankruptcy. Chapter 13 bankruptcies typically remain for 7 years, while Chapter 7 bankruptcies can remain for 10 years.

- Employment Background Checks:

- Employment background checks may include a review of an individual’s credit history, especially for positions that involve financial responsibilities, such as accounting, finance, or management roles.

- Although bankruptcy can appear in these checks, it’s important to note that not all employers review credit reports. Even if they do, certain regulations may limit the disclosure of bankruptcy filings. For instance, under the Fair Credit Reporting Act (FCRA), a bankruptcy can only be disclosed in an employment background check if it occurred within the last 7 years.

- Public Records Checks:

- Bankruptcy filings are public records, meaning they are accessible by anyone, including those performing background checks. This type of check can reveal any bankruptcy proceedings, such as Chapter 7, Chapter 13, or Chapter 11 filings.

- Public records checks can show bankruptcies regardless of the time that has passed since the filing. However, depending on state and federal laws, the relevance of this information may be limited, especially if a bankruptcy occurred many years ago.

- Criminal Background Checks:

- A criminal background check will not include bankruptcy records. Bankruptcy is a financial matter, not a criminal one, and as such, it does not appear in criminal history reports.

- If you are undergoing a criminal background check for a job or any other purpose, bankruptcy will not be factored into the decision.

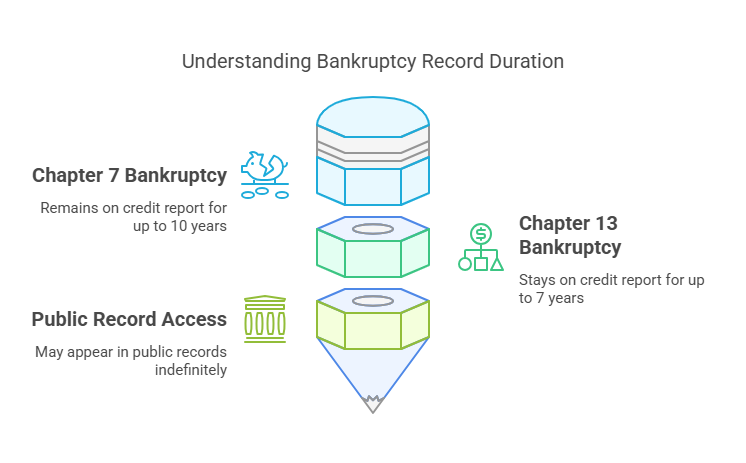

How Long Do Bankruptcies Stay on Your Record?

The length of time bankruptcy stays on a person’s record can influence whether it will show up on background checks. The FCRA (Fair Credit Reporting Act) governs how long bankruptcy and other financial data can be reported, and it specifies the following timeframes:

- Chapter 7 Bankruptcy:

- A Chapter 7 bankruptcy, which involves the liquidation of assets and discharge of debts, remains on your credit report for up to 10 years.

- Although it will remain on your credit report for this period, many lenders and employers may not consider the bankruptcy once it is older, especially if your financial situation has improved since the filing.

- Chapter 13 Bankruptcy:

- A Chapter 13 bankruptcy, which allows for the restructuring of debts and repayment over time, stays on your credit report for up to 7 years.

- Since Chapter 13 bankruptcies typically involve a repayment plan, the long-term impact on your credit may not be as severe as Chapter 7.

- Public Record Access:

- Even though bankruptcy may be removed from credit reports after the designated period (7 or 10 years), it may still appear in public records indefinitely. This is particularly relevant in legal or financial contexts where a person’s bankruptcy history is relevant to the inquiry.

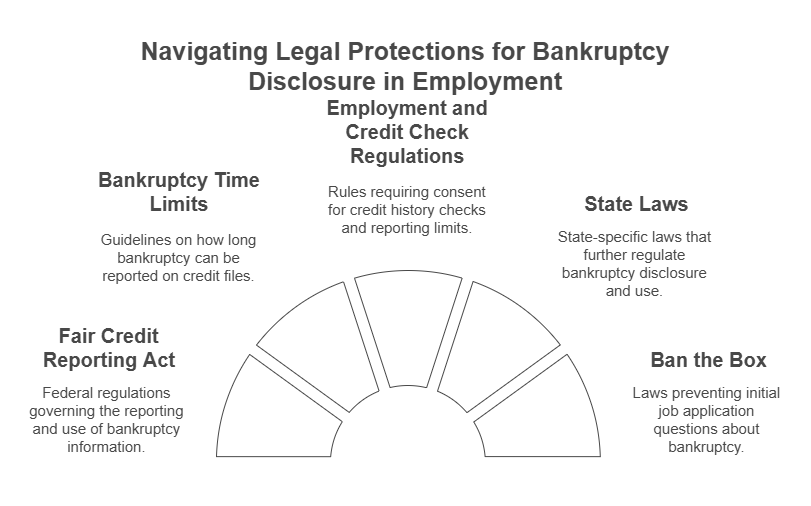

State and Federal Laws Governing Bankruptcy Disclosure

In addition to federal regulations like the Fair Credit Reporting Act (FCRA), there are also state-specific laws that govern the disclosure of bankruptcy information. These laws may affect the way bankruptcy is reported or when it can be disclosed in a background check.

State-Specific Laws:

- Some states have laws that limit when and how bankruptcy information can be shared with employers. For instance, certain Ban the Box laws restrict employers from asking about or considering bankruptcy information until after a job offer has been extended. These laws aim to reduce discrimination and allow candidates to be considered based on their qualifications, rather than financial history.

- State law variations also influence how long bankruptcy information can appear in public records and whether it must be disclosed to potential employers or creditors. For example, in some states, the law may prohibit employers from accessing bankruptcy filings that are older than a certain period.

Federal Laws:

- The FCRA provides a set of federal regulations that govern the reporting of bankruptcy filings. Under this act, a bankruptcy filing cannot appear on a credit report for more than 10 years for Chapter 7 or 7 years for Chapter 13.

- The Consumer Financial Protection Bureau (CFPB) also has regulations regarding how bankruptcy filings are treated by credit reporting agencies, ensuring that they are reported accurately.

Table: Visibility of Bankruptcy Information in Different Types of Background Checks

| Background Check Type | Does It Include Bankruptcy Information? | Duration Bankruptcy Information Appears |

|---|---|---|

| Credit Report Check | Yes, bankruptcy will appear on your credit report. | Chapter 7: Up to 10 years Chapter 13: Up to 7 years |

| Employment Background Check | May include bankruptcy if employer reviews credit report. | Same as credit report duration (Chapter 7: 10 years, Chapter 13: 7 years) |

| Public Record Search | Yes, bankruptcy is a matter of public record. | Can appear indefinitely in public records, depending on state law. |

| Criminal Background Check | No, bankruptcy does not appear in criminal checks. | N/A |

Impact of Bankruptcy on Employment

While bankruptcy may show up on a credit report or public record search, it doesn’t automatically disqualify you from employment. Employers are generally more interested in how you handle your financial situation after the bankruptcy. If you’ve demonstrated responsible financial management post-bankruptcy, it can have less of an impact.

In fact, bankruptcy may only be considered in the hiring process for certain roles, particularly those that involve financial decision-making, such as positions in accounting, finance, or management. In other cases, employers may be more focused on your skills, experience, and qualifications than on your financial history.

It’s important to note that some employers may not check credit reports, particularly for non-financial roles. Additionally, certain laws, such as Ban the Box, may prevent employers from asking about bankruptcy during the early stages of the hiring process.

Legal Aspects Surrounding Bankruptcy Disclosure on Background Checks

The disclosure of bankruptcy filings on background checks is regulated by several key laws designed to protect consumers and ensure transparency while preventing unnecessary discrimination. These laws establish what employers and other entities can access, and how they can use this information.

Fair Credit Reporting Act (FCRA)

One of the most important laws governing the reporting of bankruptcy filings is the Fair Credit Reporting Act (FCRA). This federal law sets guidelines for how credit reporting agencies can collect, use, and share consumer information, including bankruptcy records.

- Bankruptcy Time Limits: Under the FCRA, Chapter 7 bankruptcies can remain on a credit report for up to 10 years, while Chapter 13 bankruptcies are reported for 7 years. This time limit applies regardless of whether the individual has improved their financial standing after the bankruptcy.

- Employment and Credit Check Regulations: If an employer conducts a background check, they must obtain the candidate’s consent before reviewing their credit history, which may include bankruptcy filings. For employment checks, a bankruptcy can only be reported if it occurred within the specified time limits (7 years for Chapter 13 and 10 years for Chapter 7).

- Accuracy of Reporting: The FCRA also ensures that bankruptcy information is reported accurately. Consumers have the right to dispute inaccurate information and request corrections to their credit report, including bankruptcy filings.

State Laws

In addition to the FCRA, state laws also play a role in regulating bankruptcy disclosures. Some states have their own laws limiting how and when bankruptcy information can be accessed or considered during the hiring process.

- Ban the Box: Many states have implemented Ban the Box laws, which prevent employers from asking about bankruptcy (or criminal history) on initial job applications. These laws aim to reduce discrimination and give candidates a fair chance at employment, especially for those who have a bankruptcy on their record.

- Time Limits for Disclosure: Some states also restrict employers from considering bankruptcy filings older than a certain period. For example, in certain states, employers may only consider bankruptcies that occurred within the last 5 years.

- State-Specific Reporting Regulations: States may have additional rules on how bankruptcy filings are reported in public records. For example, some states may require that bankruptcies be expunged or sealed after a certain period, while others might allow them to remain publicly accessible indefinitely.

The Impact of Bankruptcy on Employment Decisions

While bankruptcy filings are public records and may appear on credit reports or public record searches, they do not automatically disqualify individuals from getting hired. Employers are generally more interested in how a candidate has handled their financial situation since the bankruptcy. Some companies may even view bankruptcy as a reflection of a candidate’s resilience and ability to overcome challenges.

However, financial roles (e.g., accounting, banking, or financial advising) may involve more scrutiny, as employers may be concerned about the potential risk of financial mismanagement. In these cases, it is crucial to demonstrate good financial practices after the bankruptcy.

Many employers who perform credit checks will also consider the time passed since the bankruptcy, the applicant’s overall creditworthiness, and any improvements to their financial situation. For non-financial roles, employers are generally less likely to consider bankruptcy filings a significant factor in the hiring decision.

Frequently Asked Questions (FAQs)

How long does bankruptcy stay on my background check?

A bankruptcy can remain on your credit report for up to 10 years for Chapter 7 bankruptcies and 7 years for Chapter 13 bankruptcies. However, public records may show bankruptcy filings indefinitely, depending on state law. For employment background checks, bankruptcy will only be disclosed if it falls within the specified time limits.

Will bankruptcy affect my chances of getting a job?

Bankruptcy may affect your chances of getting a job, particularly in positions that require financial responsibility. However, many employers are more concerned with your qualifications, work experience, and how you’ve managed your finances since the bankruptcy. It’s important to note that Ban the Box laws in many states prevent employers from asking about bankruptcy early in the hiring process.

Can employers see bankruptcy filings on a credit report?

Yes, if the employer performs a credit check, bankruptcy filings may appear. However, not all employers review credit reports, and those who do can only access bankruptcy information within the time limits outlined by the FCRA (7 years for Chapter 13 and 10 years for Chapter 7).

Are there different types of background checks that show bankruptcy?

Yes, bankruptcy can appear in the following types of background checks:

- Credit Report Checks: Bankruptcy will show up as part of your credit history.

- Employment Background Checks: If an employer reviews your credit report, bankruptcy can be disclosed.

- Public Records Checks: Bankruptcy filings are public records, so they may show up in background checks that search public records. However, criminal background checks do not show bankruptcy, as bankruptcy is not a criminal matter.

How can I remove bankruptcy from my background check or credit report?

Bankruptcy cannot be removed from your credit report until it expires based on the guidelines (7 or 10 years). However, you can dispute any inaccuracies with the credit reporting agency. If the bankruptcy was filed inaccurately, or the information is outdated, you can request a correction. It’s also possible to request early removal if the bankruptcy was discharged or resolved before the expiration date under certain circumstances, but this is rare.

How long does bankruptcy stay on my background check?

A bankruptcy can remain on your credit report for up to 10 years for Chapter 7 bankruptcies and 7 years for Chapter 13 bankruptcies. However, public records may show bankruptcy filings indefinitely, depending on state law. For employment background checks, bankruptcy will only be disclosed if it falls within the specified time limits.

Will bankruptcy affect my chances of getting a job?

Bankruptcy may affect your chances of getting a job, particularly in positions that require financial responsibility. However, many employers are more concerned with your qualifications, work experience, and how you’ve managed your finances since the bankruptcy. It’s important to note that Ban the Box laws in many states prevent employers from asking about bankruptcy early in the hiring process.

Can employers see bankruptcy filings on a credit report?

Yes, if the employer performs a credit check, bankruptcy filings may appear. However, not all employers review credit reports, and those who do can only access bankruptcy information within the time limits outlined by the FCRA (7 years for Chapter 13 and 10 years for Chapter 7).

Are there different types of background checks that show bankruptcy?

Yes, bankruptcy can appear in the following types of background checks:

- Credit Report Checks: Bankruptcy will show up as part of your credit history.

- Employment Background Checks: If an employer reviews your credit report, bankruptcy can be disclosed.

- Public Records Checks: Bankruptcy filings are public records, so they may show up in background checks that search public records. However, criminal background checks do not show bankruptcy, as bankruptcy is not a criminal matter.

How can I remove bankruptcy from my background check or credit report?

Bankruptcy cannot be removed from your credit report until it expires based on the guidelines (7 or 10 years). However, you can dispute any inaccuracies with the credit reporting agency. If the bankruptcy was filed inaccurately, or the information is outdated, you can request a correction. It’s also possible to request early removal if the bankruptcy was discharged or resolved before the expiration date under certain circumstances, but this is rare.

Conclusion

Bankruptcies can show up on background checks, particularly through credit reports and public records checks. The length of time bankruptcy remains visible depends on the type of bankruptcy (Chapter 7 or Chapter 13) and the type of background check being conducted.

It’s important for individuals to be aware of the regulations surrounding bankruptcy disclosures, including the Fair Credit Reporting Act (FCRA) and state laws like Ban the Box, which may impact when bankruptcy information is disclosed or considered. While bankruptcy may influence job prospects in certain financial positions, its impact will largely depend on the role being applied for, the time that has passed since the bankruptcy, and the individual’s financial behavior since filing.

If you are concerned about how bankruptcy may affect your background check or employment prospects, it’s beneficial to understand the guidelines and seek professional assistance from services like exact background checks for help navigating your credit report and background check process. By staying informed, you can confidently approach the hiring process, knowing how your financial history may be viewed and what your options are.