States with Unique 10-Year Background Check Laws

Introduction to 10-Year Background Checks in Different States

Background checks are an essential part of many decision-making processes in today’s society, particularly for employers, landlords, and financial institutions. Whether it’s for employment, housing, or credit, background checks help these entities ensure that individuals are trustworthy, responsible, and capable of handling the responsibilities that come with a job, lease, or loan. One common type of background check that is frequently used is the 10-year background check.

We will delve into what a 10-year background check is, why it is significant, how it works in different states, and how it is used in various situations. Understanding the 10-year timeframe for background checks can help both employers and individuals navigate the complexities of background screening. We will explore how different states handle background checks, especially with regard to criminal records, employment verification, and other personal details. Finally, we will look at some examples of states that adhere to a 10-year limit, making it easier for employers and other decision-makers to understand what they can legally check.

What is a 10-Year Background Check?

A 10-year background check is a type of screening that involves gathering information about an individual’s history over the last 10 years. The check typically focuses on aspects like criminal records, employment history, credit reports, and driving records. This period is often considered the most relevant timeframe to evaluate an individual’s recent behavior and potential risk.

The 10-year background check timeframe is widely used across many sectors due to the balance it strikes. It’s long enough to give employers, landlords, and financial institutions insight into an individual’s recent past while short enough to avoid penalizing someone for past mistakes that may have occurred many years ago. The 10-year period is also significant because it typically aligns with certain legal and regulatory frameworks, such as the Fair Credit Reporting Act (FCRA), which limits the reporting of certain negative information (like bankruptcies or criminal convictions) to a 7-10 year period.

This timeframe is commonly employed for various types of background checks, with criminal records, credit reports, and employment verification being the most common areas of focus. However, different states may have specific rules regarding what information can be gathered and how far back the checks can go, making it essential to understand how the 10-year background check rule applies in different jurisdictions.

Why is the 10-Year Period Significant?

The 10-year period is considered significant because it allows decision-makers to assess an individual’s behavior, stability, and reliability over a relatively recent timeframe, while also allowing for a fair assessment. The following areas of a 10-year background check illustrate why the 10-year period is widely used:

Criminal Records

One of the most common reasons for conducting a background check is to evaluate an individual’s criminal history. Criminal background checks are conducted to determine whether a candidate has any criminal convictions, charges, or arrests that could impact their suitability for a job, tenancy, or loan.

The 10-year period is significant because it allows employers, landlords, and financial institutions to see an individual’s criminal behavior over the past decade. In most cases, serious offenses like felonies or violent crimes can appear in a background check for much longer than 10 years, especially if they resulted in a conviction. However, the 10-year period is seen as a reasonable timeframe for evaluating an individual’s criminal record, as it reflects a time window that is both fair and relevant to their current circumstances.

Credit Checks

Credit checks are another crucial component of a background check, especially in situations involving loans, housing applications, or financial responsibility. The Fair Credit Reporting Act (FCRA) limits the reporting of negative credit information, including bankruptcies, defaults, and judgments, to 7 years. However, certain types of information, such as tax liens or bankruptcies, can stay on a credit report for up to 10 years.

In this sense, the 10-year background check period is often used to evaluate the financial stability of individuals, especially for tenants applying for a rental property or those applying for loans. The 10-year period is significant because it captures enough history to provide a thorough overview of an individual’s financial behavior without delving too far into the past.

Employment Verification

For employment purposes, background checks are conducted to verify an applicant’s previous work history, including job titles, dates of employment, and whether the applicant left under any adverse circumstances. Many employers look at employment history for the past 10 years to ensure that the candidate has relevant experience and to assess their job stability.

The 10-year timeframe is particularly useful for positions that require specific experience or skills gained over time. It’s also common for employers to verify whether a candidate has gaps in their employment or if there are any questionable events in their work history.

The Role of State Variations in Background Check Periods

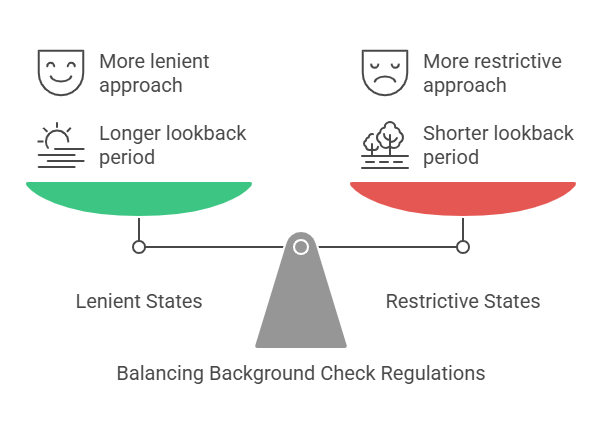

While the 10-year background check period is widely used across different sectors, it’s important to note that state laws can vary significantly regarding the scope and limits of background checks. Each state has its own set of regulations governing the reporting of criminal records, employment history, and other types of personal information.

Some states allow employers and other entities to check records going back more than 10 years, while others place stricter limitations. Understanding these state-specific rules is essential for employers, landlords, and financial institutions to ensure that they comply with local laws when conducting background checks.

In some states, criminal records may be reported for up to 7 years, while in others, felony convictions can be reported indefinitely. Employment history may also have varying limits based on the state’s regulations. States that allow a 10-year lookback period for background checks may have a more lenient approach, but others may restrict how far back certain records can be checked.

States with a 10-Year Limit for Background Checks

While state laws can differ, many states adhere to the 10-year background check rule, allowing employers, landlords, and other entities to conduct thorough screenings. These states typically permit background checks that cover criminal records, employment history, driving records, and credit reports for the past 10 years.

Here are a few examples of states where the 10-year rule applies:

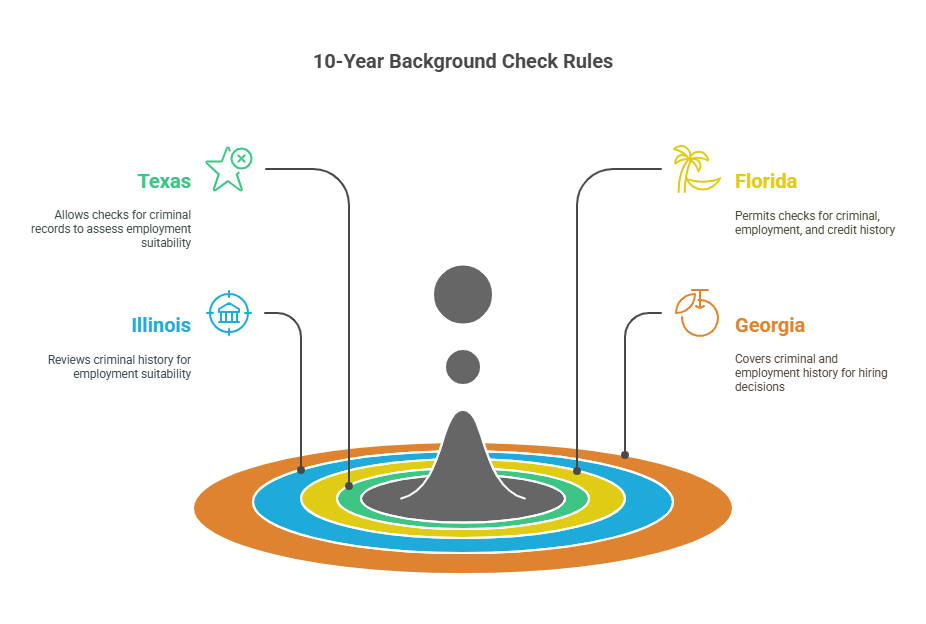

- Texas: In Texas, employers are allowed to conduct background checks for up to 10 years for criminal records, which helps them determine whether an individual has a history of criminal behavior that may impact their employment suitability. This is consistent with the state’s approach to background checks.

- Florida: Florida allows background checks to go back 10 years for criminal records, employment history, and credit checks. The 10-year period is often used to evaluate whether applicants are responsible and reliable.

- Illinois: Illinois follows the 10-year rule for criminal background checks. The state’s laws allow employers to review criminal history up to 10 years in the past to assess applicants’ suitability for employment.

- Georgia: In Georgia, background checks typically cover up to 10 years, allowing employers to view criminal records, employment history, and other relevant details to make informed hiring decisions.

Although the 10-year period is common, it’s essential to be aware that some states have exceptions for specific types of records, such as felony convictions, which may appear for longer than 10 years.

State-Specific Rules for 10-Year Background Checks

Different states have different rules about how far back criminal records, employment history, and other personal details can be checked. Some states have laws that limit the amount of time records can be accessed, while others allow checks that go back much further. Here, we’ll explore the nuances of 10-year background checks in various states, especially when it comes to criminal records, employment history, and credit reports.

Criminal Record Checks

In most states, criminal record checks are a major component of a background check, especially for employment, housing, and loan purposes. When an individual is screened for criminal history, the checking period typically ranges from 7 to 10 years, depending on state laws.

- Texas: In Texas, criminal background checks can go back up to 10 years for most offenses. Employers and landlords are allowed to access criminal history records for this time period when considering applicants. However, certain felonies or charges may appear indefinitely if they resulted in a conviction.

- Florida: Florida allows criminal background checks to span up to 10 years, but it’s important to note that some records may remain visible for a longer period, particularly felony convictions. Criminal offenses that result in imprisonment or a conviction may be accessible for an indefinite period.

- California: In California, the law restricts the reporting of criminal convictions older than 7 years for most employers. However, there are exceptions. For example, for positions that pay more than $125,000 per year, the employer may have access to older convictions, including those extending beyond 7 years, but typically not more than 10 years.

- New York: New York’s criminal background checks typically go back 7 years for most offenses, but in some cases, criminal records may be reported for up to 10 years, especially for felonies. New York also has strict regulations on reporting sealed or expunged records.

- Ohio: Ohio is one of the states that generally adheres to the 10-year rule for criminal background checks. In Ohio, an employer can check an applicant’s criminal history for up to 10 years to assess the candidate’s suitability for employment.

These state variations can have significant implications for employers, landlords, and others conducting background checks, as they will need to be aware of the specific laws in their jurisdiction.

Employment History Verification

Employment verification is another critical component of background checks. Employers frequently verify an applicant’s previous employment to confirm job titles, dates of employment, and reasons for leaving previous jobs. This helps employers assess a candidate’s experience, stability, and suitability for the role.

- Colorado: In Colorado, employers can verify an applicant’s employment history for the past 10 years, which gives a clear view of the applicant’s professional growth and work experience. The 10-year period is standard in employment verification across most sectors.

- Illinois: Similar to Colorado, Illinois employers often look back 10 years when verifying employment history. This allows them to confirm the validity of an applicant’s claims, ensuring that the candidate has the required work experience for the job.

- Georgia: In Georgia, it is typical to check employment history for the last 10 years. This period is used to verify the candidate’s previous positions and assess their job stability.

- New Jersey: New Jersey’s rules align with those in Illinois and Colorado, where employers commonly conduct employment verification checks for up to 10 years. This period allows employers to get a comprehensive picture of a candidate’s career trajectory.

It’s important to note that some states may allow employers to go beyond 10 years when verifying employment history, especially if the applicant’s role requires specialized skills or extensive experience. For most jobs, however, a 10-year history is considered sufficient.

Credit Reports

Credit reports are another common aspect of background checks, especially in situations that involve loans, housing applications, or financial responsibility assessments. The Fair Credit Reporting Act (FCRA) limits the reporting of negative credit information to 7 years, though certain items like bankruptcies can be reported for up to 10 years.

- Texas: In Texas, employers and financial institutions are allowed to access credit reports for the past 10 years. This is crucial when evaluating an applicant’s financial history, especially for positions that involve financial responsibility or when applying for loans or housing.

- Florida: Florida allows credit reports to be checked for up to 10 years. This is particularly important for applicants applying for positions that require a high level of trust and responsibility, such as those in the financial sector.

- California: California also permits the reporting of negative credit information for up to 10 years. However, California has strict regulations that prevent employers from using credit history against applicants unless it is directly relevant to the job.

- New York: New York allows credit reports to be checked for up to 10 years, but there are limitations based on the job type. Employers cannot use an applicant’s credit history unless it is necessary for the position, such as for jobs in finance or security.

- Illinois: Like the other states mentioned, Illinois permits credit checks for up to 10 years. However, Illinois also has laws that limit the use of credit reports in hiring decisions unless the applicant is applying for a position that involves financial decision-making.

Types of Records Checked in a 10-Year Background Check

When conducting a 10-year background check, the following records are commonly reviewed:

1. Criminal History: Criminal records are one of the most common aspects of a background check. This includes any arrests, convictions, and charges related to criminal activity. It is common for employers, landlords, and financial institutions to check criminal history over a 10-year period, depending on the state.

2. Employment History: Employment verification checks are often used by employers to confirm an applicant’s job titles, dates of employment, and reasons for leaving previous jobs. A 10-year employment history provides insight into an applicant’s professional stability and job performance.

3. Credit Reports: Credit reports reveal an individual’s financial history, including any debts, bankruptcies, and payment history. A 10-year credit history is often used by financial institutions, landlords, and employers in financial sectors to assess an applicant’s financial responsibility.

4. Driving Records: In some cases, background checks include driving records, especially if the job involves driving a vehicle. These records may show any traffic violations, accidents, or license suspensions over the past 10 years.

5. Educational Background: Verification of educational records is another common part of background checks. This can include checking for degrees, certifications, and any other formal education completed within the last 10 years.

Limitations of a 10-Year Background Check

While a 10-year background check provides comprehensive insight into an individual’s history, there are some limitations to be aware of:

- Sealed or Expunged Records: In many states, sealed or expunged criminal records are not accessible through a standard background check. These records are typically hidden from employers and other entities to give individuals a chance at rehabilitation after past mistakes.

- State-Specific Rules: Some states have stricter rules regarding what can be reported after a certain period. For example, in states like California, Washington, and New York, criminal records older than a certain period (typically 7 years) cannot be reported for employment purposes, even if the individual has not had any further issues.

- Inconsistent State Regulations: Because each state has its own laws about how far back criminal, employment, and credit history can be checked, it is crucial to understand the rules that apply to your specific jurisdiction.

How Exact Background Checks Can Help

Exact Background Checks is a trusted provider of 10-year background checks that helps individuals and employers navigate state-specific rules. The platform offers quick, reliable, and legally compliant background checks that adhere to the 10-year timeframe, ensuring that employers and landlords can make informed decisions. By using Exact Background Checks, you can streamline the process and receive accurate, timely reports that meet the legal requirements of your state.